Attractive Opportunities

Global Demand Analysis & Sales Opportunities in Sensor Market

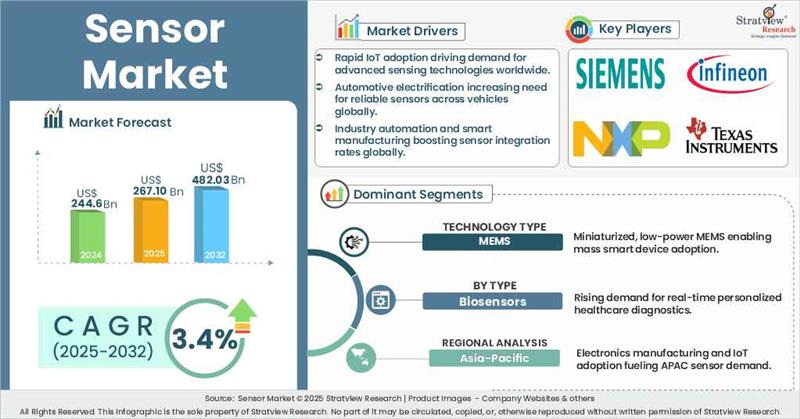

- The annual demand for sensor was USD 244.6 billion in 2024 and is expected to reach USD 267.10 billion in 2025, up 9.2% than the value in 2024.

- During the next 8 years (forecast period of 2025-2032), the sensor market is expected to grow at a CAGR of 3.4%. The annual demand will reach of USD 482.03 billion in 2032.

- During 2025-2032, the sensor industry is expected to generate a cumulative sales opportunity of USD 2933.79 billion.

Want to get a free sample? Register Here

High-Growth Market Segments:

- Asia-Pacific region accounted for the largest market share.

- By Technology type, MEMS segment dominates the global sensor market.

- By Type, Biosensors segment is expected to grow at a faster pace during the forecast period.

- By End-Use type, Biomedical and Healthcare is anticipated to grow at the highest CAGR during the forecast period.

Market Statistics

Have a look at the sales opportunities presented by the sensor market in terms of growth and market forecast.

|

Sensor Market Data & Statistics

|

|

|

Market Statistics

|

Value (in USD Billion)

|

Market Growth (%)

|

|

Annual Market Size in 2023

|

USD 224.40 billion

|

-

|

|

Annual Market Size in 2024

|

USD 244.6 billion

|

YoY Growth in 2024: 9%

|

|

Annual Market Size in 2025

|

USD 267.10 billion

|

YoY Growth in 2025: 9.2%

|

|

Annual Market Size in 2032

|

USD 482.03 billion

|

CAGR 2025-2032: 8.8%

|

|

Cumulative Sales Opportunity during 2025-2032

|

USD 2933.79 billion

|

-

|

|

Top 10 Countries’ Market Share in 2024

|

USD 196 billion +

|

> 80%

|

|

Top 10 Company’s Market Share in 2024

|

USD 122 billion to USD 170 billion

|

50% - 70%

|

Market Dynamics

Introduction:

What is a sensor?

A sensor is an electronic device that detects and responds to physical inputs such as temperature, pressure, motion, light, or chemical changes, and converts them into measurable electrical signals. Sensors play a critical role in modern technology by enabling real-time monitoring, automation, and control. They are widely used across industries, including consumer electronics, automotive, healthcare, industrial automation, aerospace, and environmental monitoring.

Market Drivers:

Increasing Automotive Production and Sensor Integration

- The surge in global automotive production, especially in countries like China and India, is significantly boosting sensor demand. Modern vehicles increasingly rely on sensors for applications such as ADAS, engine control, tire pressure monitoring, and emissions management.

- With a growing focus on safety, automation, and efficiency, the integration of advanced sensors in both electric and conventional vehicles is driving strong growth in the sensor market.

Proliferation of IoT and Smart Connected Devices

- The expanding Internet of Things (IoT) ecosystem is driving robust demand for sensors across diverse applications, including consumer electronics, smart home systems, industrial automation, and digital healthcare. As critical enablers of real-time data acquisition and intelligent decision-making, sensors are fundamental to the functionality of connected devices.

- The increasing deployment of smart appliances, wearable health monitors, and industrial IoT solutions is accelerating the need for compact, low-power, and high-precision sensors. This growing trend toward ubiquitous connectivity continues to be a major catalyst for sensor market growth.

