Market Insights

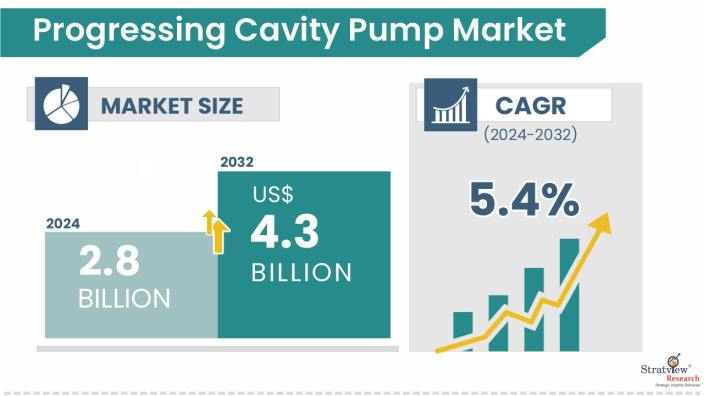

The progressing cavity pump market was valued at USD 2.8 billion in 2024 and is likely to grow at a CAGR of 5.4% during 2024-2032 to reach USD 4.3 billion in 2032.

Want to know more about the market scope? Register Here

Market Dynamics

Introduction

Progressing cavity pumps are indispensable components for precise fluid handling across a broad spectrum of industrial processes. By transforming rotational energy into steady linear flow, these pumps deliver high-efficiency performance, especially for viscous, abrasive, and shear-sensitive fluids critical to operations in wastewater treatment, oil & gas, food processing, and chemical production. The unique helical rotor-stator design enables reliable transfer with minimal pulsation and exceptional accuracy, ensuring operational stability and process optimization in demanding environments.

Market Drivers

In recent years, the need for effective water & wastewater treatment has become increasingly clear. With cities expanding rapidly and environmental standards becoming stricter, the pressure on existing water systems has grown considerably. Many urban regions are now struggling to manage rising demand, pushing both government bodies and industries to step up investments in modern and more efficient treatment facilities. The UN Water report mentions that close to $2 trillion may be needed every year by 2030 to meet global clean water and sanitation goals. That kind of investment is opening big opportunities for progressing cavity pumps. These pumps handle thick sludge quite well, help in accurate chemical dosing, and keep the flow consistent even when the conditions aren’t ideal. Because of their reliability and sturdy design, they’re turning into a must-have part of most modern treatment systems.

Market Challenges

In recent years, the need for efficient water & wastewater treatment has become more evident than ever. Rapid urban expansion, rising populations, and the growing strain on natural resources have all made it clear that current systems can no longer keep up with demand. Cities are facing mounting pressure on aging water infrastructure, while pollution concerns continue to increase. As a result, governments, municipal bodies, and industries are being pushed to take stronger action by investing in advanced treatment technologies and upgrading existing facilities. This shift is not just about compliance with stricter environmental norms but also about ensuring long-term water security and sustainability for growing urban populations.

Recent Market JVs and Acquisitions:

A considerable number of strategic alliances, including M&As, JVs, etc., have been performed over the past few years:

- Atlas Copco’s Acquisition of Wangen Pump (2022): By bringing Wangen Pump into its fold, Atlas Copco strengthened its foothold in industrial and wastewater markets. The addition of Wangen’s progressing cavity pumps expanded their product range and allowed them to serve a wider set of industries more effectively.

- SLB (Schlumberger) Acquisition of ChampionX (2024–2025): SLB’s acquisition of ChampionX helped broaden its artificial lift and pumping solutions for oil and gas clients around the world, creating a more varied portfolio and better addressing client needs.

- CIRCOR International Acquisition by KKR (2023): KKR’s takeover of CIRCOR International brought fresh resources and strategic support, giving a boost to CIRCOR’s pump business, particularly in the progressing cavity segment.

Segment Analysis

|

Segmentations

|

List of Sub-Segments

|

Segments with High-Growth Opportunity

|

|

Product-Type Analysis

|

Dosing Pump, Flanged Pumps, Hopper Pumps, Food Grade (Ehedge /3A-Certified), Food Grade (Non-Certified) Pumps, and Vertical Pumps

|

Pumps with EHEDG and 3A certifications are getting a lot of attention, especially in dairy, beverages, and processed foods. Hygiene rules are getting stricter, and people care more about food safety than ever. Because of this, manufacturers are choosing Pumps that are reliable and can keep operations clean, day in and day out.

|

|

Stage-Type Analysis

|

Single Stage (90-PSI) Pumps, Double-Stage [90-PSI] Pumps, Four Stage (360-PSI) Pumps, and Eight-Stage (720-PSI) Pumps

|

Four-Stage Pumps- popular for mid-sized industrial use. They deliver higher pressure and flow while staying efficient, making them useful in oil and gas, wastewater, and chemical plants.

