Attractive Opportunities

Global Demand Analysis & Sales Opportunities in Aircraft Decorative Laminates Market

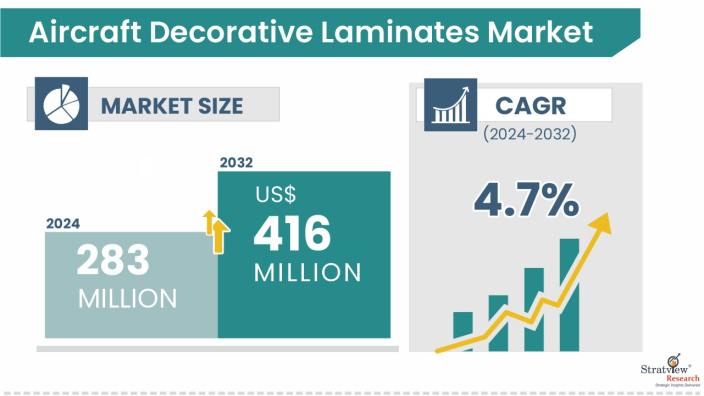

- The annual demand for aircraft decorative laminates was USD 283.2 million in 2024 and is expected to reach USD 301.5 million in 2025, up 6.5% than the value in 2024.

- During the next 7 years (forecast period of 2025-2032), the aircraft decorative laminates market is expected to grow at a CAGR of 4.7%. The annual demand will reach USD 416.4 million in 2032.

- During 2025-2032, the aircraft decorative laminates industry is expected to generate a cumulative sales opportunity of USD 3029.8 million, which is more than 2 times the opportunities during 2019-2024.

Wish to get a free sample? Click Here

High-Growth Market Segments:

- North America generated the highest demand with the largest market share of more than 35% in 2024, whereas Asia-Pacific is likely to mark the highest growth by 2032.

- By aircraft type, Narrow-body aircraft are anticipated to remain the biggest demand generator for decorative laminates, while wide-body aircraft are expected to grow at the fastest pace.

- By application type, Interior panel category is expected to be dominant, whereas seats are likely to be the fastest-growing application type during the forecast period.

- By laminate type, Film laminate holds the major share and is projected to grow at a faster pace.

- By end-user type, Aftermarket is likely to dominate the market, and OE is expected to grow at a higher rate.

Market Statistics

Have a look at the sales opportunities presented by the aircraft decorative laminates market in terms of growth and market forecast.

|

Aircraft Decorative Laminates Market Data & Statistics

|

|

|

Market Statistics

|

Value (in USD Million)

|

Market Growth (%)

|

|

Annual Market Size in 2023

|

USD 246.9 million

|

-

|

|

Annual Market Size in 2024

|

USD 283.2 million

|

YoY Growth in 2024: 14.7%

|

|

Annual Market Size in 2025

|

USD 301.5 million

|

YoY Growth in 2025: 6.5%

|

|

Annual Market Size in 2032

|

USD 416.4 million

|

CAGR 2025-2032: 4.7%

|

|

Cumulative Sales Opportunity during 2025-2032

|

USD 3029.8 million

|

-

|

|

Top 10 Countries’ Market Share in 2024

|

USD 226.4 million +

|

> 80%

|

|

Top 10 Company’s Market Share in 2024

|

USD 141.5 million to USD 198.1 million

|

50% - 70%

|

Market Dynamics

Introduction:

What is the aircraft decorative laminates market?

Aircraft decorative laminates are specialized surface materials designed to enhance the aesthetic appeal, durability, and overall functionality of aircraft interiors. These laminates are used in various parts of an aircraft's interior, such as walls, ceilings, and partitions, offering both decorative and functional benefits. The market's growth is fueled by the need for durable, fire-resistant, and aesthetically pleasing materials that comply with stringent aviation safety standards. As airlines look for ways to make passengers more comfortable and stand out from their competitors, they’re putting more effort into creating stylish, high-quality cabin interiors. The growing need for aircraft refurbishments and cabin upgrades in older fleets, along with innovations in material design such as digitally printed or eco-friendly laminates is also supporting market growth.

Segment Analysis

|

Segmentations

|

List of Sub-Segments

|

Dominant and Fastest-Growing Segments

|

|

Aircraft-Type Analysis

|

Narrow-Body Aircraft, Wide-Body Aircraft, Regional Aircraft, and General Aviation

|

Narrow-body aircraft is anticipated to remain the biggest demand generator for decorative laminates, while wide-body aircraft is expected to grow at the fastest pace.

|

|

Application-Type Analysis

|

Interior Panels, Overhead Stowage Bins, Seats, Galleys, and Other Applications

|

Interior panel category is expected to be dominant, whereas seats are likely to be the fastest-growing application type during the forecast period.

|

|

Laminate-Type Analysis

|

Film Laminates and Reinforced Laminates

|

Film laminate holds the major share and is projected to grow at a faster pace.

|

|

End-User-Type Analysis

|

OE and Aftermarket

|

Aftermarket is likely to dominate the market, and OE is expected to grow at a higher rate.

|

|

Regional Analysis

|

North America, Europe, Asia-Pacific, and The Rest of the World

|

North America is expected to remain dominant over the next few years, whereas Asia-Pacific is likely to mark the highest growth by 2032.

|

By Aircraft Type

“Narrow-body aircraft is expected to remain the largest aircraft of the market during the forecast period.”

