Attractive Opportunities

Global Demand Analysis & Sales Opportunities in Aircraft Specialty Fasteners Market

-

The annual demand for aircraft specialty fasteners was USD 1070 million in 2024 and is expected to reach USD 1120 million in 2025, up 4.7% than the value in 2024.

-

During the forecast period (2025-2034), the aircraft specialty fasteners market is expected to grow at a CAGR of 3.1%. The annual demand will reach USD 1473 million in 2034.

-

During 2025-2034, the aircraft specialty fasteners industry is expected to generate a cumulative sales opportunity of USD 13144 million, which is almost 3 times the opportunities during 2019-2024.

High-Growth Market Segments:

-

North America is expected to remain the largest market over the next eight years, whereas Asia-Pacific is likely to grow at the fastest rate.

-

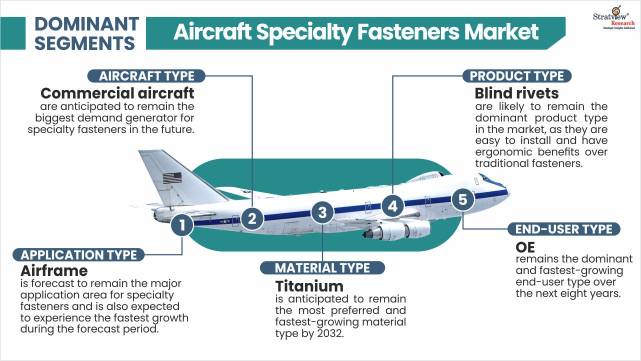

By aircraft type, Commercial aircraft are anticipated to remain the biggest demand generator for specialty fasteners in the future.

-

By application type, Airframe is forecast to remain the major application area for specialty fasteners and is also expected to experience the fastest growth during the forecast period.

-

By material type, Titanium is anticipated to remain the most preferred and fastest-growing material type by 2032.

-

By product type, Blind rivets are likely to remain the dominant product type in the market, as they are easy to install and have ergonomic benefits over traditional fasteners.

-

By end-user type, OE remains the dominant and fastest-growing end-user type over the forecasted period.

Market Statistics

Have a look at the sales opportunities presented by the aircraft specialty fasteners market in terms of growth and market forecast.

|

Aircraft Specialty Fasteners Market Data & Statistics

|

|

|

Market Statistics

|

Value (in USD Million)

|

Market Growth (%)

|

|

Annual Market Size in 2023

|

USD 892 million

|

-

|

|

Annual Market Size in 2024

|

USD 1070 million

|

YoY Growth in 2024: 19.9%

|

|

Annual Market Size in 2025

|

USD 1120 million

|

YoY Growth in 2025: 4.7%

|

|

Annual Market Size in 2034

|

USD 1473 million

|

CAGR 2025-2034: 3.1%

|

|

Cumulative Sales Opportunity during 2025-2034

|

USD 13144 million

|

-

|

|

Top 10 Countries’ Market Share in 2024

|

USD 856 million +

|

> 80%

|

|

Top 10 Company’s Market Share in 2024

|

USD 535 million to USD 749 million

|

50% - 70%

|

Market Dynamics

Introduction:

Fasteners are crucial in the aircraft industry, serving as essential hardware components found throughout the aircraft. They are used to join various parts of the aircraft, such as attaching the structure to the skin and installing and securing components like seats, stowage bins, and panels to the aircraft body. Fasteners are the most numerous components in an aircraft. For example, the A380 aircraft program consists of six million components, with more than three million of them being fasteners.

In the aerospace industry, specialty fasteners are a distinct category designed to meet specific and challenging requirements. These include high-speed or automated assembly, sandwich panel installation, thin sheet assembly, mounting on surfaces unsuitable for through-hole technology, blind assembly, frequent joint access, and optimizing preload in heavily loaded joints. Specialty fasteners streamline the assembly process by reducing the need for additional fastening components, saving time, and ultimately lowering overall costs.

Segments Analysis

|

Segmentations

|

List of Sub-Segments

|

Dominant and Fastest-Growing Segments

|

|

Aircraft -Type Analysis

|

Commercial Aircraft, Regional Aircraft, Helicopters, Military Aircraft, and General Aviation

|

Commercial aircraft are anticipated to remain the biggest demand generator for specialty fasteners in the future.

|

|

Application- Type Analysis

|

Airframe, Flight Control Surfaces, Interior, Engine, and Other Application Types

|

Airframe is forecast to remain the major application area for specialty fasteners and is also expected to experience the fastest growth during the forecast period.

|

|

Material-Type Analysis

|

Titanium, Aluminum, Steel, and Other Material Types

|

Titanium is anticipated to remain the most preferred and fastest-growing material type by 2032.

