According to Stratview Research, projected sales of composite EV battery enclosures from China and Europe between 2023 and 2030 are expected to exceed 36 million units, accounting for approximately 85% of global sales during this period.

Arguably, one of the most important components in an electric vehicle (EV) is its battery. And what is more important is, the part that keeps those batteries safe, dry and in working condition. There are many terms to describe this part. Call them boxes, trays, or enclosures; these structures hold and wrap all the battery components together.

We are talking about EV battery enclosures, and the material choice and key design consideration for these components should be very optimum. As per the Society of Automobile Engineers (SAE), material choice as of 2023 amounted to ~80% of metals including steel and aluminium, with aluminium dominating, since it is ~40% lighter than steel.

Given that battery packs can constitute up to 25%-40% of total vehicle weight, engineers are actively seeking lighter alternatives to metals, that not only reduce weight but also provide superior thermal management.

Compared to now favourite – aluminium, composites emerge as a compelling alternative ticking all the boxes for lightweight construction, thermal management and more, owing to their exceptional properties. They even offer mass savings of 30% - 50% (depending on application) compared to that of aluminium.

Composite Enclosures for Lightweighting and More

The first question a potential EV buyer asks is – “How far can I drive this car?”

Typically, EVs weigh somewhere between 600 – 1,100 pounds and most of them have a range from 250-400 miles. This range somewhat matches that of the gasoline powered vehicles, but charging stations’ count is far less than that of gasoline stations, though the count is changing. In today’s EV market, composites are primarily used for their lightweight properties in addition to other benefits, and this makes sense, as the Newton’s laws states – a lower mass requires less force to accelerate an object.

Even if 100 pounds of weight is taken off the vehicle, it can improve fuel efficiency by 1-2% – claims the United States Environmental Protection Agency (EPA). This holds opportunity for battery enclosures too.

To get a quick comparison – an empty metallic battery enclosure adds 110-160 kilograms (Kgs) to vehicle mass making them one of the heaviest components on battery electric vehicles (BEVs). And if we consider an EV battery enclosure made of 100% composite material – it would weigh around 60-90 Kgs, reflecting the 40% weight reduction composites offer. This is just one of the benefits.

EVs are susceptible to thermal runaway due to highly reactive content in its batteries. Here comes the second benefit composite material has to offer. Composite EV battery enclosures provide superior thermal insulation, which help maintain optimal battery temperatures and reduces the risk of thermal runaway.

Material wise – Aluminum has high thermal conductivity with melting point ~630 °C, and a battery fire can reach 1200°C, or more, making the aluminum box last for a short time. Composites, on the other hand, are generally safer due to their better thermal insulation and fire resistance properties.

|

Property |

Aluminium |

Composites |

|

Weight |

~40-50% lighter than steel |

~40% lighter than aluminium |

|

Strength |

Highly tension loaded applications might increase fatigue failure and maintenance |

Composites are great at handling tension compared to aluminum |

|

Corrosion Resistance |

Excellent resistance due to natural oxide layer |

Highly resistant and immune to most forms of chemical attack |

|

Cost |

Higher cost than steel but competitive due to weight savings |

Often higher cost due to complex processing and materials used |

|

Manufacturing Flexibility |

High formability allows complex designs |

Excellent design freedom; can be molded into complex shapes |

|

Flame Resistance |

Moderate flame resistance; needs additional measures for high-performance applications |

Can be engineered for high flame resistance, suitable for thermal runaway events |

|

Recyclability |

Highly recyclable with lower energy input |

Varies by type; some composites are recyclable, enhancing sustainability |

Table 1 : Aluminium and Composites: Property-by-Property Comparison

These factors lead onto a crucial third advantage of modern enclosure technology or structural benefits of composite enclosures. Battery enclosures are multicomponent assemblies, meaning – each component is attached to the previous one, which can demand some extra space.

The light-weight composite materials allow greater design freedom and enable to create complex geometries reducing the number of components (almost by 90%) needed while optimizing space.

Composite battery enclosures enhance structural integrity and fire safety says Mitsubishi Chemical Group that offers a complete suite of solutions for EV battery enclosures. The group states that composite enclosures require 30% less space, compared to traditional metals.

