Attractive Opportunities

Global Demand Analysis & Sales Opportunities in Commercial Drone Market

-

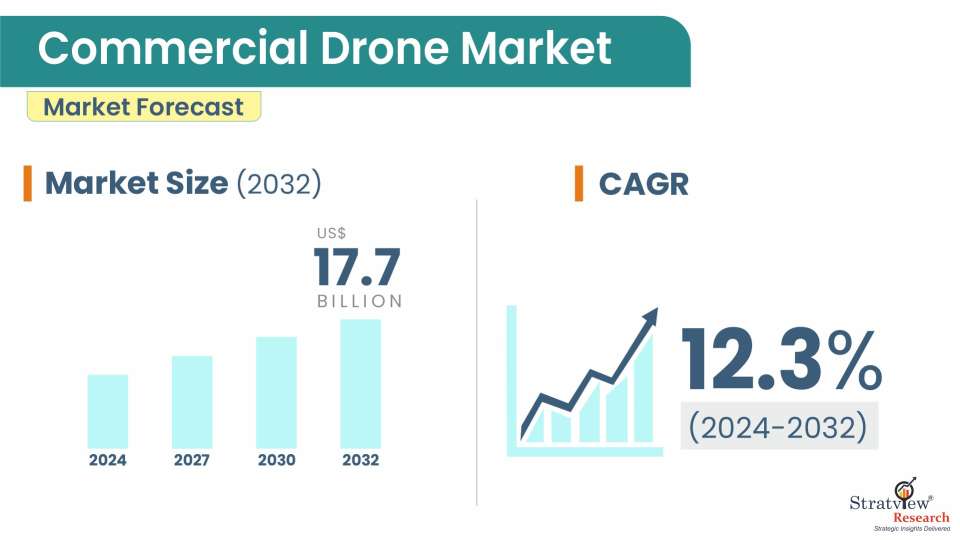

The annual demand for commercial drones was USD 7.0 billion in 2024 and is expected to reach USD 8.2 billion in 2025, up 17.7% than the value in 2024.

-

During the forecast period (2025-2032), the commercial drones market is expected to grow at a CAGR of 11.6%. The annual demand will reach USD 17.7 billion in 2032, which is more than 2 times the demand in 2025.

-

During 2025-2032, the commercial drones industry is expected to generate a cumulative sales opportunity of USD 109.8 billion, which is almost 5 times the opportunities during 2019-2024.

Want to know more about the market scope? Register Here

High-Growth Market Segments:

-

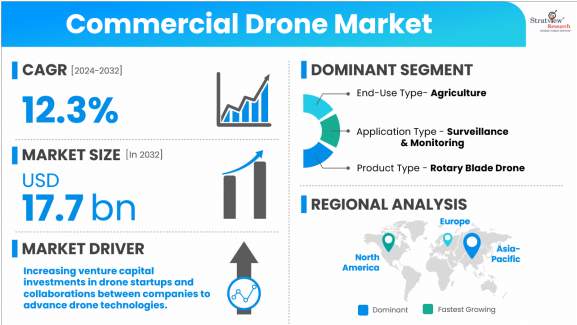

Asia-Pacific generated the highest demand with the largest market share of more than 40% in 2024.

