Attractive Opportunities

Global Demand Analysis & Sales Opportunities in Sustainable Aviation Fuel Market

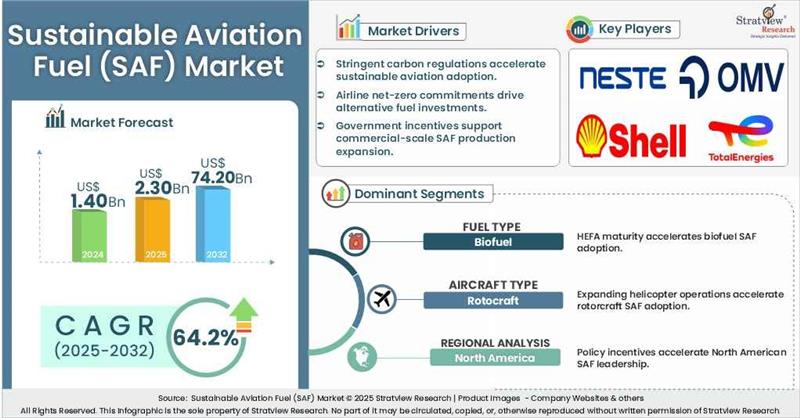

- The annual demand for sustainable aviation fuel was USD 1.40 billion in 2024 and is expected to reach USD 2.30 billion in 2025, up 64.6% than the value in 2024.

- During the next 8 years (forecast period of 2025-2032), the sustainable aviation fuel market is expected to grow at a CAGR of 64.2%. The annual demand will reach of USD 74.20 billion in 2032.

- During 2025-2032, the sustainable aviation fuel industry is expected to generate a cumulative sales opportunity of USD 186.42 billion.

Want to get a free sample? Register Here

High-Growth Market Segments:

- North America dominated the market with the largest revenue share.

- By Fuel type, Biofuel segment is expected to be the fastest-growing during the forecast period.

- By Aircraft type, Rotocraft is expected to showcase significant growth during the forecast period.

- By Technology type, FT-SPK segment is anticipated to grow at the highest CAGR during the forecast period.

- By Platform type, Commercial segment is projected to grow at the highest CAGR during the forecast period.

Market Statistics

Have a look at the sales opportunities presented by the sustainable aviation fuel market in terms of growth and market forecast.

|

Sustainable Aviation Fuel Market Data & Statistics

|

|

|

Market Statistics

|

Value (in USD Billion)

|

Market Growth (%)

|

|

Annual Market Size in 2023

|

USD 0.84 billion

|

-

|

|

Annual Market Size in 2024

|

USD 1.40 billion

|

YoY Growth in 2024: 66.6%

|

|

Annual Market Size in 2025

|

USD 2.30 billion

|

YoY Growth in 2025: 64.6%

|

|

Annual Market Size in 2032

|

USD 74.20 billion

|

CAGR 2025-2032: 64.2%

|

|

Cumulative Sales Opportunity during 2025-2032

|

USD 186.42 billion

|

-

|

|

Top 10 Countries’ Market Share in 2024

|

USD 1.1 +

|

> 80%

|

|

Top 10 Company’s Market Share in 2024

|

USD 0.7 billion to USD 0.9 billion

|

50% - 70%

|

Market Dynamics

Introduction:

What is a sustainable aviation fuel?

Sustainable Aviation Fuel (SAF) is a renewable alternative to conventional jet fuel, made from feedstocks like used cooking oil, agricultural waste, and other non-fossil sources. It can reduce lifecycle greenhouse gas emissions by up to 80% and is fully compatible with existing aircraft and fueling systems. SAF is used in commercial, military, and cargo aircraft, supporting aviation's transition toward net-zero emissions.