Dominance of Glass Fiber in Enclosure Manufacturing

Composite selection for EV battery enclosures prioritizes high strength-to-weight, thermal stability, crash resistance, and cost. Glass fiber composites dominate with 95%+ share, balancing performance with affordability, and hence, are expected to retain leadership through 2030.

The segment is projected to generate nearly US$ 23.6 billion in revenues between 2023 and 2030, with major players such as Teijin Automotive Technologies, Hanwha Group, Gestamp, SGL Carbon, and STS Group AG shaping the landscape.

Carbon fiber composites are also used, but in a handful of models, such as Chevrolet Spark, Nio, and BMW i3, either fully or in hybrid structures with glass fiber and epoxy, their adoption remains niche due to higher costs.

On the process side, sheet molding compound (SMC)-based compression molding is the industry standard, favored for scalability, design flexibility, and suitability for mass-volume production. Companies including Magna International, Teijin, Hanwha, Gestamp, Kautex, and STS Group AG continue to rely heavily on this process.

Alternative methods such as resin transfer molding (RTM) and vacuum infusion are deployed in select cases for enhanced structural integrity and precise fiber alignment, but compression molding still accounted for more than 90% of demand in 2022 and is expected to maintain this dominance through 2030.

China’s EV Battery Tech Solidifies its Dominance

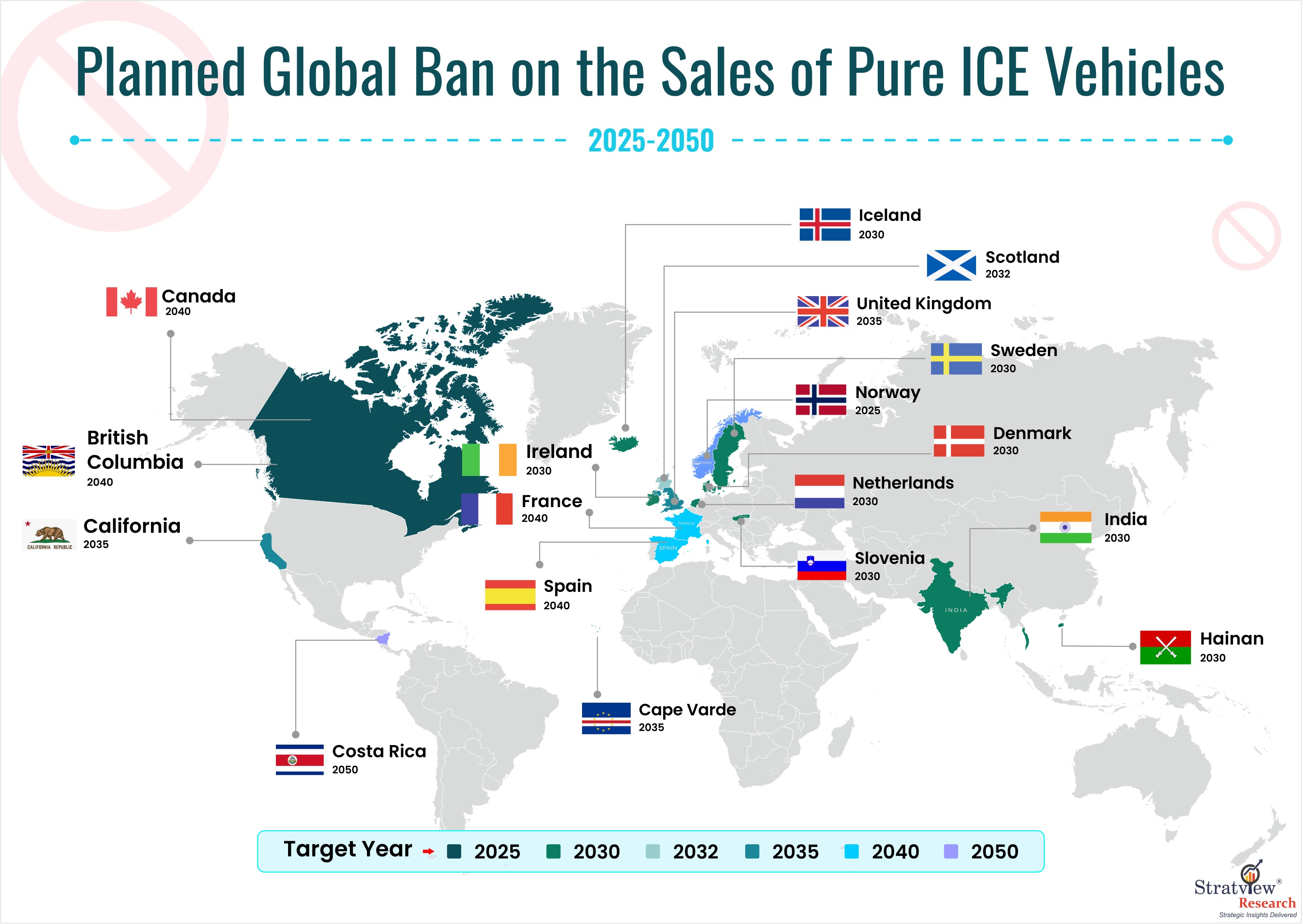

Many nations have announced targets or plans for phasing out internal combustion engines (ICE) vehicles as a strategic move to accelerate electric vehicle (EV) adoption and decarbonize transport.

Fig.1: Ban on Sales of Ice Vehicles by Nations

With this, automakers are also rapidly aiming toward all-EV production lines.

This worldwide transition to EVs is majorly led by China. The nation accounted for over 60% of global EV sales in 2023, as per the International Energy Agency (IEA). China also is the world leader in battery technology, particularly in the production of core battery components – commanding 70% of global cathode and 85% of anode production capacity. Additionally, it also has control over critical mineral refining, processing over half of the world’s lithium, cobalt, and graphite supply.

The country also hosts major players like Minth, EMP Tech, and Nio, all actively involved in developing composite EV battery enclosures. Domestic giants such as BYD and SAIC have also built in-house capabilities to manufacture these components.

