Attractive Opportunities

Global Demand Analysis & Sales Opportunities in Robotic Warfare Market

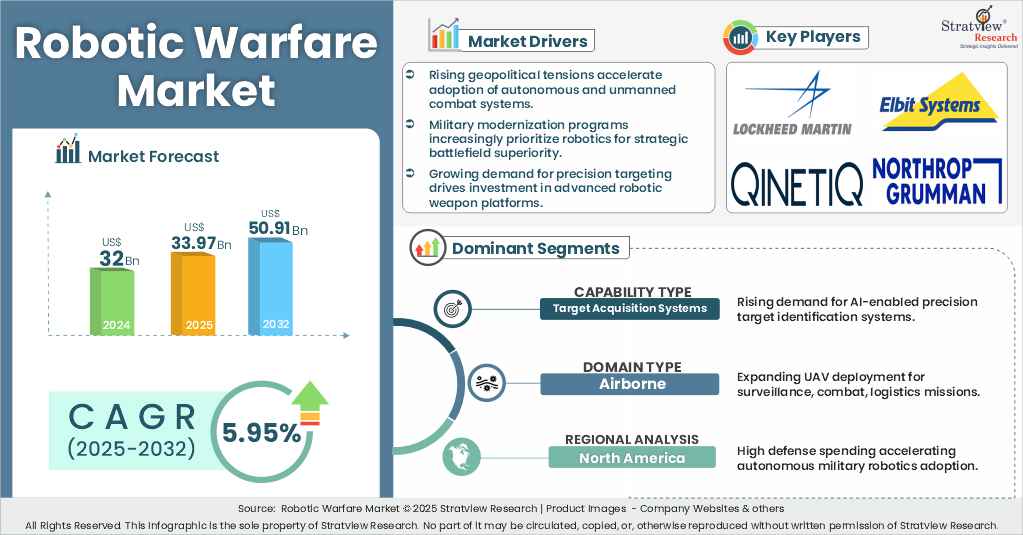

- The annual demand for robotic warfare was USD 32 billion in 2024 and is expected to reach USD 33.97 billion in 2025, up 6.15% than the value in 2024.

- During the next 8 years (forecast period of 2025-2032), the robotic warfare market is expected to grow at a CAGR of 5.95%. The annual demand will reach of USD 50.91 billion in 2032.

- During 2025-2032, the robotic warfare industry is expected to generate a cumulative sales opportunity of USD 336.15 billion.

Want to get a free sample? Register Here

High-Growth Market Segments:

- North America is expected to be the dominant and fastest-growing region over the forecasted period.

- By Application type, ISR segment is expected to grow at the highest CAGR during the forecast period.

- By Capability type, Target Acquisition Systems segment is expected to grow at a faster pace during the forecast period.

- By Domain type, Airborne segment holds the largest market revenue and is anticipated to grow at the highest CAGR during the forecast period.

- By Mode of Operation type, Semi-Autonomous segment is projected to grow at the highest CAGR during the forecast period.

Market Statistics

Have a look at the sales opportunities presented by the robotic warfare market in terms of growth and market forecast.

|

Robotic Warfare Market Data & Statistics

|

|

|

Market Statistics

|

Value (in USD Billion)

|

Market Growth (%)

|

|

Annual Market Size in 2023

|

USD 30.19 billion

|

-

|

|

Annual Market Size in 2024

|

USD 32 billion

|

YoY Growth in 2024: 6%

|

|

Annual Market Size in 2025

|

USD 33.97 billion

|

YoY Growth in 2025: 6.15%

|

|

Annual Market Size in 2032

|

USD 50.91 billion

|

CAGR 2025-2032: 5.95%

|

|

Cumulative Sales Opportunity during 2025-2032

|

USD 336.15 billion

|

-

|

|

Top 10 Countries’ Market Share in 2024

|

USD 25 billion +

|

> 80%

|

|

Top 10 Company’s Market Share in 2024

|

USD 16 billion to USD 22 billion

|

50% - 70%

|

Market Dynamics

Introduction:

What is robotic warfare?

Robotic warfare refers to the use of autonomous and semi-autonomous robotic systems in military operations. These systems include unmanned aerial vehicles (UAVs), ground robots (UGVs), marine drones, weaponized turrets, and exoskeletons designed to enhance combat capabilities, reduce human risk, and improve mission efficiency. Robotic warfare technologies are widely used in intelligence, surveillance, and reconnaissance (ISR), combat operations, logistics and support, and search and rescue missions across land, air, and naval domains.

