According to Stratview Research, The Polypropylene Boards market is projected to grow from USD 1.2B in 2023 to USD 1.5B by 2030, with packaging materials contributing ~50%. Europe leads demand due to high consumption of convenient packaged goods, while North America and APAC are expanding rapidly, with APAC emerging as the fastest-growing region.

Packaging is a critical component of a product's journey from production to utilization, serving an essential role in ensuring safety throughout the process. Effective packaging material has to be lightweight, sturdy, and strong enough to withstand weight, weather conditions, and other factors.

A variety of materials including paper/paper board, plastics, and metallic materials are used globally, for packaging purposes. While paper/paperboard holds a significant share of the global packaging materials market, which is valued at more than US$ 1 Trillion, plastics stand in second place; out of which, boards and panels made of polypropylene – a thermoplastic polymer, known for their versatile applications, are gaining popularity.

Boards made of polypropylene are lightweight yet durable, and also provide the necessary strength for various applications. Many other factors make plastic better than paper, one of which is its lightweight. Paper bags/boxes are anywhere between 6-10x heavier than lightweight plastic carrier bags and require more transport and its associated costs.

Polypropylene Board and Its Types

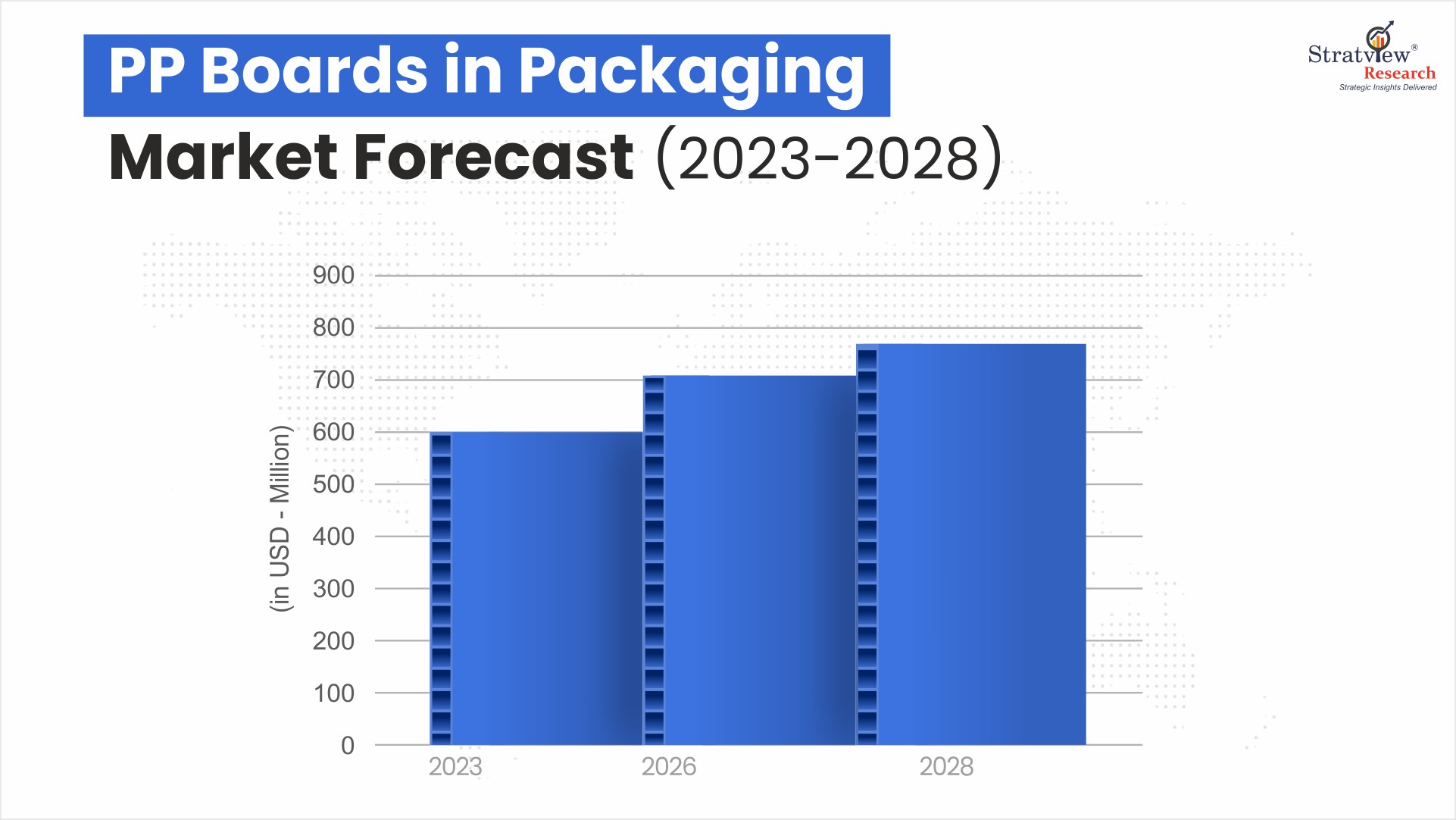

In packaging applications, boards made of Polypropylene (PP) materials are extensively utilized in various forms, including corrugated sheets, and PP panels (often come in honeycomb sheets and bubble-wrap sheets). In 2023, the global market for PP boards in the packaging industry was valued at USD 600 Million, of which, corrugated PP sheets accounted for >90% share, with the remaining share consisting of PP panels.

The corrugated structure provides enhanced cushioning and strength, making the sheet suitable not only for packaging but also for various other purposes. In addition to their primary role in packaging, PP corrugated sheets excel in creating robust and sustainable solutions across multiple industries. Their lightweight yet durable construction allows for easy handling and transportation, making them ideal for temporary or permanent signage and promotional displays.

Available in different thicknesses—ranging from less than or equal to 5 mm, 6-8 mm, to greater than 8 mm—each thickness offers distinct properties and strength characteristics. The 5 mm sheets are particularly popular due to their lightweight nature, making them the most widely used option among consumers.

Why PP in Packaging?

Businesses primarily consider several key factors when selecting packaging materials for their products, including –

- the type of product being packaged,

- the intended use of the packaging,

- the cost of the materials, and

- the environmental impact of those materials.

Businesses primarily consider several key factors when selecIrrespective of the product being packed, PP materials give support and protection to all the products with much strength, aligning well with all the above criteria.

