.jpg)

Carbon fibre consumption in India is nascent but growing, with applications in wind blade spar caps, CNG vessels, cable cores, and bridge rehabilitation. It’s projected to rise from 5.6 kt in 2024 to 12.1 kt by 2030 (~US$234 M), at a 12.8% CAGR, outpacing glass fibre’s 6.5% CAGR, according to Stratview Research.

Composites are the buzzword in today’s manufacturing world, powering everything from sleek automobiles and modern aircraft to spacecraft venturing beyond the atmosphere. At the same time, India is making its claim as a global manufacturing hub, ranking 5th in overall manufacturing strength. Yet, when it comes to composites, the picture varies. India consumes about 738.2 kilotons of polymer composite materials annually, which accounts for a rough 4.5% of global demand. This is 0.51 kg per capita, compared to the 10.1 kg in the U.S. In this article, we’ll explore what the Venn diagram looks like when India and composites overlap.

Glass Fibre Rules the Market:

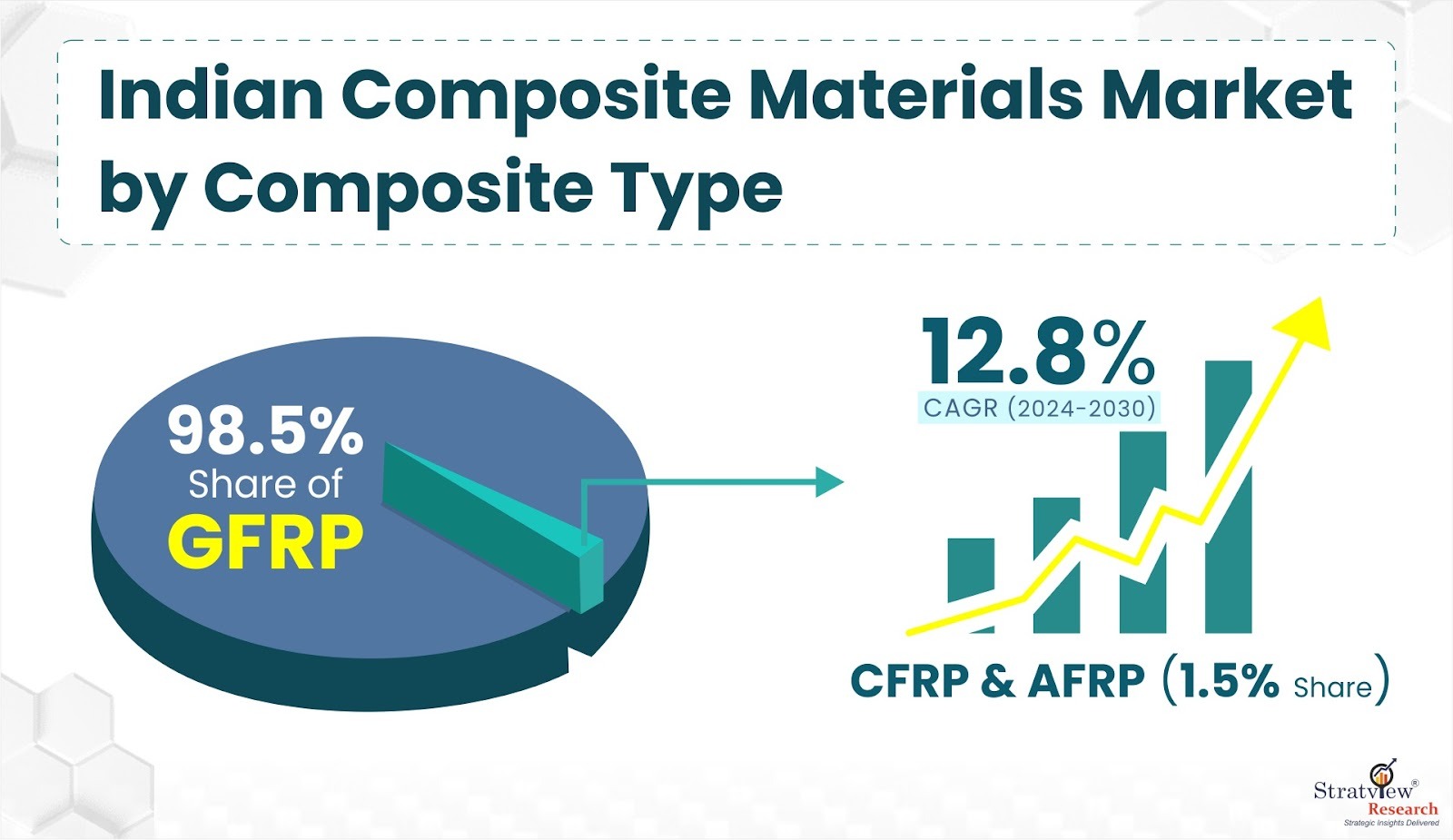

India is believed to be a price-sensitive composites market, primarily driven by small and medium-sized fabricators relying on conventional production methods. This is clearly depicted in the material choice. In 2024, India consumed around 372 kilotons of glass fibre with a market value of roughly US$376 million. Known for their impressive cost-to-performance ratio that suits almost every end-use sector from automotive and wind energy to construction, infrastructure and other industrial applications, glass fibre reinforced polymers (GFRPs) constitute more than 98% (volume share) of the composite material market in India. Apart from cost, another major reason behind such one-sided dominance of GFRP in India is the absence of large-scale end-markets that use carbon fibre reinforced polymers (CFRPs) heavily, such as aerospace.

