Market Insights

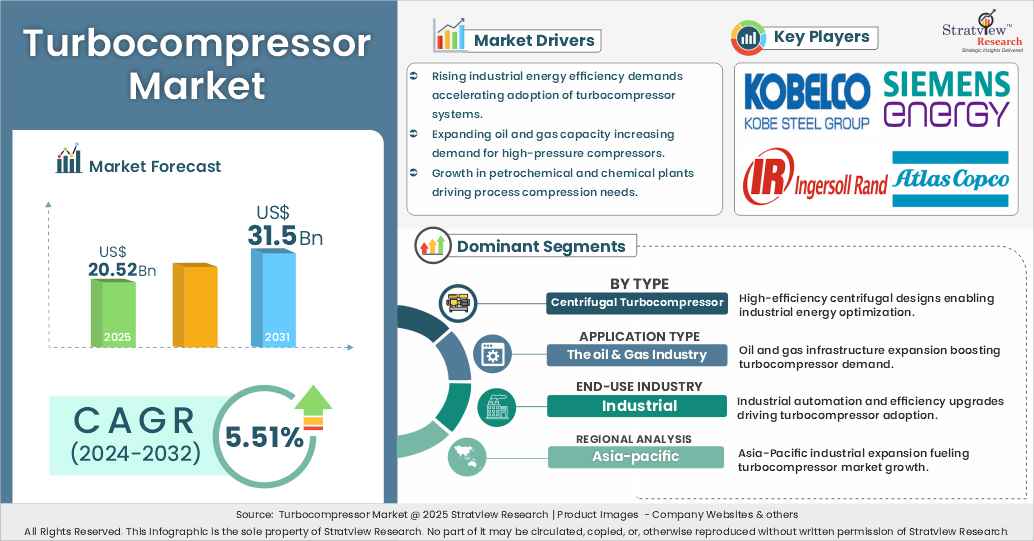

“The turbocompressor market value was US$20.52 billion in 2024 and is likely to grow at a decent CAGR of 5.51% in the long run to reach US$31.5 billion in 2032.”

Want to get a free sample? Register Here

Market Dynamics

Introduction

The turbocompressor market is set for remarkable growth, fueled by rising demand from key industries such as manufacturing, power generation, chemicals, and oil & gas. As industries worldwide push for higher efficiency, reliability, and sustainability, Turbocompressors have become an indispensable part of modern operations, delivering high-performance compression solutions across diverse applications. The surge in industrial automation, cutting-edge technological advancements, and the widespread adoption of energy-efficient Turbocompressors to meet strict emission regulations are driving this transformation. Businesses that adapt to these shifts stand to gain a competitive edge in an evolving landscape.

Recent Market JVs and Acquisitions:

- In September 2024, GE Vernova acquired the remaining 55% stake in General Electric Saudi Advanced Turbines (GESAT) from Dussur to strengthen its presence in the Middle East and enhance local manufacturing capabilities in power generation.

- In January 2013, Danfoss acquired full ownership of Danfoss Turbocor Compressors to expand its portfolio of oil-free, energy-efficient compressors and strengthen its position in the HVAC market.

Market Segments' Analysis

|

Segmentations

|

List of Sub-Segments

|

Segments with High-Growth Opportunity

|

|

Type Analysis

|

Centrifugal Turbocompressor, Axial Turbocompressor

|

Centrifugal Turbocompressor is expected to drive significant market demand due to its efficiency and reliability across industries.

|

|

Stage Analysis

|

Single-Stage Turbocompressor, Multi-Stage Turbocompressor

|

Multi-Stage Turbocompressors are projected to dominate due to their enhanced performance in high-pressure applications.

|

|

Output Pressure Analysis

|

0-20 Bar, 21-100 Bar, above 100 Bar

|

21-100 Bar Segment is anticipated to grow significantly due to its widespread use in industrial applications.

|

|

Application Analysis

|

Power Generation, Oil & Gas, Chemical & Petrochemical, Aerospace & Defence, Automotive, Manufacturing & Processing

|

The oil & Gas Industry is expected to remain the leading application segment due to increasing investments in energy infrastructure and gas processing facilities.

|

|

End-User Industry Analysis

|

Industrial, Commercial, Residential

|

Industrial is anticipated to be the dominant end-user industry, driven by rising industrial automation and demand for energy-efficient solutions.

|

|

Region Analysis

|

North America, Europe, Asia-Pacific, and The Rest of the World

|

Asia-Pacific is expected to experience the highest growth, driven by rapid industrialization and infrastructure development.

|

By Type

“Centrifugal Turbocompressors are expected to remain dominant in the market during the forecast period.”

