Attractive Opportunities

Global Demand Analysis & Sales Opportunities in the Defense Composites Market:

-

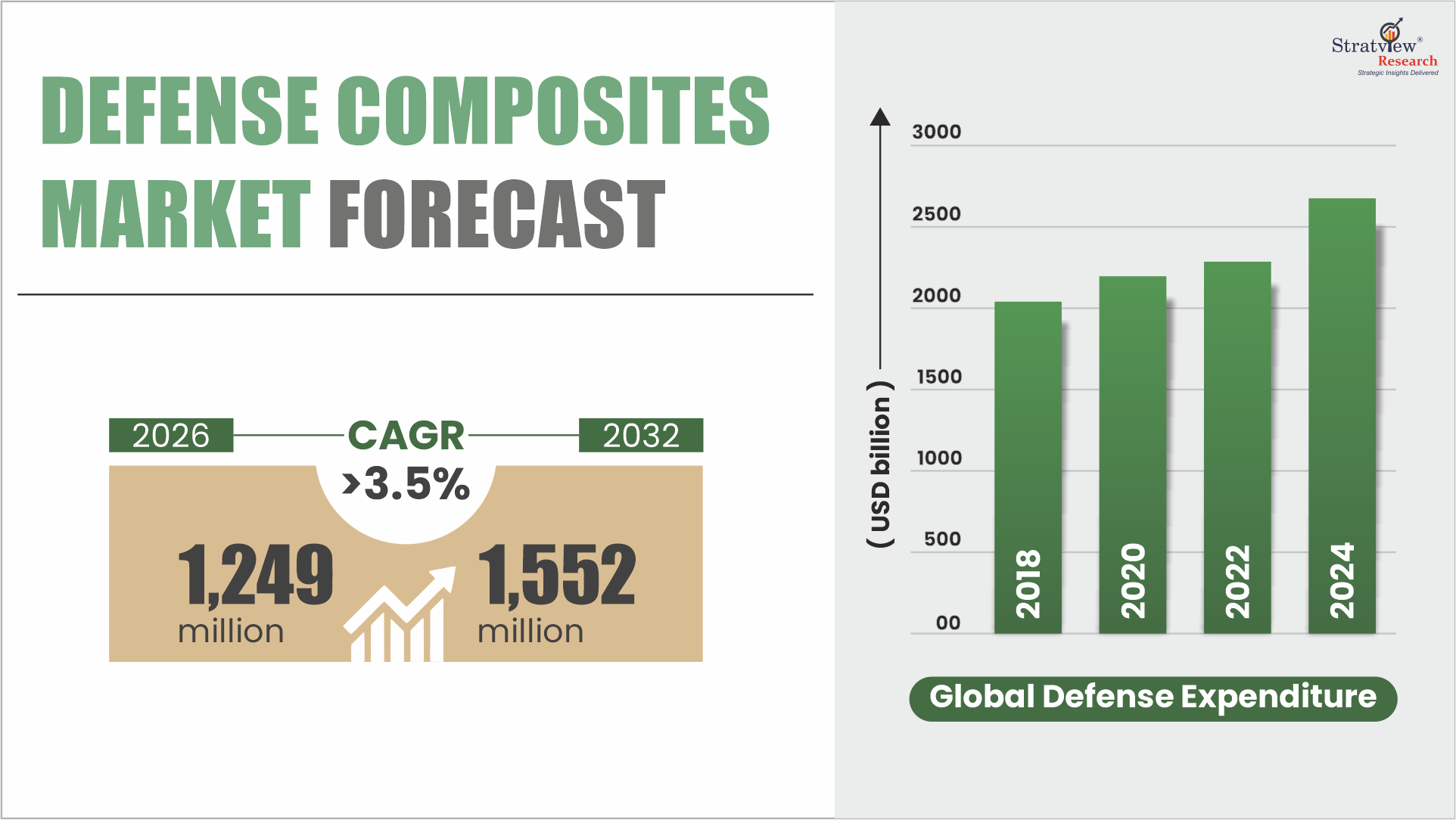

The annual demand for defense composites was USD 1,171 million in 2025 and is expected to reach USD 1,249 million in 2026, up 6.7% than the value in 2025.

