Market Insights

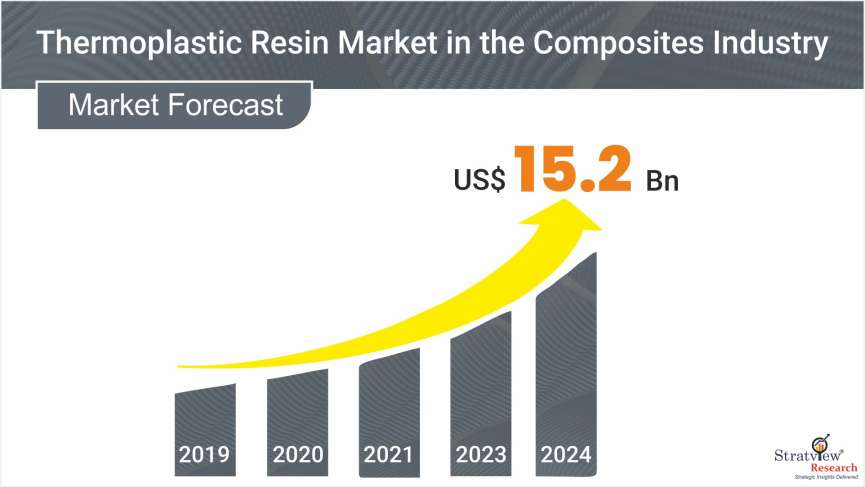

The thermoplastic resin market in the composites industry is projected to reach USD 15.2 billion in 2024 and offers favorable growth opportunities in the entire ecosystem of the market.

Want to know more about the market scope? Register Here

Market Dynamics

Introduction

Thermoplastic resin is a type of polymer material that becomes soft and moldable when heated and solidifies upon cooling. This process is reversible, allowing the material to be reshaped multiple times without significant chemical degradation. Thermoplastic resins are widely used in manufacturing due to their versatility, recyclability, and durability. Common examples include polyethylene (PE), polypropylene (PP), polyvinyl chloride (PVC), and polystyrene (PS). They are utilized in applications ranging from packaging and automotive parts to consumer goods and medical devices. Thermoplastics offer advantages like lightweight properties, chemical resistance, and ease of processing through injection molding, extrusion, and thermoforming techniques.

Market Drivers

The major factors driving the growth of the thermoplastic resin market in the composites industry are:

- Increasing automobile production.

- Development of new composite applications using thermoplastic composites.

- Rising demand for sustainable (recycling) and fast-curing materials.

- Increasing demand for lightweight components to address stringent regulations such as CAFÉ Standards.

- Increasing penetration of composite materials by replacing metals.

Segments' Analysis

|

Segmentations

|

List of Sub-Segments

|

Segments with High Growth Opportunity

|

|

Resin Type Analysis

|

PP, PA, PBT, PPS, PC, and Others

|

Polyamide is expected to remain the most dominant resin type in the market during the forecast period.

|

|

Compound Type Analysis

|

SFRT, LFRT, GMT, and CFRT

|

SFRT generates the highest demand for thermoplastic resins and is forecasted to remain the largest compound type during the forecast period.

|

|

End-Use Industry Type Analysis

|

Transportation, Consumer Goods, Electrical & Electronic, and Others

|

Transportation is projected to remain the largest market for thermoplastic resins in the composites industry during the forecast period.

|

|

Composite Type Analysis

|

GFRP and CFRP

|

Glass-fiber-reinforced plastic (GFRP) generates the highest demand for thermoplastic resins and is expected to remain the largest composite type during the forecast period.

|

|

Regional Analysis

|

North America, Europe, Asia-Pacific, and Rest of the World

|

Asia-Pacific is expected to remain the largest and the fastest-growing thermoplastic resin market in the composites industry during the forecast period.

|

By Resin Type

The thermoplastic resin market in the composites industry is segmented based on the resin type as Polypropylene, Polyamide, Polybutylene Terephthalate, Polyphenylene Sulfide, Polycarbonate, and Other Resins. Polyamide is expected to remain the most dominant resin type in the market during the forecast period. This resin is most widely used in short fiber-reinforced thermoplastic (SFRT) applications.

By Compound Type

Based on the compound type, the thermoplastic resins are used in short fiber-reinforced thermoplastics (SFRTs), long fiber-reinforced thermoplastics (LFRTs), glass mat thermoplastics, and continuous fiber-reinforced thermoplastics (CFRTs). SFRT generates the highest demand for thermoplastic resins and is forecasted to remain the largest compound type during the forecast period. SFRT is the most dominant compound type in all the major end-use industries including transportation, consumer goods, and electrical & electronics. CFRT and LFRT are relatively small segments but are gaining market tractions by registering an increased acceptance in the automotive and aerospace & defense industries.

By End-use Industry Type

Based on the end-use industry type, the market is segmented into transportation, consumer goods, electrical & electronics, and others. Transportation is projected to remain the largest market for thermoplastic resins in the composites industry during the forecast period. This segment is the second-largest composites market (thermoset + thermoplastic) after building & construction. The segment is also likely to witness the highest growth over the next five years, driven by stringent government regulations, such as CAFÉ Standards and EU’s directive on carbon emission reductions. All the major automakers are forming strategic alliances with the composite material suppliers to develop advanced thermoplastic composites that can fabricate parts in less than five minutes and offer significant weight savings. They are increasingly incorporating advanced materials including composites in the structural and semi-structural applications of their vehicles by replacing traditional metals, such as steel.