-

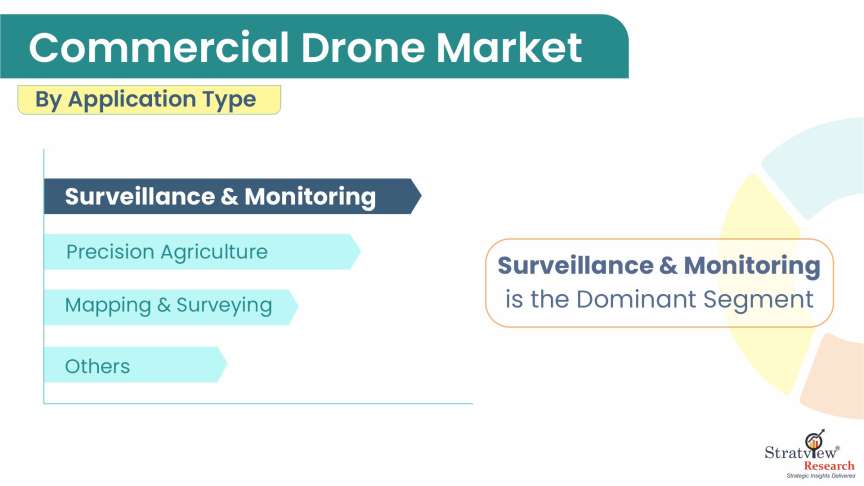

By application type, Surveillance & Monitoring is the dominant application type in the market; however, Precision Agriculture is likely to show the highest growth.

-

By product type, Rotary Blade Drone will likely remain the most preferred product type throughout the forecast period.

-

By end-use type, Agriculture is projected to maintain its leadership throughout the forecast period. Delivery & Logistics is expected to exhibit the highest growth.

Market Statistics

Have a look at the sales opportunities presented by the commercial drones market in terms of growth and market forecast.

|

Commercial Drone Market Data & Statistics

|

|

Market Statistics

|

Value (in USD Billion)

|

Market Growth (%)

|

|

Annual Market Size in 2023

|

USD 5.5 billion

|

-

|

|

Annual Market Size in 2024

|

USD 7.0 billion

|

YoY Growth in 2024: 27.8%

|

|

Annual Market Size in 2025

|

USD 8.2 billion

|

YoY Growth in 2025: 17.7%

|

|

Annual Market Size in 2032

|

USD 17.7 billion

|

CAGR 2025-2032: 11.6%

|

|

Cumulative Sales Opportunity during 2025-2032

|

USD 109.8 billion

|

-

|

|

Top 10 Countries’ Market Share in 2024

|

USD 5.6 billion +

|

>80%

|

|

Top 10 Company’s Market Share in 2024

|

USD 3.5 billion to USD 4.9 billion

|

50%-70%

|

Market Dynamics

What are commercial drones?

Commercial drones (also called commercial unmanned aerial vehicles – UAVs) are aircraft that operate without a human pilot onboard and are used for industrial, commercial, and business applications such as infrastructure inspection, agriculture monitoring, logistics and delivery, surveying, mapping, emergency response, and public safety. They vary widely in size, capabilities, payload, and autonomy level, from lightweight quadcopters with sensors to large fixed-wing systems with advanced analytics.

Market Drivers:

Rapid Industrial Adoption Driving Operational Efficiency

-

The commercial drone market is witnessing accelerated adoption across key end-use industries including agriculture, construction, energy, infrastructure inspection, logistics, and environmental monitoring, as organizations seek faster, safer, and data-driven operational solutions.

-

For instance, in agriculture, drone-based analytics are rapidly becoming mainstream, with farmonaut projecting that by the end of 2026, 70–75% of large farms will adopt drones and AI-driven data platforms to enable real-time crop monitoring, precision irrigation, and sustainable farming practices.

-

Similarly, the construction sector has embraced drone technology for project planning and site oversight, with 67% of major firms and 45% of civil contractors now utilizing drones for inspections, progress tracking, and risk reduction.

-

This widespread industrial integration is significantly improving productivity, lowering operational costs, and positioning commercial drones as essential digital tools across modern enterprises.

Expansion of Drone-Based Delivery Ecosystems

-

The rapid growth of e-commerce and rising consumer expectations for ultra-fast fulfillment are significantly accelerating commercial drone adoption in logistics. Drones enable cost-efficient, low-emission last-mile delivery while easing urban congestion. For instance, Amazon’s Prime Air expanded to deliver lithium-ion battery products such as iPhones within 60 minutes across parts of Arizona and Texas using advanced MK30 drones.

