Attractive Opportunities

Global Demand Analysis & Sales Opportunities in Small Drones Market (H3)

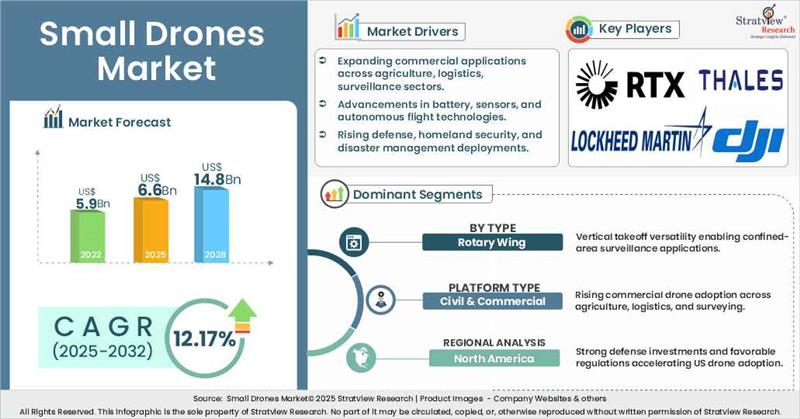

- The annual demand for small drones market was USD 5.9 billion in 2024 and is expected to reach USD 6.6 billion in 2025, up 12.35% than the value in 2024.

- During the next 8 years (forecast period of 2025-2032), the small drones market is expected to grow at a CAGR of 12.17%. The annual demand will reach of USD 14.8 billion in 2032, which is almost 2.24 times (~124% up) of the demand in 2025.

- During 2025-2032, the small drones industry is expected to generate a cumulative sales opportunity of USD 82.1 billion which is almost 2.9 times the opportunities during 2019-2024.

Want to get a free sample? Register Here

High-Growth Market Segments:

- North America generated the highest demand in 2024, with widespread use in defense as well as commercial applications as the key growth drivers in the region.

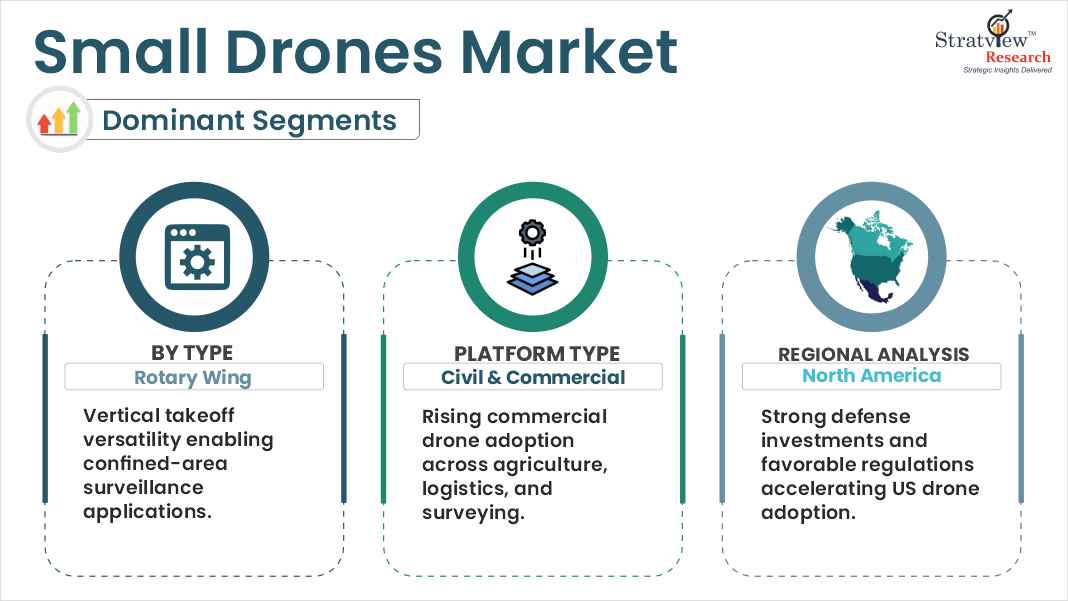

- By type, rotary wing segment is projected to be the fastest-growing segment during the forecast period.

