Attractive Opportunities

Global Demand Analysis & Sales Opportunities in Logistics Automation Market

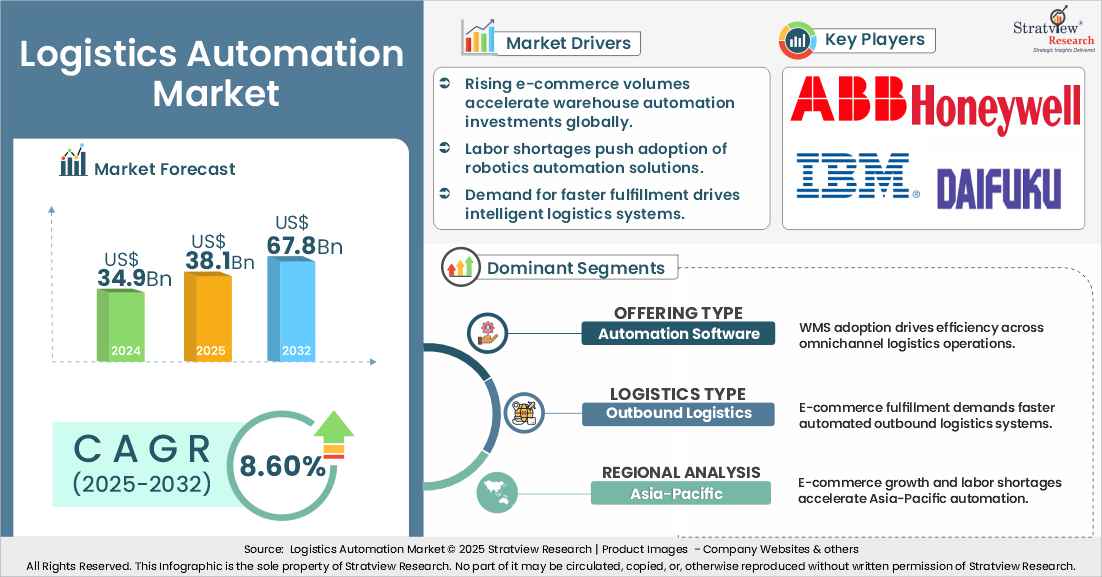

- The annual demand for data center networking was USD 34.9 billion in 2024 and is expected to reach USD 38.1 billion in 2025, up 9.0% than the value in 2024.

- During the next 8 years (forecast period of 2025-2032), the logistics automation market is expected to grow at a CAGR of 8.60%. The annual demand will reach of USD 67.8 billion in 2032, which is almost 1.75 times (~75% up) of the demand in 2025.

- During 2025-2032, the logistics automation industry is expected to generate a cumulative sales opportunity of USD 415.06 billion which is almost 2.54 times the opportunities during 2019-2024.

Want to get a free sample? Register Here

High-Growth Market Segments:

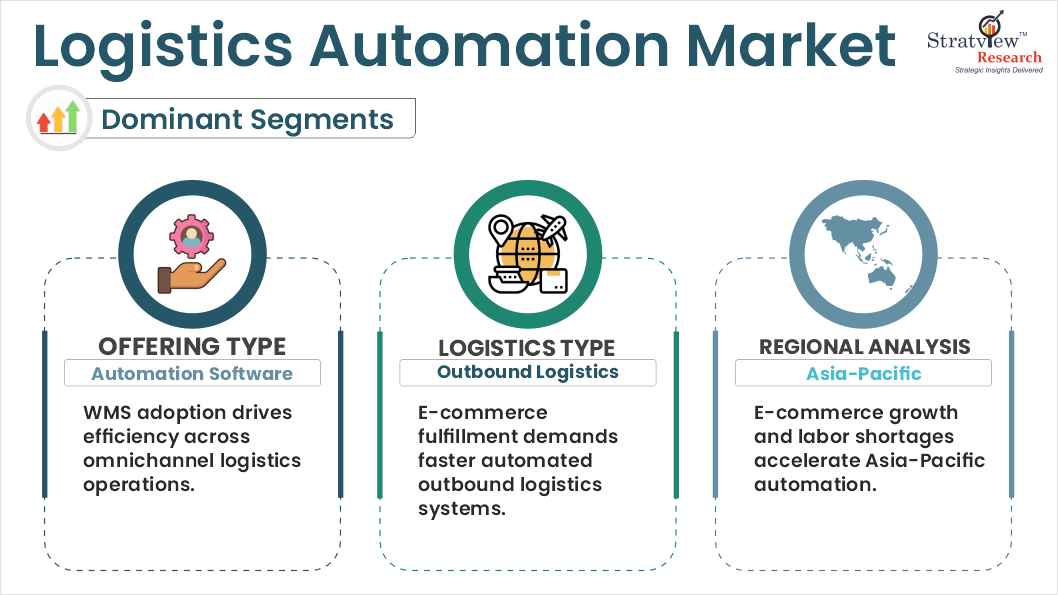

- Asia Pacific generated the highest demand in 2024, with booming e-commerce industry as the key growth driver in the region.

