Market Dynamics

Introduction

The hydraulic dosing pump market is focused on the development and usage of hydraulically actuated pumps that introduce precise, quantifiable amounts of chemicals, additives, and nutrients into a system. Hydraulic dosing pumps commonly serve as essential equipment in a variety of industries where accurate dosing at high pressures is necessary; examples of such industries include water & wastewater treatment, chemical processing, pharmaceuticals, and others. Compared to conventional mechanical dosing pumps, hydraulic dosing pumps provide improved performance and reliability because they can accurately dose fluids, such as viscous or corrosive fluids that may otherwise be ineffectively dealt with using mechanical pumps. This is particularly necessary with fluid handling in demands present in industrial environments.

Market Driver:

An important driver of the hydraulic dosing pump market includes, demand for water and wastewater treatment solutions. Globally, industries and municipalities are struggling to comply with progressive environmental regulations related to industrial discharge. Therefore, both are investing billions of dollars in treatment infrastructure, and hydraulic dosing pumps are critical to providing a variety of chemical injection and process control.

Recent Market JVs and Acquisitions:

A considerable number of strategic alliances, including M&As, JVs, etc., have been performed over the past few years:

- In January 2024, Idex Corporation acquired Mott Corporation.

- In March 2024, Ingersoll Rand Inc. completed the acquisition of UT Pumps & Systems Private Limited.

Market Segments' Analysis

|

Segmentations

|

List of Sub-Segments

|

Segments with High-Growth Opportunity

|

|

Pump-Type Analysis

|

Diaphragm Pumps, Piston Pumps, and Other Pump Types

|

Diaphragm Pumps are expected to remain dominant in the coming years.

|

|

Discharge Pressure -Type Analysis

|

Up to 25 Bar, 25–100 Bar, and Above 100 Bar

|

25–100 Bar holds the largest share throughout the forecasted period.

|

|

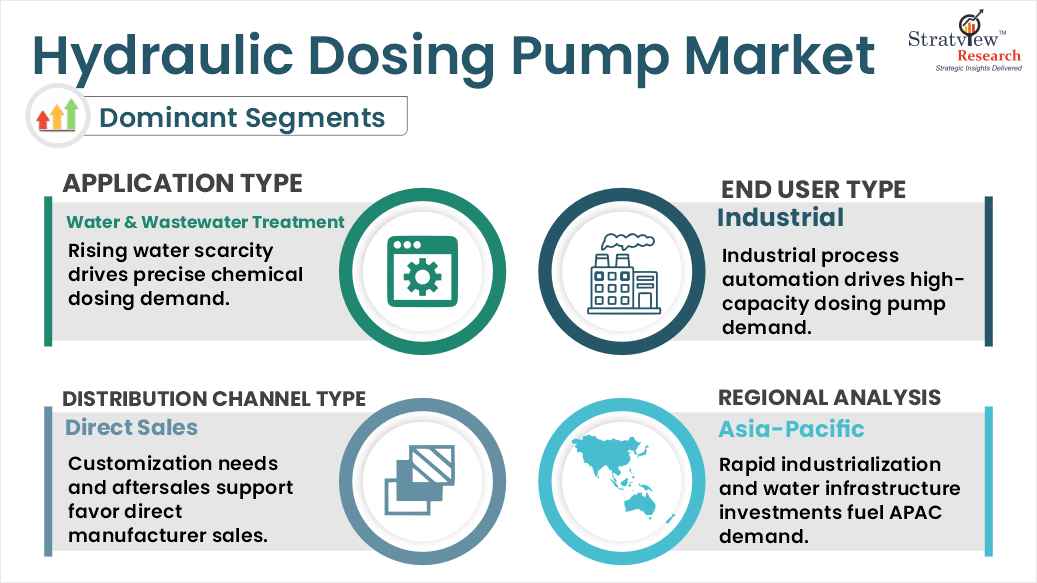

Application -Type Analysis

|

Water & Wastewater Treatment, Chemical Processing, Oil & Gas, Pharmaceuticals, and Food & Beverages

|

Water & Wastewater Treatment is anticipated to continue its dominance during the forecasted period.

