Stratview Research reports that rapid data center expansion and sustainability needs, India’s liquid cooling market is projected to grow over 25% in the coming years, surpassing USD 300 million by 2030.

Our world is brimming with data, and this exponential growth has led to a surge in the number and rack capacity of data centers. The growing pressure on racks will apparently increase the heat generation, further necessitating more efficient cooling solutions to manage the thermal loads and mitigate the strain on resources, since cooling systems often consume ~50% of the total energy usage.

Traditional air-cooling methods become inadequate gradually to manage the thermal loads of modern, high-density data centers, leading operators to seek more innovative cooling solutions. With rack densities set to grow beyond 100kW/rack, the only viable solution for cooling these high-performance servers currently is liquid cooling.

Liquid cooling enables higher computing densities, optimizing space utilization and costs. By opting different liquid cooling methods including immersive cooling, direct-to-chip, etc. organizations can reap benefits in multiple ways.

Liquid cooling, despite its ~20% share of the global data center cooling market share, is emerging as a viable solution for data centers, poised for an expected annual growth rate of >24%, states Stratview Research.

Why Indian Data Centers Need Liquid Cooling?

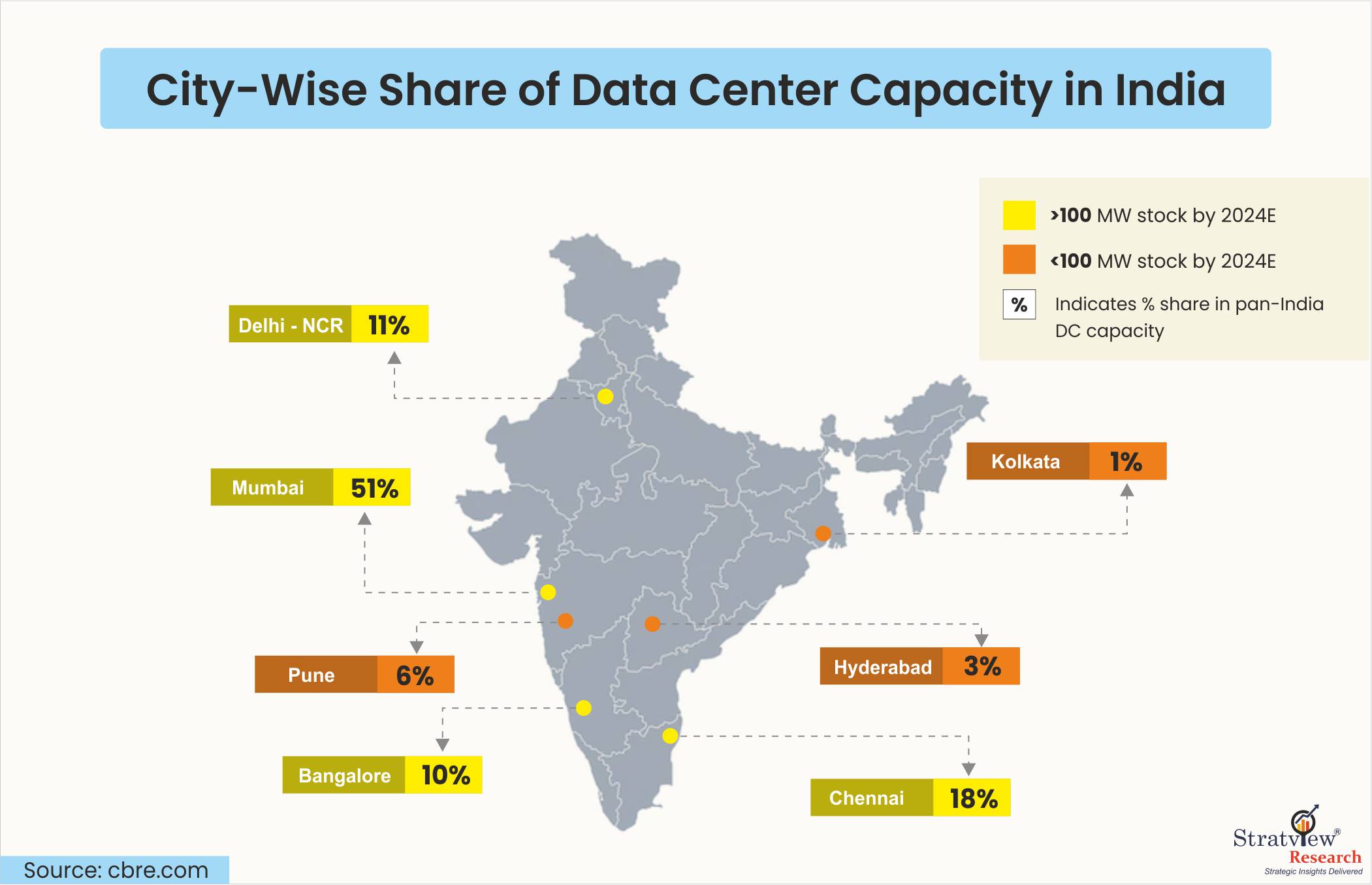

India is on the top of major APAC countries (excluding China) with the highest data center capacity of 1030 MW, states Coldwell Banker Richard Ellis (CBRE).Various estimates project that India's DC capacity could exceed 5000 MW by 2030, with a concentration anticipated in: Mumbai, Chennai, Delhi, Bengaluru, Pune, Hyderabad, and Kolkata. (Refer to Fig. 1). India’s growing data center landscape necessitates a proactive liquid-ready approach.

Fig. 1: Data Center Capacity Share by City in India

Another point of view – Water, a critical resource for any data center, is under severe strain in India. A report by the National Association of Software and Service Companies (NASSCOM), published in 2021, cited water crisis as a high-risk factor for data centers in top Indian DC markets including Bengaluru, Chennai, Hyderabad, Delhi, and Mumbai. Such scarcity poses a challenge to the DC market’s sustainability.

Annually ~26 million liters of water is used by a 1 MW capacity data center. This would mean a 20 MW DC would require about 1.4 m liters daily (or 520million liters annually). Meanwhile, the daily water supply is just over 1,450 million liters per day (MLD) in Bengaluru, 1,000-1075 MLD in Chennai, and crosses 4,000 MLD in Mumbai.