- By offering type, automation software segment is projected to be the dominant segment during the forecast period.

- By logistics type, outbound logistics segment is expected to the dominant segment during the forecast period.

Market Statistics

Have a look at the sales opportunities presented by the logistics automation market in terms of growth and market forecast.

Logistics Automation Market Data & Statistics

|

Market Statistics

|

Value (in USD Billion)

|

Market Growth (%)

|

|

Annual Market Size in 2023

|

USD 32.21 billion

|

|

|

Annual Market Size in 2024

|

USD 34.9 billion

|

YoY Growth in 2024: 8.4%

|

|

Annual Market Size in 2025

|

USD 38.1 billion

|

YoY Growth in 2025: 9.0%

|

|

Annual Market Size in 2032

|

USD 67.8 billion

|

CAGR 2025-2032: 8.60%

|

|

Cumulative Sales Opportunity during 2025-2032

|

USD 415.06 billion

|

|

|

Top 10 Countries’ Market Share in 2024

|

USD 27.92 billion +

|

> 80%

|

|

Top 10 Company’s Market Share in 2024

|

USD 17.45 billion to USD 24.43 billion

|

50% - 70%

|

Market Dynamics

Introduction

What is logistics automation?

Logistics automation refers to the use of technology and automated systems to manage and streamline logistics operations such as inventory handling, warehousing, transportation, and order fulfillment. By integrating tools like robotics, software, and data analytics, it enhances efficiency, reduces manual errors, and improves speed and accuracy across the supply chain. The logistics automation market consists of the technologies, systems, and software solutions that streamline and optimize the movement, storage, and flow of goods throughout the supply chain. Driven by the surge in e-commerce, globalization of trade, and rising consumer expectations for speed and accuracy, automation in logistics has become essential for improving operational efficiency, reducing costs, and enhancing service levels. From automated storage and retrieval systems (AS/RS) and robotics to artificial intelligence, real-time tracking, and warehouse management software, logistics automation enables organizations to handle growing volumes of goods with precision and scalability. As businesses increasingly seek resilient and adaptive supply chains, the logistics automation market is poised for sustained growth across sectors such as retail, manufacturing, healthcare, and third-party logistics.

Market Drivers:

Surge in E-Commerce Accelerates Automation Adoption:

- The trend of modular and scalable data center architectures is driven by the increasing demand for sustainability, flexibility, and efficiency. Compared to traditional facilities, modular data centers have several advantages, such as easier expansion, quicker implementation, and lower operating expenses.

- They use standardised power, cooling, and IT infrastructure modules, which makes assembly and reconfiguration easier. As a result, businesses may minimize waste and maximize energy utilization while swiftly adjusting to shifting capacity requirements, which eventually drives the logistics automation market.

Market Challenges:

High Capital Costs Limit Automation Uptake:

- The modification costs for facilities, software, hardware, and system integration of logistic automation is on the higher side, many businesses, especially small and medium-sized businesses, are discouraged from updating outdated systems due to these high costs.

- The financial load is increased by capital expenditures as well as continuing maintenance, employee retraining, and cultural adjustment. As a result, the high cost of automation becomes a significant obstacle, especially in a sector where maintaining competitiveness requires quick innovation and operational adaptability.

Complexity of Integrating with Legacy Systems:

- Many logistics companies use deeply integrated legacy systems, which makes it difficult and dangerous to integrate them with contemporary automation solutions. It often requires an extensive amount of planning, specialized knowledge, and customization to integrate new technologies, like robotics or AI-driven analytics, into these outdated infrastructures.

- Any integration error could lead to operational outages, inconsistent data, or service interruptions, discouraging companies from pursuing automation projects. Legacy system integration is a recurring obstacle in the implementation of logistics automation because of these financial and technical concerns, as well as the requirement for continuous employee training.

Market Opportunities:

Automation-as-a-Service Lowers Barriers to Entry:

- Automation-as-a-Service (AaaS) provides businesses with a low-risk, scalable solution to implement logistics automation without having to make a significant upfront investment. Organizations may quickly deploy and scale solutions that fulfill shifting market demands by utilizing cloud-based tools and robotic process automation (RPA).