-

During the forecast period (2026 to 2032), the defense composites market is expected to grow at a CAGR of 3.7%. The annual demand will reach USD 1,552 million in 2032.

-

The defense sector is witnessing a historic surge in funding, highlighted by the U.S. proposed defense budget reaching a landmark $1.5 trillion. This level of spending is significantly higher than any previous fiscal cycle; if successfully passed and executed, it will create a massive wave of new opportunities for advanced material suppliers and composite manufacturers.

-

Military aircraft, the largest application (~40%) for defense composites, is also witnessing strong growth, driven by strategic fleet modernization initiatives such as the U.S. Air Force’s objective to expand its combat-coded fighter fleet to 1,558 aircraft by 2035. Such expansions, centered on next-generation platforms, are expected to drive demand for composite materials within the defense industry significantly.

-

The global fleet of in-service military aircraft is projected to increase by approximately 3,100 units by 2032, reflecting ongoing modernization and replacement cycles.

-

During 2026-2032, the defense composites industry is expected to generate a cumulative sales opportunity of USD 9,958 million.

Want to get a free sample? Register Here

High-Growth Market Segments:

-

North America is expected to be the dominant region during the forecast period.

-

By Reinforcement type, Carbon Composites are expected to remain the dominant type in the market during the forecast period.

-

By Resin type, Thermoset Composites are likely to hold the dominant position in the market during the forecast period.

-

By Application type, Military Aircraft is projected to maintain its market lead across the forecast period.

Market Statistics:

Have a look at the sales opportunities presented by the defense composites market in terms of growth and market forecast.

|

Defense Composites Market Data & Statistics

|

|

|

Market Statistics

|

Value (in USD Million)

|

Market Growth (%)

|

|

Annual Market Size in 2024

|

USD 1,107 million

|

-

|

|

Annual Market Size in 2025

|

USD 1,171 million

|

YoY Growth in 2025: 5.7%

|

|

Annual Market Size in 2026

|

USD 1,249 million

|

YoY Growth in 2026: 6.7%

|

|

Annual Market Size in 2032

|

USD 1,552 million

|

CAGR 2026-2032: 3.7%

|

|

Cumulative Sales Opportunity during 2026-2032

|

USD 9,958 million

|

-

|

|

Top 10 Countries’ Market Share in 2025

|

USD 936 million+

|

> 80%

|

|

Top 10 Companies’ Market Share in 2025

|

USD 585 million to 820 million

|

50% - 70%

|

Market Dynamics

Market Drivers:

Rising Defense Budgets Fueling Demand for Advanced Materials

-

Global military expenditure has exhibited a sustained upward trajectory, creating a macroeconomic environment that supports increased defense procurement and the adoption of advanced materials such as composites.

-

According to SIPRI, world military spending reached approximately $2,718 billion in 2024, marking the 10th consecutive year of increases and a 9.4% rise, the largest annual jump since at least 1988. This trend reflects growing defense commitments across multiple regions, with the global military burden rising to 2.5% of GDP. Looking ahead, Forecast International projects that global defense spending will reach around $2.6 trillion by the end of 2026, representing continued financial capacity for modernization programs.

-

The combination of sustained high expenditure and forecasted growth enables governments and armed forces to invest in next-generation platforms and high-performance materials, like composites, which are essential for improving platform performance, survivability, and lifecycle effectiveness.

Growing Use of Lightweight Composites Across Defense Platforms

-

Global defense forces are increasingly integrating lightweight, high-strength composite materials across air, land, and naval platforms to enhance operational performance, durability, and lifecycle efficiency. Composites are steadily replacing conventional metals in aircraft fuselages, wings, unmanned systems, armored vehicles, and protective equipment due to their superior strength-to-weight ratio, corrosion resistance, and fatigue performance.

