Attractive Opportunities

Global Demand Analysis & Sales Opportunities in Aviation Fuel Market

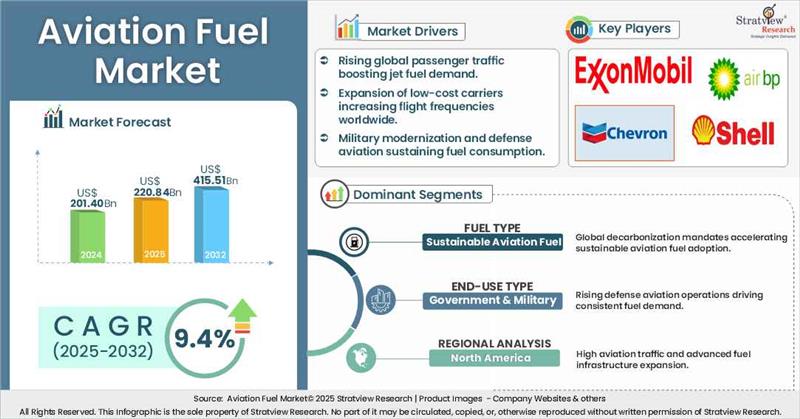

- The annual demand for aviation fuel was USD 201.40 million in 2024 and is expected to reach USD 220.84 million in 2025, up 9.6% than the value in 2024.

- During the next 8 years (forecast period of 2025-2032), the aviation fuel market is expected to grow at a CAGR of 9.4%. The annual demand will reach of USD 415.51 million in 2032.

- During 2025-2032, the aviation fuel industry is expected to generate a cumulative sales opportunity of USD 0 million.

Want to get a free sample? Register Here

High-Growth Market Segments:

- North America is expected to grow at the fastest CAGR during the forecast period.

- By Fuel Processing Technology type, Biofuel Processing Technologies segment is expected to be the fastest-growing during the forecast period.

- By Aircraft type, Fixed Wing is expected to showcase significant growth during the forecast period.

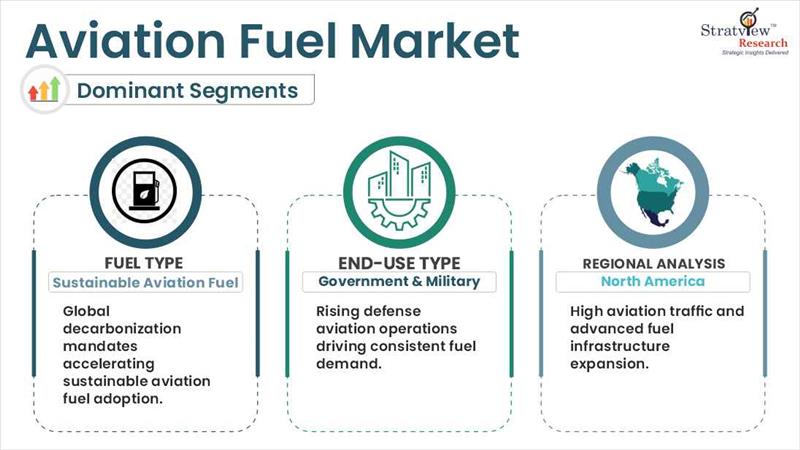

- By Fuel type, Sustainable Aviation Fuel segment is anticipated to grow at the highest CAGR during the forecast period.

- By End-Use type, Government & Military segment is projected to grow at the highest CAGR during the forecast period.

Market Statistics

Have a look at the sales opportunities presented by the aviation fuel market in terms of growth and market forecast.

|

Aviation Fuel Market Data & Statistics

|

|

|

Market Statistics

|

Value (in USD Million)

|

Market Growth (%)

|

|

Annual Market Size in 2023

|

USD 183.93 million

|

-

|

|

Annual Market Size in 2024

|

USD 201.40 million

|

YoY Growth in 2024: 9.2%

|

|

Annual Market Size in 2025

|

USD 220.84 million

|

YoY Growth in 2025: 9.6%

|

|

Annual Market Size in 2032

|

USD 415.51 million

|

CAGR 2025-2032: 9.4%

|

|

Cumulative Sales Opportunity during 2025-2032

|

USD 2479.44 million

|

-

|

|

Top 10 Countries’ Market Share in 2024

|

USD 160 +

|

> 80%

|

|

Top 10 Company’s Market Share in 2024

|

USD 100 million to USD 140 million

|

50% - 70%

|

Market Dynamics

Introduction:

What is an aviation fuel?

Aviation fuel is a specialized type of petroleum-based or alternative fuel used to power aircraft. It is designed to meet the strict requirements of aviation engines, ensuring optimal performance, safety, and efficiency. Aviation fuels are used in commercial jets, military aircraft, helicopters, and unmanned aerial vehicles across global air transportation networks.