Who produces glass fibre for India, one might wonder. It is a mix of domestic and global producers. Owens Corning and 3B are the only domestic manufacturers of glassfibre, with Owens Corning producing around 120 kilotons and 3B with 25 kilotons, annually. Nonetheless, India still faces a supply gap of around 250 kilotons, which is eventually fulfilled by imports, mainly from Chinese suppliers such as China Jushi, Chongqing Polycomp, Taishan Fibreglass, ACM, etc.

Carbon Fibre is Catching Up:

While glass fibre dominates in India with GFRPs, carbon fibre and aramid fibre follow. The remaining ~2% share (by volume) in the Indian composite material market is held by Carbon Fibre-Reinforced Polymers (CFRPs) and Aramid Fibre-Reinforced Polymers (AFRPs). Although pricier compared to glass fibre-based composites, these materials provide an exceptional strength-to-weight ratio and are deployed in niche markets like aerospace, defence, wind energy, etc. Although the carbon fibre consumption in India is still at a formative stage, with expanding applications like pultruded spar caps for next-generation wind blades, high-pressure vessels for CNG storage, advanced electrical cable cores, and structural rehabilitation of bridges and buildings, it is projected to grow at around 12.8% annually between 2025 and 2030 (5.6 kilotons in 2024 to 12.1 kilotons by 2030, valuing at ~US$234 million), compared to a 6.5% CAGR of the glass fibre during the same period, according to a report by Stratview Research.

Currently, India relies entirely on imports for carbon fibre and the derived composite material from leading global suppliers such as Hyosung Advanced Materials, Toray, Teijin, and Syensqo. However, this dependence might soon be over. With the rising demand, several Indian conglomerates are making their way into domestic CF production. For instance, Reliance Industries has announced a 20,000-ton capacity plan, starting with a 4,000-ton facility in Gujarat by early 2026. Jindal Advanced Materials is targeting a 3,500-ton plant by 2027 in partnership with MAE S.p.A. Moreover, entities like BARC, HAL, and MIDHANI are also expected to come up with their own production initiatives. If these projects materialise as expected, India is likely to transition from an entirely import-reliant carbon fibre market to a competitive production base.

Fig. 1 : Indian Composite Materials Market by Composite Type

Thermosets Lead, Epoxies Rise:

A discussion on composites is incomplete without resins, which not only bind the muscles of composites (fibres) but also provide resistance against heat, chemicals and the environment. Thermosets are the dominating resin-type led by unsaturated polyester resin (UPR), which alone accounts for ~ 64% of the total market. UPR is extensively used in FRP panels, pultruded profiles, and construction products, supported by over 30 domestic producers and global suppliers like Orson Resins, Revex Group, INEOS, and Polynt-Reichhold. While UPR leads in volume, the performance-driven segment is led by epoxy resins that hold a ~25.5% market share and are expected to rise from 59.7 kilotons in 2024 to 95.4 kilotons by 2030. This is driven by wind blade manufacturing and supported by players like Atul, Aditya Birla Chemicals, Huntsman, and Hexion. Alongside epoxy in the high-performance space is vinyl ester resin. Though it accounts for just 2.8% of the market in 2024, it is gaining traction in applications like wind blade profiles and GFRP rebars. Beyond thermosets like UPR, epoxy, and vinyl ester, thermoplastic resins hold a modest 4.4% market share (~10.3 kilotons worth US$61.6 million), the demand for most of which is met domestically.

Where Does India’s Composite Material Go?

Construction and Infrastructure remain the top application areas, combinedly holding around one-third of the market (35% by volume in 2024). Across all top application areas, the preferred process is pultrusion, with more than 50 applications already in production, from structural profiles to pedestrian bridges, fulfilled by a range of fabricators like Reliance, Jindal, Arvind Mills, etc.

Beyond construction, ground transportation emerges as a major segment with ~21% (by volume) of the market share (155 kilotons in 2024). While penetration in the automotive sector is still low when compared to global benchmarks, Indian Railways produces good demand for composites in the 6000-7000 rail coaches it manufactures annually. The Renewable Energy Industry claimed ~17% market share by volume in 2024, with wind energy as the primary demand force. Other important segments include electrical/electronics, telecommunications, and industrial pipes/tanks, which constitute the remaining market share.

