Attractive Opportunities

Global Demand Analysis & Sales Opportunities in Aircraft Hydraulic Pumps Market

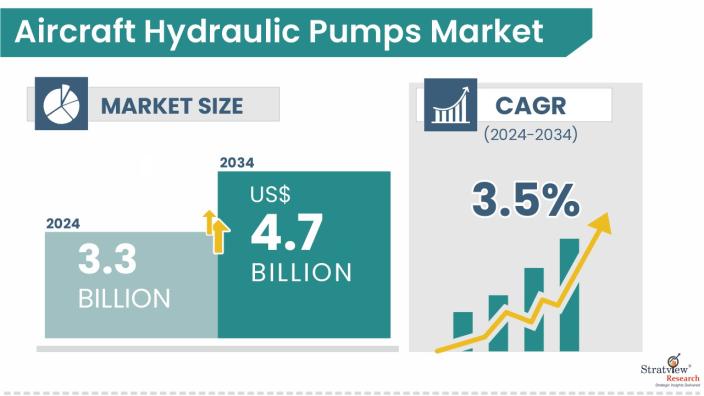

- The annual demand for aircraft hydraulic pumps was USD 3.3 billion in 2024 and is expected to reach USD 3.5 billion in 2025, up 6.4% than the value in 2024.

- During the forecast period (2025-2034), the aircraft hydraulic pumps market is expected to grow at a CAGR of 3.5%. The annual demand will reach USD 4.7 billion in 2034.

- During 2025-2034, the aircraft hydraulic pumps industry is expected to generate a cumulative sales opportunity of USD 28.5 billion, which is more than 1.5 times the opportunities during 2019-2024.

Want to know more about the market scope? Register Here

High-Growth Market Segments:

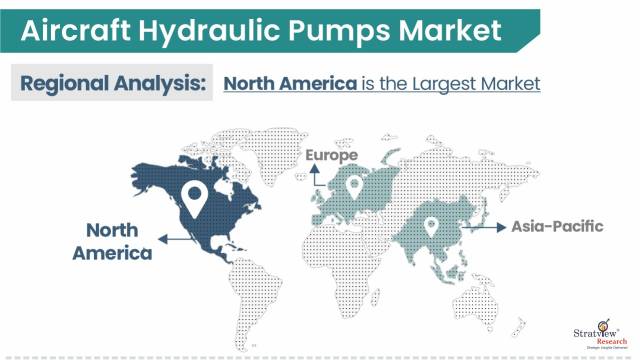

- North America is expected to maintain its reign over the forecast period, whereas Asia-Pacific is likely to grow at the fastest pace.

- By aircraft type, Commercial aircraft are expected to be the dominant as well as fastest-growing category of the aircraft hydraulic pumps market during the study period.

- By pressure type, 3000-4000 psi is anticipated to remain the most-preferred pressure type for aircraft hydraulic pumps in the market during the forecast period.

- By application type, Flight control system is projected to remain the largest application of aircraft hydraulic pumps during the forecast period.

- By technology type, Engine-driven pumps are likely to remain the most-used technology for aircraft hydraulic pumps in the market during the study period.

- By category type, Positive displacement pumps are likely to remain the dominant category type in the market during the forecast period.

- By end-user type, OEM is anticipated to remain the pioneer in the market during the study period.

Market Statistics

Have a look at the sales opportunities presented by the aircraft hydraulic pumps market in terms of growth and market forecast.

|

Aircraft Hydraulic Pumps Market Data & Statistics

|

|

|

Market Statistics

|

Value (in USD Billion)

|

Market Growth (%)

|

|

Annual Market Size in 2023

|

USD 2.9 billion

|

-

|

|

Annual Market Size in 2024

|

USD 3.3 billion

|

YoY Growth in 2024: 11.1%

|

|

Annual Market Size in 2025

|

USD 3.5 billion

|

YoY Growth in 2025: 6.4%

|

|

Annual Market Size in 2034

|

USD 4.7 billion

|

CAGR 2025-2034: 3.5%

|

|

Cumulative Sales Opportunity during 2025-2034

|

USD 28.5 billion

|

-

|

|

Top 10 Countries’ Market Share in 2024

|

USD 2.6 billion +

|

> 80%

|

|

Top 10 Company’s Market Share in 2024

|

USD 1.7 billion to USD 2.3 billion

|

50% - 70%

|

Market Dynamics

Introduction:

What is the aircraft hydraulic pumps market?

