Attractive Opportunities

Global Demand Analysis & Sales Opportunities in Data Center Infrastructure Management Market

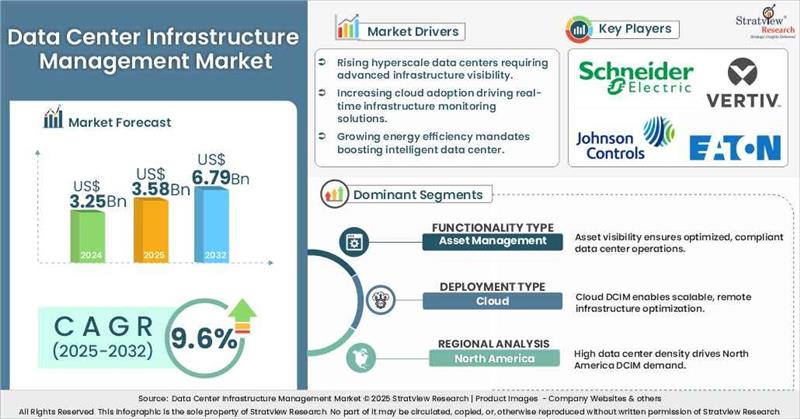

- The annual demand for data center infrastructure management market was USD 3.25 billion in 2024 and is expected to reach USD 3.58 billion in 2025, up 10% than the value in 2024.

- During the next 8 years (forecast period of 2025-2032), the data center infrastructure management market is expected to grow at a CAGR of 9.6%. The annual demand will reach of USD 6.79 billion in 2032, which is almost 1.9 times (~90% up) of the demand in 2025.

- During 2025-2032, the data center infrastructure management industry is expected to generate a cumulative sales opportunity of USD 40.42 billion which is almost 2.42 times the opportunities during 2019-2024.

Want to get a free sample? Register Here

High-Growth Market Segments:

- North America generated the highest demand in 2024, with advanced technological infrastructure and high data center concentration as the key growth drivers in the region.

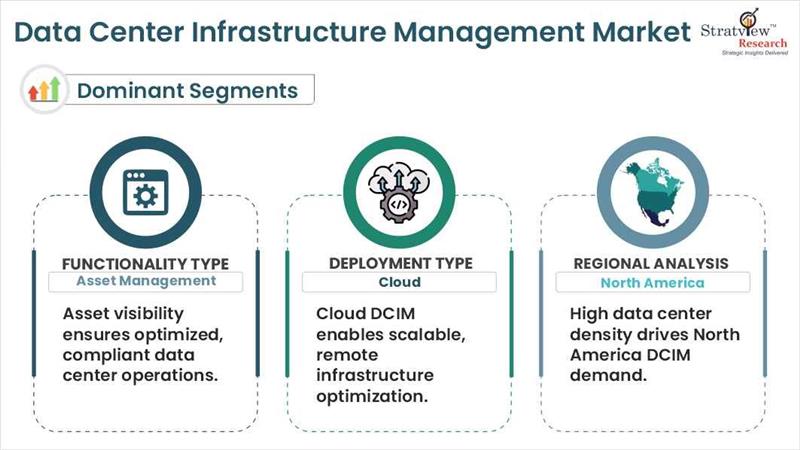

- By functionality type, asset management segment is projected to be the dominant segment during the forecast period.

- By deployment type, cloud segment is projected to be the dominant segment during the forecast period.

Market Statistics

Have a look at the sales opportunities presented by the data center infrastructure management market in terms of growth and market forecast.