- AaaS makes it possible to enhance cost effectiveness, delivery optimization, inventory management, and mistake reduction. This model is important for logistics providers looking to improve the performance and customer service without making long-term financial commitments, since it enables businesses to upgrade their supply chains while maintaining agility.

Segment Analysis

|

Segmentations

|

List of Sub-Segments

|

Segments with High-Growth Opportunity

|

|

Offering Type Analysis

|

Automated systems, Automation Software, and Software by Deployment Mode

|

Automation Software segment is projected to be the dominant segment during the forecast period.

|

|

Logistics Type Analysis

|

Inbound, Outbound, and Reverse Logistics

|

Outbound Logistics segment is expected to be the dominant segment during the forecast period.

|

|

Technology Type Analysis

|

Robotic process automation, AI & analytics, IoT, Blockchain, and Big Data

|

IoT segment is expected to be the fastest-growing segment during the forecast period.

|

|

End-Use Type Analysis

|

Retail & Ecommerce, Healthcare and Pharmaceuticals, Manufacturing, Automotive, and Third-party Logistics

|

Third Party Logistics segment is expected to be the dominant segment during the forecast period.

|

|

Regional Analysis

|

North America, Europe, Asia-Pacific, and The Rest of the World

|

Asia-Pacific is expected to be the dominant and fastest-growing region over the forecasted period.

|

By Offering Type

“Automation Software segment is projected to be the dominant segment during the forecast period.”

- The logistics automation market is segmented by offering type into automated systems, automation software, and software by deployment mode.

- Automation software segment is projected to be the dominant segment during the forecast period, by automation software. Warehouse Management Systems (WMS) optimize key warehousing activities such as inventory tracking, picking, receiving, and shipping, making it crucial for industries like retail, e-commerce, and manufacturing, which require quick and accurate order fulfillment.

- The integration of WMS with advanced technologies such as AS/RS, AGVs, and robotics boosts productivity and reduces processing time. As omnichannel retail grows, WMS helps companies improve inventory visibility and delivery speed, ensuring customer satisfaction.

By Logistics Type

“Outbound Logistics segment is expected to be the dominant segment during the forecast period.”

- The logistics automation market is segmented by logistics type into inbound, outbound, and reverse logistics.

- Outbound logistics segment is expected to be the dominant segment during the forecast period. Delivering items from warehouses to consumers is known as outbound logistics, and it is essential to supply chains, especially in the industrial, retail, and e-commerce sectors.

- Automation solutions optimize order fulfillment, reduce lead times, minimize errors, and improve customer satisfaction, creating a growing demand for speedy, safe, and adaptable deliveries. Businesses are implementing technology such as drones, driverless cars, and AI-powered route optimization to optimize outbound logistics and facilitate omnichannel retailing.

Want to get more details about the segmentations? Register Here

Regional Analysis

“Asia-Pacific is expected to be the dominant and the fastest-growing region over the forecasted period.”

- Based on region, the logistics automation market has been segmented into North America, Europe, Asia Pacific, and the Rest of the world.

- Asia-Pacific is expected to be the dominant and the fastest-growing region over the forecasted period. The booming e-commerce industry in China, India, and Southeast Asia is driving demand for faster, more efficient logistics to meet rising consumer expectations for quick delivery. Automation technologies like robotics, AI, and advanced software are being adopted to handle high order volumes and reduce reliance on manual labor.

- Labor shortages and rising costs in countries like Japan and South Korea are also pushing companies to invest in automation. Government initiatives, such as China’s “Made in China 2025” and Japan’s “Society 5.0,” along with regional trade agreements like RCEP, are further fueling the demand for automated logistics solutions. As a result, the region is poised to lead the logistics automation market.

Competitive Landscape

Top Players

Most of the major players compete in some of the factors, including price, service offerings, regional presence, etc. The following are the key players in the logistics automation market -

- ABB (Switzerland)

- Daifuku (Japan)

- Honeywell (US)

- IBM (US)

- Jungheinrich (Germany)

- KION Group (Germany)

- KUKA Group (Germany)

- Manhattan Associates (US)

- Oracle (US)

- SAP (Germany)

- Samsung SDS (South Korea)

Note: The above list does not necessarily include all the top players in the market.

Are you a leading player in this market? We would love to include your name. Please write to us at [email protected]

Recent Developments/Mergers & Acquisitions:

- In September 2024, Dematic implemented a compact AutoStore automation system for Grupo Servicio Móvil, a Spanish third-party logistics provider specializing in the healthcare sector. This system is designed to optimise the handling and distribution of medical supplies for a major hospital in Madrid. Despite occupying only 190 square meters, the system incorporates advanced features such as regenerative energy technology and scalable architecture, enabling efficient operations while allowing for future expansion in line with evolving business demands.

