Attractive Opportunities

Global Demand Analysis & Sales Opportunities in EV Inverters Market

-

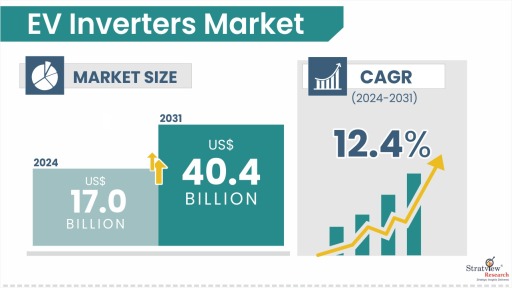

The annual demand for EV inverters was USD 17.0 billion in 2024 and is expected to reach USD 20.1 billion in 2025, up 18.3% than the value in 2024.

-

During the forecast period (2025-2031), the EV inverters market is expected to grow at a CAGR of 12.4%. The annual demand will reach USD 40.4 billion in 2031, which is 2 times the demand in 2025.

-

During 2025-2031, the EV inverters industry is expected to generate a cumulative sales opportunity of USD 218.7 billion, which is almost 3.5 times the opportunities during 2019-2024.

Want to get a free sample? Register Here

High-Growth Market Segments:

-

Asia-Pacific is expected to maintain its reign over the forecast period.

-

By vehicle type, LV is expected to maintain its dominance during the forecasted period.

-

By EV type, HEVs are the demand generator for EV Inverters, whereas BEVs are likely to grow at a faster rate in the coming years.

-

By technology type, IGBT is anticipated to contribute the largest share of the EV inverter market.

-

By number of inverter type, 2 Inverters are expected to experience the largest share of the EV Inverters market.

-

By integration type, Motor + Inverter is the largest integration type used in electric vehicles.

Market Statistics

Have a look at the sales opportunities presented by the EV inverters market in terms of growth and market forecast.

|

EV Inverters Market Data & Statistics

|

|

|

Market Statistics

|

Value (in USD Billion)

|

Market Growth (%)

|

|

Annual Market Size in 2023

|

USD 14.4 billion

|

-

|

|

Annual Market Size in 2024

|

USD 17.0 billion

|

YoY Growth in 2024: 18.1%

|

|

Annual Market Size in 2025

|

USD 20.1 billion

|

YoY Growth in 2025: 18.3%

|

|

Annual Market Size in 2031

|

USD 40.4 billion

|

CAGR 2025-2031: 12.4%

|

|

Cumulative Sales Opportunity during 2025-2031

|

USD 218.7 billion

|

-

|

|

Top 10 Countries’ Market Share in 2024

|

USD 13.6 billion +

|

> 80%

|

|

Top 10 Company’s Market Share in 2024

|

USD 8.5 billion to USD 11.9 billion

|

50% - 70%

|

Market Dynamics

Introduction:

A traction inverter is an essential part of an EV, turning battery power into energy that runs the motor. It helps control speed, improve efficiency, and even recapture energy through regenerative braking for a smoother, more efficient drive. It enhances energy management to maximize range and performance. It works alongside battery management and motor control units to optimize vehicle performance. There has been an increase in focus on the development of smaller and lighter inverters, improving overall vehicle efficiency.

Market Drivers:

-

The escalating number of EV sales, together with increased EV manufacturing, promotes the need for inverters that convert electric battery power into efficient electric motor movement.

-

Recent power electronics development has shifted production towards silicon carbide (SiC) and gallium nitride (GaN) inverters, which provide greater efficiency and decreased energy loss, coupled with enhanced vehicle operational performance.

-

Future advancements in battery technology drive the need for EV inverters capable of handling higher power loads, supported by enhanced thermal management systems for improved performance and safety.

-

Strict emission regulations, government subsidies, and driver demand for longer ranges drive automakers to choose efficient, lightweight, and compact inverters for EVs.

Segments' Analysis

|

Segmentations

|

List of Sub-Segments

|

Segments with High-Growth Opportunity

|

|

Vehicle-Type Analysis

|

LV and M&HCV

|

LV is expected to maintain its dominance during the forecasted period.

|

|

EV-Type Analysis

|

BEV and HEV

|

HEVs are the demand generator for EV Inverters, whereas BEVs are likely to grow at a faster rate in the coming years.

|

|

Technology-Type Analysis

|

IGBT, SiC, and GaN

|

IGBT is anticipated to contribute the largest share of the EV inverter market.

|

|

Number of Inverter-Type Analysis

|

1 Inverter, 2 Inverters, 3 Inverters, and 4 Inverters

|

2 Inverters are expected to experience the largest share of the EV Inverters market.

|

|

Integration-Type Analysis

|

Standalone, Inverter + Motor, Inverter + DC-DC Converter, and Other Integrations

|

Motor + Inverter is the largest integration type used in electric vehicles.LV

|

|

Region Analysis

|

North America, Europe, Asia-Pacific, and The Rest of the World

|

Asia-Pacific is expected to maintain its reign over the forecast period.

|

Vehicle Insights

“LV is expected to remain the dominant vehicle of the EV eMotors market during the forecasted period.”

