Market Insights

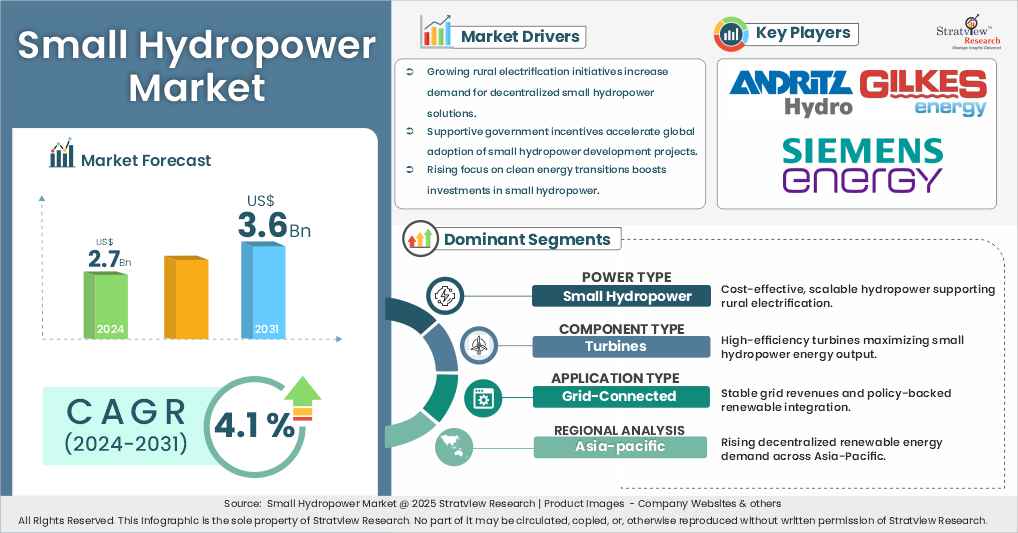

“The small hydropower market size was US$2.7 billion in 2024 and is likely to grow at a decent CAGR of 4.1 % in the long run to reach US$3.6 billion in 2031.”

Want to get a free sample? Register Here

Market Dynamics

The Small Hydropower (SHP) market is a vital part of the global shift toward decentralized, clean, and cost-effective energy systems. SHP systems—usually defined as plants that generate 10 MW of power or less—are especially well-suited to meet the demand in remote areas, to power rural industries, and to support grid balancing in developed and developing economies. SHP systems generate electricity from the flow of rivers and streams without the need for large dam structures, allowing them to be more environmentally sustainable and faster to deploy than large hydropower projects.

Around the world, governments and energy developers have reduced their SHP investments because SHP projects have low operational costs, have long asset lives, and can assist national renewable energy targets. At the same time, an increasing emphasis on sustainable development has seen mini and micro hydropower projects rise in water-rich regions, such as Asia, Africa, and parts of Latin America that have limited access to the grid. Coupled with rising turbine efficiencies and the ability to manage operations through smart control systems, SHP is becoming increasingly attractive in the clean and resilient energy landscape.

Market Driver

Rural electrification and increased access to energy in developing areas are a prominent driver of the Small Hydropower (SHP) market. National governments and international development agencies have funded SHP installations to provide consistent, off-grid power to underserved communities. In nations like India, Nepal, and Ethiopia, small hydropower is a feasible alternative to diesel generators and costly grid extensions and has both environmental and economic advantages. Furthermore, favourable policy mechanisms, including feed-in tariffs, tax exemptions, and capital subsidies, enable global market development.

Recent Market JVs and Acquisitions:

A considerable number of strategic alliances, including M&As, JVs, etc., have been performed over the past few years:

- Andritz Hydro has acquired stakes in small turbine developers to bolster local manufacturing presence, particularly in South America and Southeast Asia.

