Attractive Opportunities

Global Demand Analysis & Sales Opportunities in Aerospace Engineering Services Outsourcing Market

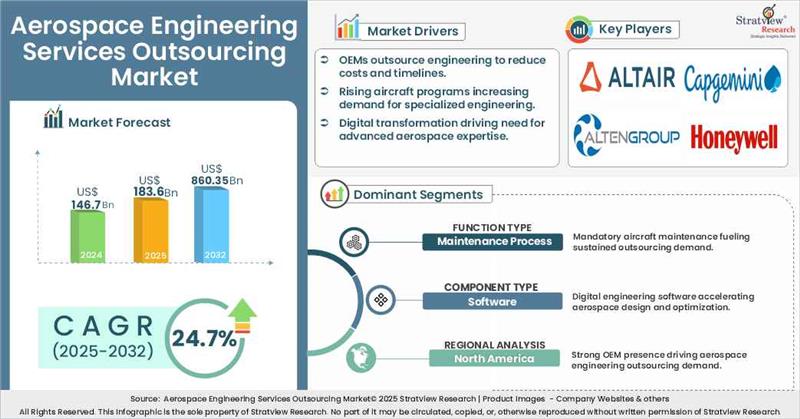

- The annual demand for aerospace engineering services outsourcing market was USD 146.7 billion in 2024 and is expected to reach USD 183.6 billion in 2025, up 25.18% than the value in 2024.

- During the next 8 years (forecast period of 2025-2032), the aerospace engineering services outsourcing market is expected to grow at a CAGR of 24.7%. The annual demand will reach of USD 860.35 billion in 2032, which is almost 4.7 times (~369% up) of the demand in 2025.

- During 2025-2032, the aerospace engineering services outsourcing industry is expected to generate a cumulative sales opportunity of USD 3612.3 billion which is almost 6.4 times the opportunities during 2019-2024.

Want to get a free sample? Register Here

High-Growth Market Segments:

- North America generated the highest demand in 2024, with strong presence of major aerospace OEMs and high investment in R&D as the key growth drivers in the region.

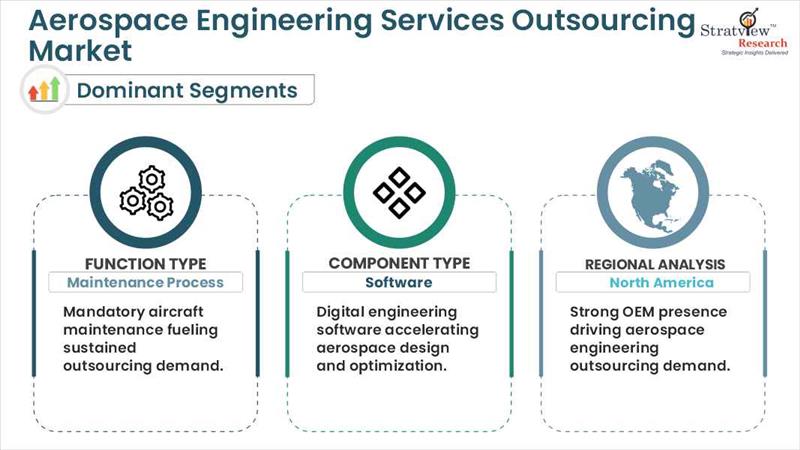

- By function type, maintenance process segment is projected to be the dominant segment during the forecast period.

- By component type, software segment is projected to be the dominant segment during the forecast period.

Market Statistics

Have a look at the sales opportunities presented by the aerospace engineering services outsourcing market in terms of growth and market forecast.

Aerospace Engineering Services Outsourcing Market Data & Statistics

|

Market Statistics

|

Value (in USD Billion)

|

Market Growth (%)

|

|

Annual Market Size in 2023

|

USD 117.17 billion

|

|

|

Annual Market Size in 2024

|

USD 146.70 billion

|

YoY Growth in 2024: 25.2%

|

|

Annual Market Size in 2025

|

USD 183.60 billion

|

YoY Growth in 2025: 25.18%

|

|

Annual Market Size in 2032

|

USD 860.35 billion

|

CAGR 2025-2032: 24.7%

|

|

Cumulative Sales Opportunity during 2025-2032

|

USD 3612.30 billion

|

|

|

Top 10 Countries’ Market Share in 2024

|

USD 117.36 billion +

|

> 80%

|

|

Top 10 Company’s Market Share in 2024

|

USD 73.35 billion to USD 102.7 billion

|

50% - 70%

|

Market Dynamics

Introduction:

What is Aerospace Engineering Services Outsourcing?

Aerospace Engineering Services Outsourcing (ESO) is the process of aerospace firms outsourcing specialized engineering work to third-party service providers that may be based in a foreign country. Such services encompass design, simulation, analysis, testing, prototyping, system integration, and software development of aircraft, spacecraft, and associated systems.