Data Center Infrastructure Management Market Data & Statistics

|

Market Statistics

|

Value (in USD Billion)

|

Market Growth (%)

|

|

Annual Market Size in 2023

|

USD 3.05 billion

|

|

|

Annual Market Size in 2024

|

USD 3.25 billion

|

YoY Growth in 2024: 6.44%

|

|

Annual Market Size in 2025

|

USD 3.58 billion

|

YoY Growth in 2025: 10%

|

|

Annual Market Size in 2032

|

USD 6.79 billion

|

CAGR 2025-2032: 9.6%

|

|

Cumulative Sales Opportunity during 2025-2032

|

USD 40.42 billion

|

|

|

Top 10 Countries’ Market Share in 2024

|

USD 2.6 billion +

|

> 80%

|

|

Top 10 Company’s Market Share in 2024

|

USD 1.62 billion to USD 2.27 billion

|

50% - 70%

|

Market Dynamics

Introduction

What is data center infrastructure management?

Data Center Infrastructure Management, or DCIM, is a comprehensive method of monitoring, managing, and optimizing physical resources and assets in a data center. It fills the gap between IT and facility management by offering real-time insight into power consumption, cooling effectiveness, server utilization, space usage, and overall operational performance. The data center infrastructure market is escalating, with the growing popularity of hybrid IT environments translating into greater demand for cloud-based DCIM solutions for remote monitoring and management of dispersed data centers. Moreover, the integration of advanced technologies like artificial intelligence, machine learning, and automation has also improved the performance of DCIM software.

Market Drivers:

Increasing Data Center Complexity:

- The increasing complexity of data centers, comprising hardware, software, physical infrastructure, and services that need seamless integration, is a significant factor driving the growth of the DCIM market. The IT infrastructure's complexity has increased as companies are moving more and more towards cloud-based environments, especially in multicloud and hybrid setups.

- Therefore, Vast volumes of data need to be processed quickly in large organisations, and maximum availability should be ensured with minimal power consumption. This has caused an increasing need for efficient data center management to maintain the optimum performance, minimize downtime, and maximize efficiency.

- Additionally, innovations in data center technologies, including AI-enabled automation, liquid cooling systems, edge data centers, and predictive analytics, will continue to accelerate the need for stable DCIM tools for future environments and service needs.

Market Challenges:

High Implementation Costs of DCIM Solutions:

- High implementation costs continue to be a major challenge to the widespread adoption of data center infrastructure management (DCIM) solutions. It starts with an up-front payment of software license costs, frequently packaged in tiers that involve extra costs for monitoring power, tracking assets, and controlling environments.

- In addition to software, the installation of physical components such as environmental sensors, intelligent power distribution units, and network hardware imposes additional costs. Seamless integration with legacy IT and facility systems involves bespoke development, both costly and time intensive. Moreover, organizations need to spend on training staff or recruiting experienced staff to run and maintain the system efficiently, which further adds to the overall costs.

Market Opportunities:

Increasing Investments in Data Centers:

- Growing investments in data center technologies present a significant opportunity for the growth of the DCIM market. Global investment in the first half of 2024 hit USD 22 billion, propelled by strong demand for more capacity, greater agility in data center performance, and more energy efficiency.

- As data center operators grow and expand their data centers, they need advanced tools to handle intricate environments, optimize resources, and improve operational efficiency. Growing investments in data center technologies by large tech players such as AWS, Microsoft, Google, IBM, and Alibaba Cloud provide great opportunities for growth for DCIM vendors. Moreover, sustainability has also led to the need for DCIM solutions.

- With the increasing green data center trend, the need for DCIM solutions will grow to minimize carbon footprints, hence driving the growth of this market.

Segments' Analysis

|

Segmentations

|

List of Sub-Segments

|

Segments with High-Growth Opportunity

|

|

Offering Type Analysis

|

DCIM Software and Services

|

Services segment is anticipated to grow at the highest CAGR during the forecast period.

|

|

Functionality Type Analysis

|

Performance Optimization, Asset Management, Configuration, Operational Monitoring, Reporting & Dashboards, and Other Functionalities

|

Asset Management segment is expected to hold the largest market share during the forecast period.

|

|

Deployment Type Analysis

|

On-premises and Cloud

|

Cloud segment is projected to register the highest growth rate during the forecast period.

|

|

Tier Type Analysis

|

Tier 1, Tier 2, Tier 3, and Tier 4

|

Tier 3 segment is expected to lead the market during the forecast period.