|

|

End User-Type

|

Industrial, Commercial, and Residential

|

Industrial is projected to remain the leading end user in the hydraulic dosing pump market.

|

|

Distribution Channel-Type

|

Direct Sales, Distributors, and Online Sales

|

The Direct Sales channel is expected to maintain its leading position during the forecast period.

|

|

Region Analysis

|

North America, Europe, Asia-Pacific, and The Rest of the World

|

The Asia-Pacific is expected to maintain its reign over the forecast period.

|

|

|

|

|

By Pump Type

“Diaphragm Pumps are expected to remain in the market during the forecast period.”

Diaphragm pumps are expected to dominate the hydraulic dosing pump market owing to their ability to handle a wide variety of aggressive, corrosive, or viscous fluids without leakage. These pumps offer high metering precision and are ideal for critical dosing applications, especially in industries like chemicals, water treatment, and oil & gas. Their design allows for safe and reliable operation in demanding conditions with minimal risk of contamination, making them a top choice across sectors.

Moreover, diaphragm pumps are favored for their low maintenance requirements and ability to run dry without damage. The diaphragm barrier eliminates the need for dynamic seals, which significantly enhances the pump’s operational life and reduces the chances of process downtime. These factors contribute to their widespread adoption, especially in facilities aiming for high process efficiency and compliance with environmental regulations.

By Discharge Pressure Type

“25–100 bar is expected to dominate the market during the forecast period.”

The 25–100 Bar range is expected to lead due to its suitable performance for mid- to high-pressure dosing applications in key industrial sectors. Buoyant investment in water treatment, chemical injection, oil & gas industries, where the end user needs to abort or control the dosing for pre-mixed liquids across variable pressure conditions, is commonly seen utilizing pumps in this pressure range. This range allows the correct energy and performance balance, making it versatile in its potential application across small to mid-scale industrial applications.

Moreover, industries want to be able to use dosing equipment that can handle some variables in the processes to ensure safety and accuracy. The 25–100 Bar range offers their processes sprawl conditions, without needing total installed costs and complexities associated with UHP and HHP, prompting a clear preference in most mid-sized industrial processes.

By Application Type

“Water & wastewater treatment is expected to remain the dominant and fastest-growing application of the market during the forecast period.”

The water & wastewater treatment sector has the largest market share since chemical dosing is a common occurrence in treatment plants that require exact control for pH adjustment, disinfection, coagulation, etc., worldwide. The continued global increase in water scarcity and stricter water quality standards spur investment in treatment infrastructure, especially in developing markets. Hydraulic dosing pumps offer the reliability and most accurate technology solution to dose chemicals continually in a treatment facility.

Moreover, the continued growth in the urban population and the increased waste produced from industrial processes have put pressure on the demand for treatment systems. Hydraulic dosing pumps enable the accurate dosing of chemical agents such as chlorine, acids, and flocculants; all of them are similar but affect the ultimate goal of ensuring treated water conforms to environmental discharge limits. The ability of hydraulic dosing pumps to promote efficiency and environmental compliance is a driver for their market position in this application.

By End User Type

“Industrial is projected to remain the leading end user in the hydraulic dosing pump market.”

Occupying the largest segment of the marketplace are Industrial end users of hydraulic dosing pumps and dosing pumps in general. These end-users require hydraulic dosing pumps to manage a variety of applications from injecting chemicals for treatment, industrial water management, and in the petrochemical, pharmaceutical, and manufacturing industries. Industrial operations need reliable and high-capacity systems that are able to operate harshly and correctly dose fluids. Hydraulic dosing pumps do a great job in these applications because of their strength, accuracy, and ability to be customized.

