Attractive Opportunities

Global Demand Analysis & Sales Opportunities in Missile Composites Market

-

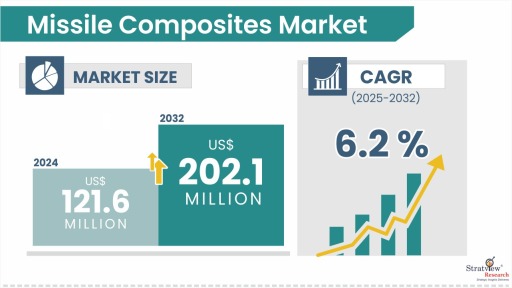

The annual demand for missile composites was USD 121.6 million in 2024 and is expected to reach USD 132.6 million in 2025, up 9.0% than the value in 2024.

-

During the forecast period (2025-2032), the missile composites market is expected to grow at a CAGR of 6.2%. The annual demand will reach USD 202.1 million in 2032, which is almost 1.5 times the demand in 2025.

-

During 2025-2032, the missile composites industry is expected to generate a cumulative sales opportunity of USD 1339.4 million, which is almost 2.5 times the opportunities during 2019-2024.

Want to get a free sample? Register Here

High-Growth Market Segments:

-

North America is expected to remain the largest market over the years, whereas Asia-Pacific is likely to grow at the fastest rate.

-

By material type, Carbon composite materials are anticipated to remain the most dominant material type for missiles in the years to come.

-

By missile type, Ballistic missiles are likely to be the major demand generator for composite materials during the forecast period.

-

By range type, Long-range missiles are likely to witness the highest growth rate during the forecast period.

-

By application type, Fuselage is estimated to be the dominant application of the market in the coming years.

Market Statistics

Have a look at the sales opportunities presented by the missile composites market in terms of growth and market forecast.

|

Missile Composites Market Data & Statistics

|

|

|

Market Statistics

|

Value (in USD Million)

|

Market Growth (%)

|

|

Annual Market Size in 2023

|

USD 115.6 million

|

-

|

|

Annual Market Size in 2024

|

USD 121.6 million

|

YoY Growth in 2024: 5.2%

|

|

Annual Market Size in 2025

|

USD 132.6 million

|

YoY Growth in 2025: 9.0%

|

|

Annual Market Size in 2032

|

USD 202.1 million

|

CAGR 2025-2032: 6.2%

|

|

Cumulative Sales Opportunity during 2025-2032

|

USD 1339.4 million

|

-

|

|

Top 10 Countries’ Market Share in 2024

|

USD 97.3 million +

|

> 80%

|

|

Top 10 Company’s Market Share in 2024

|

USD 60.8 million to USD 85.1 million

|

50% - 70%

|

Market Dynamics

Introduction:

Missile Composite refers to advanced composite materials used in the construction of missile components, such as fuselage, composite tanks, fins, and guidance systems. These composites, typically made of carbon fiber, glass fiber, ceramic, or aramid fibers combined with a resin matrix, are chosen for their high strength-to-weight ratio, durability, and resistance to extreme temperatures, corrosion, and fatigue.

Market Drivers:

-

The market for missile composites is expanding rapidly, driven by global defense modernization, increasing military conflicts, and rising investments in next-generation weapons.

-

As global defense budgets rise, especially in regions like North America, Asia-Pacific, and Europe, countries are investing more in missile defense systems, including precision-guided missiles, hypersonic weapons, and anti-ballistic missiles. These advanced missile systems require high-performance materials, driving the demand for missile composites.

-

Modern missiles require materials that offer lightweight strength, aerodynamic efficiency, and heat resistance, all of which are characteristics of composite materials. Composites contribute to the missile’s performance by reducing weight while maintaining structural integrity and heat resistance, which is crucial for high-speed and long-range missile systems.

Segments' Analysis

|

Segmentations

|

List of Sub-Segments

|

Dominant and Fastest-Growing Segments

|

|

Material-Type Analysis

|

Carbon Composite Materials, Glass Composite Materials, Aramid Composite Materials, and Ceramic Composite Materials

|

Carbon composite materials are anticipated to remain the most dominant material type for missiles in the years to come.

|

|

Missile-Type Analysis

|

Ballistic Missile and Cruise Missile

|

The ballistic missile is likely to be the major demand generator for composite materials during the forecast period.

|

|

Range-Type Analysis

|

Short Range, Medium Range, and Long Range

|

Long-range missiles are likely to witness the highest growth rate during the forecast period.

|

|

Application-Type Analysis

|

Fuselage, Composite Tank, Radome, and Other Applications

|

Fuselage is estimated to be the dominant application of the market in the coming years.

|

|

Regional Analysis

|

North America, Europe, Asia-Pacific, and Rest of the World

|

North America is expected to remain the largest market over the years, whereas Asia-Pacific is likely to grow at the fastest rate.

|

Material Insights

“Carbon composite materials are expected to maintain their dominance as the primary material type for missiles in the coming years.”