|

|

Product-Type Analysis

|

Blind Rivets, Blind Bolts, Solid Rivets, Studs & Inserts, Panel Fasteners, and Other Product Types

|

Blind rivets are likely to remain the dominant product type in the market, as they are easy to install and have ergonomic benefits over traditional fasteners.

|

|

End-User- Type Analysis

|

OE and Aftermarket

|

OE remains the dominant and fastest-growing end-user type over the next eight years.

|

|

Regional Analysis

|

North America, Europe, Asia-Pacific, and The Rest of the World

|

North America is expected to remain the largest market over the next eight years, whereas Asia-Pacific is likely to grow at the fastest rate.

|

By Aircraft Type

“Commercial aircraft are expected to remain the largest demand generator for specialty fasteners in the forecasted period.”

-

The aircraft specialty fasteners market is segmented into commercial, regional, helicopter, military, and general aviation.

-

Commercial aircraft are projected to remain the largest and fastest-growing segment of the specialty fasteners market during the forecast period. Boeing and Airbus, the two leading commercial aircraft OEMs, are ramping production rates for their best-selling models to address substantial order backlogs. Additionally, new entrants like COMAC and Irkut are making strides in the commercial aircraft industry with their C919 and MC-21 programs. The return of the B737 Max to service and the expanding global aircraft fleets further contribute to the sustainable demand for specialty fasteners in the commercial aircraft segment.

Want to get a free sample? Register Here

By Product Type

“Blind rivets are expected to remain the dominant product type in the market due to their ease of installation and ergonomic advantages over traditional fasteners.”

-

The market is segmented into blind rivets, blind bolts, solid rivets, studs and inserts, panel fasteners, and other product types.

-

Blind rivets are anticipated to remain the largest product type in the market during the forecast period, driven by their installation efficiency and ergonomic advantages over traditional fasteners. Additionally, blind rivets are projected to exhibit the fastest growth over the next eight years. Similarly, blind bolts, another key product in the blind fastener family, are expected to grow at an impressive rate during the same period.

By Application Type

“The airframe is projected to remain the primary application area for specialty fasteners and is also expected to witness the fastest growth during the forecast period.”

-

The market is segmented into the airframe, flight control surfaces, interior, engine, and other application types.

-

The airframe is anticipated to remain the most dominant segment of the market during the forecast period. As the largest structure in an aircraft, the airframe utilizes specialty fasteners in a variety of applications, including wings and fuselage, which underpins its leading position in the market.

By Material Type

“Titanium is expected to remain the most preferred and fastest-growing material type in the aircraft fastener market until 2032.”

-

The market is segmented into titanium, aluminum, steel, and other material types.

-

Titanium is expected to remain the dominant material type in the market during the forecast period. The aircraft industry has been gradually replacing steel and other heavy metal-based fasteners with titanium fasteners due to their superior performance at a relatively low weight. Additionally, titanium fasteners are highly compatible with composite materials, which are increasingly used in next-generation aircraft, such as the B787, A350XWB, and B777X. This compatibility is expected further to drive the demand for titanium fasteners in the industry.

Regional Analysis

“North America is expected to remain the largest market over the forecasted period, while Asia-Pacific is projected to grow at the fastest rate during the same period.”

-

The market is segmented into North America, Europe, Asia-Pacific, and The Rest of the World.

-

North America is expected to remain the largest market for aircraft specialty fasteners during the forecast period, driven by the presence of major aircraft OEMs, specialty fasteners suppliers, airlines, and MRO companies in the USA.

-

Meanwhile, Asia-Pacific is projected to experience the highest growth, with China, Japan, and India being key growth drivers. The substantial increase in air passenger and freight traffic in China and India is prompting aircraft manufacturers and tier suppliers to establish manufacturing plants in the region. Companies in the Asia-Pacific region are working to develop commercial and regional aircraft to meet rising domestic demand and reduce reliance on Boeing and Airbus. The COMAC C919 is an example of such efforts, already generating significant unfulfilled orders.

Want to get a free sample? Register Here

Competitive Landscape

The market is highly concentrated, with the presence of some regional and global players. Development of lightweight and durable specialty fasteners, forming strategic alliances with aircraft OEMs, and execution of mergers & acquisitions are the key strategies adopted by the major players to gain a competitive edge in the market. The following are the key players in the aircraft specialty fasteners market:

-

Howmet Aerospace Inc.

-

Precision CastParts Corp.

-

TriMas Corporation

-

Lisi Group

-

Stanley Black & Decker, Inc.

-

National Aerospace Fasteners Corporation

Note: The above list does not necessarily include all the top players in the market.