|

|

Data Center Size Type Analysis

|

Small Data Centers, Mid-Sized Data Centers, and Large Data Centers

|

Large Data Centers segment is projected to account for the largest share of the market during the forecast period.

|

|

End-User Type Analysis

|

Enterprises, Telecom Service Providers, and Cloud Service Providers

|

Enterprise segment is expected to lead the market during the forecast period.

|

|

Regional Analysis

|

North America, Europe, Asia-Pacific, and The Rest of the World

|

North America is expected to be the dominant and fastest-growing region over the forecasted period.

|

By Functionality Type

“Asset Management segment is expected to hold the largest market share during the forecast period.”

- The data center infrastructure management market is segmented by functionality type into performance optimization, asset management, configuration, operational monitoring, reporting & dashboards, and other functionalities.

- Asset management segment is expected to hold the largest market share during the forecast period as it is essential for monitoring and optimizing physical and virtual assets to ensure efficient and secure data center operations. It includes tracking all hardware, software, and related infrastructure assets.

- Asset management includes inventory management, workflow & change management, and location tracking. Additionally, the integration of asset management solutions with DCIM platforms seamlessly produces a seamless workflow transition, accurate tracking of changes, and regulatory compliance, ultimately achieving the stability and performance of data center infrastructure.

By Deployment Type

“Cloud segment is expected to dominate the market during the forecast period.”

- The data center infrastructure management market is segmented by deployment type into on-premises and cloud.

- Cloud segment is expected to dominate the market with the largest share during the forecast period. The growing demand for flexible, versatile, and cost-effective ways to monitor data center infrastructure will drive the adoption of cloud-based DCIM solutions.

- Cloud-based DCIM enables remote access for monitoring, analysis, and control of data center assets without the need for on-site servers and hardware. Moreover, Industry reports indicate that cloud-based DCIM adoption rates will surge quickly because it can incorporate technologies such as AI and ML, which optimize energy usage and forecast hardware failure.

Want to get more details about the segmentations? Register Here

Regional Analysis

“North America is expected to be the dominant and fastest-growing region over the forecasted period.”

- Based on region, the data center infrastructure management market has been segmented into North America, Europe, Asia Pacific, and the Rest of the world.

- North America is expected to be the dominant and fastest-growing region over the forecasted period, driven by the combination of advanced technological infrastructure and high data center concentration. The North American region accounts for more than 40% of the total data centers in the world.

- Moreover, the rapid adoption of the latest technologies like the Internet of Things (IoT) and edge computing in the region is generating massive amounts of data, which needs advanced DCIM solutions to manage effectively.

Competitive Landscape

Top Players

Most of the major players compete in some of the factors, including price, service offerings, regional presence, etc. The following are the key players in the data center infrastructure management market -

- Schneider Electric

- Vertiv

- Johnson Controls

- Eaton

- Delta Electronics

- Huawei

- ABB

- Rittal

- FNT Software

- Franklin Electric

Note: The above list does not necessarily include all the top players in the market.

Are you a leading player in this market? We would love to include your name. Please write to us at [email protected]

Recent Developments/Mergers & Acquisitions:

- In February 2025, FNT Software partnered with Netcon Americas to provide better IT, data center, and telecommunication infrastructure management. This union combines FNT's cutting-edge DCIM software with Netcon's consulting capabilities, providing better visibility, automation, and operational efficiency. With mutual emphasis on innovation, the companies seek to maximize IT and telecom networks, ensuring higher reliability and transformational outcomes for customers.

- In October 2024, Schneider Electric acquired a 75% controlling stake in Motivair Corporation to enhance its data center cooling solutions. Motivair, a liquid cooling provider, focuses on Distribution Units, Rear Door Heat Exchangers, and thermal management solutions. The acquisition was to boost Schneider's portfolio in the face of increasing demand for effective cooling in AI-powered data centers. Motivair operated under its current leadership, with Schneider set to buy the remaining 25% by 2028.

