Market Insights

- The cloud gaming market size was valued at USD 6.4 billion in 2024, 27.3% up from the market value of USD 5.0 billion in 2023.

- During the last six-year period (2019-2024), the market grew at a skyrocketing CAGR of 91.6%.

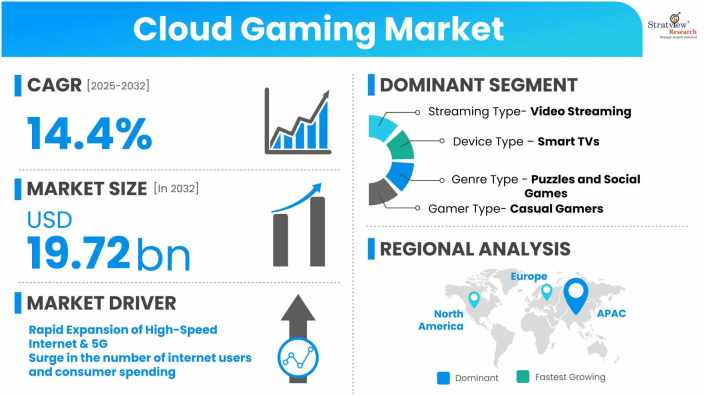

- During the forecast period of 2025-2032, the cloud gaming market is expected to grow at a CAGR of 14.4% to reach USD 19.7 billion in 2032.

- During 2025-2030, the cloud gaming industry is expected to generate a cumulative sales opportunity of USD 68.5 billion, which is almost 4 times the sales value generated during 2019-2024.

Want Insights to Tap the Growth Opportunity? Get Free Sample

Cloud Gaming Market Statistics

Have a look at the sales opportunities presented by the cloud gaming market in terms of growth, market forecast and segment opportunities.

Cloud Gaming Market Data

| Year |

Annual Market Size (in USD Billion) |

Market Growth |

| 2024 |

USD 6.4 billion |

CAGR (2019-2024): 91.6% |

| 2025 |

USD 7.7 billion |

YoY Growth: 20.2% |

| 2032 |

USD 19.7 billion |

CAGR (2025-2032): 14.4% |

High Growth Sales Opportunities in Cloud Gaming Market

| Opportunity Heads |

High Growth Segments for you |

Cumulative Sales - 2019-2024 (in Billion USD) |

Cumulative Sales - 2025-2030 (in Billion USD) |

Market Growth Opportunity |

| Global Sales |

Global |

USD 16.7 billion |

USD 68.5 billion |

4x (+300%) |

| Region |

Asia-Pacific |

USD 6.3 billion |

USD 26.0 billion |

| Streaming Type |

Video Streaming |

USD 13.4 billion |

USD 54.8 billion |

| Device Type |

Smart TVs |

USD 5.9 billion |

USD 24.0 billion |

| Genre Type |

Puzzles & Social Games |

USD 6.0 billion |

USD 24.7 billion |

| Gamer Type |

Casual Gamers |

USD 11.7 billion |

USD 47.9 billion |

Market Dynamics

Introduction

Cloud gaming refers to the process of playing video games on servers located remotely in data centers. It requires a high-speed, stable, and low-latency internet connection to stream the game on the cloud gaming platform; there is no need to download or install games on any device.

Market Drivers

The major factors driving the growth of the cloud gaming market in the coming year are:

- Rapid Expansion of High-Speed Internet & 5G:

The rapid expansion of high-speed internet and 5G is significantly propelling the cloud gaming market. According to Ericsson, cloud gaming users are expected to rise from 32 million to 87 million between 2022 and 2025.

- Surge in the number of internet users and consumer spending:

The global surge in internet users and consumer spending is significantly propelling the cloud gaming market. As of 2024, approximately 5.5 billion people—68% of the world's population—are online, up from 65% in 2023. Also, final internet consumption expenditure reached $63.5 trillion in 2023, reflecting robust consumer spending.

This combination of increased internet accessibility and higher consumer spending enhances the potential for cloud gaming services.

Want to have a closer look at this report? Get Free Sample

Key Players

The cloud gaming market is gradually consolidating, with major companies performing mergers & acquisitions to quickly gain the leading position and to tap growing opportunities in this rapidly expanding market.