Centrifugal Turbocompressors are the preferred choice across industries due to their superior efficiency, reliability, and minimal maintenance needs compared to axial Turbocompressors. Their ability to handle high flow rates with lower energy consumption makes them indispensable in industries such as oil & gas, power generation, and chemical processing. Additionally, advancements in aerodynamics and material technologies are further enhancing their performance, driving widespread adoption in various industrial applications.

By Stage

“Multi-Stage Turbocompressors are expected to remain the dominant and fastest-growing segment during the forecast period.”

Multi-stage Turbocompressors are favoured for applications requiring higher pressure ratios and increased energy efficiency. Industries such as petrochemicals, power generation, and manufacturing rely on these compressors for their ability to provide stable and continuous compression. Stringent energy efficiency regulations and the need for optimized operational costs in industrial settings further fuel their demand.

By Output Pressure

“21-100 Bar Turbocompressors are anticipated to dominate the market during the forecast period.”

The 21-100 bar pressure range is extensively used in numerous industrial industries, such as natural gas processing, chemical manufacturing, and power generation. This segment is anticipated to see consistent growth as industries increasingly prioritize energy-efficient and high-performance compression solutions to fulfill their operational needs. Furthermore, the rising demand for natural gas as a cleaner fuel source is spurring investments in Turbocompressors designed for this specific pressure range.

By Application

“The Oil & Gas industry is expected to continue leading the turbocompressor market during the forecast period.”

The market is segmented into Power Generation, Oil & Gas, Chemical & Petrochemical, Aerospace & Defence, Automotive, and Manufacturing & Processing. Among these, the oil & gas industry is expected to remain dominant due to increasing investments in energy infrastructure, LNG transportation, and refining operations. Additionally, chemical & petrochemical industries are also witnessing significant growth as they require efficient compression solutions for various processes, including gas separation and synthesis applications.

Want to get more details about the segmentations? Register Here

By End-User Industry

“The Industrial category is anticipated to continue dominating during the forecast period.”

The Turbocompressors market is segmented into Industrial, Commercial, and Residential. The industrial industry is projected to dominate the market, driven by increasing automation and advancements in efficiency within power plants, chemical manufacturing, and large-scale processing industries. Moreover, the rapid industrialization in emerging economies is fuelling the need for dependable and energy-efficient compression systems.

Regional Analysis

“The Asia-Pacific is expected to remain the largest market for the Turbocompressor Market during the forecast period.”

The Asia Pacific is expected to remain the largest market for the Turbocompressor Market during the forecast period, driven by rapid industrialization in China and India, automation adoption, and expanding industries like chemicals, pharmaceuticals, and food processing.

Key Players

The market is fragmented, with numerous manufacturers offering a variety of solutions to meet the diverse needs of industries.

Here is the list of the Top Players (Based on Dominance)

- Atlas Copco AB

- Elliott Group, a subsidiary of Ebara Corporation

- General Electric Company (GE)

- Ingersoll Rand Inc.

- Kobe Steel, Ltd. (Kobelco)

- MAN, Energy Solutions SE

- Mitsubishi Heavy Industries, Ltd.

- Siemens Energy AG

- Solar Turbines Incorporated, a subsidiary of Caterpillar Inc.

- Sulzer Ltd.

Note: The above list does not necessarily include all the top players in the market.

Are you the leading player in this market? We would love to include your name. Please write to us at [email protected]

Report Features

This report provides market intelligence most comprehensively. The report structure has been kept so that it offers maximum business value. It provides critical insights into market dynamics and will enable strategic decision-making for existing market players as well as those willing to enter the market. The following are the key features of the report:

- Market structure: Overview, industry life cycle analysis, supply chain analysis.