Report Features

This report provides market intelligence most comprehensively. The report structure has been kept so that it offers maximum business value. It provides critical insights into market dynamics and will enable strategic decision-making for existing market players as well as those willing to enter the market.

The following are the key features of the report:

- Market structure: Overview, industry life cycle analysis, supply chain analysis.

- Market environment analysis: Growth drivers and constraints, Porter’s five forces analysis, SWOT analysis.

- Market trend and forecast analysis.

- Market segment trend and forecast.

- Competitive landscape and dynamics: Market share, Service portfolio, New Product Launches, etc.

- COVID-19 impact and its recovery curve.

- Attractive market segments and associated growth opportunities.

- Emerging trends.

- Strategic growth opportunities for the existing and new players.

- Key success factors.

|

Market Study Period

|

2019-2032

|

|

Base Year

|

2024

|

|

Forecast Period

|

2025-2032

|

|

Trend Period

|

2019-2023

|

|

Number of Tables & Figures

|

>100

|

|

Number of Segments Analysed

|

7 (Offering Type, Functionality Type, Deployment Type, Tier Type, Data Center Size Type, End-Use Type, and Region)

|

|

Number of Regions Analysed

|

4 (North America, Europe, Asia-Pacific, Rest of the World)

|

|

Countries Analysed

|

15 (The USA, Canada, Mexico, Germany, France, Italy, The UK, China, Japan, India, Brazil, Saudi Arabia, Rest of Europe, Rest of APAC, and Rest of the World)

|

|

Free Customization Offered

|

10%

|

|

After Sales Support

|

Unlimited

|

|

Report Presentation

|

Complimentary

|

|

Market Dataset

|

Complimentary

|

|

Further Deep Dive & Consulting Services

|

10% Discoun

|

Market Segmentation

This report studies the market, covering a period of 15 years of trend and forecast. The report provides detailed insights into the market dynamics to enable informed business decision-making and growth strategy formulation based on the opportunities present in the market.

The data center infrastructure management market is segmented into the following categories:

By Offering Type

By Functionality Type

- Performance Optimization

- Asset Management

- Configuration

- Operational Monitoring

- Reporting & Dashboards

- Other Functionalities

By Deployment Type

By Tier Type

- Tier 1

- Tier 2

- Tier 3

- Tier 4

By Data Center Size Type

- Small Data Centers

- Mid-Sized Data Centers

- Large Data Centers

By End-Use Type

- Enterprises

- Telecom Service Providers

- Cloud Service Providers

By Region

- North America (Country Analysis: The USA, Canada, and Mexico)

- Europe (Country Analysis: Germany, France, The UK, Russia, and the Rest of Europe)

- Asia-Pacific (Country Analysis: China, Japan, India, and Rest of Asia-Pacific)

- Rest of the World (Country Analysis: Brazil, Saudi Arabia, and Others)

Report Customization Options

With this detailed report, Stratview Research offers one of the following free customization options to our respected clients:

Company Profiling

- Detailed profiling of additional market players (up to three players)

- SWOT analysis of key players (up to three players)

Competitive Benchmarking

- Benchmarking of key players on the following parameters: Service portfolio, geographical reach, regional presence, and strategic alliances

Custom Research: Stratview Research offers custom research services across industries. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to [email protected]

Research Methodology

- This strategic assessment report from Stratview Research provides a comprehensive analysis that reflects today’s data center infrastructure management market realities and future market possibilities for the forecast period.

- The report segments and analyzes the market in the most detailed manner to provide a panoramic view of the market.

- The vital data/information provided in the report can play a crucial role for market participants and investors in identifying the low-hanging fruits available in the market and formulating growth strategies to expedite their growth process.

- This report offers high-quality insights and is the outcome of a detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research’s internal database and statistical tools.

- More than 1,000 authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white papers, patents, and articles, have been leveraged to gather the data.

- We conducted more than 15 detailed primary interviews with market players across the value chain in all four regions and industry experts to obtain both qualitative and quantitative insights.