- In September 2024, SAP acquired WalkMe Ltd., a prominent provider of digital adoption platforms, to strengthen its user experience and digital transformation capabilities. By integrating WalkMe’s technology, SAP aims to streamline workflow execution across its suite of business applications, thereby enhancing user experience and operational efficiency. Additionally, WalkMe’s advanced AI functionalities will support and expand the capabilities of SAP’s digital assistant, Joule, offering context-aware assistance that improves productivity and user engagement across enterprise environments.

Report Features

This report provides market intelligence most comprehensively. The report structure has been kept so that it offers maximum business value. It provides critical insights into market dynamics and will enable strategic decision-making for existing market players as well as those willing to enter the market.

The following are the key features of the report:

- Market structure: Overview, industry life cycle analysis, supply chain analysis.

- Market environment analysis: Growth drivers and constraints, Porter’s five forces analysis, SWOT analysis.

- Market trend and forecast analysis.

- Market segment trend and forecast.

- Competitive landscape and dynamics: Market share, Service portfolio, New Product Launches, etc.

- COVID-19 impact and its recovery curve.

- Attractive market segments and associated growth opportunities.

- Emerging trends.

- Strategic growth opportunities for the existing and new players.

- Key success factors.

|

Market Study Period

|

2019-2032

|

|

Base Year

|

2024

|

|

Forecast Period

|

2025-2032

|

|

Trend Period

|

2019-2023

|

|

Number of Tables & Figures

|

>100

|

|

Number of Segments Analysed

|

5 (Offering Type, Logistics Type, Technology Type, End-Use Industry Type, and Region)

|

|

Number of Regions Analysed

|

4 (North America, Europe, Asia-Pacific, Rest of the World)

|

|

Countries Analysed

|

15 (The USA, Canada, Mexico, Germany, France, Italy, The UK, China, Japan, India, Brazil, Saudi Arabia, Rest of Europe, Rest of APAC, and Rest of the World)

|

|

Free Customization Offered

|

10%

|

|

After Sales Support

|

Unlimited

|

|

Report Presentation

|

Complimentary

|

|

Market Dataset

|

Complimentary

|

|

Further Deep Dive & Consulting Services

|

10% Discount

|

Market Segmentation

This report studies the market, covering a period of 15 years of trend and forecast. The report provides detailed insights into the market dynamics to enable informed business decision-making and growth strategy formulation based on the opportunities present in the market.

The logistics automation market is segmented into the following categories:

By Offering Type

- Automated Systems

- Automation Software

By Logistics Type

- Inbound

- Outbound

- Reverse Logistics

By Technology Type

- Robotics process automation

- AI and analytics

- Blockchain

- Big Data

- IoT

By End-Use Type

- Retail & E-commerce

- Medical and Pharmaceuticals

- Manufacturing

- Automotive

- Third party Logistics

By Region

- North America (Country Analysis: The USA, Canada, and Mexico)

- Europe (Country Analysis: Germany, France, The UK, Russia, and the Rest of Europe)

- Asia-Pacific (Country Analysis: China, Japan, India, and Rest of Asia-Pacific)

- Rest of the World (Country Analysis: Brazil, Saudi Arabia, and Others)

Research Methodology

- This strategic assessment report from Stratview Research provides a comprehensive analysis that reflects today’s logistics automation market realities and future market possibilities for the forecast period.

- The report segments and analyzes the market in the most detailed manner to provide a panoramic view of the market.

- The vital data/information provided in the report can play a crucial role for market participants and investors in identifying the low-hanging fruits available in the market and formulating growth strategies to expedite their growth process.

- This report offers high-quality insights and is the outcome of a detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research’s internal database and statistical tools.

- More than 1,000 authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white papers, patents, and articles, have been leveraged to gather the data.

- We conducted more than 15 detailed primary interviews with market players across the value chain in all four regions and industry experts to obtain both qualitative and quantitative insights.

Report Customization Options

With this detailed report, Stratview Research offers one of the following free customization options to our respected clients:

Company Profiling

- Detailed profiling of additional market players (up to three players)

- SWOT analysis of key players (up to three players)

Competitive Benchmarking

- Benchmarking of key players on the following parameters: Service portfolio, geographical reach, regional presence, and strategic alliances

Custom Research: Stratview Research offers custom research services across industries. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to [email protected]