Market Drivers:

Increasing Complexity in Aerospace Technologies:

- The increasing technological complexity of aerospace technologies, like AI-based avionics, autonomous systems, and electrified powertrains, is significantly driving the demand for Aerospace Engineering Services Outsourcing (ESO).

- OEMs and Tier-1 suppliers increasingly turn towards ESO service providers for specialized expertise, simulation software, and assistance in dealing with complex design and integration complexities, allowing them to innovate at a faster pace and scale, while keeping focus on core technical innovation.

Rising Need for Operational Efficiency and Cost Optimization:

- The rising need for operational efficiency and cost optimization is also one of the factors driving the growth of the aerospace engineering services outsourcing (ESO) market. By outsourcing engineering tasks, firms can access skilled talent at lower costs, streamline workflows, and scale resources flexibly. This enables them to keep high-quality production while minimizing overhead costs related to internal development.

- Therefore, outsourcing becomes a strategic method towards realizing efficiency, affordability, and accelerated innovation in a highly complex aerospace environment.

Market Challenges:

Intellectual Property (IP) and Data Security Threats:

- Intellectual Property (IP) and data security threats are key issues in aerospace engineering services outsourcing due to the sensitive and proprietary nature of aerospace technologies. Outsourcing confidential information to third-party suppliers poses increased vulnerability to cyber-attacks, IP theft, and regulatory non-compliance.

- Thus, to ensure secure handling of data, strict non-disclosure agreements, and strict compliance with global data protection guidelines are crucial.

Segment Analysis

|

Segmentations

|

List of Sub-Segments

|

Segments with High-Growth Opportunity

|

|

Service Type Analysis

|

Mechanical Engineering, Electric/ Electronic Engineering, and Embedded Software Engineering

|

Mechanical Engineering segment is projected to account for the largest share of the market during the forecast period.

|

|

Function Type Analysis

|

Design, Simulation & Digital Validation, Production Process, and Maintenance Process

|

Maintenance Process segment is projected to dominate the market with the largest share during the forecast period.

|

|

Location Type Analysis

|

On-shore and Off-shore

|

Off-Shore segment is projected to be the fastest-growing segment during the forecast period.

|

|

Component Type Analysis

|

Hardware and Software

|

Software segment is anticipated to be dominant and fastest-growing segment during the forecast period.

|

|

Regional Analysis

|

North America, Europe, Asia-Pacific, and The Rest of the World

|

North America is expected to be the dominant and fastest-growing region over the forecasted period.

|

By Function Type

“Maintenance Process segment is expected to dominate the market with the largest share during the forecast period.”

- The aerospace engineering services outsourcing market is segmented by function type into design, simulation & digital validation, production process, and maintenance process.

- Maintenance Process segment is expected to dominate the market with the largest share during the forecast period. This category encompasses after-market features that have become a priority for the aerospace sector. All aircraft types need regular maintenance to guarantee safety, minimized downtime & related costs, and service delivery reliability, in addition to optimal service life. Thus, the regular maintenance of the aircraft fleet drives the demand for efficient outsourcing services.

By Component Type

“Software segment is anticipated to be dominant and fastest-growing segment during the forecast period.”

- The aerospace engineering services outsourcing market is segmented by component type into Hardware and Software.

- Software segment is anticipated to be dominant and fastest-growing segment during the forecast period, driven by the growing demand for optimization and efficiency within the aerospace sector, as aerospace firms constantly look for ways to enhance design processes, shorten development timelines, and optimize flight performance. Software offerings like Computer-Aided Design (CAD), Computer-Aided Manufacturing (CAM), and simulation tools help them attain these objectives and have become a central component of designing and testing.

- In addition, software is also instrumental in incorporating new elements, utilizing technologies like artificial intelligence (AI), machine learning, and big data analytics in aerospace systems.

Want to get more details about the segmentations? Register Here

Regional Analysis

“North America is expected to be the dominant and fastest-growing region over the forecasted period.”

- Based on region, the aerospace engineering services outsourcing market has been segmented into North America, Europe, Asia Pacific, and the Rest of the world.

- North America is expected to be the dominant and fastest-growing region over the forecasted period, due to the strong presence of major aerospace OEMs and high investment in R&D.

- North American aerospace firms are rapidly adopting digital engineering, simulation, and predictive maintenance, all of which require specialized technical expertise, which are often outsourced.

- The region’s focus on digital transformation, advanced avionics, and stringent regulatory compliance further drives demand for specialized engineering services, reinforcing its dominance in global aerospace outsourcing.

Competitive Landscape

Most of the major players compete in some of the factors, including price, service offerings, regional presence, etc. The following are the key players in the aerospace engineering services outsourcing market –

- Altair Engineering Inc.

