Dissolvable frac plugs emerged as a game-changing solution for extended-reach wells, overcoming the drill-out costs associated with composite plugs. Since their introduction in 2015, their adoption has surged, and by 2025 they have grown to nearly half the market size of composite frac plugs, according to Stratview Research.

Over the past decade, the number of horizontal wells in the United States has risen from approximately 110,000 to over 200,000, and given the country’s concerted efforts to achieve energy self-sufficiency and its continued reliance on natural gas, such growth in drilling activity is no surprise.

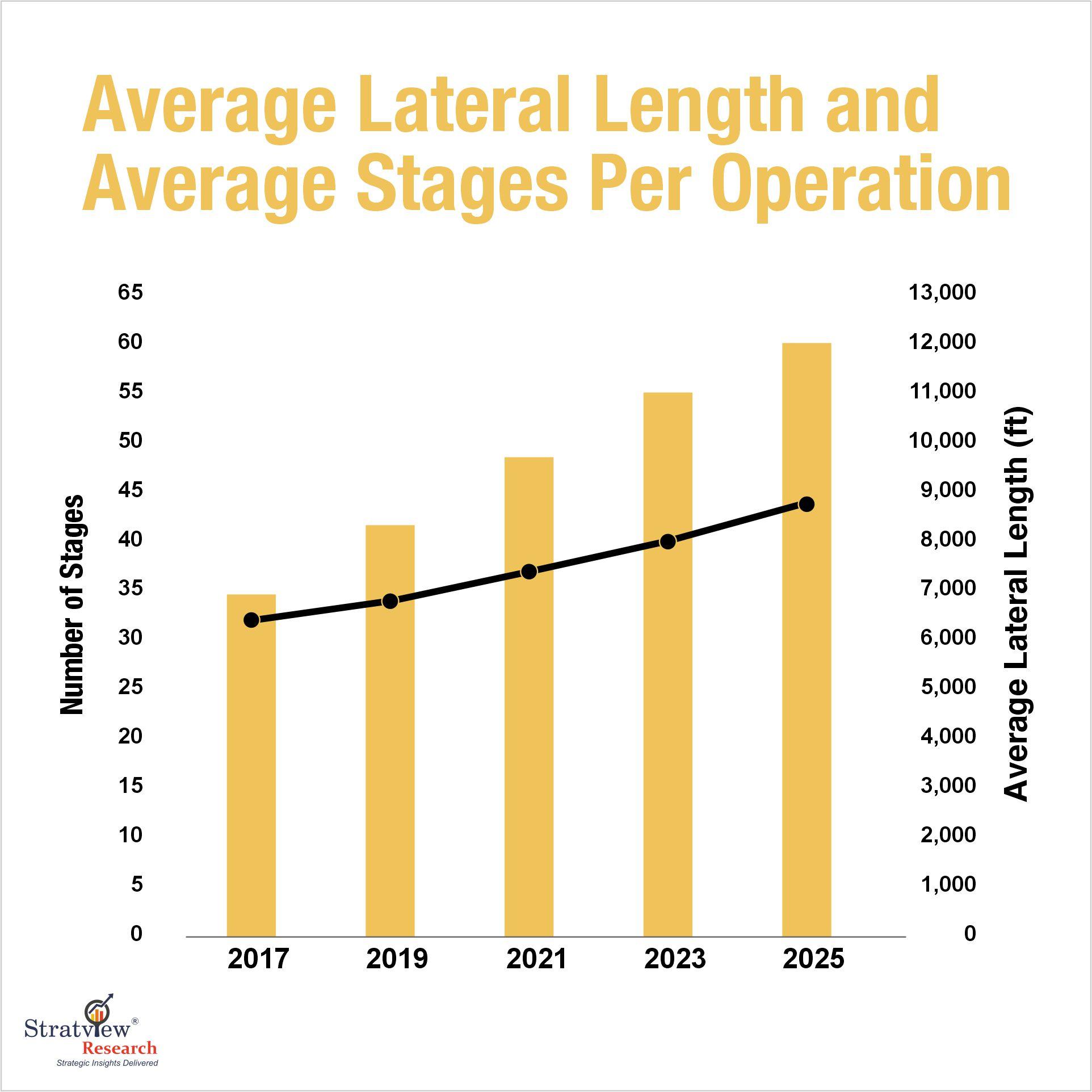

Consequently, the number of fracking operations conducted annually in the US also increased significantly, and so has the complexity of the process. Wells have become longer, and the stages have multiplied. Notably, the average number of fracture stages per well has increased from roughly 20 in 2015 to as high as 40 as of 2025.