-

The growing penetration of composites is most evident in advanced combat aircraft operated by major military powers. Fifth-generation and next-generation fighters rely extensively on composite structures to enable stealth performance, structural weight reduction, and extended mission range. Platforms such as the F-35 Lightning II, Chengdu J-20, and HAL Tejas incorporate a high proportion of carbon-fiber composites, underscoring their strategic importance in modern air superiority programs. Concurrent production scale-ups and induction programs, including Tejas Mk-1A deliveries to the Indian Air Force and continued global acquisitions of composite-intensive fighters such as the Dassault Rafale, are reinforcing sustained demand for advanced defense composites.

Market Opportunities:

Expansion of Unmanned and Next-Generation Composite-Intensive Platforms

-

The growing deployment of unmanned aerial vehicles (UAVs) and next-generation stealth aircraft is driving sustained demand for lightweight, high-strength composite materials. Reduced structural weight improves range, endurance, and payload capacity, making composites essential for performance-optimized air platforms.

-

The U.S. Department of Defense FY2025 budget request allocates approximately USD 61.2 billion for Air Power, including programs such as the F-35 Lightning II and the B-21 Raider, engineered with advanced composite and stealth-compatible structures.

-

As defense modernization efforts increasingly prioritize autonomous and survivable platforms, composite-intensive aircraft architectures present a long-term structural growth opportunity for the defense composites market.

Fleet Expansion and Modernization Driving Composite Demand

-

The global military aircraft fleet is projected to expand from approximately 56,350 aircraft in 2025 to around 58,700 by 2034, reflecting sustained aircraft deliveries and long-term fleet modernization programs.

-

This growth is increasingly driven by next-generation platforms developed by major OEMs such as Lockheed Martin (F-35 Lightning II), Boeing (F-15EX, KC-46A), Airbus Defence and Space (A400M, Eurofighter consortium partner), Dassault Aviation (Rafale), and Hindustan Aeronautics Limited (HAL) (Tejas).

-

Modern combat and transport aircraft from these manufacturers incorporate advanced composite materials to reduce weight, improve efficiency, and enhance stealth performance. As composite-intensive platforms replace legacy fleets, expanding aircraft production presents a sustained growth opportunity for the defense composites market.

Segment Analysis

|

Segmentations

|

List of Sub-Segments

|

Segments with High Growth Opportunity

|

|

Reinforcement Type Analysis

|

Carbon Composites, Glass Composites, Aramid Composites, and Ceramic Composites

|

Carbon composites are expected to be the dominant while ceramic composites are projected to be the fastest growing reinforcement type in the market during the forecast period.

|

|

Resin Type Analysis

|

Thermoset Composites, Thermoplastic Composites, and Ceramic Matrix Composites

|

Thermoset composites are projected to lead the market with the majority of market share, whereas thermoplastic composites are likely to witness the highest-growth rate during the forecast period.

|

|

Application Type Analysis

|

Military Aircraft, Naval Systems, Land Vehicles, Personal Protection, Arms & Ammunition, and Others

|

Military aircraft are anticipated to hold the major share in the market, while missiles are projected to experience the fastest growth during the forecast period.

|

|

Regional Analysis

|

North America, Europe, Asia-Pacific, and the Rest of the World

|

North America is expected to retain its leading position throughout the forecast period, while the Asia-Pacific region is projected to experience the fastest growth.

|

By Reinforcement Type

“Carbon composites are likely to retain the leading share among reinforcement types, with ceramic composites positioned to register the most rapid growth in the foreseeable future.”

-

By reinforcement type, the defense composites market is classified into carbon composites, glass composites, aramid composites, and ceramic composites. Carbon composites are projected to remain the dominant reinforcement type due to their exceptional balance of strength, weight, and performance. These materials are nearly five times stronger and about 30% lighter than aluminum, offering superior heat tolerance and design flexibility.

-

Such attributes directly enhance the operational efficiency of combat aircraft, helicopters, and missile systems by reducing drag, increasing range, and improving stealth capabilities. Modern defense programs are heavily reliant on carbon composites, with next-generation military aircraft projected to comprise over two-thirds composite materials, of which carbon composites constitute the majority. A prime example is the F-35 stealth fighter, where large sections of the wings, fuselage, and internal structures are constructed from carbon composites.

Want to get a free sample? Register Here

By Resin Type

“Thermoset composites are projected to command the largest market share, whereas thermoplastic composites are expected to register the highest growth rate throughout the forecast period.”

