Attractive Opportunities

Global Demand Analysis & Sales Opportunities in Automotive Fasteners Market

-

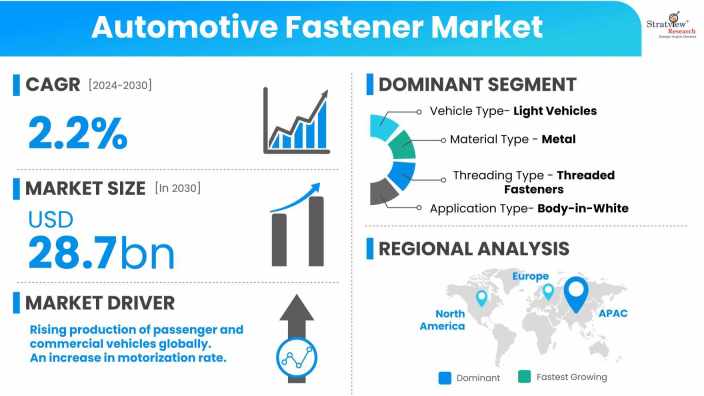

The annual demand for automotive fasteners was USD 25.1 billion in 2024 and is expected to reach USD 26.1 billion in 2025, up 3.7% than the value in 2024.

-

During the forecast period (2025-2030), the automotive fasteners market is expected to grow at a CAGR of 1.9%. The annual demand will reach USD 28.7 billion in 2030.

-

During 2025-2030, the automotive fasteners industry is expected to generate a cumulative sales opportunity of USD 164.7 billion.

High-Growth Market Segments:

-

Asia-Pacific is expected to maintain its reign in the market over the forecast period.

-

By vehicle type, Light vehicles (LV) are expected to be the demand generator for fasteners in the coming years.

-

By powertrain type, Battery electric vehicles are expected to create a massive demand for fasteners in the years to come.

-

By material type, Metal is anticipated to contribute to the largest share of the automotive fastener market.

-

By threading type, Threaded types of fasteners will see a surge in demand in the years to come.

-

By application type, Body-in-white is the most widely used application in the market and is projected to maintain its dominant position in the future.

-

By fastener type, Rivet is the largest fastener type in the market.

Market Statistics

Have a look at the sales opportunities presented by the automotive fasteners market in terms of growth and market forecast.

|

Automotive Fasteners Market Data & Statistics

|

|

|

Market Statistics

|

Value (in USD Billion)

|

Market Growth (%)

|

|

Annual Market Size in 2024

|

USD 25.1 billion

|

-

|

|

Annual Market Size in 2025

|

USD 26.1 billion

|

YoY Growth in 2025: 3.7%

|

|

Annual Market Size in 2030

|

USD 28.7 billion

|

CAGR 2025-2030: 1.9%

|

|

Cumulative Sales Opportunity during 2025-2030

|

USD 164.7 billion

|

-

|

|

Top 10 Countries’ Market Share in 2024

|

USD 20 billion +

|

> 80%

|

|

Top 10 Company’s Market Share in 2024

|

USD 12 billion to USD 18 billion

|

50% - 70%

|

Market Dynamics

What are automotive fasteners?

Automotive fasteners are critical mechanical components used to securely join and assemble vehicle parts across engine & powertrain, suspension, body, interior, braking, and electrical systems. Manufactured from materials such as stainless steel, aluminium, high-strength alloys, titanium, and engineered plastics, these fasteners provide exceptional strength, corrosion resistance, and vibration durability. Advanced coating technologies, including zinc plating, phosphate treatments, and epoxy finishes, further enhance performance in harsh automotive environments.

Market Drivers:

Rising Global Vehicle Production Boosts Fastener Demand

-

The steady rise in global vehicle production is directly increasing demand for automotive fasteners, as each passenger car and commercial vehicle requires thousands of fasteners across body, chassis, powertrain, and structural assemblies.

-

Expanding manufacturing output in major automotive hubs such as Asia-Pacific, North America, and Europe is further accelerating fastener consumption, supporting consistent market growth across OEM and aftermarket segments.

Advanced Electronic Components and Assembly Innovations

-

The growing integration of vehicle electronics, sensors, and automated manufacturing processes is driving demand for high-precision automotive fasteners designed to support complex, modern vehicle structures and advanced component assemblies.

