Attractive Opportunities

Global Demand Analysis & Sales Opportunities in Processing Industry Seals Market

-

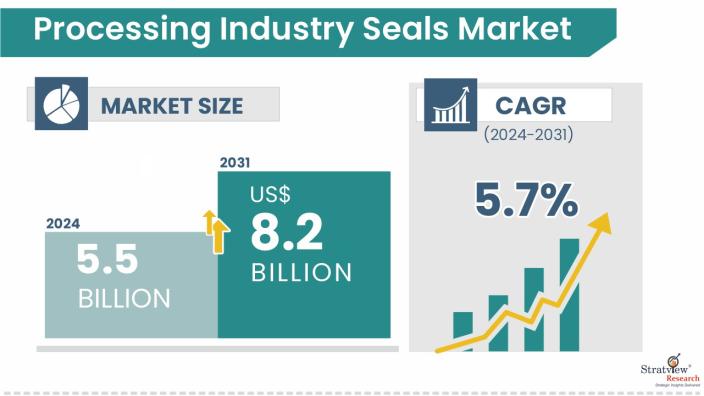

The annual demand for processing industry seals was USD 5.5 billion in 2024 and is expected to reach USD 5.8 billion in 2025, up 5.3% than the value in 2024.

-

During the forecast period (2025-2031), the processing industry seals market is expected to grow at a CAGR of 5.7%. The annual demand will reach USD 8.2 billion in 2031, which is almost 1.5 times the demand in 2025.

-

During 2025-2031, the processing industry seals industry is expected to generate a cumulative sales opportunity of USD 49.1 billion, which is more than 1.5 times the opportunities during 2019-2024.

Want to know more about the market scope? Register Here

High-Growth Market Segments:

-

Europe is anticipated to be the dominant region, whereas Asia-Pacific is expected to be the fastest-growing market by region over the forecast period.

-

By end-use industry type, Food & beverage industry is likely to be the biggest demand generator for processing industry seals throughout the forecast period.

-

By material type, Thermoplastic seals are anticipated to be the fastest-growing material type in the market during the forecast period.

-

By seal type, Lip seals are estimated to hold the major share of the market during the forecast period.

-

By motion type, Rotary seals are likely to be the most preferred choice by end-use industries during the forecast period.

Market Statistics

Have a look at the sales opportunities presented by the processing industry seals market in terms of growth and market forecast.

|

Processing Industry Seals Market Data & Statistics

|

|

|

Market Statistics

|

Value (in USD Billion)

|

Market Growth (%)

|

|

Annual Market Size in 2023

|

USD 5.3 billion

|

-

|

|

Annual Market Size in 2024

|

USD 5.5 billion

|

YoY Growth in 2024: 4.2%

|

|

Annual Market Size in 2025

|

USD 5.8 billion

|

YoY Growth in 2025: 5.3%

|

|

Annual Market Size in 2031

|

USD 8.2 billion

|

CAGR 2025-2031: 5.7%

|

|

Cumulative Sales Opportunity during 2025-2031

|

USD 49.1 billion

|

|

|

Top 10 Countries’ Market Share in 2024

|

USD 4.4 billion +

|

> 80%

|

|

Top 10 Company’s Market Share in 2024

|

USD 2.8 billion to USD 3.9 billion

|

50% - 70%

|

Market Dynamics

Introduction:

What are processing industry seals?

Processing industry seals are essential for maintaining equipment reliability, safety, and operational efficiency across various industrial applications. These mechanical components are designed to prevent the leakage of fluids or gases, sustain internal pressure, and block contaminants from entering sensitive processing environments. They are extensively used in food & beverage, chemical processing, and pharmaceuticals, where strict hygiene and process integrity are crucial. In these industries, the production of final products often involves the use of multiple additives and chemicals, along with exposure to high temperatures and pressures. As a result, seals must be capable of withstanding harsh operating conditions, including high temperatures, reactive chemicals, pressure fluctuations, and corrosion. To meet these demands, seals are primarily manufactured from elastomers, thermoplastics, and metals. Among these, elastomeric seals are gaining popularity due to their unique combination of viscosity and elasticity, along with excellent resistance to chemicals and elevated temperatures.