Are you the leading player in this market? We would love to include your name. Please write to us at [email protected]

Recent Market News

-

In December 2021, TriMas Corporation acquired TFI Aerospace, a manufacturer of specialty fasteners used in a variety of applications for aerospace and other industrial end markets. This acquisition helped expand TriMas Aerospace’s fastener product lines with the addition of complementary niche products.

-

In January 2020, Consolidated Aerospace Manufacturing, LLC (CAM) agreed to be acquired by Stanley Black & Decker, Inc. This acquisition helps to further diversify the growth of Stanley Black & Decker, Inc.’s industrial business segment.

Report Features

This report provides market intelligence most comprehensively. The report structure has been kept so that it offers maximum business value. It provides critical insights into market dynamics and will enable strategic decision-making for existing market players as well as those willing to enter the market.

The following are the key features of the report:

-

Market structure: Overview, industry life cycle analysis, supply chain analysis.

-

Market environment analysis: Growth drivers and constraints, Porter’s five forces analysis, SWOT analysis.

-

Market trend and forecast analysis.

-

Market segment trend and forecast.

-

Competitive landscape and dynamics: Market share, Service portfolio, New Product Launches, etc.

-

COVID-19 impact and its recovery curve.

-

Attractive market segments and associated growth opportunities.

-

Emerging trends.

-

Strategic growth opportunities for the existing and new players.

-

Key success factors.

|

Market Study Period

|

2019-2034

|

|

Base Year

|

2024

|

|

Forecast Period

|

2025-2034

|

|

Trend Period

|

2019-2023

|

|

Number of Tables & Figures

|

>100

|

|

Number of Segments Analysed

|

6 (Aircraft Type, Application Type, Material Type, Product Type, End-User Type, and Region)

|

|

Number of Regions Analysed

|

4 (North America, Europe, Asia-Pacific, Rest of the World)

|

|

Countries Analysed

|

15 (The USA, Canada, Mexico, Germany, France, Italy, The UK, China, Japan, India, Brazil, Saudi Arabia, Rest of Europe, Rest of APAC, and Rest of the World)

|

|

Free Customization Offered

|

10%

|

|

After Sales Support

|

Unlimited

|

|

Report Presentation

|

Complimentary

|

|

Market Dataset

|

Complimentary

|

|

Further Deep Dive & Consulting Services

|

10% Discount

|

Market Segmentation

The report provides detailed insights into the market dynamics to enable informed business decision-making and growth strategy formulation based on the opportunities present in the market.

The aircraft specialty fasteners market is segmented into the following categories.

Aircraft Specialty Fasteners Market, by Aircraft Type

-

Commercial Aircraft (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

-

Regional Aircraft (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

-

Helicopter (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

-

Military Aircraft (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

-

General Aviation (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

Aircraft Specialty Fasteners Market, by Application Type

-

Airframe (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

-

Flight Control Surfaces (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

-

Interior (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

-

Other Application Types (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

Aircraft Specialty Fasteners Market by Product Type

-

Blind Rivets ((Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

-

Blind Bolts (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

-

Solid Rivets (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

-

Stud and Inserts (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

-

Panel Fasteners (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

-

Other Products Types (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

Aircraft Specialty Fasteners Market, by Material Type

-

Titanium (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

-

Aluminum (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

-

Other Material Types (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

Aircraft Specialty Fasteners Market, by End-User Type

-

OE (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

-

Aftermarket (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

Aircraft Specialty Fasteners Market, by Region

-

North America (Country Analysis: The USA, Canada, and Mexico)

-

Europe (Country Analysis: Germany, France, The UK, Russia, and The Rest of Europe)

-

Asia-Pacific (Country Analysis: Japan, China, India, and The Rest of Asia-Pacific)

-

Rest of the World (Country Analysis: Brazil, Saudi Arabia, and Others)

Research Methodology

-

This strategic assessment report from Stratview Research provides a comprehensive analysis that reflects today’s aircraft specialty fasteners market realities and future market possibilities for the forecast period.

-

The report segments and analyzes the market in the most detailed manner in order to provide a panoramic view of the market.

-

The vital data/information provided in the report can play a crucial role for market participants and investors in identifying the low-hanging fruits available in the market and formulating growth strategies to expedite their growth process.

-

This report offers high-quality insights and is the outcome of a detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research’s internal database and statistical tools.

-

More than 1,000 authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white papers, patents, and articles, have been leveraged to gather the data.

-

We conducted more than 15 detailed primary interviews with market players across the value chain in all four regions and industry experts to obtain both qualitative and quantitative insights.

Customization Options

With this detailed report, Stratview Research offers one of the following free customization options to our respectable clients:

Company Profiling

Competitive Benchmarking

-

Benchmarking of key players on the following parameters: Service portfolio, geographical reach, regional presence, and strategic alliances

Custom Research: Stratview Research offers custom research services across sectors. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to [email protected]