Market Segments' Analysis

|

Segmentations

|

List of Sub-Segments

|

Segments with High-Growth Opportunity

|

|

Reactor-Type Analysis

|

Pressurized Water Reactor (PWR), Pressurized Heavy Water Reactor (PHWR), Boiling Water Reactor (BWR), High-Temperature Gas-cooled Reactor (HTGR), Liquid Metal Fast Breeder Reactor (LMFBR), Other Types (SMRs, Molten Salt Reactors, AMRs)

|

Small Modular Reactors (SMRs) are gaining strong traction in the U.S., Canada, and Europe due to their flexibility, safety, and modular design. HTGRs and LMFBRs are also drawing interest for industrial and hydrogen-generation applications.

|

|

Capacity-Type Analysis

|

Small (Less than 500 MW), Medium (500-1000 MW, Large (Above 1000MW).

|

Small Modular Reactors (SMRs) are projected to lead future demand, driven by their suitability for off-grid applications, faster deployment, and lower capital costs. Meanwhile, large reactors continue to play a vital role in rapidly growing economies as China and India.

|

|

Connectivity-Type Analysis

|

Grid-connected, Off-grid

|

Off-grid nuclear systems, especially SMRs and microreactors, are poised for rapid growth in sectors like defense, mining, and remote communities. Meanwhile, grid-connected nuclear projects remain essential for ensuring national energy security.

|

|

Plant Lifecycle Stage-Type Analysis

|

EPC (Engineering, Procurement, Construction), Operations & Maintenance (O&M), Decommissioning

|

Operations & Maintenance (O&M) is a fast-growing segment in North America and Europe, driven by the aging nuclear reactor fleet. Meanwhile, decommissioning activities are accelerating, particularly in Germany, France, and the United States.

|

|

Application-Type Analysis

|

Energy (Electricity Generation), Defence, Other (Medical isotopes, Hydrogen production, Desalination)

|

While electricity generation remains the primary application, hydrogen production and desalination using HTGRs are gaining momentum in the Middle East and Asia. Meanwhile, defense applications are propelling innovation in compact nuclear systems.

|

|

Region Analysis

|

North America, Europe, Asia-Pacific, and The Rest of the World

|

The Asia-Pacific region, led by China and India, remains the fastest-growing nuclear market, driven by large-scale reactor construction and energy demand. North America and Europe are focusing on SMR deployment and lifecycle services, while the Middle East and Africa are emerging with first-time nuclear programs.

|

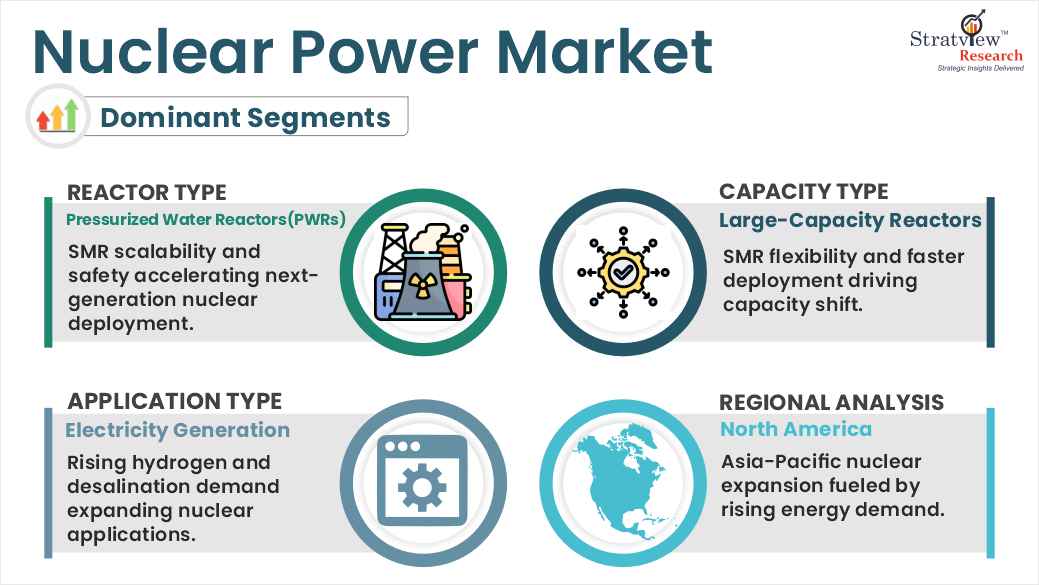

By Reactor Type

“Pressurized Water Reactors (PWRs) are expected to remain dominant, whereas Small Modular Reactors (SMRs) and Advanced Reactor Types will be the fastest-growing segment during the forecast period.”