Market Challenges:

Miniaturization and Integration Complexity in Next-Generation Devices

- The growing demand for compact, high-performance devices in wearables, medical tech, and smart systems is pushing sensor manufacturers toward ultra-miniaturized and integrated solutions. However, achieving high sensitivity and efficiency in limited form factors increases design complexity, development costs, and time-to-market, posing a key challenge to innovation and scalability in the global sensor market.

Market Opportunities:

Growing Demand for Smart and Autonomous Systems

- The accelerating adoption of autonomous vehicles, smart manufacturing (Industry 4.0), and intelligent infrastructure is creating significant opportunities for sensor manufacturers. These applications require advanced sensing technologies, such as LiDAR, pressure, and proximity sensors, for real-time monitoring, safety, and automation. This trend enables sensor providers to expand into high-growth verticals and deliver tailored, high-value solutions.

Segment Analysis

|

Segmentations

|

List of Sub-Segments

|

Segments with High-Growth Opportunity

|

|

Technology Analysis

|

MEMS, CMOS, Others (ASIC, MST)

|

MEMS segment dominates the global sensor market.

|

|

Type Analysis

|

Radar Sensors, Touch Sensors, Temperature and Humidity Sensors, Biosensors, Level Sensors, Pressure and Flow Sensors, Optical Sensors, Image Sensors, Others (Ultrasonic Sensors, Water Sensors)

|

Biosensors segment is expected to grow at a faster pace during the forecast period.

|

|

End-Users Analysis

|

Consumer Electronics, Automotive, Biomedical and Healthcare, Industrial, Aerospace and Defense, Others (IT and Telecom, Real Estate)

|

Biomedical and Healthcare is anticipated to grow at the highest CAGR during the forecast period.

|

|

Regional Analysis

|

North America, Europe, Asia-Pacific, and The Rest of the World

|

APAC holds the largest share of the sensor market.

|

By Technology Type

“MEMS segment dominates the global sensor market.”

- The MEMS (Micro-Electro-Mechanical Systems) segment dominates the global sensor market, owing to its extensive deployment in smartphones, wearables, automotive safety systems, and industrial equipment.

- MEMS sensors offer key advantages such as miniaturization, low power consumption, high sensitivity, and cost efficiency, making them ideal for compact and multifunctional electronic devices.

- As the demand for smart, connected technologies continues to rise, MEMS-based solutions are expected to remain at the forefront of innovation and volume adoption across industries.

By Type

“Biosensors segment is expected to grow at a faster pace during the forecast period.”

- The Biosensors segment is expected to grow at a faster pace during the forecast period, driven by the increasing demand for real-time health monitoring, disease diagnostics, and personalized medicine.

- With growing adoption in wearable healthcare devices, point-of-care testing, and remote patient monitoring, biosensors are gaining traction due to their high sensitivity, rapid response time, and ability to detect a wide range of biological markers.

Want to get more details about the segmentations? Register Here

By Region Type

“APAC holds the largest share of the sensor market.”

- Asia-Pacific holds the largest share of the global sensor market, primarily driven by the strong presence of consumer electronics manufacturing hubs, rapid industrialization, and expanding automotive production.

- Countries like China, Japan, South Korea, and India are leading the demand due to increased adoption of smart devices, IoT technologies, and automation across sectors.

- Favourable government initiatives and rising investments in smart city projects further strengthen the region’s market position.

Competitive Landscape

Most of the major players compete in some of the factors, including price, service offerings, regional presence, etc. The following are the key players in the sensor market -

- Siemens AG (Germany)

- NXP Semiconductors (Netherlands)

- Infineon Technologies AG (Germany)

- Texas Instruments Incorporated (U.S.)

- Analog Devices, Inc. (U.S.)

- STMicroelectronics (Switzerland)

- Bosch Sensortec GmbH (Germany)

- Microchip Technology Inc. (U.S.)

- Honeywell International Inc. (U.S.)

- OMRON Corporation (Japan)

Note: The above list does not necessarily include all the top players in the market.

Are you a leading player in this market? We would love to include your name. Please write to us at [email protected]

Recent Developments/Mergers & Acquisitions:

- In January 2024, Texas Instruments introduced the A5442WR 77GHz mm-wave radar sensors aimed at enhancing automotive intelligence and safety. These sensors support satellite radar architectures, improving sensor fusion and decision-making for advanced driver-assistance systems (ADAS).

- In October 2023, LEM International SA & TDK Corporation announced a strategic agreement focused on custom TMR dies for next-generation integrated sensors. This collaboration will bolster the adoption of TDK’s TMR technology in industrial and automotive sectors, including high-growth areas such as solar converters, energy storage, and motor drives.