Market Drivers:

Surge in Global Air Passenger and Cargo Traffic

- A key growth driver for the aviation fuel market is the surge in global air passenger and cargo traffic. According to IATA, passenger numbers are expected to rise by over 4 billion by 2043, driven by tourism, better air connectivity, and affordable fares. Simultaneously, e-commerce growth is boosting demand for air freight, with major industries relying on fast logistics. This increasing traffic is accelerating aviation fuel consumption, prompting investments in fuel infrastructure and sustainable alternatives to meet rising operational needs.

Expansion of Military and Defense Aviation Activities

- Rising geopolitical tensions and increased global defense budgets are fueling military aviation growth, directly driving aviation fuel demand. Countries are actively upgrading their fleets with advanced fighter jets, transport aircraft, and surveillance systems, all reliant on high-performance fuels. Frequent drills, border patrols, and international missions further accelerate fuel consumption, ensuring consistent demand across defense operations for both conventional and specialized aviation fuels.

Market Challenges:

Threat from Alternative Energy Sources

- The growing push for decarbonization is accelerating investments in electric and hydrogen-powered aircraft, especially for short-haul and regional travel. Governments and private players are funding R&D in alternative propulsion systems that could reduce dependency on conventional aviation fuels. Although these technologies are in early stages, their long-term potential poses a structural threat to traditional aviation fuel demand.

Market Opportunities:

Emergence of New Fuel Production Techniques

- Advanced fuel production technologies like Power-to-Liquid (PtL), Alcohol-to-Jet (AtJ), and Gas-to-Liquid (GtL) are gaining traction as scalable alternatives for sustainable aviation fuels. These techniques enable fuel generation from CO2, biomass, or waste streams, increasing feedstock flexibility and production efficiency. With policy support, such as the U.S. Inflation Reduction Act and the EU’s ReFuelEU Aviation initiative, investments in novel SAF technologies are accelerating, opening up lucrative opportunities for tech-driven fuel producers.

Segment Analysis

|

Segmentations

|

List of Sub-Segments

|

Segments with High-Growth Opportunity

|

|

Fuel Processing Technology Analysis

|

Conventional Processing Technologies, Synthetic Fuel Processing Technologies, Biofuel Processing Technologies

|

Biofuel Processing Technologies segment is expected to grow at the highest CAGR during the forecast period.

|

|

Aircraft Analysis

|

Fixed Wing, Rotary Wing, Unmanned Aerial Vehicle

|

Fixed Wing segment accounted for the largest market share in the aviation fuel market.

|

|

Fuel Analysis

|

Conventional Aviation Fuel, Sustainable Aviation Fuel

|

Sustainable Aviation Fuel segment is anticipated to grow at the highest CAGR during the forecast period.

|

|

End-Use Type

|

Airline, Government & Military, Non-Scheduled Operator

|

Government & Military segment is projected to grow at the highest CAGR during the forecast period.

|

|

Regional Analysis

|

North America, Europe, Asia-Pacific, and The Rest of the World

|

North America is expected to witness the fastest growth during the forecast period.

|

By Fuel Type

“Sustainable Aviation Fuel segment is anticipated to grow at the highest CAGR during the forecast period.”

- The growing focus on reducing carbon emissions, along with airline commitments and supportive regulations such as ICAO’s CORSIA and the EU’s Fit for 55, is accelerating the adoption of SAF.

- Government incentives, tax credits, and subsidies across the U.S. and Europe are boosting production capacities, while corporations invest heavily in SAF to meet sustainability goals.

- Technological advancements in feedstock processing and infrastructure development are helping reduce production costs and build a resilient SAF supply chain, reinforcing its long-term growth potential.

By End-Use Type

“Government & Military segment is projected to grow at the highest CAGR during the forecast period.”

- Increasing reliance on aviation fuel to support defense operations, surveillance missions, disaster response, and law enforcement is fueling growth in this segment.

- Governments worldwide maintain vast fleets of fighter jets, helicopters, and transport aircraft that require continuous fuel availability for mission readiness.

- Ongoing investments in modern aviation technologies and the adoption of sustainable fuel alternatives are reinforcing the segment’s long-term expansion and leadership in the aviation fuel market.

Want to get more details about the segmentations? Register Here

Regional Analysis

“North America is expected to witness the fastest growth during the forecast period.”

- The region benefits from a mature aviation industry, high air traffic volumes, and extensive networks of commercial, cargo, and military flights.

- Strong infrastructure, including advanced refineries, fuel storage, and distribution systems, supports a consistent aviation fuel supply across airports and military bases.

- Growth in low-cost carriers, large-scale military aviation operations, and innovations in refining technologies further bolster North America's market leadership.

Competitive Landscape

Most of the major players compete in some of the factors, including price, service offerings, regional presence, etc. The following are the key players in the aviation fuel market -

Note: The above list does not necessarily include all the top players in the market.