For instance, Sony Corporation, a leading provider of cloud gaming across the regions, acquired Bungie. After the acquisition, Sony Corporation successfully leaped ahead in the market with the added capabilities and expansion of its game titles. However, the market entry of several new players is likely to make the business environment challenging for the major players.

Here is the list of the Top Players (arranged alphabetically)

The supply chain of the cloud gaming industry comprises cloud computing providers, game developers, cloud gaming providers, telecommunication partners, and end-users. Major players are striving hard to integrate vertically to gain a competitive edge in the market.

Note: The above list does not necessarily include all the top players in the market.

Are you the leading player in this market? We would love to include your name. Write to us at [email protected]

Segments Analysis

|

Segmentations

|

List of Sub-Segments

|

Dominant and Fastest-Growing Segments

|

|

Streaming-Type Analysis

|

Video Streaming and File Streaming

|

Video streaming is likely to remain the bigger demand generator for cloud gaming platforms in the foreseeable future. This segment held more than 80% market share in 2024.

|

|

Device-Type Analysis

|

PC & Laptops, Smartphones, Smart TVs, and Gaming Consoles

|

Smart TVs remain at the nucleus for all the leading market stakeholders serving the cloud gaming industry. The smart TVs segment held more than 35% market share in 2024.

|

|

Genre-Type Analysis

|

Puzzles and Social Games, Adventure & Sports, and Arcade

|

The puzzles & social games held more than 35% market share in 2024.

|

|

Gamer-Type Analysis

|

Casual Gamers and Hardcore Gamers

|

Casual gamers dominate the market; the casual gamer segment held more than 70% market share in 2024.

|

|

Regional Analysis

|

North America, Europe, Asia-Pacific, and Rest of the World

|

Asia-Pacific held more than 35% market share in 2024 and is expected to remain the largest market for cloud gaming over the forecast period.

|

By Streaming Type

"Video streaming is the largest segment, accounting for more than 75% market share in 2024."

- The market is bifurcated into video streaming and file streaming.

- Video streaming is likely to remain the bigger demand generator for cloud gaming platforms in the foreseeable future. The key factors driving the segment's dominance are on-demand streaming requirements as well as the ability to be effective for shorter periods of play.

- Furthermore, a paradigm shift from console- and disc-based gaming to cloud-based gaming ensures a massive demand for cloud gaming platforms in the coming years.

By Device Type

"Smart TVs segment led the market with more than 35% market share in 2024."

- The market is segmented as PC & laptops, smartphones, smart TVs, and gaming consoles.

- Smart TVs remain at the nucleus for all the leading market stakeholders serving the cloud gaming industry. A smart TV provides a better gaming experience to its gamers with features such as a 4K display and better feasibility in using cloud gaming platforms with the help of a controller.

- Partnerships with smart TV manufacturers, OTT providers, and setup box providers to reach a large number of cloud gaming users are likely to provide market stakeholders with enormous growth potential. It is also anticipated that Smart TV will remain the most preferred device type in the market in the foreseeable future.

By Genre Type

"Puzzles and social games are the most popular genre on cloud gaming platforms, holding over 35% of the market share in 2024."

- The market is segmented as puzzles & social games, adventure & sports, and arcade.

- Among these genre types, puzzles & social games are the most widely played category on cloud gaming platforms, as players choose to play these games with their friends in order to socialize with them, implying that the market for puzzles & social games is rising. In addition, comprehending the game takes less time in this category.

By Gamer Type

"Casual gamers, who make up over 70% of the market, are driving the growth of cloud gaming."

- The market is segmented into casual gamers and hardcore gamers.

- Between these gamer types, casual gamers dominate the market, whereas hardcore gamers continue to prefer console gaming. Casual gamers prefer cloud gaming because it is more cost-effective.

Regional Insights

"Asia-Pacific led the cloud gaming market in 2024 with over 35% share and is poised to retain its top position in the coming years."

- Asia-Pacific is expected to remain the largest market for cloud gaming over the forecast period. In addition, the region is likely to witness healthy market growth in the coming years. Japan, India, and Southeast Asia are the preferred destinations for gaming companies to expand in Asia.

