Stratview Research reports that the global specialty batteries market is set for steady expansion, projected to grow at a 3.5% CAGR from 2024 to 2030, with defence emerging as the key driving force.

In years gone by, military troops on the ground had to carry 20-50 kgs of batteries on their backs to the field. In the Afghanistan War (2001-2011), soldiers in Operation HERRICK carried around 56 kg (123 lb) of gear. The heavy load slowed their movement so much that Taliban fighters even nicknamed them ‘donkeys’ – a detail reported in a 2011 British Army Review article.

Today’s battlefield tells a different story – leaner, smarter, and far more electrified. The Russia-Ukraine war is a live-example of what future warfare will look like. What began in 2022 as a largely conventional invasion, swiftly evolved into a high-tech conflict where both sides have extensively deployed tactical drones, cyberattacks and electronic jamming, etc. Blurring the line between physical and digital war, both sides were in a ‘drone vs. drone’ stalemate by 2023, each using quadcopters (or unmanned aerial vehicle (UAV)) and loitering munitions to target the other’s infantry. It is also expected that year 2025 would see Ukraine, using advanced drone swarms powered by AI.

Today’s battlefields run on compact, high-power electronics, communications, targeting, reconnaissance, all dependent on reliable, high-density energy sources. This is where specialty batteries become indispensable: engineered to deliver robust performance in compact, mission-critical platforms. Specialty batteries are engineered to deliver power in unique, demanding conditions where conventional batteries fall short.

From huge aerospace components to defense systems and marine & space applications, these batteries are the silent workhorses ensuring that mission-critical technology performs reliably, safely, and for extended periods. What sets specialty batteries apart is their made-to-order chemistry and construction, optimized for factors such as temperature tolerance, size constraints, energy density, safety requirements, and longevity, often developed in close collaboration with application designers.

What’s Powering the Global Specialty Batteries’ Market?

According to Stratview Research, the global specialty batteries market is experiencing growth, fueled by expanding applications across sectors. The market is projected to register a 3.5% compound annual growth rate (CAGR) between 2024 – 2030. This growth is anchored by several factors, defence being the major one.

Over 70% of specialty battery demand stems from the defense sector, used for powering modern UAVs, field communication systems, portable weapon systems, and electronic warfare platforms operating in extreme environments. The growing defense electrification, driven by unmanned systems, soldier wearable tech, and autonomous ground vehicles, is amplifying battery dependency across military inventories.

The rapid increase in military spending across the globe is also emerging as a key driver of battery demand, with many countries increasingly channelling a portion of their defense budgets toward advanced battery technologies to support next-gen combat, mobility, and energy resilience systems.

Government programs like FAStBat, Australia’s Battery Breakthrough Initiative, India’s DRDO laser weapon program, etc., clearly illustrate how defence sector is increasingly depending on specialty batteries.

Marine applications, including subsea unmanned vehicles and deep sea sensor networks, account for over 13% of total specialty battery usage, leveraging their reliability for long duration, untethered operations. Aerospace and space represent the balance, supporting CubeSats, high-altitude drones, and electric aircraft projects that demand thermal stable power sources.

Lithium-Ion – A Chemistry Behind Specialty Batteries

Not to forget that all the abovementioned industries demand batteries that are lightweight, rugged, resistant to extreme environments, and capable of delivering long operational life, making specialty batteries indispensable.

One chemistry that checks all these boxes is lithium ion, the undisputed front-runner when it comes to specialty batteries across all applications. Studies even state that these batteries can store roughly twice the energy of old lead acid batteries in the same space. This jump in capacity directly translates into longer mission duration and better performance, making it apt for military and marine systems. According to Stratview Research, nearly half of the specialty batteries used worldwide run on lithium ion. In 2024, lithium ion contributed approximately $1.65 billion in value across specialty batteries, underscoring their dominant role in high-performance sectors.

The U.S. DoD even launched a ‘Lithium Battery Strategy 2023–2030’ to secure supplies of these batteries for future mission-critical platforms. Naval forces worldwide are moving to Li-ion for vessels and undersea craft. For example, Japan’s newest diesel-electric submarines – Soryu and Taigei classes – the ‘Big Whale’ attack submarines replaced bulky lead?acid systems with lithium ion batteries. This replacement resulted in increased size and energy density of their battery storage and improved underwater endurance.

Similarly, the U.S. Navy has a formal battery-safety program to certify Li-ion packs for use on ships, aircraft and subs.

On land, tactical vehicles and heavy trucks are embracing Li?ion power. The U.S. Army’s experimental Hybrid Bradley Fighting Vehicle now includes large Li?ion battery packs to run its electric drive motor. The army anticipates 20% fuel savings and greater on-board electric power without increasing size or weight.

However, nickel-cadmium and lead-acid, and a few other chemistries are also used in the specialty battery manufacturing, but due to their limited capabilities, they collectively account only for about 20–30% each of the global landscape.

In short, compared to legacy chemistries, Li?ion cells double the usable energy per kilo, recharge far more efficiently, and pack far more punch for their weight making them the most reliable chemistries worldwide, to meet critical mission demands.

Challenges and Opportunities Shaping Specialty Batteries

Where, the growing integration of artificial intelligence (AI), remote monitoring, and data analytics, etc., into battery design and management create new opportunities for specialty batteries, some stringent qualification processes, material availability and price volatility, particularly for rare earth metals and lithium, pose potential constraints by lengthened product development cycles, and other supply-chain issues.

The year 2024 has seen a ~30% rise in lithium demand. Major producers oversupplied EV-grade raw materials, but they typically don’t fit for direct deployment on defence, space, aerospace or any critical mission, without major modification. EV-grade batteries allow trace impurities while military or space systems strictly avoid those. Even micro-level contamination can trigger voltage drift, premature failure or thermal runaway.