- Based on the aircraft type, the aircraft decorative laminates market is segmented into narrow-body aircraft, wide-body aircraft, regional aircraft, and general aviation.

- Mainly driven by the growth of low-cost carriers, increasing popularity of air travel, re-entry of B737Max, and commercial launch of new aircraft programs, such as A321XLR, Irkut MC-21, and COMAC C919. The B737 Max, A350, and A320 are the biggest demand generators in narrow-body aircraft. Commercial aircraft (narrow-body and wide-body aircraft) lead due to high passenger demand and frequent maintenance needs.

- Larger fleet sizes and higher usage frequency in commercial aviation, compared to regional aircraft and general aviation, also contribute significantly to its dominance in the market.

By Application Type

“Interior panels are anticipated to remain the leading application, while aircraft seats are projected to be the fastest-growing application.”

- Based on the application type, the market is segmented into interior panels, overhead stowage bins, seats, galleys, and other applications.

- Interior panels are expected to remain the dominant application in the market during the forecast period. This dominance is primarily driven by the extensive surface areas of sidewall and ceiling panels, which require large volumes of decorative laminates. In 2024, interior panels accounted for the largest share of the market in terms of both value and volume.

- Growing demand for aesthetically pleasing and well-finished cabin interiors and increasing penetration of composite panels are other key fueling factors.

- Seats are likely to grow at the fastest rate in the coming years on account of the development of advanced, lightweight, and compact seats and the growing trend of installing premium economy-class seats and smart cabin seats.

By Laminate Type

“Film laminates are expected to remain both the largest and fastest-growing laminates of the market during the forecast period.”

- Based on the laminate type, the market is segmented into film laminates and reinforced laminates. Film laminates are expected to remain the dominant laminate type of the aircraft decorative laminates market throughout the forecast period, due to its suitability for 3D or complex-shaped cabin interior parts and superior formability, which provides the ability to be bent and applied over several complex curves. They are also more economical and cost-effective than reinforced laminates.

- Reinforced laminates are used only on 2D or flat surfaces where high strength is required. Film laminates in aircraft applications are used for interior surfaces, providing a lightweight, aesthetically pleasing, and functional solution for areas like sidewalls, bulkheads, and seating, while also enhancing passenger experience and meeting aviation safety regulations. Reinforced laminates are preferred in high-abuse areas, especially galleys and lavatories.

By End-User Type

“Aftermarket is projected to remain the dominant segment, while the OEM is expected to grow at a faster rate during the forecast period.”

- Based on the end-user type, the market is segmented into OE and aftermarket. The aftermarket is expected to be the larger segment of the aircraft decorative laminates market, whereas OE is expected to be the faster-growing end-user during the forecast period, driven by the growing interest of airlines and aircraft operators to improve passenger experience, address changing regulatory requirements, and modernize cabin interiors.

- Developments in lightweight laminates, antimicrobial coatings, and new design solutions are also accelerating demand for aftermarket upgrades. With every replacement of interior applications, new decorative laminates are required. The average replacement time of aircraft interior panels is 5 to 8 years.

Regional Insights

“North America is projected to remain the leading market in the coming years, while the Asia-Pacific region is expected to experience the fastest growth.”

- North America is expected to remain the largest market for aircraft decorative laminates during the forecast period. North America has a well-established and robust commercial aviation industry. It is home to major airlines, aircraft manufacturers, and maintenance, repair, and overhaul facilities. The continuous growth and expansion of the commercial aviation sector in North America drives the demand for decorative laminates in the aftermarket as airlines seek to upgrade their aircraft interiors.

- Asia-Pacific is expected to be the fastest-growing region in the coming eight years, due to factors such as rising disposable incomes, an expanding middle-class population, growing per capita income, and increasing preference for air travel and tourism. This surge in air travel creates a higher demand for new aircraft deliveries and retrofitting of existing aircraft, driving the need for decorative laminates in the aftermarket.

Know the high-growth countries in this report. Register Here

Competitive Landscape

The market is highly consolidated with the presence of a few global players. Most of the major players compete in some of the governing factors, including price, product offerings, and regional presence etc. The following are the key players in the aircraft decorative laminates market (arranged based on dominance):

- Schneller LLC.

- Isovolta AG

- The Boeing Company

- DuPont de Nemours, Inc.

- DUNMORE Corporation

Note: The above list does not necessarily include all the top players in the market.

Are you the leading player in this market? We would love to include your name. Please write to us at [email protected]

Recent Market JVs and Acquisitions:

A few strategic alliances, including M&As, JVs, etc., have been performed over the past few years, while major aircraft OEMs and airlines are forming long-term contracts with the major decorative laminate manufacturers to get decorative laminates uninterruptedly.