To mitigate the impact of data centers on water resources, it is vital to adopt sustainable water management practices and water-efficient cooling technologies. DC operators in India are exploring different technologies in this way, one of which is the liquid cooling method.

The Nippon Telegraph and Telephone Public Corporation (NTT), one of the top three global data center service providers, has deployed Liquid immersion Cooling (LIC) and Direct Contact Liquid Cooling (DCLC) technologies in India, marking the first time these technologies have been deployed in a production environment in the country. This deployment has resulted in ~30% improved energy efficiency.

Yotta Group, one of the top Indian DCs, also claims that Indian data centers having PUE between 1.5 and 1.6 can bring down the PUE levels to 1.1 and 1.2 by adopting liquid cooling methods.

Equinix, which till date uses only air-cooled chillers, is now set to use liquid cooling in 100 centers across the globe, including India. They have also started constructing their upcoming DCs suitable for liquid cooling methods. Microsoft, after using two-phase immersion cooling, claims to have observed reduced power consumption for any given server by 5% to 15%.

Liquid Cooling – A Necessity in a Growing Digital World

India’s digitalization wave is driving a five-fold increase in its data center capacity expansion. Beyond online payment trends, internet penetration exceeding 52% of the total population at the start of 2024, the e-commerce thriving with >11% annual growth rate, etc., there are some more tailwinds ensuring a robust demand for data center capacity in India.

India’s rapid adoption of cutting-edge technologies including AI, blockchain, augmented reality & virtual reality, etc. is further necessitating a huge rack density for DCs, which would proportionally increase the heat load. AI DC racks can consume up to seven times more power than traditional data center racks. This strengthens the need for much more efficient liquid cooling methods.

India is also emerging as a co-location powerhouse and a major data center hub, driven by a confluence of factors, including affordable land prices, competitive data costs, a burgeoning internet-savvy population, etc.

With the exponential growth of data centers and rising environmental concerns, the Indian data center liquid cooling market is set to experience a robust growth of over 25% during the next few years and clock a revenue of more than USD 300 million by 2030.

Authored by Stratview Research. Also published on – Data Center Knowledge