Want to have a closer look at this market report? Click Here

Market Challenges:

Simplified EV Architectures Limiting Fastener Volume per Vehicle

-

The growing adoption of battery-electric vehicle (BEV) platforms is subtly impacting the automotive fastener market, as EVs eliminate several component-heavy systems such as internal combustion engines, exhaust assemblies, transmissions, and fuel storage units.

-

For instance, traditional vehicles typically require around 3,500 fasteners, while EVs use closer to 2,800 fasteners per unit, nearly 20% fewer due to streamlined powertrain designs. Although electric vehicle production continues to expand, this reduction in fasteners per vehicle is slightly moderating overall market growth.

Competition from Alternative Joining Technologies

-

The growing use of non-mechanical joining methods such as welding, adhesive bonding, and clinching in lightweight and composite vehicle components is gradually reducing dependence on traditional automotive fasteners, posing a significant challenge to market growth.

-

With OEMs increasingly adopting alternative joining solutions to achieve lightweighting, enhanced safety, and improved assembly efficiency, traditional fastener manufacturers face mounting pressure to innovate and offer advanced or hybrid fastening technologies to remain competitive.

Market Opportunities:

Emergence of Smart & Sensor‑Enabled Fasteners

-

The emergence of smart automotive fasteners embedded with IoT sensors and strain gauges represents a major growth opportunity, enabling real-time monitoring of clamp load, temperature, and structural integrity across EV and autonomous vehicle platforms.

-

Their growing use in EV battery packs and autonomous sensor mounts is accelerating predictive maintenance adoption, enhancing vehicle safety and reliability, and encouraging OEMs to integrate advanced fastening solutions into next-generation vehicle architectures.

Key Trends Shaping the Market

-

Increased utilization of lightweight materials for manufacturing fasteners, such as advanced plastics and composite materials, to reduce vehicle weight and increase fuel efficiency.

-

Development of high-strength fasteners that can withstand high stress and offer enhanced durability. High-strength fasteners are essential for critical applications, ensuring vehicle safety and reliability.

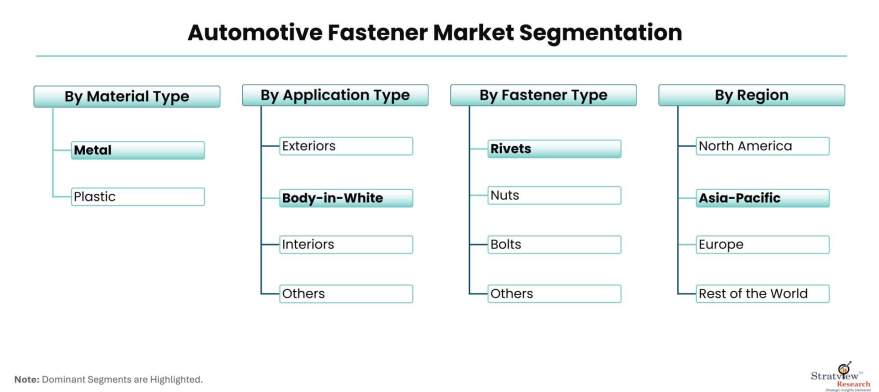

Segment Analysis

|

Segmentations

|

List of Sub-Segments

|

Segments with High Growth Opportunity

|

|

Vehicle-Type Analysis

|

Light Vehicles and Medium & Heavy Duty Commercial Vehicles

|

Light vehicles (LV) are expected to be the demand generator for fasteners in the coming years.

|

|

Powertrain-Type Analysis

|

ICE vehicles, HEV, and BEV

|

Battery electric vehicles are expected to create a massive demand for fasteners in the years to come.

|

|

Material-Type Analysis

|

Metal Fasteners and Plastic Fasteners

|

Metal is anticipated to contribute to the larger share of the automotive fastener market.

|

|

Threading-Type Analysis

|

Threaded Fasteners and Non-threaded Fasteners

|

Threaded types of fasteners will see a surge in demand in the years to come.

|

|

Application-Type Analysis

|

Body-in-White, Engine & Powertrain, Chassis, Interior, Exterior, and Others

|

Body-in-white is the most widely used application in the market and is projected to maintain its dominant position in the future.

|

|

Fastener-Type Analysis

|

Clips, Nuts, Bolts, Screws, Rivets, and Others

|

Rivet is the largest fastener type in the market.

|

|

Region Analysis

|

North America, Europe, Asia-Pacific, and The Rest of the World

|

The Asia-Pacific is expected to maintain its reign in the market over the forecast period.

|

By Material Type

“Metal is expected to remain the dominant material type of the automotive fastener market during the forecast period.”