- By platform type, civil & commercial segment is projected to be the dominant segment during the forecast period.

Market Statistics

Have a look at the sales opportunities presented by the small drones market in terms of growth and market forecast.

|

Small Drones Market Data & Statistics

|

|

|

Market Statistics

|

Value (in USD Billion)

|

Market Growth (%)

|

|

Annual Market Size in 2023

|

USD 5.24 billion

|

|

|

Annual Market Size in 2024

|

USD 5.9 billion

|

YoY Growth in 2024: 12.5%

|

|

Annual Market Size in 2025

|

USD 6.6 billion

|

YoY Growth in 2025: 12.35%

|

|

Annual Market Size in 2032

|

USD 14.8 billion

|

CAGR 2025-2032: 12.17%

|

|

Cumulative Sales Opportunity during 2025-2032

|

USD 82.1 billion

|

|

|

Top 10 Countries’ Market Share in 2024

|

USD 4.72 billion +

|

> 80%

|

|

Top 10 Company’s Market Share in 2024

|

USD 2.95 billion to USD 4.13 billion

|

50% - 70%

|

Market Dynamics

Introduction:

What are small drones?

The small drones sector includes the global industry that is involved in the innovation, manufacturing, and deployment of small unmanned aerial vehicles (UAVs) or micro, mini, nano drones. These lightweight and portable drones are designed for short-range operations and can be easily operated by a single individual. They are capable of reaching tight spaces and offering real-time information, which makes them essential for applications like surveillance, aerial photography, crop monitoring, and disaster response. These drones are used in numerous industries such as defense, agriculture, infrastructure inspection, media, and emergency response. The industry is registering high growth due to technological innovation, cost-effectiveness, and increasing applications.

Market Drivers:

Rising Utilization of Drones Across Civil and Commercial Applications:

- The application of small drones is rapidly expanding across civilian and commercial sectors, driven by advancements in drone technology and rising automation needs. These drones are increasingly used in aerial photography, precision agriculture, 3D mapping, infrastructure inspection, logistics, and internet connectivity in remote areas.

- High-resolution imaging and cost-effective operations make them ideal for land surveys, crop monitoring, and maintenance of tall structures. Moreover, rapid industrialization and growing government investments are further accelerating the growth of the small drone market.

Market Challenges:

Prolonged Authorization Timelines:

- Prolonged authorization timelines from the government to fly small drones present a significant challenge to this market. Every country has its own rules and regulations for managing air traffic, training drone pilots, safety inspections, and drone use acceptance by the public.

- Although new drone technologies are constantly being created and enhanced, they still have to adhere to national legislation to allow safe and lawful operations. The Federal Aviation Administration (FAA) provides three ways to approve small drone operations in the US: a Certificate of Authorization (CoA) for public agencies, special airworthiness certificates for private companies, and compliance with model aircraft rules for hobbyists.

- The UK follows the same in CAP 722, and in Europe, flying certificates are issued by the European Union Aviation Safety Agency (EASA). These long and rigorous approval processes are a major hindrance for drone companies that are looking to grow quickly and expand into new markets globally.

Market Opportunities:

Significant Public and Private Sector Funding in Drone Technology:

- Governments and private companies are making significant investments in the drone industry to promote its rapid growth and innovation. Numerous governments are increasingly employing drones for defense, border surveillance, and safeguarding critical infrastructure. At the same time, private enterprises are investing in drones for business purposes, including the delivery of goods, infrastructure inspection, and data collection for analysis.

- In recent times, there have been significant investments in firms to enhance sophisticated drone technology. For instance, Unusual Machines Inc. raised US$40M in Florida to speed up drone motor production. France has allocated €500 million for drone development in its 2024 military budget, focusing on low-cost UAVs and loitering munitions.

- Moreover, European startups such as Quantum Systems and Swarmer have secured major investments to advance AI-powered drones for defense. Quantum Systems has raised €170 million, while Swarmer received $2.7 million to enhance its autonomous swarm drone technology.

