Market Insights

“The Rubber Processing Chemicals market size was US$ 6 Billion in 2023 and is likely to grow at a decent CAGR of 4.5 % in the long run”.

Want to get a free sample? Register Here

Market Dynamics

Introduction

Rubber processing chemicals play a key role in making rubber products stronger and more durable. By improving the physical and mechanical properties of rubber, these additives help it stand up better to tough environmental conditions. Common chemicals used in the process include accelerators, anti-degradants, processing aids, and curing agents, each contributing to a smoother and more efficient production.

Recent Market JVs and Acquisitions:

A decent number of strategic alliances including M&As, JVs, etc. have been performed over the past few years:

- In 2023, Eastman Chemical Company entered into a joint venture with several major tire manufacturers to focus on developing sustainable rubber processing chemicals. The initiative seeks to enhance the environmental performance of tires and rubber products, driven by the rising regulatory demands for eco-friendly chemicals.

Recent Product Development:

- In 2023, Lanxess launched a range of low-volatile organic compound (VOC) rubber additives under its Rhenogran® and Vulkacit® brands, aimed at reducing harmful emissions during rubber manufacturing.

- In 2022, SI Group introduced Weston 705, an advanced rubber antioxidant designed for use in high-performance rubber products.

Market Segments' Analysis

|

Segmentations

|

List of Sub-Segments

|

Segments with High Growth Opportunity

|

|

Product-Type Analysis

|

Anti-degradants, Accelerators, Flame Retardants, Processing Aids/ Promoters, and Others

|

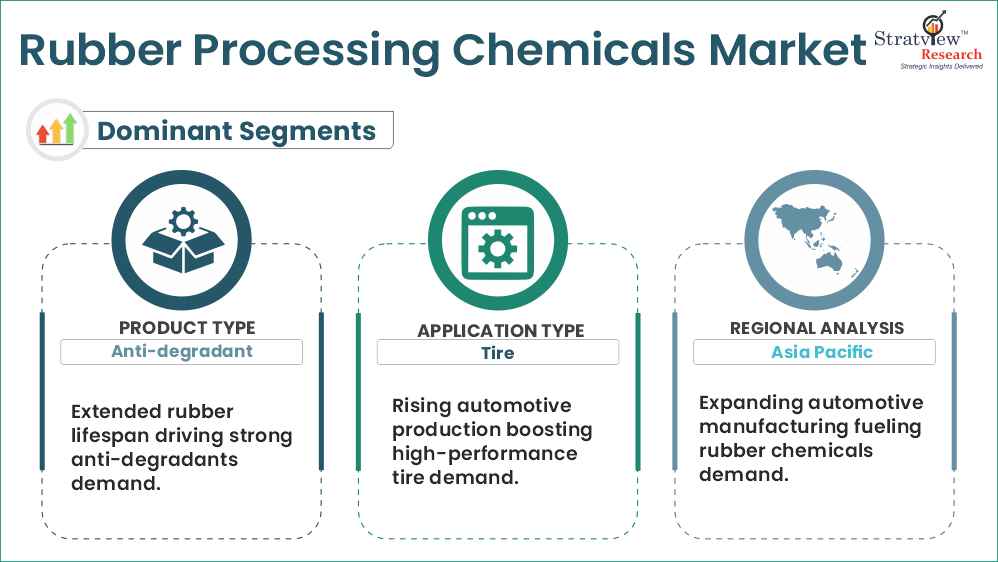

The anti-degradants segment led the market, accounting for 50% of the total share in 2023. Anti-degradants protect rubber from degradation caused by oxygen, ozone, and other environmental factors. This segment is expected to continue growing due to its critical role in enhancing the lifespan of rubber products.

|

|

Application-Type Analysis

|

Tire and Non-Tire

|

The tire application represents the largest share of the market, with the tire manufacturing industry being the biggest consumer of rubber processing chemicals. Growing automotive production, combined with an increasing emphasis on fuel-efficient and durable tires, is boosting the demand for specialized chemicals.

|

|

Region Analysis

|

North America, Europe, Asia-Pacific, and The Rest of the World

|

Asia-Pacific leads the global market, driven by high automotive production and industrial growth in countries like China, India, and Japan. The presence of large tire manufacturers and increasing demand for industrial rubber products are further boosting the market.

|

By Product Type

“The anti-degradants segment dominates the rubber processing chemical market, with a share of over 50% in 2023. These chemicals protect rubber from oxidative degradation, ozone exposure, and other environmental stressors, which extends the lifespan of rubber products.”

- Based on product type the market is segmented into Anti-degradants, Accelerators, Flame Retardants, Processing Aid/ Promoters, and Others.

- Anti-degradants are critical for enhancing the longevity and durability of rubber products by protecting them from environmental stressors such as heat, UV radiation, ozone, and oxidation.

