Market Insights

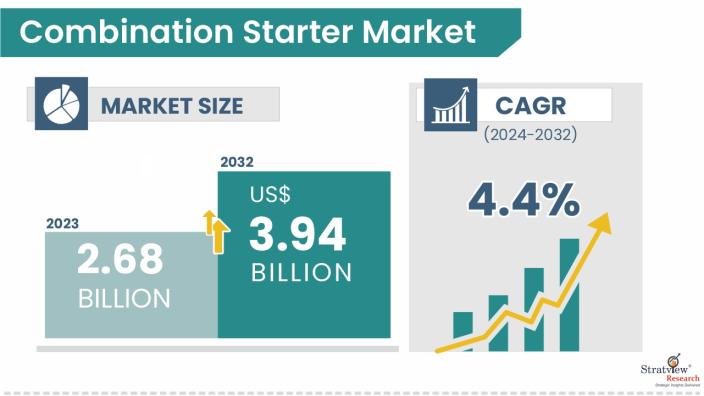

“The combination starter market value was USD 2.68 billion in 2023 and is likely to grow at a steady CAGR of 4.4% during 2024-2032 to reach USD 3.94 billion in 2032.”

Want to know more about the market scope? Register Here

Market Dynamics

Introduction

The combination starter market plays a vital role in industrial automation by integrating motor starters, overload protection, and disconnects into a single unit. These systems enhance safety, simplify installation, and ensure efficient motor control across applications in oil & gas, water treatment, mining, infrastructure, and more.

Driven by the push for energy efficiency, digitalization, and smart manufacturing, the market is evolving toward intelligent starters that feature real-time monitoring and IoT connectivity. Growth is particularly strong in emerging regions, including the Asia-Pacific and the Middle East & Africa.

Recent Market JVs and Acquisitions:

A considerable number of strategic alliances, including M&As, JVs, etc., have been performed over the past few years:

- In January 2024, ABB and Real Tech entered into a definitive agreement for a strategic acquisition. ABB aimed to integrate Real Tech's optical sensor technology into its water monitoring solutions, marking a long-term commitment to expanding ABB’s digital infrastructure and AI-driven product portfolio. Later in the same month, ABB also acquired Meshmind, an R&D software firm, to bolster its AI and software capabilities, part of its growing focus on digitalization and smart automation.

- In October 2024, Siemens signed an agreement to acquire Altair Engineering Inc. in a $10 billion deal. Altair, known for simulation and analysis software, will help Siemens expand its AI-powered industrial software leadership.

- In March 2023, Regal Rexnord completed a $5 billion acquisition of Altra Industrial Motion Corp., famed for its motion control and clutches/brakes businesses. This large-scale deal realigned market dynamics in mechanical and motor control solutions.

Recent Product Development:

Recent product developments in the combination starter market focus on smart integration, energy efficiency, compact designs, and enhanced motor protection. In April 2024, Schneider Electric launched the TeSys U modular starter, while Siemens introduced the SIMATIC ET 200SP e-starter with fast semiconductor protection and IoT features in November. ABB released its PSTX soft starter in January 2024 for high-inertia loads with built-in thermal monitoring. Schneider also expanded its Altivar ATS430/490 series in June 2025, targeting energy-efficient applications. In March 2025, Rockwell Automation launched the M100 starter, combining safety, monitoring, and dual-mode operation. Other notable products include Rockwell’s SMC-50, Eaton’s DS7, Schneider’s Altistart 48, and Siemens’ 3RW5, each offering adaptive control and IoT-ready capabilities. These innovations reflect the market’s shift toward smarter, safer, and more efficient motor starters.

- April 2024 – Schneider Electric launched the TeSys U modular combination starter series for flexible industrial applications.

- November 2024 – Siemens introduced the SIMATIC ET 200SP e-starter, a fully electronic starter with ultra-fast semiconductor-based short-circuit protection and IoT integration.

- January 2024 – ABB released the PSTX soft starter, designed for high-inertia loads like compressors and crushers, with built-in real-time temperature monitoring.

Segment Analysis

|

Segmentations

|

List of Sub-Segments

|

Segments with High-Growth Opportunity

|

|

Type Analysis

|

Reversing, Non-Reversing

|

Reversing starters are expected to be a major demand driver due to their increasing use in automated industrial systems, conveyor belts, and HVAC applications, where frequent direction changes are required.

|

|

Rated Power-Type Analysis

|

Up to 7.5 kW, Between 7.5kW and 75kW, Above 75kW

|

The 7.5–75 kW rated power segment is likely to witness the fastest growth as it caters to a wide range of medium-sized industrial applications, especially in manufacturing and infrastructure development.

|

|

Application-Type Analysis

|

Pumps, Fans, Compressors, Conveyors, Others

|

Pumps and compressors are anticipated to remain key applications, driven by rising demand in the oil & gas and water treatment sectors, where efficient motor control and protection are critical.

|

|

Industry-Type Analysis

|

Oil & Gas, Water & Wastewater, Infrastructure, Metals and Mining, Food and Beverages, Others

|

Water & wastewater and infrastructure industries are projected to grow rapidly due to global investments in smart cities, sustainable utility solutions, and urban development projects.

|

|

Region Analysis

|

North America, Europe, Asia-Pacific, and The Rest of the World

|

Asia-Pacific is expected to dominate the market in the coming years, powered by rapid industrialization, increased automation adoption, and large-scale investments in sectors like manufacturing, construction, and energy.

|

By Type

“Reversing starters are expected to grow fastest, while Non-Reversing starters remain widely used across basic motor applications.”

The market is segmented into Non-Reversing and Reversing types. Non-reversing starters continue to dominate due to their simplicity and cost-effectiveness, especially in legacy industrial setups. However, reversing starters are witnessing faster growth driven by increasing automation, material handling systems, and conveyor-based applications, where motor direction needs to switch frequently for efficiency.