The aircraft hydraulic pumps market is a critical part within the broader aerospace industry, dedicated to providing hydraulic power to essential systems in both commercial and military aircraft. These pumps are responsible for delivering high-pressure hydraulic fluid to operate vital components such as flight control surfaces, landing gear, brakes, cargo doors, and other flight-critical systems. Hydraulic pumps in aircraft use a variety of mechanisms, including gear, piston, vane, and centrifugal technologies, to deliver consistent and reliable performance under the extreme conditions of flight.

Market Drivers:

- The market for aircraft hydraulic pumps is experiencing steady growth, fueled by the ongoing expansion of global air travel, increasing airline fleet sizes, and heightened defense procurement. The shift towards more energy-efficient, lighter, and electronically controlled systems in next-generation aircraft is prompting advancements in hydraulic pump technologies, as manufacturers aim to meet the demands for enhanced fuel efficiency, reduced weight, and improved system reliability.

- The increasing focus on aircraft safety, performance, and environmental sustainability, coupled with rising aircraft production rates, is driving significant demand for advanced hydraulic pump systems. Aerospace OEMs and suppliers are continuously innovating to meet stricter regulatory and performance standards, positioning the aircraft hydraulic pumps market for substantial growth in the years ahead.

Segment Analysis

|

Segmentations

|

List of Sub-Segments

|

Segments with High-Growth Opportunity

|

|

Aircraft-Type Analysis

|

Commercial Aircraft, Military Aircraft, Regional Aircraft, Business Jet, and Helicopter

|

Commercial aircraft are expected to be the dominant as well as fastest-growing category of the aircraft hydraulic pumps market during the study period.

|

|

Pressure-Type Analysis

|

3000-4000 psi and 5000 psi

|

3000-4000 psi is anticipated to remain the most-preferred pressure type for aircraft hydraulic pumps in the market during the forecast period.

|

|

Application-Type Analysis

|

Flight Control System, Landing Gear & Nose Wheel Steering, Braking System, Thrust Reversal System, and Other Applications

|

Flight control system is projected to remain the largest application of aircraft hydraulic pumps during the forecast period.

|

|

Technology-Type Analysis

|

Engine-Driven Pumps, Electric Motor-Driven Pumps, and Others

|

Engine-driven pumps are likely to remain the most-used technology for aircraft hydraulic pumps in the market during the study period.

|

|

Category-Type Analysis

|

Positive Displacement Pumps and Nonpositive Displacement Pumps

|

Positive displacement pumps are likely to remain the dominant category type in the market during the forecast period.

|

|

End-User-Type Analysis

|

OEM and Aftermarket

|

OEM is anticipated to remain the pioneer in the market during the study period.

|

|

Region Analysis

|

North America, Europe, Asia-Pacific, and The Rest of the World

|

North America is expected to maintain its reign over the forecast period, whereas Asia-Pacific is likely to grow at the fastest pace.

|

By Aircraft Type

“Commercial aircraft are estimated to maintain their sheer dominance in the aircraft pumps market during the forecast period.”

- The aircraft hydraulic pumps market is segmented into commercial aircraft, military aircraft, regional aircraft, business jets, and helicopters. Commercial aircraft are the biggest and fastest-growing segment in the aircraft hydraulic pumps market due to several key factors that drive demand for hydraulic systems across their operations. These aircraft require hydraulic pumps for critical functions such as flight control, landing gear, braking systems, and other essential components that ensure safe and efficient flight operations.