-

In terms of material type, the automotive fastener market is segmented into metal fasteners and plastic fasteners.

-

Metal remains the most preferred material type owing to its high tensile strength, resistance to rust and heat, shockproof properties, recyclability, versatility, coating compatibility, cost-effectiveness, high machinability, and strong wear resistance, making it essential across automotive fastening applications.

-

Plastic fasteners are expected to remain the fastest-growing material segment during the forecast period due to their lightweight properties, corrosion resistance, lower manufacturing costs, electrical insulation, design flexibility, and growing adoption in lightweight vehicle designs.

By Threading Type

“Threaded fasteners are projected to maintain their dominance and experience faster growth in the automotive fastener market throughout the forecast period.”

-

In terms of threading type, the automotive fastener market is segmented into threaded and non-threaded fasteners.

-

Threaded fasteners offer strong, reliable, and removable joints, making them widely used across critical automotive components and supporting sustained market demand.

-

Their ease of assembly, disassembly, maintenance, and reuse further strengthens their dominance in the global automotive fasteners industry.

By Application Type

“Body-in-white is the widely used application in the automotive fastener market and is expected to retain its dominant position during the forecast period.”

-

In terms of application type, the automotive fastener market is segmented into body-in-white, engine & powertrain, chassis, interiors, exteriors, and others.

-

Body-in-white forms the structural foundation of vehicles and requires a high volume of automotive fasteners to ensure rigidity, strength, and crash performance, sustaining strong demand in this segment.

-

Stringent vehicle safety regulations and the shift toward lightweight vehicle body construction further increase the need for advanced fastening solutions adapted to modern automotive designs.

By Fastener Type

“Rivets represent the largest fastener type, whereas nuts hold the second leading position in the automotive fastener market.”

-

In terms of fastener type, the automotive fastener market is segmented into clips, nuts, bolts, screws, rivets, and others.

-

Rivets dominate the market due to growing adoption of self-piercing rivets, automated riveting systems, and advanced vehicle assembly technologies supporting lightweight structures.

-

Nuts hold the second-largest market share owing to their versatility, strength, affordability, and widespread application across engines, chassis, suspension systems, interior assemblies, and body components.

Regional Insights

“Asia-Pacific is expected to remain the largest automotive fastener market during the forecast period.”

-

The automotive fastener market is segmented by region into North America, Europe, Asia-Pacific, and the Rest of the World.

-

Asia-Pacific serves as the global automotive manufacturing hub, driving massive demand for automotive fasteners across light vehicles and commercial vehicles. The region hosts major OEMs including Toyota, Honda, Hyundai, Kia, Tata Motors, Nissan, and emerging EV manufacturers.

-

China leads the global automotive fasteners market due to its large-scale vehicle production, cost-efficient manufacturing, strong EV adoption, and advanced automotive supply chain ecosystem.

-

Europe and North America are also expected to generate significant automotive fastener demand, supported by technological innovation, vehicle electrification, and strong OEM presence across the United States, Germany, France, and the United Kingdom.

Know the high-growth countries in this report. Register Here

Competitive Landscape

Most of the major players compete in some of the factors, including price, service offerings, regional presence, etc. The following are the key players in the automotive fastener market -

-

ITW

-

Aoyama Seisakusho Co., Ltd.

-

Nifco Inc.

-

Shanghai Prime Machinery Co., Ltd.

-

Stanley Black & Decker, Inc.

-

Kamax Group

-

Lisi Automotive

Note: The above list does not necessarily include all the top players in the market.

Are you the leading player in this market? We would love to include your name. Please write to us at [email protected]

Recent Developments/Mergers & Acquisitions:

-

In January 2025, Bossard Group completed the acquisition of Germany-based Ferdinand Gross Group, a leading distributor of fastening technology for the automotive fastener market across Germany and Eastern Europe. This strategic move strengthened Bossard’s European presence, expanded its high-precision automotive fastening solutions portfolio, and enhanced supply chain reach for OEMs and Tier-1 suppliers.

