Attractive Opportunities

Global Demand Analysis & Sales Opportunities in Recycled Polyethylene Terephthalate Market

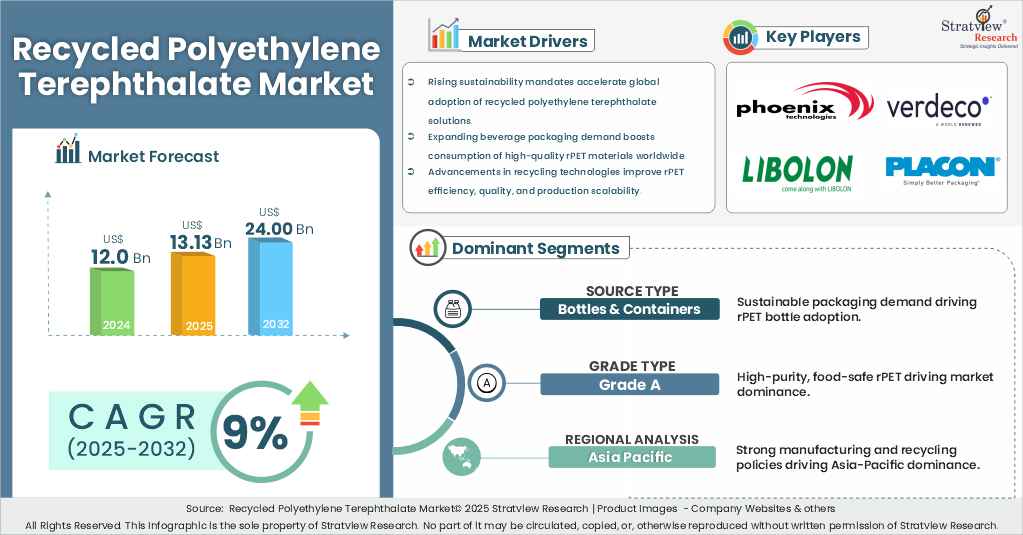

- The annual demand for recycled polyethylene terephthalates was USD 12 billion in 2024 and is expected to reach USD 13.13 billion in 2025, up 9.4% than the value in 2024.

- During the next 8 years (forecast period of 2025-2032), the recycled polyethylene terephthalate market is expected to grow at a CAGR of 9%. The annual demand will reach of USD 24.00 billion in 2032, which is almost 2 times of the demand in 2025.

- During 2025-2032, the recycled polyethylene terephthalate industry is expected to generate a cumulative sales opportunity of USD 145.24 billion which is almost 2.5 times the opportunities during 2019-2024.

Want to get a free sample? Register Here

High-Growth Market Segments:

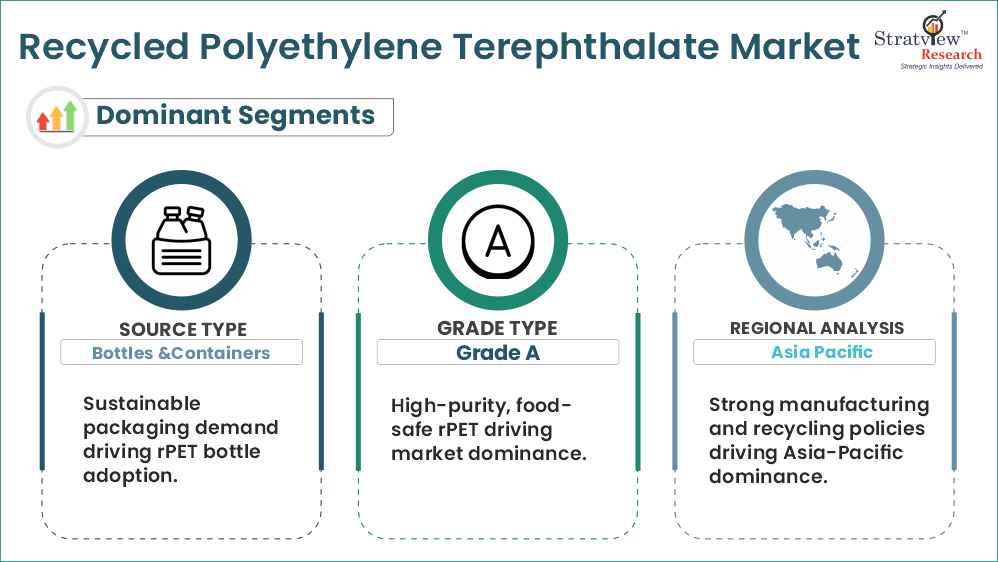

- Asia-Pacific generated the highest demand with the largest market share in 2024, with China & India as the key growth drivers in the region.