Market Segments' Analysis

|

Segmentations

|

List of Sub-Segments

|

Segments with High-Growth Opportunity

|

|

Power-Type Analysis

|

Micro Hydropower, Mini Hydropower, and Small Hydropower

|

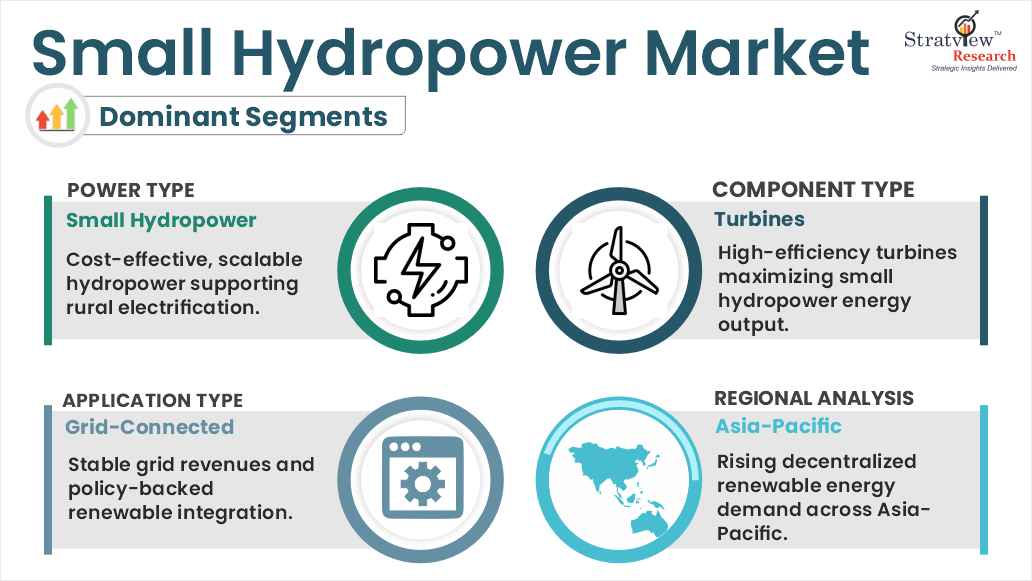

Small Hydropower types are expected to remain dominant in the coming years.

|

|

Capacity-Type Analysis

|

<1 MW, 1–5 MW, and 5–10 MW

|

5-10MW is anticipated to hold the largest share of the market in the upcoming years.

|

|

Component-Type Analysis

|

Turbines, Generators, Control Panels, and Other Component Types

|

Turbines are expected to be the dominant component type in the market.

|

|

Application-Type Analysis

|

Off-Grid Electrification, Grid-Connected Power Supply, and Industrial & Commercial Use

|

The grid-connected application type is expected to be the dominant type in the market.

|

|

Region Analysis

|

North America, Europe, Asia-Pacific, and The Rest of the World

|

The Asia-Pacific is expected to maintain its reign over the forecast period.

|

By Power Type

“Small hydropower types are expected to remain in the market during the forecast period.”

Of the various type segments, small hydropower systems in the 1–10 MW range are the most prevalent, representing an effective trade-off between capacity and cost-effectiveness. Small hydropower plants are generally large enough to connect to grids, providing power to small towns, villages, or industries. Many developing countries are deploying small hydropower plants to expand rural energy access while reducing reliance on fossil fuels.

Small hydro installations may also be easier to permit and have shorter construction timelines when compared to developing large dams. Small hydro systems are easily scalable to renewable energy targets and are therefore preferred in many policy frameworks worldwide, especially in Asia and Latin America.

By Capacity Type

“5-10MW is expected to remain the dominant capacity type of the market during the forecast period.”

The 5-10 MW capacity range leads the way as it consistently maximizes the return on investment for grid-connected projects. This range is a sweet spot for rural electrification efforts and still provides considerable energy to national grids. Many of the installations in this range use a run-of-river design where the least amount of environmental disruption is made, and the displacement issues of large reservoirs are avoided completely.

Countries such as China and Brazil target this capacity range in their hydropower development plans because it has reliably efficient operational costs and minimal operational and maintenance costs, while also allowing for integration into existing distributed energy systems. Existing distributed generation needs to be digitized for additional controls, digitized for automation, and digitized for life post costs – that includes increasing performance and extending lifespan.

By Component Type

“Turbine is expected to be the dominant component type of the market during the forecast period.”

Turbines are the largest part of the small hydropower system in cost and technical significance. The turbine is the energy conversion device and thus determines the overall system efficiency and output; therefore, the turbine is the focal point for design and investment. Depending on the site conditions, Kaplan, Pelton, or Francis turbines are commonly used.

High-efficiency turbines also enable the best utilization of low-head or variable-flow water sources, thereby diversifying the potential for small hydro in other areas of the world. Manufacturers are constantly designing turbines for use in micro and mini systems, allowing for less maintenance and noise and increasing compatibility with smart-grid applications.

Want to get more details about the segmentations? Register Here

By Application Type

“Grid-connected application is expected to be the dominant application of the market during the forecast period.”

Due to the potential of connection to the national electricity supply and revenues from feed-in tariffs or power purchase agreements, grid-connected small hydropower systems are a dominant market force. There are also many government incentives for utilities to add clean energy sources into their power mix, making SHP projects a low-risk investment.

