Market Dynamics

Introduction

Robotaxi is a new form of ride-hailing service where autonomous vehicles serve as taxis. Robotaxis provides an affordable, efficient, and convenient transportation option, with no need for human drivers. Passengers use a smartphone app to request a ride, and the robotaxi picks them up and takes them to their destination. The car's onboard sensors and artificial intelligence systems enable it to navigate through traffic, avoid obstacles, and make decisions in real-time to ensure passenger safety.

Robotaxis has the potential to transform the transportation industry by reducing traffic congestion, improving air quality, and reducing the number of vehicles on the road. They are also expected to be cheaper than traditional taxis or ride-sharing services, making transportation more accessible to low-income individuals.

Robotaxis is still in the development phase, and several companies are currently testing them on public roads to ensure their safety and reliability. Once fully deployed, they could revolutionize the way we travel, making transportation more sustainable, efficient, and accessible for everyone.

|

Robotaxi Market Highlights

|

|

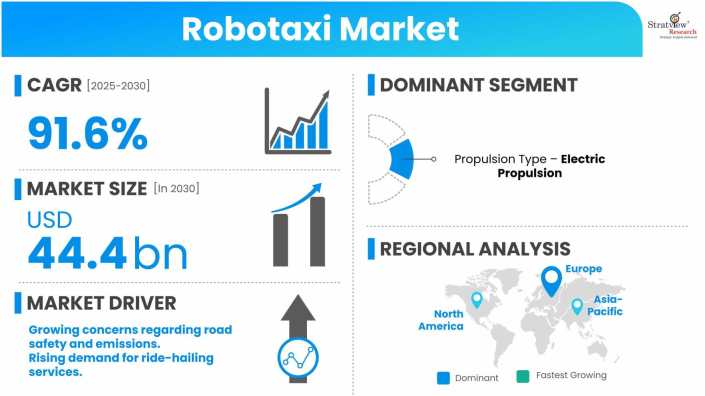

Market Size in 2024

|

USD 0.8 billion

|

|

Market Size in 2030

|

USD 44.4 billion

|

|

Market Growth (2025-2030)

|

91.6% CAGR

|

|

Base Year of Study

|

2024

|

|

Trend Period

|

2019-2023

|

|

Forecast Period

|

2025-2030

|

Market Drivers

The market has experienced growth due to various factors, including the growing concerns regarding road safety and emissions, as well as the rising demand for ride-hailing services. Autonomous vehicles have the added benefit of optimizing costs for fleet operators. Furthermore, innovative business models like mobility as a service could offer a sustainable and profitable revenue stream in the future.

Driver: Need for road safety

The NHTSA has reported that human error is responsible for approximately 94% of car accidents globally on a daily basis. Waymo stated in 2020 that around 1.4 million individuals die each year in road accidents worldwide. Additionally, the MIT Energy Initiative's Mobility of the Future study in 2020 revealed that about 40,000 lives were lost in the US due to road accidents in 2019.

Adopting technology to take over human activities like driving could decrease these behavioral errors, leading to a reduction in the number of owned vehicles on the road and easing traffic congestion. This would result in increased efficiency in traffic control and fewer cars on the streets in cities worldwide.

Restraint: High cost of R&D for robotaxis

Implementing a complete robotaxi service involves significant investments due to the high cost of components such as LiDAR, ultrasonic sensors, and cameras. The deployment and adoption of robotaxi fleets is a complicated and time-consuming process. Currently, only a few level 4 and level 5 autonomous vehicles are available for testing as of June 2021, making it challenging to deploy robotaxi services comprehensively.

Additionally, the development of robotaxi software is complex, and widespread application of level 5 autonomous vehicles is capital-intensive and subject to regulatory compliance. Robotaxis must process vast amounts of sensor data, which is almost 100 times greater than that of today's most advanced vehicles. The software's complexity is also increasing exponentially, with multiple Diverse Deep Neural Networks (DNNs) operating simultaneously as part of the software stack.