By Composite Type

Based on the composite type, glass-fiber-reinforced plastic (GFRP) generates the highest demand for thermoplastic resins and is expected to remain the largest composite type during the forecast period. GFRP dominates in all the major end-use industries, such as transportation, electrical & electronics, and consumer goods. Carbon fiber-reinforced plastic (CFRP) is likely to witness the highest growth during the same period, propelled by its excellent properties at a relatively lower weight.

Regional Insights

In terms of region, Asia-Pacific is expected to remain the largest and the fastest-growing thermoplastic resin market in the composites industry during the forecast period. High production of automobiles, continuous shift of electronic industry from the developed economies to the developing Asian economies, and increasing penetration of composites are major growth drivers of the thermoplastic resin market in the Asia-Pacific’s composites industry.

Know the high-growth countries in this report. Click Here

Key Players

Some of the key suppliers of thermoplastic resins to the composites industry are:

- BASF SE

- E. I. du Pont de Nemours and Company

- Koninklijke DSM N.V.

- Solvay S.A.

- Lanxess

- LyondellBasell Industries N.V.

- SABIC

Note: The above list does not necessarily include all the top players in the market.

Are you the leading player in this market? We would love to include your name. Write to us at [email protected]

Most of the players are forward integrated and supply reinforced compounds. New product development, wide geographical reach, and execution of mergers & acquisitions are the key strategies adopted by major players to gain a competitive edge in the market throughout the globe.

Research Methodology

- This strategic assessment report from Stratview Research provides a comprehensive analysis that reflects thermoplastic resin market in the composites industry realities and future market possibilities for the forecast period.

- The report segments and analyzes the market in the most detailed manner in order to provide a panoramic view of the market.

- The vital data/information provided in the report can play a crucial role for market participants as well as investors in the identification of the low-hanging fruits available in the market as well as to formulate growth strategies to expedite their growth process.

- This report offers high-quality insights and is the outcome of a detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research’s internal database and statistical tools.

- More than 1,000 authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white papers, patents, and articles, have been leveraged to gather the data.

- We conducted more than 15 detailed primary interviews with market players across the value chain in all four regions and industry experts to obtain both qualitative and quantitative insights.

Report Features

This report provides market intelligence in the most comprehensive way. The report structure has been kept such that it offers maximum business value. It provides critical insights into market dynamics and will enable strategic decision-making for existing market players as well as those willing to enter the market. The following are the key features of the report:

- Market structure: Overview, industry life cycle analysis, supply chain analysis.

- Market environment analysis: Growth drivers and constraints, Porter’s five forces analysis, SWOT analysis.

- Market trend and forecast analysis.

- Market segment trend and forecast.

- Competitive landscape and dynamics: Market share, Service portfolio, New Product Launches, etc.

- COVID-19 impact and its recovery curve

- Attractive market segments and associated growth opportunities.

- Emerging trends.

- Strategic growth opportunities for the existing and new players.

- Key success factors.

Market Segmentation

This report studies the market covering a period of 12 years of trend and forecast. The report provides detailed insights into the market dynamics to enable informed business decision-making and growth strategy formulation based on the opportunities present in the market.

The thermoplastic resin market in the composites industry is segmented into the following categories:

By Resin Type

- Polypropylene (PP)

- Polyamide (PA)

- Polybutylene Terephthalate (PBT)

- Polyphenylene Sulfide (PPS)

- Polycarbonate (PC)

- Other Resins

By Compound Type

- Short Fiber-Reinforced Thermoplastics (SFRTs)

- Long Fiber-Reinforced Thermoplastics (LFRTs)

- Continuous Fiber-Reinforced Thermoplastics (CFRTs)

- Glass-Mat Thermoplastics (GMTs)

By End-Use Industry Type

- Transportation

- Consumer Goods

- Electrical & Electronics

- Others

By Composite Type

- Glass Fiber-Reinforced Plastics (GFRPs)

- Carbon Fiber-Reinforced Plastics (CFRPs)

By Manufacturing Process Type

- Injection Molding

- Compression Molding

- Others

By Region

- North America (Country Analysis: The USA, Canada, and Mexico)

- Europe (Country Analysis: Germany, France, the UK, Russia, and Rest of Europe)

- Asia-Pacific (Country Analysis: China, Japan, India, and Rest of Asia-Pacific)

- Rest of the world (Country Analysis: The Middle East, Latin America, and Others)

Click Here, to learn the market segmentation details.

Report Customization Options

With this detailed report, Stratview Research offers one of the following free customization options to our respectable clients:

Company Profiling

- Detailed profiling of key market players (up to 3 players)

- SWOT analysis of key market players (up to 3 players)

Market Segmentation

- Current market segmentation of any one of the compounds by resin type.

Competitive Benchmarking

- Benchmarking of key players on the following parameters: Product portfolio, geographical reach, regional presence, and strategic alliances.

Custom Research: Stratview Research offers custom research services across sectors. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to [email protected].