- By Source type, Bottles & Containers System segment is projected to be the dominant segment during the forecast period.

- By Grade type, Grade A segment is expected to have the largest market share during the forecast period

- By Form type, rPET Flakes segment is anticipated to be the fastest-growing segment of this market during the forecast period.

- By Product type, Colored rPET segment is expected to have the largest market share during the forecast period.

- By End-Use type, Fiber segment accounted for the largest revenue share in the market.

Market Statistics

Have a look at the sales opportunities presented by the recycled polyethylene terephthalate market in terms of growth and market forecast.

|

Recycled Polyethylene Terephthalate Market Data & Statistics

|

|

|

Market Statistics

|

Value (in USD Billion)

|

Market Growth (%)

|

|

Annual Market Size in 2023

|

USD 10.98 billion

|

-

|

|

Annual Market Size in 2024

|

USD 12.00 billion

|

YoY Growth in 2024: 9.3%

|

|

Annual Market Size in 2025

|

USD 13.13 billion

|

YoY Growth in 2025: 9.4%

|

|

Annual Market Size in 2032

|

USD 24.00 billion

|

CAGR 2025-2032: 9.0%

|

|

Cumulative Sales Opportunity during 2025-2032

|

USD 145.24 billion

|

-

|

|

Top 10 Countries’ Market Share in 2024

|

USD 9.6 billion +

|

> 80%

|

|

Top 10 Company’s Market Share in 2024

|

USD 6.0 to USD 8.4

|

50% - 70%

|

Market Dynamics

Introduction:

What is recycled polyethylene terephthalate?

Recycled Polyethylene Terephthalate (rPET) is a type of plastic material obtained by recycling used PET products, primarily bottles and containers. It involves collecting, cleaning, and reprocessing post-consumer or post-industrial PET waste into new, reusable raw material. rPET is widely used in textiles, packaging, and food-grade containers due to its durability, transparency, and lower environmental impact compared to virgin PET. It plays a key role in promoting the circular economy and reducing plastic pollution.

Market Drivers:

Rising Adoption of rPET in Sustainable Packaging Solutions

- One of the key growth drivers of the recycled polyethylene terephthalate (rPET) market is the rising adoption of sustainable packaging across various industries. As environmental concerns surrounding plastic waste intensify, brands in the food & beverage, cosmetics, and personal care sectors are increasingly transitioning toward rPET-based packaging to reduce their carbon footprint and align with global sustainability targets.

- Regulatory pressures, such as mandates on minimum recycled content in plastic packaging by the European Union and similar policies worldwide, are further accelerating the demand for high-quality rPET.

Technological Advancements in Recycling Processes

- Rapid advancements in recycling technologies, particularly in chemical recycling and AI-powered sorting systems, are acting as a major growth driver for the recycled polyethylene terephthalate (rPET) market.

- These innovations are significantly improving the efficiency, scalability, and output quality of recycling processes, making it possible to recover high-purity, food-grade rPET from previously non-recyclable or contaminated PET waste.

- As a result, manufacturers now have access to a more reliable and consistent supply of premium-grade recycled material, expanding rPET’s usability across diverse applications, including food packaging, textiles, and automotive components.

Market Challenges:

High Processing Costs

- The production of high-quality or food-grade recycled polyethylene terephthalate (rPET) involves capital-intensive technologies such as chemical depolymerization and advanced purification systems.

- These complex processes significantly elevate production costs, making rPET less competitive compared to virgin PET, particularly in price-sensitive markets.

- This cost disparity remains a key restraint, limiting broader adoption of rPET despite increasing emphasis on sustainable material use across industries.

Market Opportunities:

Rising Demand for Food-Grade rPET in Packaging Applications

- The growing shift toward sustainable packaging, driven by both regulatory mandates and consumer preference, is creating substantial opportunities for food-grade rPET.