- With the growth of global air travel and the expansion of airline fleets, the commercial aircraft industry continues to see an increase in the demand for hydraulic pumps for both new aircraft and as part of ongoing fleet maintenance.

- One of the main reasons for this dominance is the significant number of commercial aircraft in service worldwide. Major manufacturers, such as Boeing and Airbus, produce a high volume of commercial aircraft annually, each requiring a variety of hydraulic pump systems.

- In addition, the shift towards more energy-efficient, electric, and digitally controlled hydraulic pump systems is driving innovation within the commercial aircraft industry. As airlines focus on reducing weight and improving fuel efficiency, the adoption of advanced hydraulic pump technologies, including electric and smart systems, is on the rise.

By Pressure Type

“3000-4000 psi pressure is expected to maintain its reign in the market, whereas 5000 psi is expected to register the faster growth in the market during the forecast period.”

- The market is segmented into airframes 3000-4000 psi and 5000 psi. In the aircraft hydraulic pumps market, the 3000–4000 PSI pressure range is expected to maintain its dominant position due to its long-standing usage across a wide spectrum of commercial, military, and general aviation aircraft. This pressure range has become an industry standard, offering a balanced combination of power efficiency, reliability, and safety.

- On the other hand, 5000 PSI systems are gaining significant momentum and are projected to register the fastest growth during the forecast period. This is primarily driven by the increasing push for weight reduction and improved performance in next-generation aircraft. Higher-pressure systems allow for the use of smaller and lighter hydraulic components without compromising power output, making them highly desirable for modern aircraft design, especially in advanced military jets and upcoming commercial platforms.

- The shift toward more compact and efficient systems aligns with the broader industry trend toward fuel efficiency, reduced emissions, and increased payload capacity, all of which support the accelerated adoption of 5000 PSI systems.

By Application Type

“Flight control system is likely to remain the biggest as well as the fastest-growing application of the aircraft hydraulic pumps market during the forecast period.”

- The market is segmented into flight control systems, landing gear & nose wheel steering, braking systems, thrust reversal systems, and others. Flight control systems are expected to remain both the largest and the fastest-growing application of the aircraft hydraulic pumps market during the forecast period due to their critical role in aircraft safety, maneuverability, and performance. These systems are responsible for controlling key flight surfaces such as ailerons, elevators, rudders, and spoilers, all of which require reliable and precise hydraulic actuation to ensure smooth and responsive operation.

- As newer aircraft models become more technologically advanced, the demand for higher performance, redundancy, and control precision in flight control systems is increasing. Hydraulic pumps are integral to meeting these requirements, especially in fly-by-wire and hybrid systems, where they continue to serve as a robust backbone for mechanical motion.

- Additionally, the rising global aircraft fleet, increased production of narrow-body and wide-body aircraft, and the growing emphasis on passenger safety and aircraft maneuverability are contributing to the expanding scope of flight control systems.

By Technology Type

“Engine-driven pumps are likely to hold their dominance, whereas electric motor-driven pump is expected to be the fastest-growing technology of the market during the forecast period.”

- The market is segmented into engine-driven, electric motor-driven, and others. Engine-driven pumps are anticipated to maintain their dominance in the aircraft hydraulic pumps market during the forecast period due to their proven reliability, high power output, and established use in conventional aircraft architectures. These pumps are directly connected to the aircraft’s engine and operate continuously during flight, providing a steady and powerful source of hydraulic pressure for critical systems such as flight controls, landing gear, and brakes.

- At the same time, electric motor-driven pumps are expected to be the fastest-growing technology in the market, driven by the aerospace industry’s shift toward electrification and more-electric aircraft (MEA) concepts. Unlike engine-driven pumps, electric motor-driven pumps are independent of the engine, allowing for on-demand operation, improved energy efficiency, and greater flexibility in system design. This makes them highly attractive for new-generation aircraft, including hybrid-electric and fully electric planes, where weight savings and energy optimization are paramount.