-

Similarly, in Bengaluru, BigBasket partnered with Skye Air Mobility to deliver groceries and medicines within 5–10 minutes using DGCA-certified drones carrying up to 7 kg with real-time tracking and no additional customer cost. These successful deployments highlight scalability and are transforming last-mile logistics into a major growth engine for the commercial drones market.

Want to have a closer look at this market report? Click Here

Market Challenges:

Regulatory Complexity

-

Regulatory complexity remains a significant challenge in the commercial drones market, as countries continue to enforce fragmented airspace regulations, varying pilot certification requirements, and inconsistent approvals for beyond visual line of sight (BVLOS) operations.

-

This lack of regulatory harmonization restricts cross-border drone services, delays commercial scalability, and increases compliance costs for operators, slowing widespread adoption across logistics, infrastructure inspection, and enterprise drone applications.

Market Opportunities:

Sustainability-Focused Technology Adoption Across Industries

-

Sustainability initiatives are accelerating commercial drone adoption as businesses seek low-emission, resource-efficient operational solutions.

-

In agriculture alone, drone usage has contributed to massive water savings and significant carbon emission reductions globally. Meanwhile, drone logistics consume far less energy than traditional delivery vehicles.

-

Governments and enterprises increasingly favor drone technology to meet environmental targets, positioning commercial drones as a core enabler of green transformation across agriculture, logistics, infrastructure, and environmental monitoring sectors.

Segments Analysis

|

Segmentations

|

List of Sub-Segments

|

Segments with High Growth Opportunity

|

|

End-Use Type

|

Agriculture, Delivery & Logistics, Media & Entertainment, Building & Construction, General, Photography/Real State, Energy, Insurance, and Other End-Use Types

|

Agriculture is projected to maintain its leadership throughout the forecast period. Delivery & Logistics is expected to exhibit the highest growth.

|

|

Application Type

|

Filming & Photography, Inspection & Maintenance, Mapping & Surveying, Precision Agriculture, Surveillance & Monitoring, and Other Application Types

|

Surveillance & Monitoring is the dominant application type in the market however, Precision Agriculture is likely to show the highest growth.

|

|

Product Type

|

Rotary Blade Drone, Fixed Wing Drone, and Hybrid Drone

|

Rotary Blade Drone will likely remain the most preferred product type throughout the forecast period.

|

|

Region Analysis

|

North America, Europe, Asia- Pacific and The Rest of the World.

|

Asia-Pacific dominates the market and is anticipated to experience the fastest growth in the coming years.

|

By End-Use Type

“Agriculture is expected to maintain its dominance in the market during the forecast period, while delivery & logistics is expected to exhibit the fastest growth.”

-

The market is segmented into agriculture, delivery & logistics, media & entertainment, building & construction, general, photography/real estate, energy, insurance, and others.

-

Agriculture continues to dominate the commercial drones market due to the rapid adoption of precision farming, crop health monitoring, and resource-efficient spraying technologies. As of DJI’s 2025 report, by the end of 2024, over 400,000 agriculture drones were in operation globally, representing a 90% increase since 2020, significantly improving farm productivity and sustainability. Drone deployment has helped conserve 222 million tons of water while reducing 30.87 million tons of carbon emissions, reinforcing their role in modern climate-smart agriculture.

-

Delivery and logistics is the fastest-growing end-use segments in the commercial drones market, driven by rising e-commerce demand and the need for rapid last-mile solutions. Studies indicate drones can reduce delivery costs by up to 60%, while consuming 94% less energy per parcel. Real-world implementations such as Amazon Prime Air and drone grocery services in India demonstrate the commercial viability of ultra-fast aerial logistics.

By Application Type

“Surveillance & Monitoring is the dominant application type, whereas Precision Agriculture is the fastest-growing application type in the market during the forecast period.”

-

The commercial drone market is segmented into filming & photography, inspection & maintenance, mapping & surveying, precision agriculture, surveillance & monitoring, and others.