- DuPont Tedlar® collaborated with Isovolta Aviation & Transportation to introduce Airdec FW, a lightweight decorative foil for aircraft sidewalls using Tedlar. This collaboration was showcased at the 2024 Aircraft Interiors Expo (AIX) in Hamburg, Germany.

Recent Product Development:

Companies in the market are developing new products with a primary focus on creating lightweight, customizable, eco-friendly, and durable materials that integrate smart technologies while meeting strict safety standards. Some of the notable product innovations in the market include

- The Airdec FW introduced by Isovolta AG in collaboration with DuPont Tedlar, is a lightweight decorative foil for aircraft sidewalls. It is 25% lighter than traditional alternatives, such as powder coatings, while maintaining a diverse range of colors, textures, and adhesives.

- At the 2024 Aircraft Interiors Expo, DuPont™ Tedlar® showcased several innovations, including photorealistic printed films for unique and custom finishes, touch-up Tedlar® tape, metallic finishes, new colors, and more.

- Schneller LLC's AerFilm LHR® is the original low-heat-release, low-smoke, and low-toxic-gas, thin-film decorative laminate developed to cover both flat and three-dimensional panels.

Report Features

This report provides market intelligence most comprehensively. The report structure has been kept so that it offers maximum business value. It provides critical insights into market dynamics and will enable strategic decision-making for existing market players as well as those willing to enter the market.

The following are the key features of the report:

- Market structure: Overview, industry life cycle analysis, supply chain analysis.

- Market environment analysis: Growth drivers and constraints, Porter’s five forces analysis, SWOT analysis.

- Market trend and forecast analysis.

- Market segment trend and forecast.

- Competitive landscape and dynamics: Market share, Service portfolio, New Product Launches, etc.

- COVID-19 impact and its recovery curve.

- Attractive market segments and associated growth opportunities.

- Emerging trends.

- Strategic growth opportunities for the existing and new players.

- Key success factors.

|

Market Study Period

|

2019-2032

|

|

Base Year

|

2024

|

|

Forecast Period

|

2025-2032

|

|

Trend Period

|

2019-2023

|

|

Number of Tables & Figures

|

>100

|

|

Number of Segments Analysed

|

5 (Aircraft Type, Application Type, Laminate Type, End-User Type, and Region)

|

|

Number of Regions Analysed

|

4 (North America, Europe, Asia-Pacific, Rest of the World)

|

|

Countries Analysed

|

15 (The USA, Canada, Mexico, Germany, France, Italy, The UK, China, Japan, India, Brazil, Saudi Arabia, Rest of Europe, Rest of APAC, and Rest of the World)

|

|

Free Customization Offered

|

10%

|

|

After Sales Support

|

Unlimited

|

|

Report Presentation

|

Complimentary

|

|

Market Dataset

|

Complimentary

|

|

Further Deep Dive & Consulting Services

|

10% Discount

|

Market Segmentation

The report provides detailed insights into the market dynamics to enable informed business decision-making and growth strategy formulation based on the opportunities present in the market.

The aircraft decorative laminates market is segmented into the following categories:

Aircraft Decorative Laminates Market, by Aircraft Type

- Narrow-Body Aircraft

- Wide-Body Aircraft

- Regional Aircraft

- General Aviation

Aircraft Decorative Laminates Market, by Application Type

- Interior Panels

- Overhead Stowage Bins

- Seats

- Galleys

- Other Applications

Aircraft Decorative Laminates Market, by Laminate Type

- Film Laminates

- Reinforced Laminates

Aircraft Decorative Laminates Market, by End-User Type

Aircraft Decorative Laminates Market, by Region

- North America (Country Analysis: The USA, Canada, and Mexico)

- Europe (Country Analysis: Germany, France, The UK, Russia, and The Rest of Europe)

- Asia-Pacific (Country Analysis: Japan, China, India, and The Rest of the Asia-Pacific)

- Rest of the World (Country Analysis: Saudi Arabia, Brazil, and Others)

Research Methodology

- This strategic assessment report from Stratview Research provides a comprehensive analysis that reflects today’s aircraft decorative laminates market realities and future market possibilities for the forecast period.

- The report segments and analyzes the market in the most detailed manner to provide a panoramic view of the market.

- The vital data/information provided in the report can play a crucial role for market participants and investors in identifying the low-hanging fruits available in the market and formulating growth strategies to expedite their growth process.

- This report offers high-quality insights and is the outcome of a detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research’s internal database and statistical tools.

- More than 1,000 authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white papers, patents, and articles, have been leveraged to gather the data.

- We conducted more than 15 detailed primary interviews with market players across the value chain in all four regions and industry experts to obtain both qualitative and quantitative insights.

Customization Option

With this detailed report, Stratview Research offers one of the following free customization options to our respected clients:

Company Profiling

- Detailed profiling of additional market players (up to three players)

- SWOT analysis of key players (up to three players)

Competitive Benchmarking

- Benchmarking of key players on the following parameters: Service portfolio, geographical reach, regional presence, and strategic alliances.

Custom Research: Stratview Research offers custom research services across industries. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to [email protected].