To operate robotaxis in various conditions globally, extensive DNN training using significant amounts of data is required, and this data is expected to grow exponentially with the increasing number of robotaxis on the road. For example, a fleet of 50 robotaxis driving for six hours a day may produce approximately 1.6 petabytes of data daily, which is difficult to store and process for vehicles to perform various functions in different conditions.

While leading companies such as Google, Volkswagen, Volvo Cars, Nissan, Toyota, and General Motors have enough resources to enter the robotaxi market, companies with limited resources may not be able to afford expensive R&D processes.

Opportunity: Government programs to drive the market

The race to deploy autonomous vehicles, particularly in developed nations, has become a point of interest for public policymakers focused on autonomous transportation and its potential impact. Governments worldwide have already relaxed legal barriers to test self-driving vehicles. The Ministry of Transport and Communications in Finland has taken things further by establishing a legal structure for testing autonomous vehicles.

Similarly, other jurisdictions in countries such as Austria, France, the Netherlands, the UK, and the US are also implementing similar legal frameworks. In 2020, the California Public Utilities Commission (CPUC) introduced two new commercial programs that enable companies to test their robotaxis for commercial ride-hailing services.

Want to have a closer look at this market report? Click Here

Segment Analysis

|

Segmentations

|

List of Sub-Segments

|

Segments with High Growth Opportunity

|

|

Propulsion Type Analysis

|

Electric, Fuel Cell

|

Electric propulsion is to account for the largest market size during the forecast period.

|

|

Regional Analysis

|

North America, Europe, Asia-Pacific, and Rest of the World

|

Europe is to witness significant growth during the forecast period.

|

By Propulsion Type

Electric propulsion is to account for the largest market size during the forecast period. The growing concern over emissions has created a demand for fuel-efficient vehicles. Robotaxis not only offers robotic assistance but also introduces an era of fuel efficiency and carbon-free emissions.

The collaboration between Volvo and Uber introduced self-driving cars in the mid-size luxury segment in 2021, with 50% of these vehicles being fully electric cars. By 2030, it is projected that two-thirds of the global population will reside in urban areas. Daimler and Bosch are working together to develop self-driving electric cars in Germany that may be on the road by the early 2020s.

There is already a demand for fully electric robotaxis due to the strict government regulations around the world for an emission-free environment. The joint venture between Volvo and Baidu for electric self-driving taxis in China is an example of an environmentally friendly and advanced technical approach. Similarly, the partnership between BMW and Daimler has secured investments worth USD 1.13 billion in autonomous electric cars.

Regional Insights

Europe is to witness significant growth during the forecast period. Countries like Germany, France, Norway, and the Netherlands are expected to dominate the autonomous taxi market in Europe. The region benefits from advanced technology and supportive infrastructure, making it easier for fleet operators to test and deploy autonomous vehicles.

According to the European Commission, the automotive industry is the largest investor in research and development, with about 180 automobile facilities in the EU. As the demand for self-driving taxis increases with growing technological trends, the market is expected to expand further. Leading manufacturers like NAVYA, Aptiv, EasyMile, Moia, and Daimler also have a significant presence in the region.

Know the high-growth countries in this report. Register Here

Research Methodology

This strategic assessment report, from Stratview Research, provides a comprehensive analysis that reflects today’s robotaxi market realities and future market possibilities for the forecast period of 2025 to 2030. After a continuous interest in our robotaxi market report from the industry stakeholders, we have tried to further accentuate our research scope to the robotaxi market to provide the most crystal-clear picture of the market. The report segments and analyzes the market in the most detailed manner to provide a panoramic view of the market. The vital data/information provided in the report can play a crucial role for the market participants as well as investors in the identification of the low-hanging fruits available in the market as well as the formulation of the growth strategies to expedite their growth process.

This report offers high-quality insights and is the outcome of a detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research’s internal database and statistical tools. More than 1000 authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white papers, patents, and articles, have been leveraged to gather the data. We conducted more than 15 detailed primary interviews with the market players across the value chain in all four regions and industry experts to obtain both qualitative and quantitative insights.