Are you a leading player in this market? We would love to include your name. Please write to us at [email protected]

Recent Developments/Mergers & Acquisitions:

- In September 2024, TotalEnergies (France) signed a 10-year agreement with Air France-KLM (France) to supply up to 1.5 million tons of Sustainable Aviation Fuel (SAF) to the group’s airlines by 2035.

- In July 2024, Shell (UK) and Amex GBT (US), a leading provider of B2B travel and expense solutions, extended their partnership to further advance the Avelia SAF Program, aiming to accelerate SAF adoption in aviation.

- In August 2023, Chevron Corporation (US) and Cummins Inc. (US) expanded their previous collaboration by signing a Memorandum of Understanding (MoU) focused on hydrogen, renewable natural gas, and other low-carbon liquid fuels, such as renewable diesel, biodiesel, and renewable gasoline blends, supporting their broader commercial and industrial deployment across North America.

Report Features

This report provides market intelligence most comprehensively. The report structure has been kept so that it offers maximum business value. It provides critical insights into market dynamics and will enable strategic decision-making for existing market players as well as those willing to enter the market.

The following are the key features of the report:

- Market structure: Overview, industry life cycle analysis, supply chain analysis.

- Market environment analysis: Growth drivers and constraints, Porter’s five forces analysis, SWOT analysis.

- Market trend and forecast analysis.

- Market segment trend and forecast.

- Competitive landscape and dynamics: Market share, Service portfolio, New Product Launches, etc.

- COVID-19 impact and its recovery curve.

- Attractive market segments and associated growth opportunities.

- Emerging trends.

- Strategic growth opportunities for the existing and new players.

- Key success factors.

|

Market Study Period

|

2019-2032

|

|

Base Year

|

2024

|

|

Forecast Period

|

2025-2032

|

|

Trend Period

|

2019-2023

|

|

Number of Tables & Figures

|

>100

|

|

Number of Segments Analysed

|

5 (Fuel Processing Technology Type, Aircraft Type, Fuel Type, End-Use Type, and Region)

|

|

Number of Regions Analysed

|

4 (North America, Europe, Asia-Pacific, Rest of the World)

|

|

Countries Analysed

|

15 (The USA, Canada, Mexico, Germany, France, Italy, The UK, China, Japan, India, Brazil, Saudi Arabia, Rest of Europe, Rest of APAC, and Rest of the World)

|

|

Free Customization Offered

|

10%

|

|

After Sales Support

|

Unlimited

|

|

Report Presentation

|

Complimentary

|

|

Market Dataset

|

Complimentary

|

|

Further Deep Dive & Consulting Services

|

10% Discount

|

Market Segmentation

This report studies the market, covering a period of 15 years of trend and forecast. The report provides detailed insights into the market dynamics to enable informed business decision-making and growth strategy formulation based on the opportunities present in the market.

The global aviation fuel market is segmented into the following categories.

Global Aviation Fuel Market, by Fuel Processing Technology Type

- Conventional Processing Technologies

- Synthetic Fuel Processing Technologies

- Biofuel Processing Technologies

Global Aviation Fuel Market, by Aircraft Type

- Fixed Wing

- Rotary Wing

- Unmanned Aerial Vehicle

Global Aviation Fuel Market, by Fuel Type

- Conventional Aviation Fuel

- Sustainable Aviation Fuel

Global Aviation Fuel Market, by End-Use Type

- Airline

- Government & Military

- Non-Scheduled Operator

Global Aviation Fuel Market, by Region

- North America (Country Analysis: The USA, Canada, and Mexico)

- Europe (Country Analysis: Germany, France, Italy, The UK, and Rest of Europe)

- Asia-Pacific (Country Analysis: Japan, China, India, and Rest of Asia-Pacific)

- Rest of the World (Country Analysis: Brazil, Saudi Arabia, and Others)

Research Methodology

- This strategic assessment report from Stratview Research provides a comprehensive analysis that reflects today’s global aviation fuel market realities and future market possibilities for the forecast period.

- The report segments and analyzes the market in the most detailed manner to provide a panoramic view of the market.

- The vital data/information provided in the report can play a crucial role for market participants and investors in identifying the low-hanging fruits available in the market and formulating growth strategies to expedite their growth process.

- This report offers high-quality insights and is the outcome of a detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research’s internal database and statistical tools.

- More than 1,000 authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white papers, patents, and articles, have been leveraged to gather the data.

- We conducted more than 201.4 detailed primary interviews with market players across the value chain in all four regions and industry experts to obtain both qualitative and quantitative insights.

Customization Options

With this detailed report, Stratview Research offers one of the following free customization options to our respected clients:

Company Profiling

- Detailed profiling of additional market players (up to three players)

- SWOT analysis of key players (up to three players)

Competitive Benchmarking

- Benchmarking of key players on the following parameters: Service portfolio, geographical reach, regional presence, and strategic alliances

Custom Research: Stratview Research offers custom research services across industries. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to [email protected]