- Alten Group

- Capgemini

- Honeywell International Inc.

- L&T Technology Services Limited

- Teledyne Technologies Incorporated

- BAE Systems

- L3Harris Technologies, Inc.

- Elbit Systems Ltd.

- RTX

Note: The above list does not necessarily include all the top players in the market.

Are you a leading player in this market? We would love to include your name. Please write to us at [email protected]

Recent Developments/Mergers & Acquisitions:

- In June 2024, Honeywell announced the acquisition of CAES Systems Holdings LLC to strengthen its aerospace and defense portfolio. The deal enhances Honeywell’s capabilities in electromagnetic defense technologies and RF signal management across air, land, sea, and space domains.

- In 2023, ALTEN Group, headquartered in Paris, and a market leader in engineering and technology consulting services, acquired the strategic Accord Global Technology Solutions. This strategic acquisition combines ALTEN's scale and technology diversity with the digital innovation and know-how of Accord Global Technology Solutions in the aerospace and automotive industries.

Report Features

This report provides market intelligence most comprehensively. The report structure has been kept so that it offers maximum business value. It provides critical insights into market dynamics and will enable strategic decision-making for existing market players as well as those willing to enter the market.

The following are the key features of the report:

- Market structure: Overview, industry life cycle analysis, supply chain analysis.

- Market environment analysis: Growth drivers and constraints, Porter’s five forces analysis, SWOT analysis.

- Market trend and forecast analysis.

- Market segment trend and forecast.

- Competitive landscape and dynamics: Market share, Service portfolio, New Product Launches, etc.

- COVID-19 impact and its recovery curve.

- Attractive market segments and associated growth opportunities.

- Emerging trends.

- Strategic growth opportunities for the existing and new players.

- Key success factors.

|

Market Study Period

|

2019-2032

|

|

Base Year

|

2024

|

|

Forecast Period

|

2025-2032

|

|

Trend Period

|

2019-2023

|

|

Number of Tables & Figures

|

>100

|

|

Number of Segments Analysed

|

5 (Service Type, Function Type, Location Type, Component Type, and Region)

|

|

Number of Regions Analysed

|

4 (North America, Europe, Asia-Pacific, Rest of the World)

|

|

Countries Analysed

|

15 (The USA, Canada, Mexico, Germany, France, Italy, The UK, China, Japan, India, Brazil, Saudi Arabia, Rest of Europe, Rest of APAC, and Rest of the World)

|

|

Free Customization Offered

|

10%

|

|

After Sales Support

|

Unlimited

|

|

Report Presentation

|

Complimentary

|

|

Market Dataset

|

Complimentary

|

|

Further Deep Dive & Consulting Services

|

10% Discount

|

Market Segmentation

This report studies the market, covering a period of 15 years of trend and forecast. The report provides detailed insights into the market dynamics to enable informed business decision-making and growth strategy formulation based on the opportunities present in the market.

The Aerospace Engineering Services Outsourcing market is segmented into the following categories:

By Service Type

- Mechanical Engineering

- Electric/ Electronic Engineering

- Embedded Software Engineering

By Function Type

- Design

- Simulation & Digital Validation

- Production Process

- Maintenance Process

By Location Type

By Component Type

By Region

- North America (Country Analysis: The USA, Canada, and Mexico)

- Europe (Country Analysis: Germany, France, Italy, The UK, and Rest of Europe)

- Asia-Pacific (Country Analysis: Japan, China, India, and Rest of Asia-Pacific)

- Rest of the World (Country Analysis: Brazil, Saudi Arabia, and Others)

Research Methodology

- This strategic assessment report from Stratview Research provides a comprehensive analysis that reflects today’s Aerospace Engineering Services Outsourcing market realities and future market possibilities for the forecast period.

- The report segments and analyzes the market in the most detailed manner to provide a panoramic view of the market.

- The vital data/information provided in the report can play a crucial role for market participants and investors in identifying the low-hanging fruits available in the market and formulating growth strategies to expedite their growth process.

- This report offers high-quality insights and is the outcome of a detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research’s internal database and statistical tools.

- More than 1,000 authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white papers, patents, and articles, have been leveraged to gather the data.

- We conducted more than 15 detailed primary interviews with market players across the value chain in all four regions and industry experts to obtain both qualitative and quantitative insights.

Report Customization Options

With this detailed report, Stratview Research offers one of the following free customization options to our respected clients:

Company Profiling

- Detailed profiling of additional market players (up to three players)

- SWOT analysis of key players (up to three players)

Competitive Benchmarking

- Benchmarking of key players on the following parameters: Service portfolio, geographical reach, regional presence, and strategic alliances

Custom Research: Stratview Research offers custom research services across industries. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to [email protected]