- In August 2023, Texas Instruments launched new sensing solutions, including the industry’s lowest-drift isolated Hall-effect current sensor for high-voltage systems. The innovation enables engineers to design more accurate and compact systems across varied temperature and voltage conditions.

- In April 2023, Siemens AG rolled out the SIBushing, a smart cable coupling bushing, alongside the SICAM FCM system and an indicator for short circuits and earth faults, enhancing grid monitoring and fault detection capabilities.

Report Features

This report provides market intelligence most comprehensively. The report structure has been kept so that it offers maximum business value. It provides critical insights into market dynamics and will enable strategic decision-making for existing market players as well as those willing to enter the market.

The following are the key features of the report:

- Market structure: Overview, industry life cycle analysis, supply chain analysis.

- Market environment analysis: Growth drivers and constraints, Porter’s five forces analysis, SWOT analysis.

- Market trend and forecast analysis.

- Market segment trend and forecast.

- Competitive landscape and dynamics: Market share, Service portfolio, New Product Launches, etc.

- COVID-19 impact and its recovery curve.

- Attractive market segments and associated growth opportunities.

- Emerging trends.

- Strategic growth opportunities for the existing and new players.

- Key success factors.

|

Market Study Period

|

2019-2032

|

|

Base Year

|

2024

|

|

Forecast Period

|

2025-2032

|

|

Trend Period

|

2019-2023

|

|

Number of Tables & Figures

|

>100

|

|

Number of Segments Analysed

|

4 (Technology Type, Type, End-Use Type, and Region)

|

|

Number of Regions Analysed

|

4 (North America, Europe, Asia-Pacific, Rest of the World)

|

|

Countries Analysed

|

15 (The USA, Canada, Mexico, Germany, France, Italy, The UK, China, Japan, India, Brazil, Saudi Arabia, Rest of Europe, Rest of APAC, and Rest of the World)

|

|

Free Customization Offered

|

10%

|

|

After Sales Support

|

Unlimited

|

|

Report Presentation

|

Complimentary

|

|

Market Dataset

|

Complimentary

|

|

Further Deep Dive & Consulting Services

|

10% Discount

|

Market Segmentation

This report studies the market, covering a period of 15 years of trend and forecast. The report provides detailed insights into the market dynamics to enable informed business decision-making and growth strategy formulation based on the opportunities present in the market.

The sensor market is segmented into the following categories.

Global Sensor Market, by Technology Type

- MEMS

- CMOS

- Others (ASIC, MST)

Global Sensor Market, by Type

- Radar Sensors

- Touch Sensors

- Temperature and Humidity Sensors

- Biosensors

- Level Sensors

- Pressure and Flow Sensors

- Optical Sensors

- Image Sensors

- Others (Ultrasonic Sensors, Water Sensors)

Global Sensor Market, by End-User Type

- Consumer Electronics

- Automotive

- Biomedical and Healthcare

- Industrial

- Aerospace and Defense

- Others (IT and Telecom, Real Estate)

Sensor Market, by Region

- North America (Country Analysis: The USA, Canada, and Mexico)

- Europe (Country Analysis: Germany, France, Italy, The UK, and Rest of Europe)

- Asia-Pacific (Country Analysis: Japan, China, India, and Rest of Asia-Pacific)

- Rest of the World (Country Analysis: Brazil, Saudi Arabia, and Others)

Research Methodology

- This strategic assessment report from Stratview Research provides a comprehensive analysis that reflects today’s global sensor market realities and future market possibilities for the forecast period.

- The report segments and analyzes the market in the most detailed manner to provide a panoramic view of the market.

- The vital data/information provided in the report can play a crucial role for market participants and investors in identifying the low-hanging fruits available in the market and formulating growth strategies to expedite their growth process.

- This report offers high-quality insights and is the outcome of a detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research’s internal database and statistical tools.

- More than 1,000 authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white papers, patents, and articles, have been leveraged to gather the data.

- We conducted more than 32 detailed primary interviews with market players across the value chain in all four regions and industry experts to obtain both qualitative and quantitative insights.

Customization Options

With this detailed report, Stratview Research offers one of the following free customization options to our respected clients:

Company Profiling

- Detailed profiling of additional market players (up to three players)

- SWOT analysis of key players (up to three players)

Competitive Benchmarking

- Benchmarking of key players on the following parameters: Service portfolio, geographical reach, regional presence, and strategic alliances

Custom Research: Stratview Research offers custom research services across industries. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to [email protected]