- Market environment analysis: Growth drivers and constraints, Porter’s five forces analysis, SWOT analysis.

- Market trend and forecast analysis.

- Market segment trend and forecast.

- Competitive landscape and dynamics: Market share, Service portfolio, New Product Launches, etc.

- COVID-19 impact and its recovery curve

- Attractive market segments and associated growth opportunities.

- Emerging trends.

- Strategic growth opportunities for the existing and new players.

- Key success factors.

The global turbocompressor market is segmented into the following categories:

Turbocompressor Market, by Type

- Centrifugal Turbocompressor (Regional Analysis: North America, Europe, Asia-Pacific, and RoW).

- Axial Turbocompressor (Regional Analysis: North America, Europe, Asia-Pacific, and RoW).

Turbocompressor Market, by Stage

- Single-Stage Turbocompressor (Regional Analysis: North America, Europe, Asia-Pacific, and RoW).

- Multi-Stage Turbocompressor (Regional Analysis: North America, Europe, Asia-Pacific, and RoW).

- Combination System (Regional Analysis: North America, Europe, Asia-Pacific, and RoW)

Turbocompressor Market, by Output Pressure

- 0-20 Bar (Regional Analysis: North America, Europe, Asia-Pacific, and RoW).

- 21-100 Bar (Regional Analysis: North America, Europe, Asia-Pacific, and RoW)

- Above 100 Bar (Regional Analysis: North America, Europe, Asia-Pacific, and RoW)

Turbocompressor Market, by Application

• Power Generation (Regional Analysis: North America, Europe, Asia-Pacific, and RoW)

• Oil & Gas (Regional Analysis: North America, Europe, Asia-Pacific, and RoW)

• Chemical & Petrochemical (Regional Analysis: North America, Europe, Asia-Pacific, and RoW)

• Aerospace & Defence (Regional Analysis: North America, Europe, Asia-Pacific, and RoW)

• Automotive (Regional Analysis: North America, Europe, Asia-Pacific, and RoW)

• Manufacturing & Processing (Regional Analysis: North America, Europe, Asia-Pacific, and RoW)

Turbocompressor Market, by End-User Industry

• Industrial Industry (Regional Analysis: North America, Europe, Asia-Pacific, and RoW)

• Commercial Industry (Regional Analysis: North America, Europe, Asia-Pacific, and RoW)

• Residential Industry (Regional Analysis: North America, Europe, Asia-Pacific, and RoW)

Turbocompressor Market, by region

- North America (Country Analysis: The USA, Canada, and Mexico)

- Europe (Country Analysis: Germany, France, The UK, Russia, and the Rest of Europe)

- Asia-Pacific (Country Analysis: Japan, China, India, and Rest of Asia-Pacific)

- Rest of the World (Country Analysis: Brazil, Saudi Arabia, and Others)

Research Methodology

- This strategic assessment report from Stratview Research provides a comprehensive analysis that reflects today’s turbocompressor market realities and future market possibilities for the forecast period.

- The report segments and analyses the market in the most detailed manner in order to provide a panoramic view of the market.

- The vital data/information provided in the report can play a crucial role for market participants and investors in identifying the low-hanging fruit available in the market and formulating growth strategies to expedite their growth process.

- This report offers high-quality insights and is the outcome of a detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research’s internal database and statistical tools.

- More than 1,000 authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white papers, patents, and articles, have been leveraged to gather the data.

- We conducted more than 15 detailed primary interviews with market players across the value chain in all four regions and industry experts to obtain both qualitative and quantitative insights.

Report Customization Options

With this detailed report, Stratview Research offers one of the following free customization options to our respected clients:

Company Profiling

- Detailed profiling of additional market players (up to three players)

- SWOT analysis of key players (up to three players)

Competitive Benchmarking

- Benchmarking of key players on the following parameters: Service portfolio, geographical reach, regional presence, and strategic alliances

Custom Research: Stratview Research offers custom research services across industries. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to [email protected]