Market Drivers:

Increasing Development and Deployment of AI-Driven Robotic Systems

- The increasing adoption of AI-enabled robotic systems is a major growth driver for the robotic warfare market. These advanced platforms, such as unmanned aerial and ground systems, are transforming defense strategies by enhancing situational awareness, reducing human risk, and enabling autonomous operations.

- Backed by government funding and defense modernization programs, countries like the U.S., China, and Israel are rapidly expanding their robotic warfare capabilities, driving strong demand for intelligent, mission-ready robotic technologies.

Market Challenges:

High Development Costs, Integration Complexities

- One of the major challenges in the robotic warfare market is the high cost of development, testing, and integration of advanced autonomous systems. Designing military-grade robotic platforms that meet strict performance, durability, and cybersecurity standards requires significant investment.

- Additionally, integrating these systems into existing defense infrastructure, while ensuring seamless interoperability with legacy equipment and human troops, poses technical and logistical hurdles. These challenges can slow down procurement cycles, especially in cost-sensitive or less technologically advanced defense markets.

Market Opportunities:

Increasing Adoption of Autonomous Training and Simulation

- The growing adoption of autonomous training and simulation systems presents a significant opportunity in the robotic warfare market. These systems use AI-driven platforms to replicate real-world combat environments, allowing soldiers to train with robotic units in virtual or controlled settings.

- Autonomous simulation reduces costs, enhances training effectiveness, and improves readiness without risking human lives. As militaries shift toward high-tech warfare, demand for advanced, simulation-based robotic training tools is expected to rise significantly worldwide.

Segment Analysis

|

Segmentations

|

List of Sub-Segments

|

Segments with High-Growth Opportunity

|

|

Application Analysis

|

Intelligence, Surveillance, & Reconnaissance (ISR), Logistics & Support, Search & Rescue, Tracking & Targeting, Combat & Operations, Training & Simulation

|

ISR segment is expected to grow at the highest CAGR during the forecast period.

|

|

Capability Analysis

|

Unmanned Platforms & Systems, Exoskeleton & Wearables, Target Acquisition Systems, Turret & Weapon System

|

Target Acquisition Systems segment is expected to grow at a faster pace during the forecast period.

|

|

Domain Analysis

|

Land, Marine, Airborn

|

Airborne segment holds the largest market revenue and is anticipated to grow at the highest CAGR during the forecast period.

|

|

Mode of Operation Analysis

|

Autonomous, Semi-Autonomous

|

Semi-Autonomous segment is projected to grow at the highest CAGR during the forecast period.

|

|

Regional Analysis

|

North America, Europe, Asia-Pacific, and The Rest of the World

|

North America holds the largest share of the robotic warfare market.

|

By Capability Type

“Target Acquisition Systems segment is expected to grow at a faster pace during the forecast period.”

- The growing need for accurate and real-time identification of targets in modern combat scenarios is driving the rapid adoption of target acquisition systems.

- Advancements in sensor technologies, artificial intelligence, and image processing are enhancing the precision and efficiency of these systems.

- Target acquisition capabilities are becoming integral to autonomous and semi-autonomous robotic platforms, supporting missions in surveillance, combat, and threat neutralization across land, air, and marine domains.

By Domain Type

“Airborne segment holds the largest market revenue and is anticipated to grow at the highest CAGR during the forecast period.”

- The dominance of the airborne segment is driven by the widespread deployment of unmanned aerial vehicles (UAVs) for surveillance, reconnaissance, combat, and logistics support.

- Increased defense budgets and growing demand for long-range, high-endurance aerial systems are fueling market expansion.

- Continuous advancements in drone autonomy, AI integration, and sensor payloads are making airborne robotic platforms more efficient, mission-ready, and indispensable in modern warfare.

Want to get more details about the segmentations? Register Here

By Region Type

“North America holds the largest share of the robotic warfare market.”

- North America's dominance is driven by substantial defense spending, rapid adoption of advanced military technologies, and strong government support for autonomous systems.

- The U.S. Department of Defense leads global investments in AI, robotics, and unmanned combat platforms, accelerating regional market growth.

- The presence of major defense contractors and ongoing modernization programs further reinforces North America's leading position in the global robotic warfare market.

Competitive Landscape

Most of the major players compete in some of the factors, including price, service offerings, regional presence, etc. The following are the key players in the robotic warfare market -

- Elbit Systems Ltd.

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- Rheinmetall AG

- QinetiQ

- General Atomics

- AeroVironment, Inc.

- BAE Systems plc

- Thales Group

- Textron Inc.

Note: The above list does not necessarily include all the top players in the market.