-

In March 2025, Fontana Gruppo agreed to acquire a 60% stake in India-based Right Tight Fasteners (RTF) for approximately INR 1,000 crore (~USD 114 million), significantly expanding its manufacturing capacity in India’s rapidly growing automotive fastener market. The acquisition supports rising vehicle production, localization strategies, and demand for high-strength metal fasteners across passenger cars and commercial vehicles.

Report Features

This report provides market intelligence most comprehensively. The report structure has been kept so that it offers maximum business value. It provides critical insights into market dynamics and will enable strategic decision-making for existing market players as well as those willing to enter the market.

The following are the key features of the report:

-

Market structure: Overview, industry life cycle analysis, supply chain analysis.

-

Market environment analysis: Growth drivers and constraints, Porter’s five forces analysis, SWOT analysis.

-

Market trend and forecast analysis.

-

Market segment trend and forecast.

-

Competitive landscape and dynamics: Market share, Service portfolio, New Product Launches, etc.

-

COVID-19 impact and its recovery curve.

-

Attractive market segments and associated growth opportunities.

-

Emerging trends.

-

Strategic growth opportunities for the existing and new players.

-

Key success factors.

|

Market Study Period

|

2019-2030

|

|

Base Year

|

2024

|

|

Forecast Period

|

2025-2030

|

|

Trend Period

|

2019-2023

|

|

Number of Tables & Figures

|

>100

|

|

Number of Segments Analysed

|

7 (Vehicle Type, Powertrain Type, Material Type, Threading Type, Application Type, Fastener Type, and Region)

|

|

Number of Regions Analysed

|

4 (North America, Europe, Asia-Pacific, Rest of the World)

|

|

Countries Analysed

|

15 (The USA, Canada, Mexico, Germany, France, Italy, The UK, China, Japan, India, Brazil, Saudi Arabia, Rest of Europe, Rest of APAC, and Rest of the World)

|

|

Free Customization Offered

|

10%

|

|

After Sales Support

|

Unlimited

|

|

Report Presentation

|

Complimentary

|

|

Market Dataset

|

Complimentary

|

|

Further Deep Dive & Consulting Services

|

10% Discount

|

Market Segmentation

The report provides detailed insights into the market dynamics to enable informed business decision-making and growth strategy formulation based on the opportunities present in the market.

The automotive fastener market is segmented into the following categories:

Automotive Fastener Market, by Vehicle Type

-

Light Vehicles

-

Commercial Vehicles

Automotive Fastener Market, by Powertrain Type

Automotive Fastener Market, by Material Type

-

Metal Fasteners

-

Plastic Fasteners

Automotive Fastener Market, by Threading Type

-

Threaded Fasteners

-

Non-Threaded Fasteners

Automotive Fastener Market, by Application Type

-

Body-in-White

-

Engine & Powertrain

-

Chassis

-

Interior

-

Exterior

-

Other Application Types

Automotive Fastener Market, by Fastener Type

-

Clips

-

Nuts

-

Bolts

-

Screws

-

Rivets

-

Others

Automotive Fastener Market, by Region

-

North America (Country Analysis: The USA, Canada, and Mexico)

-

Europe (Country Analysis: Germany, France, The UK, Russia, Italy, and Rest of Europe)

-

Asia-Pacific (Country Analysis: Japan, China, India, South Korea, and Rest of Asia-Pacific)

-

Rest of the World (Country Analysis: Brazil, Argentina, and Others)

Click here to learn the market segmentation details.

Research Methodology

-

This strategic assessment report from Stratview Research provides a comprehensive analysis that reflects today’s automotive fasteners market realities and future market possibilities for the forecast period.

-

The report segments and analyzes the market in the most detailed manner to provide a panoramic view of the market.

-

The vital data/information provided in the report can play a crucial role for market participants and investors in identifying the low-hanging fruits available in the market and formulating growth strategies to expedite their growth process.

-

This report offers high-quality insights and is the outcome of a detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research’s internal database and statistical tools.

-

More than 1,000 authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white papers, patents, and articles, have been leveraged to gather the data.

Customization Options

With this detailed report, Stratview Research offers one of the following free customization options to our respectable clients:

Company Profiling

Competitive Benchmarking

-

Benchmarking of key players on the following parameters: Service portfolio, geographical reach, regional presence, and strategic alliances

Custom Research: Stratview Research offers custom research services across industries. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to [email protected]