Fig. 2 : Breakdown of India Composite Material Applications

What Lies Ahead?

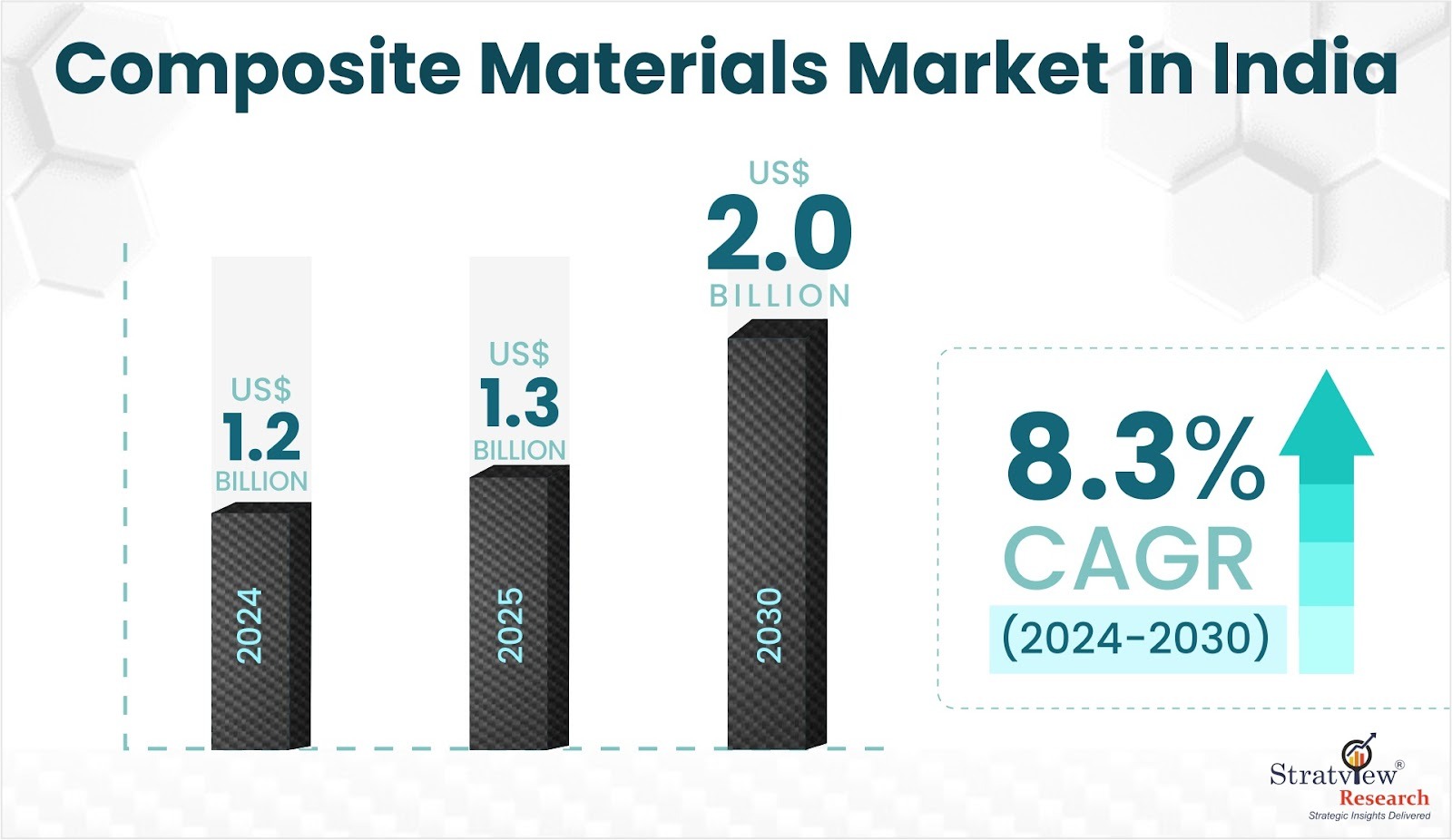

The composite material market in India is witnessing a significant transformation. With a market size of US$1.28 billion in 2024, projected to reach US$1.34 billion in 2025 and further hit US$2.0 billion by 2030 (according to Stratview Research), India is growing at approximately double the global average. Though growth is anticipated across all categories, carbon fibre is projected to grow twice as fast as glass fibre, supported by initiatives by conglomerates such as Reliance Industries, Jindal Advanced Materials, etc and momentum in intermediates like prepregs and compounds.

Fig. 3 : Composite Materials Market in India (2024-2030)

After mastering GFRP, major Indian players are now advancing into high-performance composites, building a fully integrated value chain from raw materials to finished parts. Stratview Research foresees India’s gradual shift toward advanced applications, including hydrogen pressure vessels and aerospace structures, positioning the nation as an increasingly influential player in the global composites landscape.

Authored by Stratview Research. Also published on – cecaasia.com

.jpg)