By Rated Power Type

“The 7.5–75 kW segment is expected to grow fastest, while above 75 kW remains key for heavy-duty operations.”

Combination starters are segmented by rated power into Up to 7.5 kW, 7.5–75 kW, and Above 75 kW. The 7.5–75 kW range is gaining rapid adoption due to its relevance in mid-scale industrial machinery, water treatment pumps, HVAC systems, and commercial applications. On the other hand, the Above 75 kW segment remains crucial for large-scale operations in mining, oil & gas, and energy sectors requiring robust motor control.

By Application Type

“Pumps are expected to remain dominant, while Compressors will be the fastest-growing application.”

Applications are divided into Pumps, Fans, Compressors, Conveyors, and Others. Pumps dominate due to their widespread use in water supply, treatment, oil circulation, and agriculture. However, Compressors are projected to grow fastest owing to their increased deployment in industrial automation, HVAC systems, and refrigerated storage sectors, where efficient motor starting is critical for energy savings.

By Industry Type

“Water & Wastewater remains dominant, while Infrastructure is expected to grow the fastest.”

The industry segmentation includes Oil & Gas, Water & Wastewater, Infrastructure, Metals & Mining, Food & Beverages, and Others. Water & Wastewater leads due to the ongoing modernization of municipal water systems, regulatory compliance, and the critical need for uptime. Meanwhile, Infrastructure is the fastest-growing segment, propelled by new residential and commercial construction projects globally requiring reliable motor control for elevators, HVAC, and utilities.

Regional Insights

“Asia-Pacific is expected to be the fastest-growing region, while North America maintains a strong market presence.”

Regions include North America, Europe, Asia-Pacific, South America, and the Middle East & Africa. North America has a strong industrial base and regulatory standards that sustain stable demand. However, Asia-Pacific is set to grow at the fastest pace due to expanding industrial activity, urban infrastructure projects, and rising automation in countries like China, India, and Southeast Asia.

Know the high-growth countries in this report. Register Here

Key Players

The combination starter market is notably fragmented, with over 500 active participants operating across various regions. Key manufacturers differentiate themselves through factors such as competitive pricing, diversified product portfolios, technological advancements, and regional market penetration. While some industry leaders deliver end-to-end motor control solutions across multiple sectors, others focus on niche applications or specific industrial domains. The players listed below represent the most influential entities shaping the current competitive dynamics of the combination starter market.

Here is the list of the Top Players (Based on Dominance)

- Siemens AG

- Rockwell Automation

- Mitsubishi Electric

- Schneider Electric

- ABB Ltd.

- Eaton Corporation

- WEG S.A.

- Danfoss

- General Electric(GE)

Note: The above list does not necessarily include all the top players in the market.

Are you the leading player in this market? We would love to include your name. Please write to us at [email protected]

Report Features

This report provides market intelligence most comprehensively. The report structure has been kept so that it offers maximum business value. It provides critical insights into market dynamics and will enable strategic decision-making for existing market players as well as those willing to enter the market. The following are the key features of the report:

- Market structure: Overview, industry life cycle analysis, supply chain analysis.

- Market environment analysis: Growth drivers and constraints, Porter’s five forces analysis, SWOT analysis.

- Market trend and forecast analysis.

- Market segment trend and forecast.

- Competitive landscape and dynamics: Market share, Service portfolio, New Product Launches, etc.

- COVID-19 impact and its recovery curve.

- Attractive market segments and associated growth opportunities.

- Emerging trends.

- Strategic growth opportunities for the existing and new players.

- Key success factors.

Market Segmentation

This report studies the market, covering a period of 12 years of trends and forecasts. The report provides detailed insights into the market dynamics to enable informed business decision-making and growth strategy formulation based on the opportunities present in the market.

The combination starter market is segmented into the following categories.

By Type

- Non-Reversing (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Reversing (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

By Rated Power Type

- Up to 7.5 kW (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- 7.5kW to 75kW (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Above 75kW (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

By Application Type

- Pumps (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Fans (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Compressors (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Conveyors (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Others (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

By Industry Type

- Oil & Gas (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Water & Wastewater (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Infrastructure (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Metals and Mining (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Food & Beverages (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Others (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

By Region

- North America (Country Analysis: The USA, Canada, and Mexico)

- Europe (Country Analysis: Germany, France, The UK, Russia, and the Rest of Europe)

- Asia-Pacific (Country Analysis: Japan, China, India, and Rest of Asia-Pacific)

- Rest of the World (Country Analysis: Brazil, Saudi Arabia, and Others)

Research Methodology

- This strategic assessment report from Stratview Research provides a comprehensive analysis that reflects today’s combination of starter market realities and future market possibilities for the forecast period

- The report segments and analyzes the market in the most detailed manner in order to provide a panoramic view of the market.

- The vital data/information provided in the report can play a crucial role for market participants and investors in identifying the low-hanging fruit available in the market and formulating growth strategies to expedite their growth process.

- This report offers high-quality insights and is the outcome of a detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research’s internal database and statistical tools.

- More than 1,000 authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white papers, patents, and articles, have been leveraged to gather the data.

- We conducted more than 15 detailed primary interviews with market players across the value chain in all four regions and industry experts to obtain both qualitative and quantitative insights.

Customization Options

With this detailed report, Stratview Research offers one of the following free customization options to our respected clients:

Company Profiling

- Detailed profiling of additional market players (up to three players)

- SWOT analysis of key players (up to three players)

Competitive Benchmarking

- Benchmarking of key players on the following parameters: Service portfolio, geographical reach, regional presence, and strategic alliances

Custom Research: Stratview Research offers custom research services across sectors. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to [email protected]