- As brands across sectors like beverages, personal care, and household goods commit to integrating recycled materials, demand for high-quality, safe rPET is accelerating.

- This trend is opening up new revenue streams for recyclers and manufacturers equipped with advanced purification technologies, especially in developed markets with strict packaging standards.

Segment Analysis

|

Segmentations

|

List of Sub-Segments

|

Segments with High-Growth Opportunity

|

|

Source Analysis

|

Bottles & Containers, Films & Sheets

|

Bottles & Containers segment is projected to be the dominant segment during the forecast period.

|

|

Grade Analysis

|

Grade A, Grade B

|

Grade A segment is projected to be the dominant segment during the forecast period.

|

|

Form Analysis

|

rPET Flakes, rPET Chips

|

rPET Flakes segment is anticipated to be the fastest-growing segment of this market during the forecast period.

|

|

Product Analysis

|

Clear, Colored

|

Colored rPET segment is expected to have the largest market share during the forecast period.

|

|

End-Use Analysis

|

Fibers, Films & Sheets, Strapping, Food & Beverage Containers and Bottles, Non-Food Containers and Bottles

|

Fiber segment accounted for the largest revenue share in the market.

|

|

Regional Analysis

|

North America, Europe, Asia-Pacific, and The Rest of the World

|

Asia-pacific dominates the global market.

|

By Source Type

“Bottles & Containers segment is projected to be the dominant segment during the forecast period.”

- Bottles and containers are the most common sources of PET waste, offering a steady and abundant feedstock for high-quality rPET production.

- The food and beverage industry's growing focus on sustainable packaging is fueling demand for recycled PET bottles, especially in carbonated drinks and water segments.

- Global regulations mandating recycled content in packaging are compelling manufacturers to increasingly adopt rPET bottles and containers, reinforcing segment dominance.

By Grade Type

“Grade A segment is projected to be the dominant segment during the forecast period.”

- Grade A rPET offers high purity and meets stringent regulatory standards, making it ideal for food-grade packaging and high-performance applications.

- Growing demand from major beverage and consumer goods companies is driving large-scale adoption of Grade A rPET to meet circular economy goals.

- Technological improvements in decontamination and purification processes have made it easier to produce food-safe recycled PET, boosting its market dominance.

Want to get more details about the segmentations? Register Here

Regional Analysis

“Asia-Pacific dominates the global market.”

- Asia Pacific benefits from strong manufacturing capabilities, abundant availability of plastic waste, and a large consumer base driving demand for recycled PET.

- Government-led initiatives and policies promoting recycling infrastructure in countries like China, India, and Japan are accelerating market expansion.

- Low labor costs and increasing foreign investments in recycling plants across the region support large-scale, cost-effective rPET production, reinforcing its global leadership.

Competitive Landscape

Most of the major players compete in some of the factors, including price, service offerings, regional presence, etc. The following are the key players in the recycled polyethylene terephthalate market -

- Placon

- Clear Path Recycling LLC

- Verdeco Recycling, Inc.

- Indorama Ventures Public Ltd.

- Zhejiang Anshun Pettechs Fibre Co., Ltd.

- PolyQuest

- Evergreen Plastics, Inc.

- Phoenix Technologies

- Libolon

- Biffa

Note: The above list does not necessarily include all the top players in the market.

Are you a leading player in this market? We would love to include your name. Please write to us at [email protected]

Recent Developments/Mergers & Acquisitions:

- In October 2023, Axens, IFPEN, and JEPLAN announced the commissioning of their innovative Rewind PET recycling unit. The facility, a modified and expanded version of JEPLAN’s Kitakyushu Hibikinada Pilot demonstration plant in Japan, has a capacity of 1,000 tons per year. Its development was supported by the French Environment and Energy Management Agency (ADEME), marking a significant step toward advanced PET recycling.

- In September 2023, Indorama Ventures increased the PET recycling capacity of its Juiz de Fora facility in Minas Gerais, Brazil, from 9,000 tons to 25,000 tons per year. This expansion significantly enhances the company’s ability to meet growing demand for recycled PET in Latin America.