-

Based on material type, the missile composite is segmented into carbon composite materials, glass composite materials, aramid composite materials, and ceramic composite materials.

-

Carbon composite materials are expected to remain the most dominant material type for missiles due to their exceptional strength-to-weight ratio, high durability, and resistance to extreme environmental conditions. These materials are crucial for missile performance, as they significantly reduce the overall weight of the missile while maintaining structural integrity, which is essential for high-speed flight and long.

-

Carbon composites offer excellent thermal resistance, which is critical for missiles that experience intense heat during launch and flight. Their fatigue resistance and ability to withstand high-impact forces make them ideal for the demanding environments missiles operate in.

-

Carbon composites are highly corrosion-resistant, ensuring long-term reliability and performance in various weather conditions. As missile technology Carbon composite materials are expected to remain the most dominant material type for missiles due to their exceptional strength-to-weight ratio, high durability, and resistance to extreme environmental conditions. These materials are crucial for missile performance, as they significantly reduce the overall weight of the missile while maintaining str continues to advance, particularly with the development of precision-guided, hypersonic, and long-range missile systems, the demand for lightweight, high-performance materials like carbon composites will continue to grow, reinforcing their dominance in the market.

Missile Insights

“Ballistic missile is expected to remain the dominant, whereas cruise missiles will be the fastest-growing missile of the market.”

-

Based on the missile type, the market is segmented into ballistic missiles and cruise missiles.

-

Ballistic missiles are likely to hold the major share of the missile market during the forecast period due to their widespread use, strategic importance, and ongoing technological advancements aimed at improving their range, speed, and payload capacity. For instance, DRDO was able to increase the range of the Agni-5 missile beyond 7,000 km by replacing steel with composites.

-

Ballistic missiles, which are launched into a high arc and then descend towards their target, require materials that can withstand intense aerodynamic forces and high-speed reentry conditions. The increasing focus on enhancing the range and payload of ballistic missiles has driven the demand for advanced composite materials, which provide the necessary strength-to-weight ratio and heat resistance.

Application Insights

“Fuselage is expected to maintain its dominant position in the market throughout the forecast period and is projected to experience the highest growth between 2025 and 2032.”

-

In terms of application type, the market is segmented into fuselage, composite tank, radome, and other applications. The fuselage is expected to maintain its dominant position in the missile market and experience the highest growth from 2025 to 2032 due to its critical role in ensuring the overall performance, strength, and durability of missile systems.

-

The fuselage serves as the central structure that houses and supports key components such as the payload, guidance systems, and propulsion units. Composites are increasingly used to create strong, lightweight structural components like frames, heat shields, fins, and control surfaces, which must endure the high stresses and temperatures experienced during missile flights. These materials offer the necessary strength-to-weight ratio and thermal resistance required for missiles to perform efficiently at high speeds and extreme altitudes. Some examples of missiles that utilize carbon composites for their fuselage include the AGM-129 ACM (Advanced Cruise Missile), AIM-9X Sidewinder, AGM-88 HARM (High-speed Anti-Radiation Missile), RIM-116 Rolling Airframe Missile, and Astra BVRAAM.

Regional Insights

“North America is anticipated to maintain its position as the largest market for missile composite materials throughout the forecast period.”

-

North America is the largest market for missile composite materials due to its well-established defense infrastructure, significant investments in advanced military technologies, and a strong presence of major aerospace and defense manufacturers. The United States, in particular, has the largest defense budget globally, driving continuous development and deployment of sophisticated missile systems. The U.S. military's heavy reliance on high-performance composite materials in missiles for enhanced range, accuracy, and durability further solidifies North America's dominance. Major missile systems, such as the Trident II D5 and AGM-88 HARM, extensively use composite materials, contributing to the region's market leadership.

-

On the other hand, Asia-Pacific is the fastest-growing market for missile composites due to the region's rapid military modernization, rising defense budgets, and increasing investments in indigenous missile technology. Countries like China, India, and Japan are significantly enhancing their defense capabilities, including the development of advanced missile systems like hypersonic weapons and long-range ballistic missiles. The growing emphasis on strengthening national security and regional influence, coupled with technological advancements, makes Asia-Pacific the fastest-growing market for missile composites in the coming years.