- Tires are the largest application segment for rubber processing chemicals. Anti-degradants are vital in tire production to ensure resistance to environmental degradation and mechanical stress

By Application Type

“The tire application dominates the rubber processing chemical market, driven by the automotive industry, which is the largest consumer of rubber processing chemicals.”

- The automotive sector remains the largest consumer of rubber processing chemicals, primarily due to the demand for high-quality tires. Increased automotive production.

- Tires require additives such as anti-degradants, accelerators, and vulcanization agents to enhance their durability, resistance to wear and tear, and performance in various terrain conditions.

Want to get more details about the segmentations? Register Here

Regional Analysis

“Asia-Pacific is the largest and fastest-growing market for rubber processing chemicals, driven by strong demand from the automotive and industrial industries.”

- Asia-Pacific, especially nations such as China, India, and Japan, boasts a vast automotive manufacturing industry. Since the automotive sector is the largest consumer of rubber processing chemicals, particularly for tire production, the region's high vehicle output generates substantial demand for these chemicals.

Also, North America is a well-established market with a high demand for sustainable and high-performance rubber processing chemicals. The region's automotive and industrial industries are key drivers of this demand, particularly for durable and environmentally friendly rubber products.

Key Players

The market is highly fragmented with the presence of over 500 players across the region. Most of the major players compete in some of the governing factors including price, service offerings, regional presence, etc. The following are the key players in the Rubber Processing Chemicals market. Some of the major players are providing a complete range of rubber processing chemicals.

Here is the list of the Top Players (Based on Dominance)

- Akzo Nobel N.V.

- Arkema

- BASF SE

- Behn Meyer

- Eastman Chemical Company

- KUMHO PETROCHEMICAL

- Lanxess

- Paul & Company

- R.T. Vanderbilt Holding Company, Inc.

- Solvay

Note: The above list does not necessarily include all the top players of the market.

Are you the leading player in this market? We would love to include your name. Write to us at [email protected]

Report Features

This report provides market intelligence most comprehensively. The report structure has been kept such that it offers maximum business value. It provides critical insights into market dynamics and will enable strategic decision-making for existing market players as well as those willing to enter the market. The following are the key features of the report:

- Market structure: Overview, industry life cycle analysis, supply chain analysis.

- Market environment analysis: Growth drivers and constraints, Porter’s five forces analysis, SWOT analysis.

- Market trend and forecast analysis.

- Market segment trend and forecast.

- Competitive landscape and dynamics: Market share, Service portfolio, New Product Launches, etc.

- COVID-19 impact and its recovery curve

- Attractive market segments and associated growth opportunities.

- Emerging trends.

- Strategic growth opportunities for the existing and new players.

- Key success factors.

The global rubber processing chemical market is segmented into the following categories.

Rubber Processing Chemicals Market, by Product Type

- Anti-degradants (Regional Analysis: North America, Europe, Asia-Pacific, and RoW)

- Accelerators (Regional Analysis: North America, Europe, Asia-Pacific, and RoW)

- Flame Retardants (Regional Analysis: North America, Europe, Asia-Pacific, and RoW)

- Processing Aid/ Promoters (Regional Analysis: North America, Europe, Asia-Pacific, and RoW)

- Others (Regional Analysis: North America, Europe, Asia-Pacific, and RoW)

Rubber Processing Chemicals Market, by Application Type

- Tire (Regional Analysis: North America, Europe, Asia-Pacific, and RoW)

- Non-Tire (Regional Analysis: North America, Europe, Asia-Pacific, and RoW)

Rubber Processing Chemicals Market, by Region

- North America (Country Analysis: The USA, Canada, and Mexico)

- Europe (Country Analysis: Germany, France, The UK, Russia, and Rest of Europe)

- Asia-Pacific (Country Analysis: Japan, China, India, and Rest of Asia-Pacific)

- Rest of the World (Country Analysis: Brazil, Saudi Arabia, and Others)

Research Methodology

- This strategic assessment report from Stratview Research provides a comprehensive analysis that reflects today’s Rubber Processing Chemicals market realities and future market possibilities for the forecast period.

- The report segments and analyzes the market in the most detailed manner in order to provide a panoramic view of the market.

- The vital data/information provided in the report can play a crucial role for market participants as well as investors in the identification of the low-hanging fruits available in the market as well as to formulate growth strategies to expedite their growth process.

- This report offers high-quality insights and is the outcome of a detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research’s internal database and statistical tools.

- More than 1,000 authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white papers, patents, and articles, have been leveraged to gather the data.

- We conducted more than 15 detailed primary interviews with market players across the value chain in all four regions and industry experts to obtain both qualitative and quantitative insights.

Report Customization Options

With this detailed report, Stratview Research offers one of the following free customization options to our respectable clients:

Company Profiling

- Detailed profiling of additional market players (up to three players)

- SWOT analysis of key players (up to three players)

Competitive Benchmarking

- Benchmarking of key players on the following parameters: Service portfolio, geographical reach, regional presence, and strategic alliances

Custom Research: Stratview Research offers custom research services across sectors. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to [email protected]