-

By resin type, the defense composites market is classified into thermoset composites, thermoplastic composites, and ceramic matrix composites. Thermoset composites are anticipated to remain the dominant resin type during the forecast period, primarily due to their proven strength, durability, and rigidity in demanding defense applications. These materials are especially well-suited for structural components that experience extreme mechanical stress, including military aircraft fuselages, wings, and control surfaces, as well as armored vehicle panels and ballistic protection systems.

-

A significant share of carbon fiber-reinforced composites used in defense platforms is thermoset-based, particularly those using epoxy and bismaleimide (BMI) resins. For example, advanced combat aircraft such as the F-35 fighter jet, Eurofighter Typhoon, and rotary-wing platforms like the Apache and Black Hawk helicopters rely heavily on thermoset composites to ensure structural integrity under high G-loads and extreme environmental conditions.

By Application Type

“Military aircraft are anticipated to continue being the foremost application of the market, and missiles are likely to be the fastest-growing application type during the forecast period.”

-

Based on application type, the defense composites market is segmented into military aircraft, military rotorcraft, UAVs, missiles, land vehicles, and other applications. Military aircraft are expected to be the dominant application in the defense composites market during the forecast period. Modern combat aircraft are increasingly composite-intensive platforms, with composites accounting for 30–50% of their total weight.

-

With global air forces prioritizing modernization and replacement of legacy fleets, demand for military aircraft composites is expected to remain strong. Production ramp-ups in flagship programs further reinforce this trend. For example, Lockheed Martin plans to deliver around 190 F-35 Lightning II fighter jets in 2025, up from its current annual production rate of 156, with continued growth anticipated in subsequent years.

-

Similarly, the People's Liberation Army Air Force is accelerating production of the Chengdu J-20, with output reportedly rising from roughly 30 to 100 aircraft per year; conservative estimates suggest the fleet could exceed 800 aircraft by 2030 and approach 1,500 by 2035, further strengthening long-term demand for advanced composite structures.

Regional Analysis

“North America is anticipated to maintain its market dominance by region over the forecast period, whereas the Asia-Pacific region is poised to emerge as the fastest-growing market.”

-

North America is likely to remain the dominant market by region throughout the forecast period, underpinned by its strong defense industrial base and sustained investments in advanced military programs. A major growth driver is the region’s emphasis on composite-rich military aircraft, rotorcraft, missiles, lightweight land vehicles, and personal protection equipment such as body armor and tactical helmets. Furthermore, North America is home to global aerospace and defense giants such as Boeing and Lockheed Martin, which have established assembly lines for major aircraft programs.

Want to get a free sample? Register Here

-

Boeing produces platforms like the P-8A Poseidon, F/A-18E/F Super Hornet, and F-15E Strike Eagle, while Lockheed Martin manufactures the F-35, F-16, C-130J Super Hercules, and Black Hawk helicopters, all of which rely extensively on composites for structural efficiency, durability, and stealth performance. This concentration of OEMs, coupled with high defense spending by the U.S., ensures that North America remains the largest market for defense composites.

Competitive Landscape

Most of the major players compete in some of the factors, including price, service offerings, regional presence, etc.

The following are the key players in the defense composites market (Based on Dominance) -

Note: The above list does not necessarily include all the top players in the market.

Are you the leading player in this market? We would love to include your name. Please write to us at [email protected]

Recent Developments/Mergers & Acquisitions:

-

In 2025, TexTech acquired FMI for $165 million to expand into carbon–carbon composites, strengthening its ability to support hypersonic and missile defense systems.

-

In 2025, Hexcel and Konsberg came to a long-term agreement for the supply of HexWeb® engineered honeycomb materials for defense & aerospace applications.

-

In 2025, Syensqo and Terma collaborated to integrate Syensqo’s high-performance adhesives, polymers, and composites into Terma’s aerospace & defense system.

-

In 2024, Toray acquired Gordon Plastics to expand its continuous-fiber thermoplastic tape production via a Colorado facility, enabling advanced high-temperature defense applications like lightweight ballistic structures and rugged UAV parts.