While these technological refinements have enhanced operational efficiency and yield, they have also introduced heightened complexity to well completion and zonal isolation procedures. From an engineering perspective, achieving these levels of intricacy in multi-stage fracturing operations would have otherwise been very difficult for oilfield service companies, if not for the advent of methods like plug-and-perf, the concept of zonal isolation, and innovations like frac plugs.

Making Well Operations More Efficient and Economical:

Originally manufactured from cast iron, frac plugs made their initial transition to composite materials in the late 1980s. This shift was primarily driven by the need to accelerate the drill-out process, as cast iron frac plugs struggled to perform effectively with the increasing perforated lateral lengths in hydraulic fracturing operations. At the time of their introduction, the average lateral length in major shale basins such as the Marcellus and Permian was typically <2,000 feet, which has now extended to over 12,000 feet.

Fig 1 : Avg Lateral Length and Average Stages per Operation Overview

Despite the adoption of composite materials, the early versions of composite frac plugs continued to utilize cast iron slips, which still posed operational challenges. Fortunately, these cast iron slips were eventually replaced with ceramic slips, resulting in enhanced performance and efficiency.

As a result, drill-out times per plug decreased dramatically - from upwards of 20 minutes in the case of cast iron plugs, to as little as 6–7 minutes for their composite counterparts in certain instances.

While a reduction of a few minutes per plug may appear marginal in isolation, modern fracturing operations frequently employ anywhere between 60-80 plugs. Even a conservative savings of 10 minutes per plug aggregates to roughly 13 hours, translating into cost reductions of ~$150,000 per operation.

Nevertheless, composite frac plugs too had their limitations revealed during the toe stages of extended-reach wells because, although faster to remove as compared to cast iron plugs, coiled-tube drill-outs still remained expensive. This limitation gave rise to the invention of dissolvable frac plugs, which are now slowly becoming the industry standard for extended-reach wells. The adoption rate of Dissolvable Frac Plugs has been continuously high ever since their entry into the industry around 2015 and as of 2025, it already has a market half as big as that of Composite Frag Plugs, according to Stratview Research.

Drilling Deep into the Multi-stage Market:

Approximately 90 % (~65% from the US and ~25% from the rest of NA) of the demand for composite fracturing plugs is projected to originate from North America. This regional concentration is influenced by factors beyond the mere presence of shale formations and requisite technological capabilities. In Europe, for instance, initial exploratory efforts in Poland—once believed to host the continent’s largest shale?gas reserves—proved disappointing and have thus been shelved for ~10 years now. France, long regarded as the second?largest prospect, has imposed multiple fracking bans and officially designates the practice as environmentally hazardous. Among all the regions, the APAC region is expected to grow the fastest in the next five years, mainly attributed to China. But, as mentioned earlier as well, the output obtained will hardly be 5% of the US.

For the US, despite some minor drops in the overall active rig count in major areas like the Permian basin, and consequently in the number of new wells drilled, expected in 2026, the number of fracking operations is expected to remain more or less constant till 2029.

According to a May 2025 report from the IEA, ~11,000 new wells were drilled onshore in the US in 2024. Maintaining a similar number of new well operations with minor fluctuations, the US alone is expected to generate a demand for ~440,000 units of frac plug and frac ball sets in 2025, according to Stratview Research. The demand translates to ~$530 million and is expected to surpass $660 million in 2030. Within NA, other than the US, countries like Canada and Mexico also contribute significantly(~25%) to the global market for FRP frac plugs and present opportunities bigger than the rest of the regions like Europe, APAC, etc., combined. The global market for Composite Frac Plugs is expected to surpass $1 bn by 2030.