-

The market is segmented into LV (light vehicles) and M&HCV (medium- and heavy-duty commercial vehicles). LVs include passenger cars and LCVs (light commercial vehicles). The increasing motorization rate and higher production of passenger cars and LCVs are the key factors behind the market's dominance.

-

Stringent government policies and regulations, rising EV adoption, technological advancements in e-motors, fleet electrification, and growing R&D investment in passenger car and LCV e-motors are some other factors driving the LV’s demand in the market.

EV Insights

“Currently, HEVs dominate the EV inverters market, but BEVs are set to take the lead in the coming years.”

-

The market is segmented into BEV and HEV. HEVs offer a more affordable option than BEVs, providing longer driving ranges without range anxiety, making them a practical choice for current driving needs.

-

BEVs will dominate the future market, driven by expanding charging infrastructure and advancements in battery technology, enabling faster charging and longer driving ranges. Government incentives, combined with lower maintenance costs, will gradually reduce BEV prices, making them more attractive to consumers.

Technology Insights

“IGBT is expected to remain the dominant technology type, whereas SiC is expected to be the second-largest technology type in the market during the forecast period.”

-

The market is segmented into IGBT, SiC, and GaN. IGBTs lead the market due to their proven performance, cost-effectiveness, and widespread use in EV inverters. They offer reliable operation, high efficiency, and scalability for modern EV systems.

-

SiC technology is the market's second-largest and second-fastest technology type, driven by its superior efficiency, higher power density, and reduced energy losses in EV applications. Advancing technology and lower production costs are making SiC inverters more attractive for next-generation EVs, enabling better performance, longer range, and improved efficiency.

Number of Inverters Insights

“2 Inverters are expected to remain the dominant category of the market during the forecast period.”

-

The market is segmented into 1 inverter, 2 inverters, 3 inverters, and 4 inverters. The market-leading configuration of EVs uses two inverters to maximize performance and efficiency. Using two inverters in one system helps all-wheel-drive (AWD) and high-performance EVs drive better by improving traction, balancing power, and enhancing control with independent motors for the front and rear. The dual-inverter system improves efficiency while staying more cost-effective than advanced multi-inverter setups.

-

The two-inverter configuration has become more popular because it provides enhanced redundancy and flexibility without requiring substantial weight or complexity increases. Manufacturers prefer this configuration to build a wide range of EVs, from standard to high-performance models, ensuring better market reach and higher customer satisfaction than single or multi-inverter designs.

Integration Insights

“Motor + Inverter integration is expected to remain dominant throughout the forecast period.”

-

The market is segmented into standalone, inverter + motor, inverter + DC-DC converter, and other integrations. The market leads with the inverter + motor integration type, as this integration improves performance while minimizing power waste and maximizing system efficiency.

-

The integration type offers higher efficiency, compact design, cost savings, improved reliability, and better thermal management, making EVs more efficient and performance-driven. The combination provides better space efficiency, making it ideal for automakers looking to improve EV drivetrain performance while simplifying design.

Regional Insights

“Asia-Pacific is expected to remain the largest market for EV Inverters during the forecast period.”

-

In terms of region, the market is segmented into North America, Europe, Asia-Pacific, and RoW. Higher EV production, especially in China, strong government support (incentives and policies) increases adoption, advancement in battery and power electronics technology, and expanding charging infrastructure support EV adoption among consumers, which are key factors driving the region’s market.

-

China remains the EV market leader, driven by its high manufacturing capacity, strong local demand, government incentives, advancements in power electronics, efficient supply chain, extensive charging infrastructure, and major EV manufacturers.

Want to get a free sample? Register Here

Competitive Landscape

The market is moderately fragmented, with over 50 players across the region. Most of the major players compete in some of the governing factors, including price, service offerings, regional presence, etc. The following are the key players in the EV inverters market.

Here is the list of the Top Players (Based on Dominance)

-

Denso Corporation

-

BYD Auto Co., Ltd.