-

In 2019, Hexcel acquired ARC Technologies LLC, a leading supplier of custom RF / EMI and microwave absorbing composite materials for military, aerospace, and industrial applications, for growth and market penetration.

Report Features

This report provides market intelligence most comprehensively. The report structure has been kept so that it offers maximum business value. It provides critical insights into market dynamics and will enable strategic decision-making for existing market players as well as those willing to enter the market.

The following are the key features of the report:

-

Market structure: Overview, industry life cycle analysis, supply chain analysis.

-

Market environment analysis: Growth drivers and constraints, Porter’s five forces analysis, SWOT analysis.

-

Market trend and forecast analysis.

-

Market segment trend and forecast.

-

Competitive landscape and dynamics: Market share, Service portfolio, New Product Launches, etc.

-

COVID-19 impact and its recovery curve.

-

Attractive market segments and associated growth opportunities.

-

Emerging trends.

-

Strategic growth opportunities for the existing and new players.

-

Key success factors.

|

Market Study Period

|

2019-2032

|

|

Base Year

|

2025

|

|

Forecast Period

|

2026-2032

|

|

Trend Period

|

2019-2024

|

|

Number of Tables & Figures

|

>100

|

|

Number of Segments Analysed

|

4 (Reinforcement Type, Resin Type, Application Type, and Region)

|

|

Number of Regions Analysed

|

4 (North America, Europe, Asia-Pacific, Rest of the World)

|

|

Countries Analysed

|

15 (The USA, Canada, Mexico, Germany, France, Italy, The UK, China, Japan, India, Brazil, Saudi Arabia, Rest of Europe, Rest of APAC, and Rest of the World)

|

|

Free Customization Offered

|

10%

|

|

After Sales Support

|

Unlimited

|

|

Report Presentation

|

Complimentary

|

|

Market Dataset

|

Complimentary

|

|

Further Deep Dive & Consulting Services

|

10% Discount

|

Market Segmentation

The report provides detailed insights into the market dynamics to enable informed business decision-making and growth strategy formulation based on the opportunities present in the market.

The defense composites market is segmented into the following categories.

Defense Composites Market, by Reinforcement Type

-

Carbon Composites (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

-

Glass Composites (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

-

Aramid Composites (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

-

Ceramic Composites (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

Defense Composites Market, by Resin Type

-

Thermoset Composites (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

-

Thermoplastic Composites (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

-

Ceramic Matrix Composites (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

Defense Composites Market, by Application Type

-

Military Aircraft (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

-

Military rotorcraft (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

-

UAVs (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

-

Missiles (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

-

Land Vehicles (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

-

Other Applications (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

Defense Composites Market, by Region

-

North America (Country Analysis: The USA, Canada, and Mexico)

-

Europe (Country Analysis: Germany, France, The UK, Russia, and the Rest of Europe)

-

Asia-Pacific (Country Analysis: Japan, China, India, and the Rest of Asia-Pacific)

-

Rest of the World (Country Analysis: Saudi Arabia, Brazil, and Others)

Research Methodology

-

This strategic assessment report from Stratview Research provides a comprehensive analysis that reflects today’s defense composites market realities and future market possibilities for the forecast period.

-

The report segments and analyzes the market in the most detailed manner in order to provide a panoramic view of the market.

-

The vital data/information provided in the report can play a crucial role for market participants and investors in identifying the low-hanging fruit available in the market and formulating growth strategies to expedite their growth process.

-

This report offers high-quality insights and is the outcome of a detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research’s internal database and statistical tools.

-

More than 1000+ authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white papers, patents, and articles, have been leveraged to gather the data.

-

We conducted more than 10 detailed primary interviews with market players across the value chain in all four regions and industry experts to obtain both qualitative and quantitative insights.

Customization Options

With this detailed report, Stratview Research offers one of the following free customization options to our respected clients:

Company Profiling

- Detailed profiling of additional market players (up to three players)

- SWOT analysis of key players (up to three players)

Competitive Benchmarking

- Benchmarking of key players on the following parameters: Product portfolio, geographical reach, regional presence, and strategic alliances

Custom Research: Stratview Research offers custom research services across industries. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to [email protected]