Market Segments' Analysis

|

Segmentations

|

List of Sub-Segments

|

Segments with High-Growth Opportunity

|

|

Platform Analysis

|

Civil & Commercial and Defense & Government

|

Civil & Commercial segment is anticipated to experience more growth during the forecast period.

|

|

Type Analysis

|

Fixed Wing, Rotary Wing, and Hybrid

|

Rotary Wing segment is expected to be the fastest-growing segment during the forecast period.

|

|

Mode of Operation Analysis

|

Remotely Piloted, Optionally Piloted, and Fully Autonomous

|

Remotely Piloted segment is projected to experience more growth during the forecast period.

|

|

Power Source Analysis

|

Fuel Powered and Battery Operated/Electric

|

Battery Operated/Electric segment is projected to be the fastest-growing segment during the forecast period.

|

|

Application Analysis

|

Commercial, Consumer, Military & Defense, and Government & Law Enforcement

|

Military & Defense segment is expected to account for the largest share during the forecast period.

|

|

Regional Analysis

|

North America, Europe, Asia-Pacific, and The Rest of the World

|

North America is expected to be the dominant and fastest-growing region over the forecasted period.

|

By Type

“Rotary Wing segment is expected to be the fastest growing segment during the forecast period.”

- The small drones market is segmented by type into fixed wing, rotary wing, and hybrid.

- Rotary wing segment is expected to be the fastest-growing segment during the forecast period, driven by its ability to take off and land vertically in a confined area without requiring any additional space. The rotary-wing UAVs can remain stationary in the air, which is useful for surveillance, photography, video recording, and inspections.

- However, battery life limits flight time, but they remain a solid option for short and specific missions. In general, rotary-wing drones are preferred for their adaptability, low cost, and versatility, making them the leading segment in the small drones market.

By Platform Type

“Civil & Commercial segment is anticipated to experience more growth during the forecast period.”

- The small drones market is segmented by platform type into civil & commercial and defense & government.

- Civil & commercial segment is anticipated to experience more growth in the coming years. In the civil sector, small drones are employed for observation, disaster relief, and monitoring the environment. In the commercial sector, they are being used in agriculture for crop evaluation, in real estate for aerial property surveys, and in logistics for last-mile delivery services, as they offer a cost-effective, efficient, and safer alternative to conventional methods.

- With continued advancements in technology, small drones are increasingly becoming capable of conducting more sophisticated operations, thereby increasing their value across industries.

Want to get more details about the segmentations? Register Here

Regional Analysis

“North America is expected to be the dominant and fastest-growing region over the forecasted period.”

- Based on region, the small drones market has been segmented into North America, Europe, Asia Pacific, and the Rest of the world.

- North America is expected to be the dominant and fastest-growing region over the forecasted period, primarily because of their widespread use in defense as well as commercial applications. In the US, drones are being used more and more for rapid delivery, border surveillance, and rescue, fueling their market growth. US firms are focusing on creating small drones that are intelligent, cheap, and heavy-lifting.

- The US Army also invests significantly in drones such as Switchblade, which helps target on-the-move objects and ensures soldiers' safety. The market for small drones is growing faster in the US because of the less complicated regulatory structure, enabling companies to create and implement drones with ease.

Competitive Landscape

Top Players

Most of the major players compete in some of the factors, including price, service offerings, regional presence, etc. The following are the key players in the small drones market -

- Lockheed Martin Corporation

- Thales

- DJI

- RTX

- Boeing

- Parrot Drone SAS

- Northrop Grumman

- Textron Inc.

- Bae Systems

- Skydio Inc.

Note: The above list does not necessarily include all the top players in the market.

Are you a leading player in this market? We would love to include your name. Please write to us at [email protected]

Recent Developments/Mergers & Acquisitions:

- In February 2025, AeroVironment, Inc. (US) received a USD 288 million delivery order for Switchblade loitering munition systems under the US Army’s Directed Requirement for Lethal unmanned systems. The order is part of a multi-year contract awarded in August 2024, with a ceiling of USD 990 million.

- In May 2024, Lockheed Martin Corporation (US) partnered with Grupo Oesía, a Spanish multinational with expertise in technological and digital engineering, to create new solutions in the area of unmanned system platforms.