-

Tesla, Inc.

-

Nidec Corporation

-

Dana Incorporated

-

Valeo SA

Note: The above list does not necessarily include all the top players in the market.

Are you the leading player in this market? We would love to include your name. Please write to us at [email protected]

Recent Market JVs and Acquisitions:

A considerable number of strategic alliances, including M&As, JVs, etc., have been performed over the past few years:

-

In December 2020, LG Electronics teamed up with Magna International Inc. to establish a joint venture to manufacture e-motors, inverters, and onboard chargers, supporting the global shift toward vehicle electrification. The newly formed company, LG Magna e-Powertrain Co., Ltd., combines the strengths of both companies in electric powertrain systems and world-class automotive manufacturing, aiming to drive innovation and efficiency in the EV industry.

Report Features

This report provides market intelligence most comprehensively. The report structure has been kept so that it offers maximum business value. It provides critical insights into market dynamics and will enable strategic decision-making for existing market players as well as those willing to enter the market.

The following are the key features of the report:

-

Market structure: Overview, industry life cycle analysis, supply chain analysis.

-

Market environment analysis: Growth drivers and constraints, Porter’s five forces analysis, SWOT analysis.

-

Market trend and forecast analysis.

-

Market segment trend and forecast.

-

Competitive landscape and dynamics: Market share, Service portfolio, New Product Launches, etc.

-

COVID-19 impact and its recovery curve.

-

Attractive market segments and associated growth opportunities.

-

Emerging trends.

-

Strategic growth opportunities for the existing and new players.

-

Key success factors.

|

Market Study Period

|

2019-2031

|

|

Base Year

|

2024

|

|

Forecast Period

|

2025-2031

|

|

Trend Period

|

2019-2023

|

|

Number of Tables & Figures

|

>100

|

|

Number of Segments Analysed

|

6 (Vehicle Type, EV Type, Technology Type, Number of Inverters Type, Integration Type, and Region)

|

|

Number of Regions Analysed

|

4 (North America, Europe, Asia-Pacific, Rest of the World)

|

|

Countries Analysed

|

15 (The USA, Canada, Mexico, Germany, France, Italy, The UK, China, Japan, India, Brazil, Saudi Arabia, Rest of Europe, Rest of APAC, and Rest of the World)

|

|

Free Customization Offered

|

10%

|

|

After Sales Support

|

Unlimited

|

|

Report Presentation

|

Complimentary

|

|

Market Dataset

|

Complimentary

|

|

Further Deep Dive & Consulting Services

|

10% Discount

|

Market Segmentation

The report provides detailed insights into the market dynamics to enable informed business decision-making and growth strategy formulation based on the opportunities present in the market.

The EV Inverters market is segmented into the following categories:

EV Inverters Market, by Vehicle Type

EV Inverters Market, by EV Type

EV Inverters Market, by Technology Type

EV Inverters Market, by Number of Inverters

-

1 Inverter

-

2 Inverters

-

3 Inverters

-

4 Inverters

EV Inverters Market, by Integration Type

EV Inverters Market, by Region

-

North America (Country Analysis: The USA, Canada, and Mexico)

-

Europe (Country Analysis: Germany, France, The UK, Italy, Russia, and Rest of Europe)

-

Asia-Pacific (Country Analysis: Japan, China, India, South Korea, and Rest of Asia-Pacific)

-

Rest of the World (Country Analysis: Brazil, Argentina, and Others)

Research Methodology

-

This strategic assessment report from Stratview Research provides a comprehensive analysis that reflects today’s EV inverters market realities and future market possibilities for the forecast period.

-

The report segments and analyzes the market in the most detailed manner to provide a panoramic view of the market.

-

The vital data/information provided in the report can play a crucial role for market participants and investors in identifying the low-hanging fruits available in the market and formulating growth strategies to expedite their growth process.

-

This report offers high-quality insights and is the outcome of a detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research’s internal database and statistical tools.

-

More than 1,000 authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white papers, patents, and articles, have been leveraged to gather the data.

-

We conducted more than 15 detailed primary interviews with market players across the value chain in all four regions and industry experts to obtain both qualitative and quantitative insights.

Customization Options

With this detailed report, Stratview Research offers one of the following free customization options to our respected clients:

Company Profiling

Competitive Benchmarking

-

Benchmarking of key players on the following parameters: Service portfolio, geographical reach, regional presence, and strategic alliances

Custom Research: Stratview Research offers custom research services across sectors. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to [email protected]