While off-grid applications are critically important for rural quality of life and rural development, they are usually funding-dependent and require levels of infrastructure that are often absent. Grid connectivity often provides better financing options and compliance assurance, as most grid-connected SHP projects fall under established guidelines. This is especially the case in regions especially as Europe and China, and South America, where renewable integration is a policy priority and grid-connected SHP is set to be a major player in any renewable energy transfer.

Regional Analysis

“The Asia-Pacific is expected to remain the largest market for small hydropower during the forecast period.”

Developed countries continue to have a relatively low share of the small hydropower market at this time. However, we see many opportunities in Australia and New Zealand as SHP plants are established in remote areas with no access to the electric grid. Overall, the market is dominated by Asia-Pacific, with smaller albeit significant contributions from North America and Latin America. As the world seeks to meet climate commitments and decarbonise the grid, SHP and other renewable power generation sources will continue to emerge to meet the energy demand. The revolution in energy today is about decentralized power generation. This paradigm shift is a business model pivot that will change reliance on traditional energy sources, and we will see growth in company diversification into energy-rich opportunities and changes to the large corporations and utilities in the energy sphere.

Key Players

The market is moderately fragmented, with over 200 players. Most of the major players compete in some of the governing factors, including price, service offerings, regional presence, etc. The following are the key players in the small hydropower market.

Here is the list of the Top Players (Based on Dominance)

- Voith Group

- Andritz Hydro

- GE Renewable Energy

- Gilkes

- Toshiba Energy Systems & Solutions

- Marvel a.s.

- Siemens Energy

- Rainpower

- Zhejiang Jinlun Electromechanic Co., Ltd.

- Global Hydro Energy GmbH

Note: The above list does not necessarily include all the top players in the market.

Are you the leading player in this market? We would love to include your name. Please write to us at [email protected]

Report Features

This report provides market intelligence most comprehensively. The report structure has been kept so that it offers maximum business value. It provides critical insights into market dynamics and will enable strategic decision-making for existing market players as well as those willing to enter the market. The following are the key features of the report:

- Market structure: Overview, industry life cycle analysis, supply chain analysis.

- Market environment analysis: Growth drivers and constraints, Porter’s five forces analysis, SWOT analysis.

- Market trend and forecast analysis.

- Market segment trend and forecast.

- Competitive landscape and dynamics: Market share, Service portfolio, New Product Launches, etc.

- COVID-19 impact and its recovery curve.

- Attractive market segments and associated growth opportunities.

- Emerging trends.

- Strategic growth opportunities for the existing and new players.

- Key success factors.

The small hydropower market is segmented into the following categories.

Small Hydropower Market, by Power Type

- Micro Hydropower (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of World)

- Mini Hydropower (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of World)

- Small Hydropower (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of World)

Small Hydropower Market by Capacity Type

- <1 MW (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of World)

- 1–5 MW (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of World)

- 5–10 MW (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of World)

Small Hydropower Market by Component Type

- Turbines (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of World)

- Generators (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of World)

- Control Panels (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of World)

- Other Component Types (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of World)

Small Hydropower Market by Application Type

- Off-Grid Electrification (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of World)

- Grid-Connected Power Supply (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of World)

- Industrial & Commercial Use (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of World)

Small Hydropower Market by Region

- North America (Country Analysis: The USA, Canada, and Mexico)

- Europe (Country Analysis: Germany, France, The UK, Russia, and the Rest of Europe)

- Asia-Pacific (Country Analysis: Japan, China, India, and Rest of Asia-Pacific)

- Rest of the World (Country Analysis: Brazil, Saudi Arabia, and Others)

Research Methodology

- This strategic assessment report from Stratview Research provides a comprehensive analysis that reflects today’s small hydropower market realities and future market possibilities for the forecast period.

- The report segments and analyzes the market in the most detailed manner in order to provide a panoramic view of the market.

- The vital data/information provided in the report can play a crucial role for market participants and investors in identifying the low-hanging fruit available in the market and formulating growth strategies to expedite their growth process.

- This report offers high-quality insights and is the outcome of a detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research’s internal database and statistical tools.

- More than 1,000 authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white papers, patents, and articles, have been leveraged to gather the data.

- We conducted more than 15 detailed primary interviews with market players across the value chain in all four regions and industry experts to obtain both qualitative and quantitative insights.

Report Customization Options

With this detailed report, Stratview Research offers one of the following free customization options to our respected clients:

Company Profiling

- Detailed profiling of additional market players (up to three players)

- SWOT analysis of key players (up to three players)

Competitive Benchmarking

- Benchmarking of key players on the following parameters: Service portfolio, geographical reach, regional presence, and strategic alliances

Custom Research: Stratview Research offers custom research services across sectors. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to [email protected]