The choice of PP sheet depends on the specific application. For fragile or perishable items, high-density PP sheets are necessary, while some PP sheets may be used solely for wrapping purposes. For items such as glass containers, chemicals, ceramics, or any fragile goods, a more rigid sheet is required. This is why trays, containers, and boxes made from PP are commonly used.

ting packaging materials for their products, including – the type of product being packaged, the intended use of the packaging, the cost of the materials, and the environmental impact of those materials.

To Conclude

The rise of online shopping, or e-commerce, has been nothing short of exponential. Lifestyle changes also have significantly increased the demand for packaged food and groceries. Following the COVID-19 pandemic, there has been a notable surge in the trend of contactless deliveries. This heightened demand for contactless deliveries, packed products, etc., has also driven growth in the packaging materials market.

Alongside the growing demand for packaging materials, there is also an increasing interest in biodegradable packaging driven by environmental concerns. Though traditional polypropylene (PP) materials are recyclable but are criticised for their environmental impact due to their non-biodegradable nature. It might take >100years to degrade, which prompts many companies to innovate and produce biodegradable PP alternatives.

Mitsui Chemicals, Inc., has developed bio-PP through innovative production methods, utilizing fermentation of non-edible biomass. LyondellBasell Industries Holdings B.V. Borealis, and SABIC, etc., are a few companies working this way.

Presently, the demand for packaging comes from Europe due to its status as a developed region and the increasing popularity of packaged items, and a shift towards convenience-oriented products. Additionally, the food packaging market in Europe is expected to reach a volume of ~ 41.7 million tonnes by 2031, indicating robust demand in the packaging segment, states research.

After Europe, the demand for packaging is rapidly increasing in North America and the Asia Pacific region. Notably, the Asia Pacific region is emerging as the fastest-developing area, driven by a growing population and rising economic development. As a result, the demand for innovative packaging solutions from the APAC region is likely to increase in the coming years. The global value of PP boards is projected to grow from USD 1,200 Million in 2023 to USD 1,500 Million by 2030, with packaging materials accounting for ~50% of this market share.

Fig. 1: PP Boards in Packaging: Global Market Forecast 2023–2028

Packaging is the need of the hour, and consumers, and businesses continue to prioritize sustainable practices. By embracing innovations like biodegradable materials, we can create a more sustainable future where packaging contributes to environmental preservation rather than degradation.

Authored by Stratview Research. Also published on – Reuseable Packaging News