Market Drivers:

Technological Advancements in Feedstock Processing and Refining

- One of the strongest drivers of the SAF market growth is the advancement in feedstock conversion and refining technologies. Processes like HEFA, Alcohol-to-Jet (AtJ), and Fischer-Tropsch now enable the efficient production of SAF from a wide range of sources, including used cooking oil, agricultural waste, and municipal solid waste.

- These innovations reduce production costs, improve fuel yields, and ensure compliance with aviation safety standards. As a result, SAF is becoming more scalable, affordable, and commercially viable, accelerating global adoption.

Stringent Emission Targets and Global Net-Zero Commitments

- The global push toward aviation decarbonization is a major driver for the SAF market. Regulatory bodies such as ICAO and IATA have committed to achieving net-zero carbon emissions by 2050, making sustainable aviation fuel a central component of their long-term emission reduction strategies. IATA, in particular, has emphasized SAF as a primary solution for reducing the aviation industry’s carbon footprint.

- Complementing these goals, policies like the U.S. Inflation Reduction Act and the EU’s ReFuelEU initiative are offering tax credits, mandates, and investment support, accelerating the production and adoption of SAF worldwide.

Market Challenges:

Cost Competitiveness

- A major challenge in the sustainable aviation fuel (SAF) market is its high production cost compared to conventional jet fuel. Limited availability of certified feedstocks, energy-intensive refining processes, and a lack of large-scale infrastructure contribute to SAF being 2 to 5 times more expensive than fossil-based alternatives.

- This cost gap makes it difficult for airlines, especially those with tight operating margins, to adopt SAF at scale. Without improvements in production efficiency and expanded supply, cost competitiveness will continue to hinder widespread market growth.

Market Opportunities:

Accelerating Airline Commitments Unlock Long-Term Demand

- Global airlines are increasingly committing to net-zero emissions, creating a powerful long-term demand driver for sustainable aviation fuel. Industry giants like United, Lufthansa, and Air France-KLM have signed multi-year SAF purchase agreements and invested in production ventures to secure future supply.

- As environmental targets tighten and investor pressure around ESG grows, SAF adoption is becoming a strategic priority. This shift presents a major opportunity for fuel producers to scale operations and for new entrants to capture early market share in a rapidly growing sector.

Segment Analysis

|

Segmentations

|

List of Sub-Segments

|

Segments with High-Growth Opportunity

|

|

Fuel Type Analysis

|

Biofuel, Hydrogen Fuel, Power to Liquid Fuel, Gas-to-Liquid

|

Biofuel segment is expected to grow at the highest CAGR during the forecast period.

|

|

Technology Analysis

|

HEFA-SPK, FT-SPK, HFS-SIP, ATJ-SPK

|

FT-SPK segment is expected to grow at a faster pace during the forecast period.

|

|

Aircraft Type Analysis

|

Fixed Wings, Rotorcraft, Others

|

Rotocraft is anticipated to grow at the highest CAGR during the forecast period.

|

|

Platform Type

|

Commercial, Regional Transport Aircraft, Military Aviation, Business & General Aviation, Unmanned Aerial Vehicles

|

Commercial segment is projected to grow at the highest CAGR during the forecast period.

|

|

Regional Analysis

|

North America, Europe, Asia-Pacific, and The Rest of the World

|

North America dominated the market with the largest revenue share.