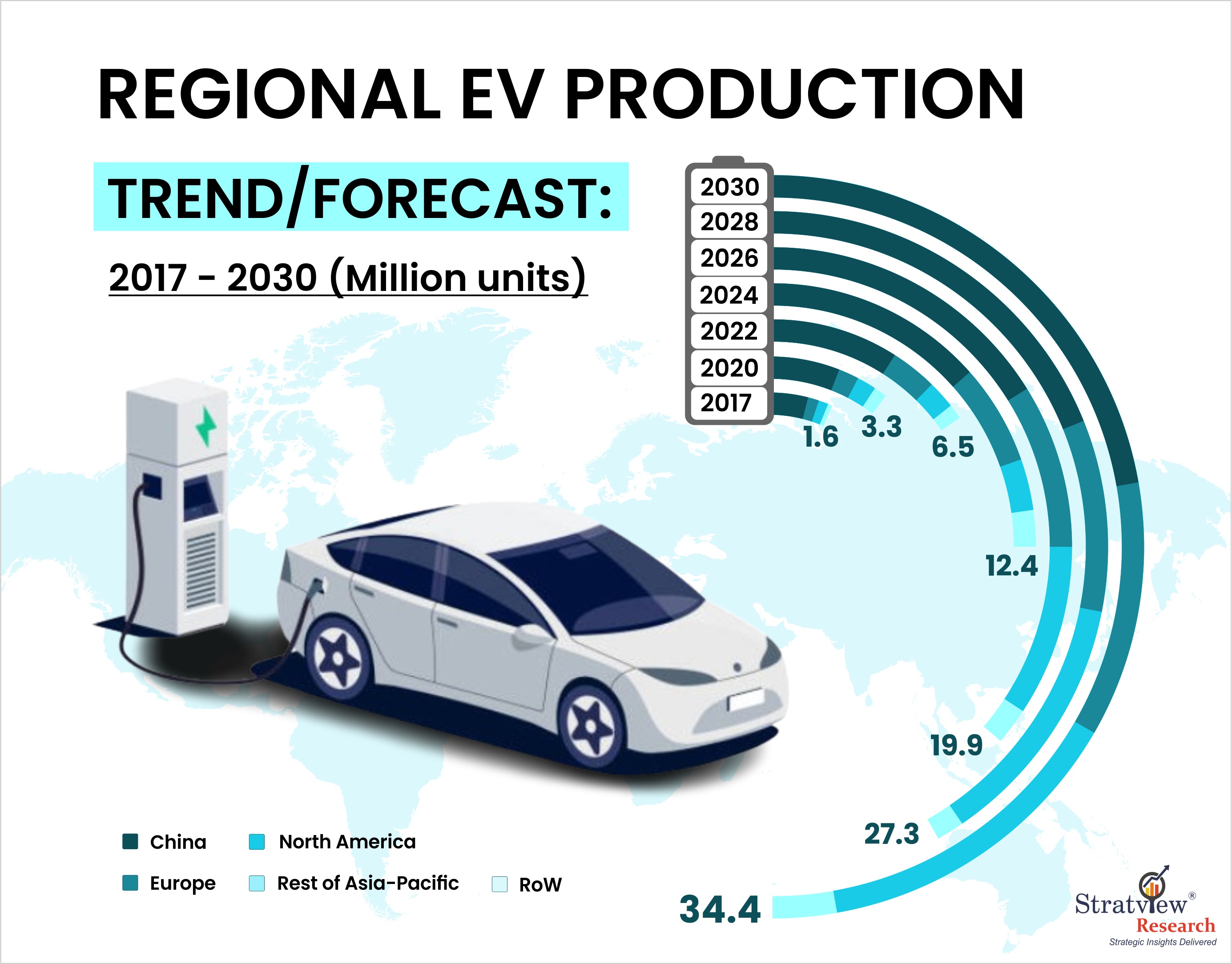

Fig 2: Regional Ev Production Trend/forecast - 2017 - 2030 Million Units

Following these, China alone, overwhelmingly shapes the global composite EV battery enclosures market, commanding around 65% of global sales in 2022. With a market size of $560 million that year and projected cumulative sales of more than $13 billion by 2030, the country stands as the clear global leader.

Europe – the second top region in the global composite EV battery enclosures market, also is advancing faster in relative terms, though lags far behind in absolute market volume. Big players such as Gestamp, SGL Carbon, and STS Group develop composite EV battery enclosures, and the nation’s legislation to decrease CO2 emissions are enhancing the regional sales.

As per Stratview Research, the combined (projected) sales from China and Europe during 2023-2030 might account for over 36 million units, representing ~85% of the global composite EV battery enclosures’ sales, during the same period.

Composite Battery Enclosures Making Mobility of Tomorrow Even More Efficient

There are a few barriers to the mass adoption of composite-made enclosures, but breakthroughs and a few global trends are driving their unstoppable growth.

Composite materials for enclosures face high costs (3–10× aluminum), complex molding, and insulation risks. Porsche recalled its Taycan models to reinstall their software to avoid insulation risks. Suppliers like Zircotec use conductive coatings to counter failures.

On the other side, breakthroughs include Teijin’s 15% lighter multi-material design, SABIC’s flame-retardant Stamax FR, and Mitsubishi–EDAG’s box that is 40% lighter, stiffer, and space-saving. Integration is advancing too: BYD’s Blade CTP and CTB packs boost space use by 50%, while Hyundai/Kia explore chassis-integrated designs for greater density and range.

Today, electric vehicles occupy a growing share of traffic on roads around the world. Watching the rising trend of EVs globally, the overall EV battery enclosure market indicates a market value exceeding US$ 18 billion by 2030.

Among the different type of EVs’ powertrain Battery Electric Vehicles (BEVs) are the leading type in terms of market share and sales volume. By 2031, the production of BEVs is expected to surpass 51 million units, accounting for the majority share of total EV production.

Similarly, supported by government policies and other initiatives, the growing production numbers of passenger car segment remains the front-runner in this transition. In 2024, more than 70% of the motor vehicle production was generated by the passenger cars segment, amounting to almost 67 million.

With BEVs, especially passenger cars continuing to outpace hybrids in both innovation and adoption, the need for lighter, thermally efficient, and scalable battery enclosures is only intensifying.