- The growing focus on reducing fuel consumption, lowering emissions, and enhancing maintenance efficiency is accelerating the adoption of electric motor-driven pumps, particularly in auxiliary and backup systems. As aerospace manufacturers develop more sophisticated electrical architectures, electric motor-driven pumps are poised to play an increasingly prominent role, contributing to their rapid market growth during the forecast period.

By End-User Type

“OEMs are likely to remain the biggest demand generator for aircraft hydraulic pumps throughout the forecast period.”

- The market is segmented into OEM and aftermarket. OEMs (Original Equipment Manufacturers) are both the dominant and fastest-growing end-user type in the aircraft hydraulic pumps market due to the continued production of new commercial, military, and business aircraft worldwide.

- As aircraft manufacturers like Boeing, Airbus, Lockheed Martin, and others ramp up their production rates to meet the growing global demand for air travel and defense capabilities, the need for factory-fitted hydraulic pumps will naturally increase. Hydraulic pumps are essential for powering flight control systems, landing gear, brakes, and other critical aircraft functions, making them an integral part of OEM assembly lines.

- Moreover, as airlines and governments look to modernize their fleets with more fuel-efficient and technologically advanced aircraft, OEMs are integrating next-generation hydraulic systems that include lighter, more efficient, and more compact pumps. This push toward innovation and performance enhancement further fuels the demand for new hydraulic pump units at the manufacturing level.

Regional Insights

“North America is expected to remain the largest market for aircraft hydraulic pumps during the forecast period.”

- North America is the dominant region in the aircraft hydraulic pumps market due to its well-established aerospace industry, presence of major aircraft manufacturers, and large fleet of both commercial and military aircraft.

- The region is home to industry giants such as Boeing, Lockheed Martin, Raytheon Technologies, and Northrop Grumman, which are key contributors to the development and production of aircraft hydraulic systems. These companies work closely with suppliers to integrate hydraulic pump technologies into a wide range of aircraft platforms, from commercial jets and cargo planes to fighter aircraft and UAVs.

- In addition to manufacturing, North America has one of the largest and most advanced defense aviation industry, with continued spending on next-generation fighter jets, surveillance aircraft, unmanned aerial systems (UAS), and military transport planes. These platforms rely heavily on robust hydraulic systems for mission-critical functions, further bolstering the market for hydraulic pumps.

- In contrast, the Asia-Pacific region is the fastest-growing market for aircraft hydraulic pumps, driven by rapid growth in commercial aviation, expanding defense budgets, and increasing domestic aircraft production. Countries such as China, India, Japan, and South Korea are investing heavily in the development of indigenous aircraft programs and modernizing their air forces, creating significant opportunities for hydraulic pump manufacturers. The surge in air passenger traffic across the region has also led to major airline fleet expansions, fueling the demand for hydraulic systems in both narrow-body and wide-body aircraft.

Know the high-growth countries in this report. Register Here

Competitive Landscape

Most of the major players compete in some of the factors, including price, service offerings, and regional presence, etc. The following are the key players in the aircraft hydraulic pumps market -

- Eaton Corporation plc

- Parker Hannifin Corporation

- Triumph Group

- Liebherr Group

- ESCO Technologies Inc. (Crissair Inc.)

- AeroControlex Group

- Ametek Inc.

- Cascon Inc.

Note: The above list does not necessarily include all the top players in the market.

Are you the leading player in this market? We would love to include your name. Please write to us at [email protected]

Report Features

This report provides market intelligence most comprehensively. The report structure has been kept so that it offers maximum business value. It provides critical insights into market dynamics and will enable strategic decision-making for existing market players as well as those willing to enter the market.

The following are the key features of the report:

- Market structure: Overview, industry life cycle analysis, supply chain analysis.

- Market environment analysis: Growth drivers and constraints, Porter’s five forces analysis, SWOT analysis.

- Market trend and forecast analysis.

- Market segment trend and forecast.

- Competitive landscape and dynamics: Market share, Service portfolio, New Product Launches, etc.

- COVID-19 impact and its recovery curve.

- Attractive market segments and associated growth opportunities.