|

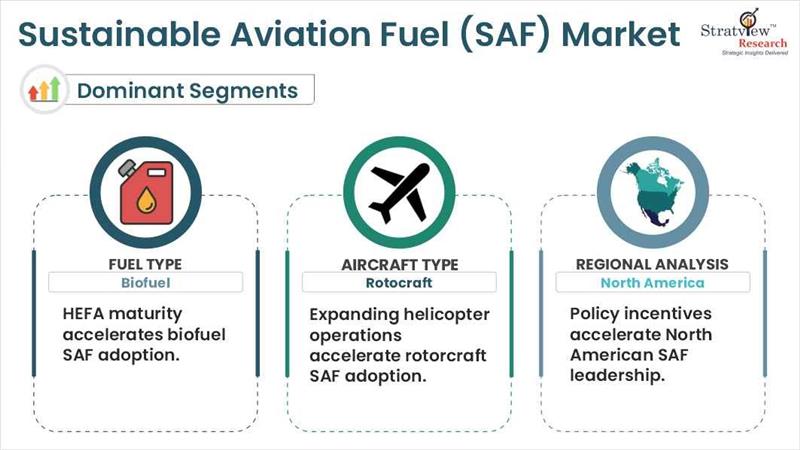

By Fuel Type

“Biofuel segment is expected to grow at the highest CAGR during the forecast period.”

- The strong growth of the biofuel segment is driven by its technological maturity, wide feedstock availability, and compatibility with existing aircraft engines and infrastructure.

- HEFA-based biofuels, produced from used cooking oil and animal fats, are already certified and in commercial use, accelerating large-scale adoption.

- Supportive government policies, blending mandates, and increasing airline investments in SAF projects using bio-based feedstocks are further fueling segment growth.

By Aircraft Type

“Rotocraft is anticipated to grow at the highest CAGR during the forecast period.”

- The growth of the rotorcraft segment is fueled by increasing use of helicopters in defense, emergency medical services, offshore operations, and urban mobility.

- As sustainability goals extend to rotary-wing aviation, SAF is emerging as a viable low-emission fuel alternative for helicopter fleets.

- Advancements in lightweight turbine engines and increased investments in SAF-compatible rotary platforms are accelerating adoption across both civil and military rotorcraft sectors.

Want to get more details about the segmentations? Register Here

Regional Analysis

“North America dominated the market with the largest revenue share.”

- The region’s leadership is driven by early adoption of SAF policies, strong airline commitments, and substantial investments in production infrastructure.

- The U.S. government’s Inflation Reduction Act and SAF tax credits have created a favorable environment for domestic fuel production and usage.

- Major industry players, ongoing R&D, and large-scale procurement agreements by U.S.-based carriers like United and Delta further reinforce North America’s dominant position in the global SAF market.

Competitive Landscape

Most of the major players compete in some of the factors, including price, service offerings, regional presence, etc. The following are the key players in the sustainable aviation fuel market -

Note: The above list does not necessarily include all the top players in the market.

Are you a leading player in this market? We would love to include your name. Please write to us at [email protected]

Recent Developments/Mergers & Acquisitions:

- In February 2025, Neste partnered with DHL Group to explore renewable energy solutions, including renewable diesel (HVO100) and sustainable aviation fuel (SAF), aligning with DHL’s target of net-zero greenhouse gas emissions by 2050. The collaboration focuses on building a commercial model that would allow DHL to procure around 300,000 tons of unblended SAF annually by 2030.

- In February 2025, Gevo and Axens expanded their existing partnership to accelerate the development and commercialization of SAF through the ethanol-to-jet (ETJ) pathway. The collaboration leverages Axens’ Jetanol technology and Gevo’s ethanol-to-olefins (ETO) platform.

- In January 2025, Shell entered a collaboration with Yilkins to combine their technologies for advancing the production of sustainable aviation fuel.

- In January 2025, Topsoe signed a technology and service agreement with Chuangui New Energy Company to support the production of SAF and renewable diesel.

- In December 2024, Neste reached an agreement with Air New Zealand to supply 30 million liters of unblended Neste MY Sustainable Aviation Fuel, Air New Zealand’s largest SAF procurement to date. The fuel will be utilized at Los Angeles (LAX) and San Francisco (SFO) airports through February 2026.

Report Features

This report provides market intelligence most comprehensively. The report structure has been kept so that it offers maximum business value. It provides critical insights into market dynamics and will enable strategic decision-making for existing market players as well as those willing to enter the market.

The following are the key features of the report:

- Market structure: Overview, industry life cycle analysis, supply chain analysis.