- In February 2024, Malloy Aeronautics (England) was acquired by BAE Systems (UK), a firm that develops innovative unmanned aerial systems (UAS). The move adds BAE Systems' portfolio in the unmanned systems sector, with the firm now in a position to utilize Malloy's skills in electric-powered heavy-lift drones.

Report Features

This report provides market intelligence most comprehensively. The report structure has been kept so that it offers maximum business value. It provides critical insights into market dynamics and will enable strategic decision-making for existing market players as well as those willing to enter the market.

The following are the key features of the report:

- Market structure: Overview, industry life cycle analysis, supply chain analysis.

- Market environment analysis: Growth drivers and constraints, Porter’s five forces analysis, SWOT analysis.

- Market trend and forecast analysis.

- Market segment trend and forecast.

- Competitive landscape and dynamics: Market share, Service portfolio, New Product Launches, etc.

- COVID-19 impact and its recovery curve.

- Attractive market segments and associated growth opportunities.

- Emerging trends.

- Strategic growth opportunities for the existing and new players.

- Key success factors.

|

Market Study Period

|

2019-2032

|

|

Base Year

|

2024

|

|

Forecast Period

|

2025-2032

|

|

Trend Period

|

2019-2023

|

|

Number of Tables & Figures

|

>100

|

|

Number of Segments Analysed

|

6 (Platform Type, Type, Mode of Operation Type, Power Source Type, Application Type, and Region)

|

|

Number of Regions Analysed

|

4 (North America, Europe, Asia-Pacific, Rest of the World)

|

|

Countries Analysed

|

15 (The USA, Canada, Mexico, Germany, France, Italy, The UK, China, Japan, India, Brazil, Saudi Arabia, Rest of Europe, Rest of APAC, and Rest of the World)

|

|

Free Customization Offered

|

10%

|

|

After Sales Support

|

Unlimited

|

|

Report Presentation

|

Complimentary

|

|

Market Dataset

|

Complimentary

|

|

Further Deep Dive & Consulting Services

|

10% Discount

|

Market Segmentation

This report studies the market, covering a period of 15 years of trend and forecast. The report provides detailed insights into the market dynamics to enable informed business decision-making and growth strategy formulation based on the opportunities present in the market.

The small drones market is segmented into the following categories:

By Platform Type

- Civil & Commercial

- Defense & Government

By Type

- Fixed Wing

- Rotor Wing

- Hybrid

By Mode of Operation Type

- Remotely Piloted

- Optionally Piloted

- Fully Autonomous

By Power Source Type

By Application Type

- Commercial

- Consumer

- Government & Law Enforcement

- Military & Defense

By Region

- North America (Country Analysis: The USA, Canada, and Mexico)

- Europe (Country Analysis: Germany, France, The UK, Russia, and the Rest of Europe)

- Asia-Pacific (Country Analysis: China, Japan, India, and Rest of Asia-Pacific)

- Rest of the World (Country Analysis: Brazil, Saudi Arabia, and Others)

Research Methodology

- This strategic assessment report from Stratview Research provides a comprehensive analysis that reflects today’s small drones market realities and future market possibilities for the forecast period.

- The report segments and analyzes the market in the most detailed manner in order to provide a panoramic view of the market.

- The vital data/information provided in the report can play a crucial role for market participants and investors in identifying the low-hanging fruits available in the market and formulating growth strategies to expedite their growth process.

- This report offers high-quality insights and is the outcome of a detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research’s internal database and statistical tools.

- More than 1,000 authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white papers, patents, and articles, have been leveraged to gather the data.

- We conducted more than 15 detailed primary interviews with market players across the value chain in all four regions and industry experts to obtain both qualitative and quantitative insights.

Report Customization Options

With this detailed report, Stratview Research offers one of the following free customization options to our respectable clients:

Company Profiling

- Detailed profiling of additional market players (up to three players)

- SWOT analysis of key players (up to three players)

Competitive Benchmarking

- Benchmarking of key players on the following parameters: Service portfolio, geographical reach, regional presence, and strategic alliances

Custom Research: Stratview Research offers custom research services across industries. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to [email protected]