- The leading player in the market, Sony Corporation, has expansion plans in the region. Already existing 5G infrastructure in countries such as Malaysia and Thailand is creating healthy demand for the market.

- The partnership between Blacknut and Celcom Telecommunication, Tencent to launch its cloud gaming platform in Southeast Asian countries, and the development of 5G infrastructure in key Asian economies such as India and China are likely to generate huge demand for cloud gaming in the region.

Get Free Sample to Know the high-growth countries in this report.

Research Methodology

This strategic assessment report, from Stratview Research, provides a comprehensive analysis that reflects today’s cloud gaming market realities and future market possibilities for the forecast period of 2025 to 2032. The report segments and analyzes the market in the most detailed manner in order to provide a panoramic view of the market. The vital data/information provided in the report can play a crucial role for the market participants as well as investors in the identification of the low-hanging fruits available in the market as well as to formulate the growth strategies to expedite their growth process.

This report offers high-quality insights and is the outcome of a detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research’s internal database and statistical tools. More than 1,000 authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white papers, patents, and articles, have been leveraged to gather the data. We conducted more than 15 detailed primary interviews with the market players across the value chain in all four regions and industry experts to obtain both qualitative and quantitative insights.

Report Features

This report provides market intelligence in the most comprehensive way. The report structure has been kept such that it offers maximum business value. It provides critical insights into market dynamics and will enable strategic decision-making for existing market players as well as those willing to enter the market. The following are the key features of the report:

- Market structure: Overview, industry life cycle analysis, supply chain analysis.

- Market environment analysis: Growth drivers and constraints, Porter’s five forces analysis, SWOT analysis.

- Market trend and forecast analysis.

- Market segment trend and forecast.

- Competitive landscape and dynamics: Market share, Service portfolio, New Product Launches, etc.

- COVID-19 impact and its recovery curve

- Attractive market segments and associated growth opportunities.

- Emerging trends.

- Strategic growth opportunities for the existing and new players.

- Key success factors.

Market Segmentation

This report studies the market, covering a period of 12 years of trend and forecast. The report provides detailed insights into the market dynamics to enable informed business decision-making and growth strategy formulation based on the opportunities present in the market.

The cloud gaming market is segmented into the following categories:

By Streaming Type

- Video Streaming

- File Streaming

By Device Type

- PC & Laptops

- Smartphones

- Smart TVs

- Gaming Consoles

By Genre Type

- Puzzles and social Games

- Adventure & Sports

- Arcade

By Gamer Type

- Casual Gamers

- Hardcore Gamers

By Region

- North America (Country Analysis: the USA, Canada, and Mexico)

- Europe (Country Analysis: Germany, France, the UK, Russia, Spain, and Rest of Europe)

- Asia-Pacific (Country Analysis: China, Japan, India, South Korea, and Rest of Asia-Pacific)

- Rest of the World (Sub-Region Analysis: Latin America, the Middle East, and Others)

Get Free Sample, to learn the market segmentation details.

Report Customization Options

Stratview Research offers one of the following free customization options to our respectable clients:

Company Profiling

- Detailed profiling of additional market players (up to three players)

- SWOT analysis of key players (up to three players)

Competitive Benchmarking

- Benchmarking of key players on the following parameters: Product portfolio, geographical reach, regional presence, and strategic alliances.

Custom Research: Stratview Research offers custom research services across the sectors. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to [email protected].

Recent Developments

On 2 August 2023, GTA V's popularity increased Xbox cloud gaming wait times as Rockstar brought GTA 5 and GTA Online back to Xbox Game Pass. All devices that enable Xbox Cloud Streaming are compatible with Ultimate members playing the game.

On 2 August 2023, Samsung plans to push into cloud gaming beyond TVs, similar to YouTube, to simplify game discovery for users and publishers. This initiative aligns with the company's priorities and growth opportunities.

On 28 April 2023, Microsoft and Nware signed a 10-year deal to stream Xbox games on Nware's platform, despite the Competition and Markets Authority blocking Activision Blizzard titles. The agreement will allow users to enjoy PC games built by Xbox on Nware's platform.