- Market environment analysis: Growth drivers and constraints, Porter’s five forces analysis, SWOT analysis.

- Market trend and forecast analysis.

- Market segment trend and forecast.

- Competitive landscape and dynamics: Market share, Service portfolio, New Product Launches, etc.

- COVID-19 impact and its recovery curve.

- Attractive market segments and associated growth opportunities.

- Emerging trends.

- Strategic growth opportunities for the existing and new players.

- Key success factors.

|

Market Study Period

|

2019-2032

|

|

Base Year

|

2024

|

|

Forecast Period

|

2025-2032

|

|

Trend Period

|

2019-2023

|

|

Number of Tables & Figures

|

>100

|

|

Number of Segments Analysed

|

5 (Fuel Type, Aircraft Type, Technology Type, Platform Type, and Region)

|

|

Number of Regions Analysed

|

4 (North America, Europe, Asia-Pacific, Rest of the World)

|

|

Countries Analysed

|

15 (The USA, Canada, Mexico, Germany, France, Italy, The UK, China, Japan, India, Brazil, Saudi Arabia, Rest of Europe, Rest of APAC, and Rest of the World)

|

|

Free Customization Offered

|

10%

|

|

After Sales Support

|

Unlimited

|

|

Report Presentation

|

Complimentary

|

|

Market Dataset

|

Complimentary

|

|

Further Deep Dive & Consulting Services

|

10% Discount

|

Market Segmentation

This report studies the market, covering a period of 15 years of trend and forecast. The report provides detailed insights into the market dynamics to enable informed business decision-making and growth strategy formulation based on the opportunities present in the market.

The global sustainable aviation fuel market is segmented into the following categories.

Global Sustainable Aviation Fuel Market, by Fuel Type

- Biofuel

- Hydrogen Fuel

- Power to Liquid Fuel

- Gas-to-Liquid

Global Sustainable Aviation Fuel Market, by Technology Type

- HEFA-SPK

- FT-SPK

- HFS-SIP

- ATJ-SPK

Global Sustainable Aviation Fuel Market, by Aircraft Type

- Fixed Wings

- Rotorcraft

- Others

Global Sustainable Aviation Fuel Market, by Platform Type

- Commercial

- Regional Transport Aircraft

- Military Aviation

- Business & General Aviation

- Unmanned Aerial Vehicles

Global Sustainable Aviation Fuel Market, by Region

- North America (Country Analysis: The USA, Canada, and Mexico)

- Europe (Country Analysis: Germany, France, Italy, The UK, and Rest of Europe)

- Asia-Pacific (Country Analysis: Japan, China, India, and Rest of Asia-Pacific)

- Rest of the World (Country Analysis: Brazil, Saudi Arabia, and Others)

Research Methodology

- This strategic assessment report from Stratview Research provides a comprehensive analysis that reflects today’s global sustainable aviation fuel market realities and future market possibilities for the forecast period.

- The report segments and analyzes the market in the most detailed manner to provide a panoramic view of the market.

- The vital data/information provided in the report can play a crucial role for market participants and investors in identifying the low-hanging fruits available in the market and formulating growth strategies to expedite their growth process.

- This report offers high-quality insights and is the outcome of a detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research’s internal database and statistical tools.

- More than 1,000 authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white papers, patents, and articles, have been leveraged to gather the data.

- We conducted more than 1.4 detailed primary interviews with market players across the value chain in all four regions and industry experts to obtain both qualitative and quantitative insights.

Customization Options

With this detailed report, Stratview Research offers one of the following free customization options to our respected clients:

Company Profiling

- Detailed profiling of additional market players (up to three players)

- SWOT analysis of key players (up to three players)

Competitive Benchmarking

- Benchmarking of key players on the following parameters: Service portfolio, geographical reach, regional presence, and strategic alliances

Custom Research: Stratview Research offers custom research services across industries. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to [email protected]