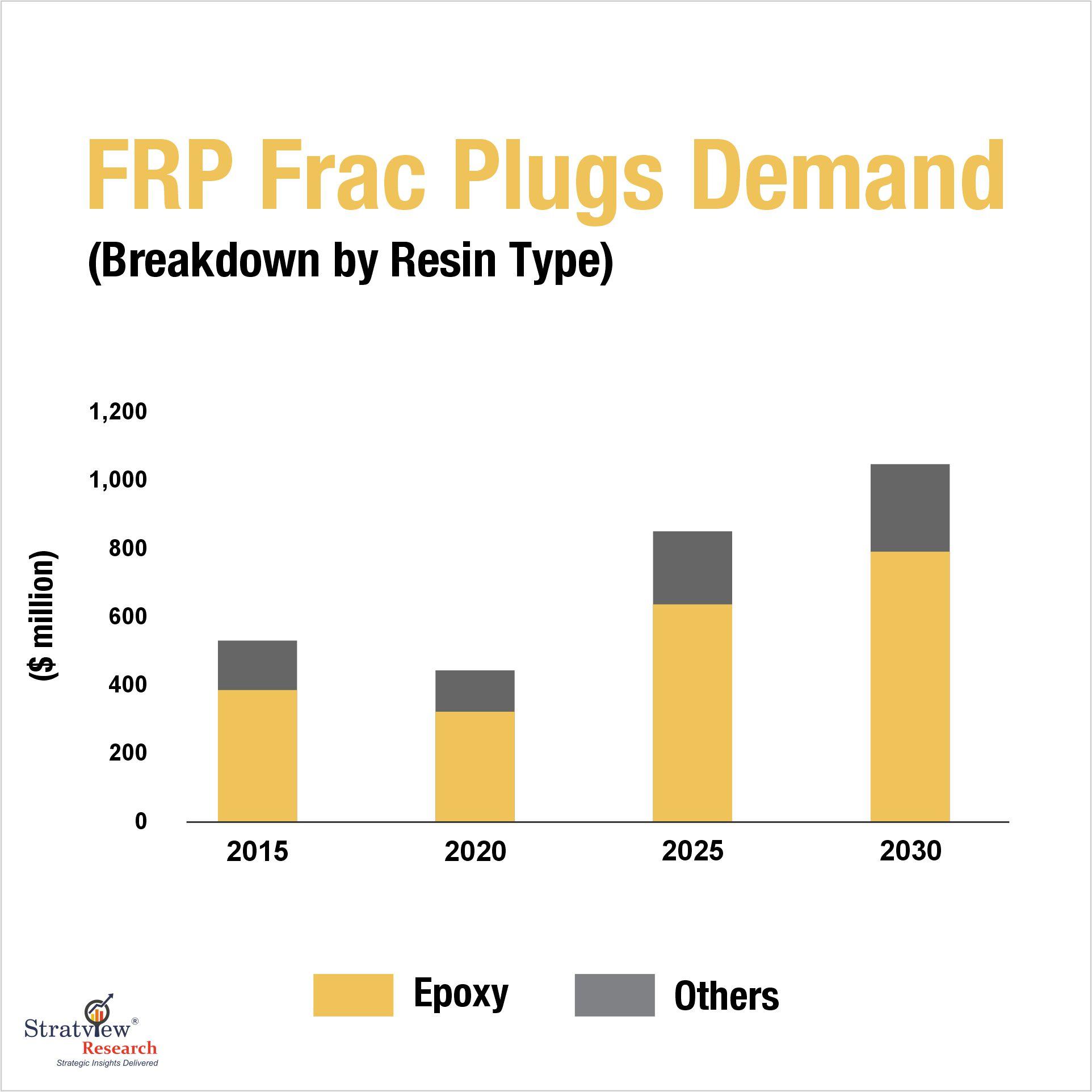

Fig 2: Demand Distribution of FRP Frac Plugs by Resin Type

Almost the entire line of FRP frac plugs is made of glass composites, and according to Stratview, ~50% of the FRP frac plug portfolio utilizes Glass Fibre Reinforced Epoxy Composites. A cumulative demand for ~2.4 million units of composite frac plugs made of GFRE, thus, is expected to be generated globally between 2025-30, according to Stratview’s analysis.

While the demand from regions other than NA is not as huge, one cannot say the same about the opportunities. An estimated 14 trillion cubic meters (tcm) of technically recoverable shale gas reserves remain untapped in European countries, which has the potential to position Europe among the top producers of shale gas, and a lucrative market for Frac Plugs.

Though a critical enabler in modern fracking operations, composite frac plugs also have their own share of challenges. Stringent government regulations, introduction of alternatives like Dissolvable Frac Plugs, and quick but expensive drill-outs remain some of the key challenges that still need to be addressed. Nonetheless, the role of FRP frac plugs in revolutionizing fracking operations globally cannot be overlooked and as the industry moves towards longer and more complex fracking operations, the opportunities for this critical enabler grow bigger and stronger.

Authored by Stratview Research. Also published on – JEC Composites Magazine July-August 2025