Want to get a free sample? Register Here

Competitive Landscape

The market is highly consolidated with a handful of players securing a lion’s share. Most of the major players compete in some of the governing factors, including price, product offerings, regional presence, etc. The following are the key players in the missile composite materials market.

Here is the list of the Top Players (Based on Dominance)

Note: The above list does not necessarily include all the top players in the market.

Are you the leading player in this market? We would love to include your name. Please write to us at [email protected]

Recent Developments

Recent Market JVs and Acquisitions:

A considerable number of strategic alliances, including M&As, JVs, etc., have been performed over the past few years:

-

In 2018, Toray Industries acquired TenCate Advanced Composites to accelerate growth, expand its high-performance composite offering, and leverage synergies by combining TenCate's product lineup with Toray's carbon fiber and polymer technologies, particularly in areas like space, defense, and heat-resistant applications.

-

In May 2018, Hexcel Corporation formed a joint venture with the Chinese aerospace parts manufacturer, Future Aerospace, to establish a materials testing lab in Shanghai, China, called Future Aerospace Hexcel Commercial Composite Testing Limited (FAHCCT).

Report Features

This report provides market intelligence most comprehensively. The report structure has been kept so that it offers maximum business value. It provides critical insights into market dynamics and will enable strategic decision-making for existing market players as well as those willing to enter the market.

The following are the key features of the report:

-

Market structure: Overview, industry life cycle analysis, supply chain analysis.

-

Market environment analysis: Growth drivers and constraints, Porter’s five forces analysis, SWOT analysis.

-

Market trend and forecast analysis.

-

Market segment trend and forecast.

-

Competitive landscape and dynamics: Market share, Service portfolio, New Product Launches, etc.

-

COVID-19 impact and its recovery curve.

-

Attractive market segments and associated growth opportunities.

-

Emerging trends.

-

Strategic growth opportunities for the existing and new players.

-

Key success factors.

|

Market Study Period

|

2019-2032

|

|

Base Year

|

2024

|

|

Forecast Period

|

2025-2032

|

|

Trend Period

|

2019-2023

|

|

Number of Tables & Figures

|

>100

|

|

Number of Segments Analysed

|

5 (Material Type, Missile Type, Range Type, Application Type, and Region)

|

|

Number of Regions Analysed

|

4 (North America, Europe, Asia-Pacific, Rest of the World)

|

|

Countries Analysed

|

15 (The USA, Canada, Mexico, Germany, France, Italy, The UK, China, Japan, India, Brazil, Saudi Arabia, Rest of Europe, Rest of APAC, and Rest of the World)

|

|

Free Customization Offered

|

10%

|

|

After Sales Support

|

Unlimited

|

|

Report Presentation

|

Complimentary

|

|

Market Dataset

|

Complimentary

|

|

Further Deep Dive & Consulting Services

|

10% Discount

|

Market Segmentation

The report provides detailed insights into the market dynamics to enable informed business decision-making and growth strategy formulation based on the opportunities present in the market.

The missile composites market is segmented into the following categories:

Missile Composites Market, by Material Type

-

Carbon Composite Materials

-

Glass Composite Materials

-

Aramid Composite Materials

-

Ceramic Composite Materials

Missile Composites Market, by Missile Type

-

Ballistic Missile

-

Cruise Missile

Missile Composites Market, by Range Type

-

Short Range

-

Medium Range

-

Long Range

Missile Composites Market, by Application Type

-

Fuselage

-

Composite Tank

-

Radome

-

Other Applications

Missile Composites Market, by Region

-

North America

-

Europe

-

Asia-Pacific

-

Rest of the World

Research Methodology

-

This strategic assessment report from Stratview Research provides a comprehensive analysis that reflects today’s missile composites market realities and future market possibilities for the forecast period.

-

The report segments and analyzes the market in the most detailed manner to provide a panoramic view of the market.

-

The vital data/information provided in the report can play a crucial role for market participants and investors in identifying the low-hanging fruits available in the market and formulating growth strategies to expedite their growth process.

-

This report offers high-quality insights and is the outcome of a detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research’s internal database and statistical tools.

-

More than 1,000 authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white papers, patents, and articles, have been leveraged to gather the data.

-

We conducted more than 15 detailed primary interviews with market players across the value chain in all four regions and industry experts to obtain both qualitative and quantitative insights.

Customization Options

With this detailed report, Stratview Research offers one of the following free customization options to our respected clients:

Company Profiling

Competitive Benchmarking

-

Benchmarking of key players on the following parameters: Service portfolio, geographical reach, regional presence, and strategic alliances

Custom Research: Stratview Research offers custom research services across industries. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to [email protected]