- In March 2023, SK Chemicals signed a USD 98.4 million agreement to acquire a chemical recycling and PET production facility from Shuye Environmental Technology. The plant, which features depolymerization technology, enables the production of 50,000 tons per year of chemically recycled PET (rPET). The process breaks down post-consumer plastic waste into rBHET (recycled bis-hydroxyethyl terephthalate), a key monomer used in rPET manufacturing.

Report Features

This report provides market intelligence most comprehensively. The report structure has been kept so that it offers maximum business value. It provides critical insights into market dynamics and will enable strategic decision-making for existing market players as well as those willing to enter the market.

The following are the key features of the report:

- Market structure: Overview, industry life cycle analysis, supply chain analysis.

- Market environment analysis: Growth drivers and constraints, Porter’s five forces analysis, SWOT analysis.

- Market trend and forecast analysis.

- Market segment trend and forecast.

- Competitive landscape and dynamics: Market share, Service portfolio, New Product Launches, etc.

- COVID-19 impact and its recovery curve.

- Attractive market segments and associated growth opportunities.

- Emerging trends.

- Strategic growth opportunities for the existing and new players.

- Key success factors.

|

Market Study Period

|

2018-2032

|

|

Base Year

|

2024

|

|

Forecast Period

|

2025-2032

|

|

Trend Period

|

2018-2023

|

|

Number of Tables & Figures

|

>100

|

|

Number of Segments Analysed

|

6 (Source Type, Grade Type, Form Type, Product Type, End-Use Type, and Region)

|

|

Number of Regions Analysed

|

4 (North America, Europe, Asia-Pacific, Rest of the World)

|

|

Countries Analysed

|

15 (The USA, Canada, Mexico, Germany, France, Italy, The UK, China, Japan, India, Brazil, Saudi Arabia, Rest of Europe, Rest of APAC, and Rest of the World)

|

|

Free Customization Offered

|

10%

|

|

After Sales Support

|

Unlimited

|

|

Report Presentation

|

Complimentary

|

|

Market Dataset

|

Complimentary

|

|

Further Deep Dive & Consulting Services

|

10% Discount

|

Market Segmentation

This report studies the market, covering a period of 15 years of trend and forecast. The report provides detailed insights into the market dynamics to enable informed business decision-making and growth strategy formulation based on the opportunities present in the market.

The Recycled Polyethylene Terephthalate market is segmented into the following categories.

Recycled Polyethylene Terephthalate Market, by Source Type

- Bottles & Containers

- Films & Sheets

Recycled Polyethylene Terephthalate Market, by Grade Type

Recycled Polyethylene Terephthalate Market, by Form Type

Recycled Polyethylene Terephthalate Market, by Product Type

Recycled Polyethylene Terephthalate Market, by End-Use Type

- Fiber

- Sheet & Film

- Strapping

- Food & Beverage Containers & Bottles

- Non-food Containers & Bottles

Recycled Polyethylene Terephthalate Market, by Region

- North America (Country Analysis: The USA, Canada, and Mexico)

- Europe (Country Analysis: Germany, France, Italy, The UK, and Rest of Europe)

- Asia-Pacific (Country Analysis: Japan, China, India, and Rest of Asia-Pacific)

- Rest of the World (Country Analysis: Brazil, Saudi Arabia, and Others)

Research Methodology

- This strategic assessment report from Stratview Research provides a comprehensive analysis that reflects today’s Recycled Polyethylene Terephthalate market realities and future market possibilities for the forecast period.

- The report segments and analyzes the market in the most detailed manner to provide a panoramic view of the market.

- The vital data/information provided in the report can play a crucial role for market participants and investors in identifying the low-hanging fruits available in the market and formulating growth strategies to expedite their growth process.

- This report offers high-quality insights and is the outcome of a detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research’s internal database and statistical tools.

- More than 1,000 authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white papers, patents, and articles, have been leveraged to gather the data.

- We conducted more than 15 detailed primary interviews with market players across the value chain in all four regions and industry experts to obtain both qualitative and quantitative insights.

Customization Options

With this detailed report, Stratview Research offers one of the following free customization options to our respected clients:

Company Profiling

- Detailed profiling of additional market players (up to three players)

- SWOT analysis of key players (up to three players)

Competitive Benchmarking

- Benchmarking of key players on the following parameters: Service portfolio, geographical reach, regional presence, and strategic alliances

Custom Research: Stratview Research offers custom research services across industries. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to [email protected]