Another challenge that comes with specialty batteries is the protocols followed by end-use industries. Defense and aerospace platforms follow strict protocols like Military Performance Specification (MIL-PRF), Naval Sea Systems Command Instruction 9310.1C: Naval Lithium Battery Safety Program (NAVSEA Instruction 9310.1C), NASA-STD-4009, and European Cooperation for Space Standardization (ECSS). These materials often take 2-3 weeks longer (compared to EV-grade batteries) to source, test, and qualify.

Many such challenges underscore the importance of diversified sourcing and recycling initiatives.

Batteries at the Core of Tomorrow

By 2035, The North Atlantic Treaty Organization (NATO) has announced to raise defence spending to 5% of GDP. In parallel, global military expenditure surged >$2.7 trillion in 2024, a 9.4% real-term increase from the previous year, according to SIPRI.

Even in 2025, the USA’s military budget crossed $997 billion – with a significant portion dedicated to modernizing military capabilities.

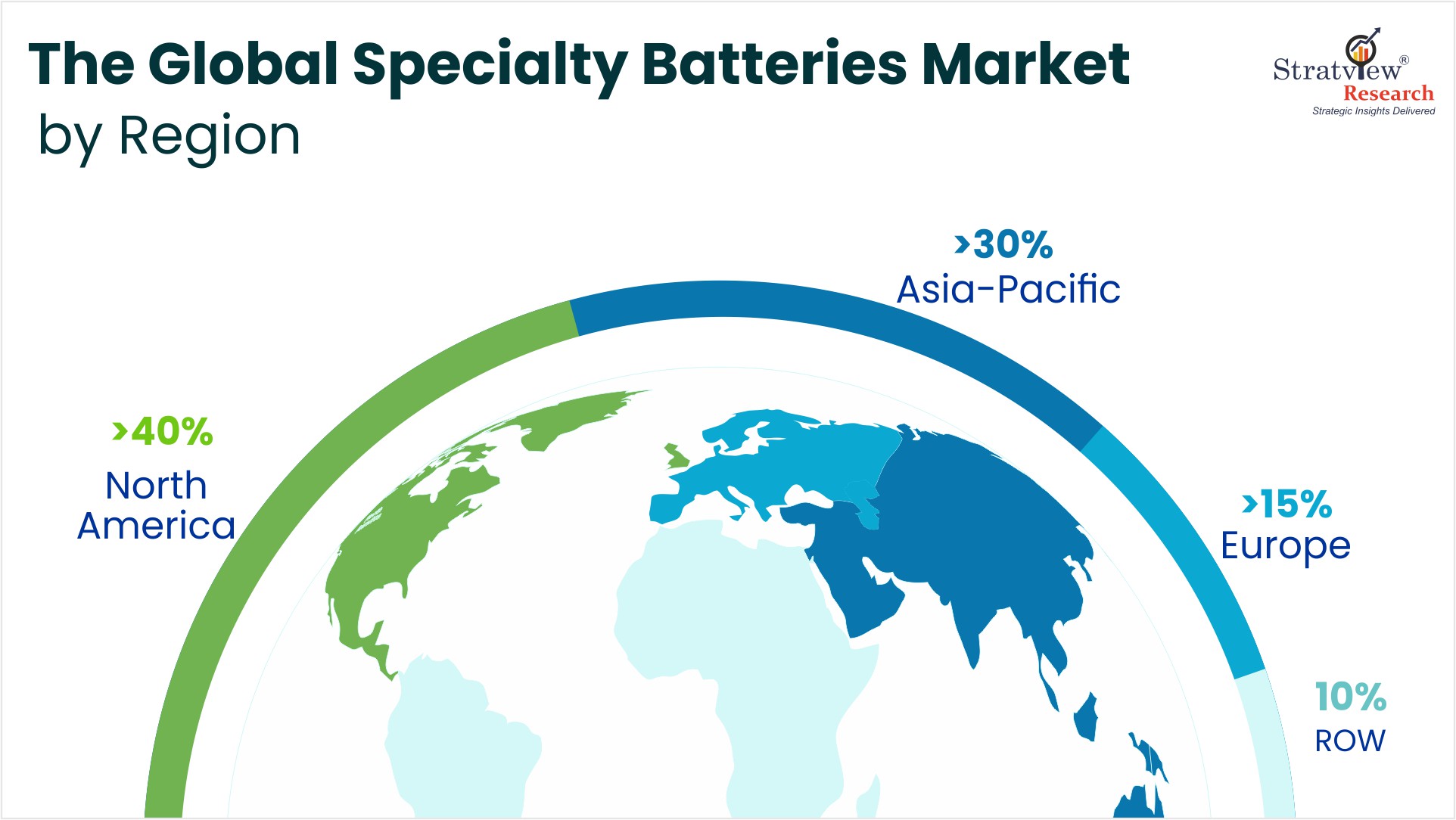

Fig 1: Showing Global Specialities Market

Ongoing wars, intensifying geopolitical risks, ranging from the Indo-Pacific to flare ups in the Middle East, etc. are significantly impacting the way countries plan their defence budget. The ripple effect is clear: everything from ground combat platforms to naval systems, satellites, and fighter jets sees accelerated development.

These are not passing trends, or just data. These are structural shifts backed by investments, policy shifts, and global momentum. These are about upgrading entire ecosystems, where electronics are the core. This clearly depicts a picture of specialty batteries market rising. Research suggests, the global value of specialty batteries market is likely to cross ~4.4 billion in 2030.

Authored by Stratview Research. Also published on – Battery Tech Online