Are you a leading player in this market? We would love to include your name. Please write to us at [email protected]

Recent Developments/Mergers & Acquisitions:

- In August 2023, Rheinmetall AG showcased its advanced autonomous vehicle capabilities during UGV trials in Estonia, featuring the Mission Master SP. This platform is designed to operate both with onboard crews and via remote teleoperation, with the ability to transition seamlessly between the two modes.

- In March 2023, General Dynamics Corporation presented its Tracked Robot 10-ton (TRX) technology demonstrator at the Association of the U.S. Army’s Global Force Symposium. The company highlighted its focus on air defense by integrating the proven M-SHORAD turret onto its robotic combat vehicle.

Report Features

This report provides market intelligence most comprehensively. The report structure has been kept so that it offers maximum business value. It provides critical insights into market dynamics and will enable strategic decision-making for existing market players as well as those willing to enter the market.

The following are the key features of the report:

- Market structure: Overview, industry life cycle analysis, supply chain analysis.

- Market environment analysis: Growth drivers and constraints, Porter’s five forces analysis, SWOT analysis.

- Market trend and forecast analysis.

- Market segment trend and forecast.

- Competitive landscape and dynamics: Market share, Service portfolio, New Product Launches, etc.

- COVID-19 impact and its recovery curve.

- Attractive market segments and associated growth opportunities.

- Emerging trends.

- Strategic growth opportunities for the existing and new players.

- Key success factors.

|

Market Study Period

|

2019-2032

|

|

Base Year

|

2024

|

|

Forecast Period

|

2025-2032

|

|

Trend Period

|

2019-2023

|

|

Number of Tables & Figures

|

>100

|

|

Number of Segments Analysed

|

5 (Application Type, Capability Type, Domain Type, Mode of Operation Type, and Region)

|

|

Number of Regions Analysed

|

4 (North America, Europe, Asia-Pacific, Rest of the World)

|

|

Countries Analysed

|

15 (The USA, Canada, Mexico, Germany, France, Italy, The UK, China, Japan, India, Brazil, Saudi Arabia, Rest of Europe, Rest of APAC, and Rest of the World)

|

|

Free Customization Offered

|

10%

|

|

After Sales Support

|

Unlimited

|

|

Report Presentation

|

Complimentary

|

|

Market Dataset

|

Complimentary

|

|

Further Deep Dive & Consulting Services

|

10% Discount

|

Market Segmentation

This report studies the market, covering a period of 15 years of trend and forecast. The report provides detailed insights into the market dynamics to enable informed business decision-making and growth strategy formulation based on the opportunities present in the market.

The robotic warfare market is segmented into the following categories.

Global Robotic Warfare Market, by Application Type

- Intelligence, Surveillance, and Reconnaissance (ISR)

- Logistics and Support

- Search and Rescue

- Tracking and Targeting

- Combat and Operations

- Training and Simulation

Global Robotic Warfare Market, by Capability Type

- Unmanned Platforms & Systems

- Exoskeleton & Wearables

- Target Acquisition Systems

- Turret & Weapon Systems

Global Robotic Warfare Market, by Domain Type

Global Robotic Warfare Market, by Mode of Operation Type

- Autonomous

- Semi-Autonomous

Robotic Warfare Market, by Region

- North America (Country Analysis: The USA, Canada, and Mexico)

- Europe (Country Analysis: Germany, France, Italy, The UK, and Rest of Europe)

- Asia-Pacific (Country Analysis: Japan, China, India, and Rest of Asia-Pacific)

- Rest of the World (Country Analysis: Brazil, Saudi Arabia, and Others)

Research Methodology

- This strategic assessment report from Stratview Research provides a comprehensive analysis that reflects today’s global robotic warfare market realities and future market possibilities for the forecast period.

- The report segments and analyzes the market in the most detailed manner to provide a panoramic view of the market.

- The vital data/information provided in the report can play a crucial role for market participants and investors in identifying the low-hanging fruits available in the market and formulating growth strategies to expedite their growth process.

- This report offers high-quality insights and is the outcome of a detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research’s internal database and statistical tools.

- More than 1,000 authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white papers, patents, and articles, have been leveraged to gather the data.

- We conducted more than 32 detailed primary interviews with market players across the value chain in all four regions and industry experts to obtain both qualitative and quantitative insights.

Customization Options

With this detailed report, Stratview Research offers one of the following free customization options to our respected clients:

Company Profiling

- Detailed profiling of additional market players (up to three players)

- SWOT analysis of key players (up to three players)

Competitive Benchmarking

- Benchmarking of key players on the following parameters: Service portfolio, geographical reach, regional presence, and strategic alliances

Custom Research: Stratview Research offers custom research services across industries. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to [email protected]