Moreover, these industrial processes often use hazardous and reactive fluids, and dosing pumps limit contact with the person administering treatment and the environment. Hydraulic pumps are rugged and capable of managing high pressure, so they are suitable for many complicated operations. Dilution, mixing, and in-line systems are inherently easier to design using hydraulic pumps. They also have built-in scalability and the ability to interface with digital control systems.

By Distribution Channel Type

“Direct Sales channel is expected to maintain its leading position during the forecast period.”

Direct sales are the most common sales channel for the hydraulic dosing pump market because of the complex nature of the products and a greater need for customization and post-sale support. Industrial buyers often seek tailored solutions that align with specific flow, pressure, and fluid requirements, which especially necessitates a direct dialogue with manufacturers. Direct sales also provide for the installation service and calibration service, and maintenance service. This adds importance for customers seeking a hydronic dosing pump in industrial processes with prolonged timelines.

Many large enterprises and municipalities prefer to deal directly with manufacturers to get authentic products. Large enterprise and municipal buyers view direct purchase relationships as legitimate and secure, with a warranty and service agreements with the manufacturer through direct purchasing. For this reason, a direct sales experience is the preferred and trusted distribution channel for buyers of hydraulic dosing pumps.

Want to get more details about the segmentations? Register Here

Regional Analysis

“The Asia-Pacific is expected to remain the largest market for hydraulic dosing pumps during the forecast period.”

The hydraulic dosing pump market is expected to be led by Asia-Pacific because of rapid industrialization, urbanization, and ongoing investments in water treatment facilities in countries like China, India, and Southeast Asia. The region's growing demand for clean water, strict government regulations, and the increasing number of manufacturing units are expected to drive growth.

In addition, end-use industries, such as textiles, chemicals, and food & beverage, in the region are likely to expand, producing a necessity for efficient dosing solutions. Governments in the region are providing more funds for public infrastructure projects, including wastewater management systems. As a result, both demand and future growth potential place Asia-Pacific as a key market in the hydraulic dosing pump industry

Report Features

This report provides market intelligence most comprehensively. The report structure has been kept so that it offers maximum business value. It provides critical insights into market dynamics and will enable strategic decision-making for existing market players as well as those willing to enter the market. The following are the key features of the report:

- Market structure: Overview, industry life cycle analysis, supply chain analysis.

- Market environment analysis: Growth drivers and constraints, Porter’s five forces analysis, SWOT analysis.

- Market trend and forecast analysis.

- Market segment trend and forecast.

- Competitive landscape and dynamics: Market share, Service portfolio, New Product Launches, etc.

- COVID-19 impact and its recovery curve

- Attractive market segments and associated growth opportunities.

- Emerging trends.

- Strategic growth opportunities for the existing and new players.

- Key success factors.

The global Hydraulic Dosing Pump market is segmented into the following categories.

Hydraulic Dosing Pump Market, by Pump Type

- Diaphragm Pumps (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of World)

- Piston Pumps (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of World)

- Other Pump types (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of World)

Hydraulic Dosing Pump Market by Discharge Pressure Type

- Up to 25 Bar (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of World)

- 25–100 Bar (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of World)

- Above 100 Bar (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of World)

Hydraulic Dosing Pump Market, by Application Type

- Water & Wastewater Treatment (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of World)

- Chemical Processing (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of World)

- Oil & Gas (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of World)

- Pharmaceuticals (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of World)

- Food & Beverages (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of World)

Hydraulic Dosing Pump Market, by End User Type

- Industrial, and (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of World)

- Commercial (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of World)

- Residential (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of World)

Hydraulic Dosing Pump Market, by Distribution Channel Type

- Direct Sales, and (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of World)

- Distributors (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of World)

- Online Sales (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of World)

Hydraulic Dosing Pump Market by Region

- North America (Country Analysis: The USA, Canada, and Mexico)

- Europe (Country Analysis: Germany, France, The UK, Russia, and the Rest of Europe)

- Asia-Pacific (Country Analysis: Japan, China, India, and Rest of Asia-Pacific)

- Rest of the World (Country Analysis: Brazil, Saudi Arabia, and Others)