|

|

Power Rating -Type Analysis

|

Up to 50 HP, 51-150 HP, and Above 150 HP

|

51–150 HP, this mid-range segment balances power and efficiency. It’s widely used in emerging markets where moderate-to-high power is needed for expanding projects.

|

|

Pump Capacity -Type Analysis

|

Up to 500 GPM, 501-1000 GPM, and Above 1000 GPM

|

501–1000 GPM used for municipal water, industrial flows, and biogas plants. These pumps ensure steady high-volume operation as systems scale up.

|

|

End User -Type Analysis

|

Oil & Gas Industry, Water & Wastewater Treatment Industry, Food & Beverages Industry, Biogas Plants, Battery Recycling Plants, Chemicals & Petrochemicals Industry, and Others

|

The water & wastewater industry is growing rapidly, fueled by stricter environmental regulations and rising infrastructure investments. Progressing cavity pumps are in demand here because they handle sludge and abrasive fluids efficiently.

|

|

Region Analysis

|

North America, Europe, Asia-Pacific, and The Rest of the World

|

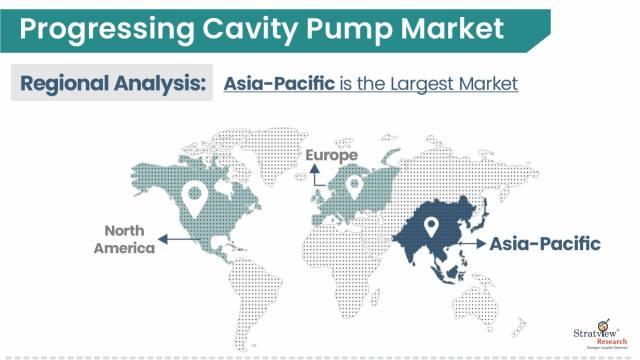

Asia-Pacific, Rapid industrialization, urbanization, and new infrastructure in China, India, and Southeast Asia are driving pump adoption in oil and gas, water treatment, and food industries.

|

By Product Type

“Food-grade pumps and specialized industrial pumps are witnessing strong demand.”

EHEDG- and 3A-certified food-grade pumps are increasingly adopted in dairy, beverage, and processed food industries due to stricter hygiene regulations and growing consumer awareness about food safety. Flanged, hopper, and vertical pumps are also seeing strong uptake in industrial applications, particularly where viscous, abrasive, or high-pressure fluids need to be handled efficiently. This diversity in product types allows manufacturers to meet the varying needs of industries ranging from food and beverages to chemicals, biogas, and wastewater treatment, ensuring smooth operations and reduced downtime.

By Stage Type

“Four-stage pumps are emerging as the fastest-growing segment.”

These pumps provide higher pressure and improved flow capacity while maintaining efficiency, making them ideal for municipal water supply, wastewater treatment, and chemical processing plants. Single- and double-stage pumps remain relevant in smaller applications, but industries are increasingly shifting toward higher-stage pumps to improve performance, energy efficiency, and operational reliability. Eight-stage pumps, although less common, are gaining interest in specialized high-pressure applications, reflecting the growing complexity of industrial pumping requirements.

By Power Rating Type

“The 51–150 HP segment is expected to lead growth.”

This mid-range power segment balances operational efficiency with sufficient pumping capacity, making it highly versatile for both industrial and municipal applications. Emerging markets are driving growth in this segment as infrastructure projects expand and moderate-to-high power pumps are needed to handle large-scale operations. Pumps in this range also support a wide variety of fluid types and industrial processes, making them an attractive choice for operators seeking a balance between energy consumption and performance.

By Capacity Type

“Pumps with capacities of 501–1000 GPM are in high demand.”

This capacity range is well-suited for municipal water supply systems, industrial process flows, and biogas plants, where consistent high-volume pumping is critical. Larger capacity pumps above 1000 GPM are increasingly being adopted in large-scale treatment plants, chemical facilities, and energy-intensive industries. The rising demand for higher-capacity pumps reflects the need for scalable, reliable solutions that can handle increasing industrial throughput without frequent maintenance or downtime.

By End User Type

“Water & wastewater treatment is the fastest-growing end-user industry.”

Tighter environmental regulations, growing urban populations, and increasing infrastructure investments are driving significant adoption of progressing cavity pumps in this industry. These pumps are especially valued for handling sludge and abrasive fluids efficiently, which are common in treatment plants. Other industries, including oil & gas, food & beverages, chemicals, and biogas, also contribute to steady demand, highlighting the versatility of progressing cavity pumps across multiple applications. The increasing complexity of industrial processes and stricter quality standards further strengthen the need for reliable pumping solutions across end-user segments.