-

Surveillance and monitoring remain the dominant application in the commercial drones market, driven by extensive use in infrastructure inspection, construction safety, energy utilities, and insurance assessments. Drones deliver real-time aerial intelligence, reduce human risk, and significantly accelerate inspection processes, making them essential for asset protection, environmental monitoring, and operational efficiency across multiple industries.

-

Precision agriculture is the fastest-growing application segment as farms increasingly adopt drone-based analytics for yield optimization and resource efficiency. According to Farmonaut, by the end of 2026, 70–75% of large farms are expected to use drones and AI-driven data analytics, enabling real-time crop monitoring, targeted irrigation, and sustainable presicion farming practices, positioning this segment as a major growth engine of the commercial drones market.

Want to know more about the market scope? Register Here

By Product Type

“Rotary blade drones stand tall as the leading product type in the market, reigning throughout the forecast period.”

-

The commercial drone market is segmented into rotary blade drones, fixed-wing drones, and hybrid drones.

-

Rotary blade drones are the dominant product type in the market due to their versatility, maneuverability, ability to hover, and suitability for diverse applications like surveillance, inspection, and photography.

-

Hybrid drones are the fastest-growing segment in the market due to their combined advantages of fixed-wing efficiency and rotary-wing versatility, making them ideal for diverse applications like delivery and inspection.

Regional Insights

“Asia-Pacific is anticipated to maintain its position as the largest market for commercial drones throughout the forecast period.”

-

Asia-Pacific dominates the commercial drones market and is expected to experience the fastest growth in the coming years. The region benefits from strong government support and regulatory momentum in key countries such as China, India, Japan, and South Korea, which are creating digital air traffic infrastructure and simplifying flight authorizations to accelerate drone adoption.

-

Robust precision agriculture deployment, driven by the need to monitor vast farmland with multispectral and GPS-enabled drones, and a booming e-commerce sector demanding last-mile logistics solutions further propel market expansion.

-

Additionally, China’s strong domestic manufacturing ecosystem, led by players like DJI with more than half of the global market share, boosts affordability and widespread adoption across commercial applications, from delivery to infrastructure inspection.

Know the high-growth countries in this report. Register Here

Competitive Landscape

The global market is consolidated primarily due to the presence of major players like DJI Technology Co., Ltd in the market, which allows the company to benefit from economies of scale, enabling it to offer drones at lower prices than its competitors in this price-sensitive market.

The following are the key players in the commercial drone market (based on dominance):

-

DJI Technology Co., Ltd

-

Yuneec International

-

Parrot Drone SAS

-

Skydio Inc.

-

AeroVironment, Inc.

-

Draganfly Innovations Inc

-

AgEagle Aerial Systems Inc

-

JOUAV Automation Tech Co., Ltd

-

Teal Drones, Inc.

- Ehang Holdings Limited

Note: The above list does not necessarily include all the top players in the market.

Are you the leading player in this market? We would love to include your name. Please write to us at [email protected]

Recent Developments/Mergers & Acquisitions:

-

In February 2026, FAA Administrator Bryan Bedford visited Dublin to meet Manna Drone Delivery founder Bobby Healy, alongside leaders from Avtrain and the Irish Aviation Authority, to strengthen regulatory alignment between the U.S. and Europe for scaling commercial drone delivery operations, signaling accelerating global policy support for drone logistics expansion.

-

In January 2026, Wing and Walmart significantly expanded their drone delivery network, announcing rollout plans across 150 additional stores, with a target of over 270 locations by 2027, aiming to serve millions of customers nationwide and further commercialize last-mile drone logistics.

-

In January 2026, ST Engineering unveiled its DrN-600 electric VTOL cargo drone at the 2026 Singapore Airshow, featuring a 100 kg payload capacity and 70 km range, highlighting the company’s strategic expansion into autonomous logistics and infrastructure support solutions.