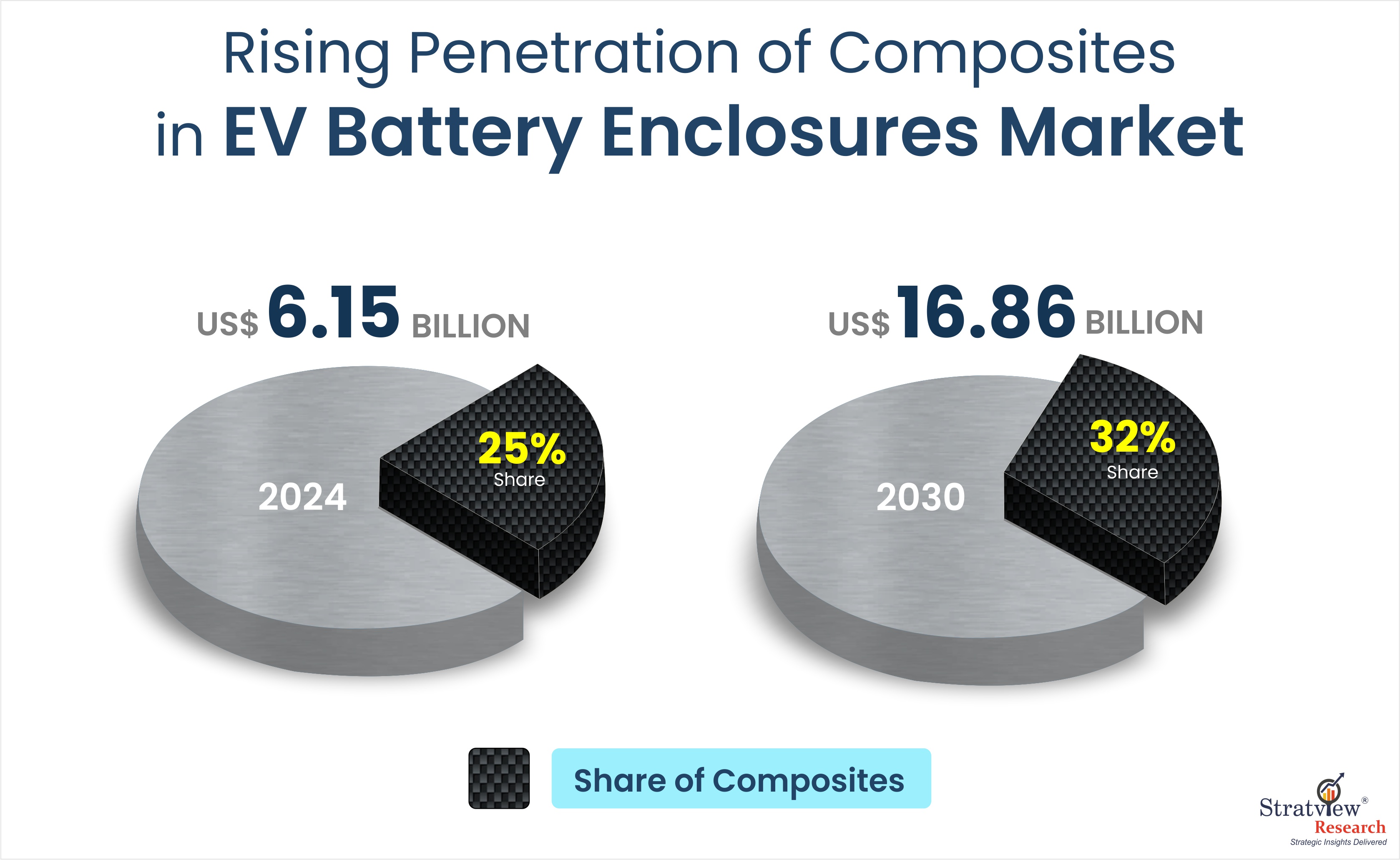

Fig. 3 : Rising Composite Adoption in EV Battery Enclosure Market (2024–2030)

Of the total EV battery enclosures market – which was worth US$ 5.6 billion in 2023, composite EV battery enclosures contributed a 27% share.

While the current market share of composite EV battery enclosures may be modest, it is projected to experience rapid growth, with an annual growth rate exceeding 23%. As electric vehicles become increasingly mainstream, composite enclosures will be instrumental in driving the industry forward, enabling the development of more powerful, efficient, and sustainable transportation solutions.

Authored by Stratview Research. Also published on – Battery Tech Online

(1).jpg)