- Emerging trends.

- Strategic growth opportunities for the existing and new players.

- Key success factors.

|

Market Study Period

|

2019-2034

|

|

Base Year

|

2024

|

|

Forecast Period

|

2025-2034

|

|

Trend Period

|

2019-2023

|

|

Number of Tables & Figures

|

>100

|

|

Number of Segments Analysed

|

7 (Aircraft Type, Pressure Type, Application Type, Technology Type, Category Type, End-User Type, and Region)

|

|

Number of Regions Analysed

|

4 (North America, Europe, Asia-Pacific, Rest of the World)

|

|

Countries Analysed

|

15 (The USA, Canada, Mexico, Germany, France, Italy, The UK, China, Japan, India, Brazil, Saudi Arabia, Rest of Europe, Rest of APAC, and Rest of the World)

|

|

Free Customization Offered

|

10%

|

|

After Sales Support

|

Unlimited

|

|

Report Presentation

|

Complimentary

|

|

Market Dataset

|

Complimentary

|

|

Further Deep Dive & Consulting Services

|

10% Discount

|

Market Segmentation

The report provides detailed insights into the market dynamics to enable informed business decision-making and growth strategy formulation based on the opportunities present in the market.

The aircraft hydraulic pumps market is segmented into the following categories.

Aircraft Hydraulic Pumps Market, by Aircraft Type

- Commercial Aircraft (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Military Aircraft (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Regional Aircraft (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Business Jet (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Helicopter (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

Aircraft Hydraulic Pumps Market, by Pressure Type

- 3000-4000 psi (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- 5000 psi (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

Aircraft Hydraulic Pumps Market, by Application Type

- Flight Control System (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Landing Gear & Nose Wheel Steering (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Braking System (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Thrust Reversal System (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Other Applications (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

Aircraft Hydraulic Pumps Market, by Technology Type

- Engine-Driven Pumps (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Electric Motor-Driven Pumps (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Others (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

Aircraft Hydraulic Pumps Market, by Category Type

- Positive Displacement Pumps (Regional Analysis and Sub-Category Analysis)

- Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World

- Sub-Category Analysis: Fixed Displacement Pumps and Variable Displacement Pumps

- Nonpositive Displacement Pumps (Regional Analysis and Sub-Category Analysis)

- Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World

- Sub-Category Analysis: Centrifugal Pump and Others

Aircraft Hydraulic Pumps Market, by End-User Type

- OE (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Aftermarket (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

Aircraft Hydraulic Pumps Market by Region

- North America (Country Analysis: The USA, Canada, and Mexico)

- Europe (Country Analysis: Germany, France, The UK, Russia, and the Rest of Europe)

- Asia-Pacific (Country Analysis: Japan, China, India, and Rest of Asia-Pacific)

- Rest of the World (Country Analysis: Brazil, Saudi Arabia, and Others)

Research Methodology

- This strategic assessment report from Stratview Research provides a comprehensive analysis that reflects today’s aircraft hydraulic pump market realities and future market possibilities for the forecast period.

- The report segments and analyzes the market in the most detailed manner to provide a panoramic view of the market.

- The vital data/information provided in the report can play a crucial role for market participants and investors in identifying the low-hanging fruits available in the market and formulating growth strategies to expedite their growth process.

- This report offers high-quality insights and is the outcome of a detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research’s internal database and statistical tools.

- More than 1,000 authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white papers, patents, and articles, have been leveraged to gather the data.

- We conducted more than 15 detailed primary interviews with market players across the value chain in all four regions and industry experts to obtain both qualitative and quantitative insights.

Customization Options

With this detailed report, Stratview Research offers one of the following free customization options to our respected clients:

Company Profiling

- Detailed profiling of additional market players (up to three players)

- SWOT analysis of key players (up to three players)

Competitive Benchmarking

- Benchmarking of key players on the following parameters: Service portfolio, geographical reach, regional presence, and strategic alliances

Custom Research: Stratview Research offers custom research services across industries. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to [email protected]