The nuclear power market is segmented into Pressurized Water Reactors (PWRs), Pressurized Heavy Water Reactors (PHWRs), Boiling Water Reactors (BWRs), High-Temperature Gas-cooled Reactors (HTGRs), Liquid Metal Fast Breeder Reactors (LMFBRs), and other advanced reactor types, including SMRs and AMRs.

PWRs are expected to remain dominant due to their proven track record, global operational base, and standardized technology, especially across the USA, France, and China.

However, SMRs and other modular designs are likely to witness the fastest growth, driven by their flexibility, scalability, safety profile, and suitability for remote or decentralized power needs. Countries like Canada, the US, and the UK are heavily investing in SMRs for both grid and off-grid applications.

By Capacity Type

“Large-capacity reactors (above 1000 MW) are expected to remain dominant, while small-capacity reactors (below 500 MW) are anticipated to grow at the fastest rate.”

The nuclear power market is categorized by capacity into small (<500 MW), medium (500–1000 MW), and large (>1000 MW) reactor types. Large reactors continue to dominate baseload, grid-connected generation, especially in countries like China, India, and Russia, where their economies of scale make them cost-effective for high-demand regions.

In contrast, small reactors (mainly SMRs) are witnessing the fastest growth, driven by shorter construction timelines, lower capital costs, and flexibility for deployment in both urban settings and remote areas. Governments and private companies increasingly view these reactors as critical to the future of clean, scalable energy solutions.

By Connectivity Type

“Grid-connected reactors are dominant, while off-grid nuclear solutions, primarily based on SMRs, are expected to be the fastest-growing segment.”

Grid-connected nuclear reactors play a key role in meeting national electricity demand in countries such as France, the United States, and South Korea.

Meanwhile, off-grid nuclear systems, particularly SMRs, are gaining momentum for applications in remote regions, mining sites, islands, military installations, and disaster-prone areas. These systems offer resilient, localized power generation with reduced transmission losses and lower maintenance requirements.

Want to get more details about the segmentations? Register Here

By Plant Lifecycle Stage Type

“Operations & Maintenance (O&M) services are expected to remain the dominant lifecycle segment, whereas decommissioning and EPC (Engineering, Procurement, Construction) will see rapid growth. “

With more than 400 reactors in operation globally, Operations & Maintenance (O&M) remains a vital and dependable revenue stream, particularly in North America and Europe, where many reactors are reaching the end of their operational lifespans.

At the same time, decommissioning activities are accelerating due to plant closures in countries such as Germany and Japan, while the Engineering, Procurement, and Construction (EPC) segment is seeing strong growth in the Asia-Pacific and Middle East regions, driven by new nuclear capacity expansion.

By Application Type

“Energy production will remain the dominant application, whereas defense and non-electric applications like hydrogen production and desalination are emerging as high-growth areas.”

Nuclear power is primarily utilized for electricity generation, playing a key role in supporting low-carbon energy objectives.

However, defense applications, including submarine propulsion and nuclear weapons programs, remain strategically important in countries like the United States, Russia, and India.

In addition, non-electric uses of nuclear energy are drawing growing interest, particularly for hydrogen production using HTGRs and SMRs, as well as for thermal desalination, as more nations seek to broaden nuclear's role within their overall energy strategies.

Regional Analysis

“Asia-Pacific is expected to be the fastest-growing region, while North America remains dominant in terms of operational capacity and technological leadership.”

The Asia Pacific region, led by China and India, is making substantial investments in new nuclear buildouts to address rapidly growing energy needs and meet climate targets.

In contrast, North America maintains a dominant position with its extensive reactor fleet, especially in the United States and Canada, and is at the forefront of SMR development, reactor safety enhancements, and decommissioning services.

Europe presents a mixed landscape with France renewing its commitment to nuclear power, while Germany continues its phase-out policy. Meanwhile, emerging nuclear nations such as Saudi Arabia and Brazil are actively exploring nuclear energy to ensure long-term clean energy security.