Regional Insights

“Asia-Pacific is expected to witness the fastest growth.”

Rapid industrialization, urbanization, and large-scale infrastructure projects in China, India, and Southeast Asia are driving strong adoption of progressing cavity pumps. Rising investments in water treatment, oil & gas, and food industries are also supporting market expansion. North America and Europe remain important markets due to established industrial bases, ongoing infrastructure upgrades, and strong regulatory frameworks. Additionally, increasing focus on energy efficiency and sustainability in these regions is encouraging the adoption of advanced pump technologies, which is expected to support steady growth throughout the forecast period.

Know the high-growth countries in this report. Register Here

Key Players

The market is moderately fragmented, with over 200+ players. Most of the major players compete in some of the governing factors, including price, service offerings, and regional presence, etc. The following are the key players in the Progressing Cavity Pump market. Some of the major players provide a complete range of services, including engine and airframe.

Here is the list of the Top Players (Based on Dominance)

- NETZSCH Group

- PCM

- NOV INC.

- CIRCOR International

- SLB

- SEEPEX GmbH

- ChampionX

- Xylem

- Wilo Se

- Verder Liquids

- Varisco

Note: The above list does not necessarily include all the top players in the market.

Are you the leading player in this market? We would love to include your name. Please write to us at [email protected]

Report Features

This report provides market intelligence most comprehensively. The report structure has been kept so that it offers maximum business value. It provides critical insights into market dynamics and will enable strategic decision-making for existing market players as well as those willing to enter the market. The following are the key features of the report:

- Market structure: Overview, industry life cycle analysis, supply chain analysis.

- Market environment analysis: Growth drivers and constraints, Porter’s five forces analysis, SWOT analysis.

- Market trend and forecast analysis.

- Market segment trend and forecast.

- Competitive landscape and dynamics: Market share, Service portfolio, New Product Launches, etc.

- COVID-19 impact and its recovery curve.

- Attractive market segments and associated growth opportunities.

- Emerging trends.

- Strategic growth opportunities for the existing and new players.

- Key success factors.

Market Segmentation

This report studies the market, covering a period of 12 years of trends and forecasts. The report provides detailed insights into the market dynamics to enable informed business decision-making and growth strategy formulation based on the opportunities present in the market.

The progressing cavity pump market is segmented into the following categories.

By Product Type

- Dosing Pumps (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Flanged Pumps (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Hopper Pumps (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Food Grade (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Food Grade [Non-Certified] Pumps (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Vertical Pumps (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

By Stage Type

- Single Stage Pumps (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Double Stage Pumps (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Four Stage Pumps (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Eight Stage Pumps (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

By Power Rating Type

- Up to 50 HP (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- 51–150 HP (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Above 150 HP (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

By Pump Capacity Type

- Up to 500 GPM (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- 501–1000 GPM (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Above 1000 GPM (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

By End User Type

- Oil & Gas Industry (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Water & Wastewater Treatment Industry (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Food & Beverages Industry (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World

- Biogas Plants (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Battery Recycling Plants (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Chemicals & Petrochemicals Industry (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Others (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

By Region

- North America (Country Analysis: The USA, Canada, and Mexico)

- Europe (Country Analysis: Germany, France, The UK, Russia, and the Rest of Europe)

- Asia-Pacific (Country Analysis: Japan, China, India, and the Rest of Asia-Pacific)

- Rest of the World (Country Analysis: Brazil, Saudi Arabia, and Others)

Research Methodology

- This strategic assessment report from Stratview Research provides a comprehensive analysis that reflects today’s progressing cavity pump market realities and future market possibilities for the forecast period.

- The report segments and analyzes the market in the most detailed manner in order to provide a panoramic view of the market.

- The vital data/information provided in the report can play a crucial role for market participants and investors in identifying the low-hanging fruit available in the market and formulating growth strategies to expedite their growth process.

- This report offers high-quality insights and is the outcome of a detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research’s internal database and statistical tools.

- More than 1,000 authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white papers, patents, and articles, have been leveraged to gather the data.

- We conducted more than 15 detailed primary interviews with market players across the value chain in all four regions and industry experts to obtain both qualitative and quantitative insights.

Customization Options

With this detailed report, Stratview Research offers one of the following free customization options to our respected clients:

Company Profiling

- Detailed profiling of additional market players (up to three players)

- SWOT analysis of key players (up to three players)

Competitive Benchmarking

- Benchmarking of key players on the following parameters: Service portfolio, geographical reach, regional presence, and strategic alliances

Custom Research: Stratview Research offers custom research services across industries. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to [email protected]