-

In December 2025, XTI Aerospace acquired Drone Nerds, LLC, a leading U.S. drone distributor and service provider, strengthening its commercial UAV footprint and signaling increasing consolidation as companies expand service capabilities across enterprise drone applications.

Report Features

This report provides market intelligence most comprehensively. The report structure has been kept so that it offers maximum business value. It provides critical insights into market dynamics and will enable strategic decision-making for existing market players as well as those willing to enter the market.

The following are the key features of the report:

-

Market structure: Overview, industry life cycle analysis, supply chain analysis.

-

Market environment analysis: Growth drivers and constraints, Porter’s five forces analysis, SWOT analysis.

-

Market trend and forecast analysis.

-

Market segment trend and forecast.

-

Competitive landscape and dynamics: Market share, Service portfolio, New Product Launches, etc.

-

COVID-19 impact and its recovery curve.

-

Attractive market segments and associated growth opportunities.

-

Emerging trends.

-

Strategic growth opportunities for the existing and new players.

-

Key success factors.

|

Market Study Period

|

2019-2032

|

|

Base Year

|

2024

|

|

Forecast Period

|

2025-2032

|

|

Trend Period

|

2019-2023

|

|

Number of Tables & Figures

|

>100

|

|

Number of Segments Analysed

|

4 (Product Type, Application Type, End-Use Type, and Region)

|

|

Number of Regions Analysed

|

4 (North America, Europe, Asia-Pacific, Rest of the World)

|

|

Countries Analysed

|

15 (The USA, Canada, Mexico, Germany, France, Italy, The UK, China, Japan, India, Brazil, Saudi Arabia, Rest of Europe, Rest of APAC, and Rest of the World)

|

|

Free Customization Offered

|

10%

|

|

After Sales Support

|

Unlimited

|

|

Report Presentation

|

Complimentary

|

|

Market Dataset

|

Complimentary

|

|

Further Deep Dive & Consulting Services

|

10% Discount

|

Market Segmentation

The report provides detailed insights into the market dynamics to enable informed business decision-making and growth strategy formulation based on the opportunities present in the market.

The commercial drone market is segmented into the following categories:

Commercial Drone Market, by Product Type

-

Fixed Wing Drone

-

Rotary Blade Drone

-

Hybrid Drone

Commercial Drone Market, by Application Type

Commercial Drone Market, by End-Use Type

-

Agriculture

-

Delivery & Logistics

-

Energy, Media & Entertainment

-

Real Estate & Construction

-

Security & Law Enforcement

-

Others

Commercial Drone Market, by Region

-

North America (Country Analysis: the USA, Canada, and Mexico)

-

Europe (Country Analysis: Germany, France, the UK, Russia, Spain, and Rest of Europe)

-

Asia-Pacific (Country Analysis: China, Japan, India, South Korea, and Rest of Asia-Pacific)

-

Rest of the World (Sub-Region Analysis: Latin America, the Middle East, and Others)

Research Methodology

-

This strategic assessment report from Stratview Research provides a comprehensive analysis that reflects today’s commercial drone market realities and future market possibilities for the forecast period.

-

The report segments and analyzes the market in the most detailed manner to provide a panoramic view of the market.

-

The vital data/information provided in the report can play a crucial role for market participants and investors in identifying the low-hanging fruits available in the market and formulating growth strategies to expedite their growth process.

-

This report offers high-quality insights and is the outcome of a detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research’s internal database and statistical tools.

-

More than 1,000 authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white Fusion End-Uses, patents, and articles, have been leveraged to gather the data.

-

We conducted more than 15 detailed primary interviews with market players across the value chain in all four regions and industry experts to obtain qualitative and quantitative insights.

Customization Options

With this detailed report, Stratview Research offers one of the following free customization options to our respectable clients:

Company Profiling

Competitive Benchmarking

-

Benchmarking of key players on the following: Service portfolio, geographical reach, regional presence, and strategic alliances.

Custom Research: Stratview Research offers custom research services across industries. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, and target screening, please send your inquiry to [email protected].