Market Drivers:

-

The market for processing seals is witnessing steady growth, driven by increasing industrial automation, stringent regulatory standards related to safety and hygiene, and the rising demand for high-performance sealing solutions.

-

With growing investment in advanced processing equipment and heightened awareness of operational efficiency, end-use industries are seeking sealing technologies that can withstand aggressive chemicals, extreme temperatures, and high-pressure environments. Material innovation also serves as a significant driver in this market.

Segment Analysis

|

Segmentations

|

List of Sub-Segments

|

Segments with High-Growth Opportunity

|

|

End-Use Industry-Type Analysis

|

Food & Beverage, Chemical Processing, and Pharmaceutical

|

Food & beverage is likely to be the biggest demand generator for processing industry seals throughout the forecast period.

|

|

Material-Type Analysis

|

Elastomeric Seals, Thermoplastic Seals, and Metallic Seals.

|

Thermoplastic seals are anticipated to be the fastest-growing material type in the market during the forecast period.

|

|

Product-Type Analysis

|

O-rings, Gaskets, Profile Seals, Lip Seals, Energized Seals, Mechanical Seals, and Other Products.

|

Lip seals are estimated to hold the major share of the market during the forecast period.

|

|

Motion-Type Analysis

|

Static Seals, Linear Seals, and Rotary Seals.

|

Rotary seals are likely to be the most preferred choice by end-use industries during the forecast period.

|

|

Region Analysis

|

North America, Europe, Asia-Pacific, and The Rest of the World

|

Europe is anticipated to be the dominant whereas Asia-Pacific is expected to be the fastest-growing market by region over the forecast period.

|

By End-Use Industry Type

“Food & beverages are expected to be the dominant end-use industry for the processing industry seals market throughout the forecast period.”

-

Based on end-use-industry type, the processing industry seals market is divided into food & beverage, chemical processing, and pharmaceutical.

-

The dominance is primarily attributed to the rapid expansion of food processing activities worldwide, driven by rising population, changing dietary habits, and increasing demand for packaged and convenience foods. As the global population continues to grow, particularly in emerging economies, there is a parallel increase in the number of food production and processing facilities to meet the escalating demand for diverse food products.

-

Additionally, evolving consumer preferences have significantly influenced the industry’s dynamics. The surge in demand for health-oriented products such as immunity boosters, functional foods, and nutraceuticals, especially following recent global health concerns, has prompted manufacturers to ramp up production capacities. Moreover, the growing pet food industry, fueled by rising pet ownership and humanization of pet diets, has further contributed to the need for hygienic, efficient, and safe food processing systems.

-

In this context, processing seals are essential for ensuring contamination-free production and maintaining high hygiene standards. The industry is highly regulated, with strict guidelines from bodies like the FDA and EFSA, which mandate the use of specialized sealing solutions that can withstand rigorous cleaning processes, resist chemical exposure, and operate effectively under high temperatures and pressures. As a result, the demand for high-performance seals, particularly those made of elastomers and thermoplastics, is steadily rising in food and beverage applications.

By Material Type

“Thermoplastic seals are expected to be the fastest-growing material type in the market during the forecast period.”

-

Based on material type, the processing industry seals market is divided into Elastomeric Seals, Thermoplastic Seals, and Metallic Seals.

-

Thermoplastic seals are projected to be the fastest-growing material of the processing industry seals market during the forecast period, owing to their superior performance characteristics and increasing suitability across a wide range of demanding industrial applications. These seals offer a unique combination of high chemical resistance, low friction, dimensional stability, and excellent wear properties, making them highly preferred in industries such as pharmaceuticals, food & beverages, and chemical processing.

-

One of the key factors driving the growth of thermoplastic seals is their exceptional resistance to aggressive chemicals and high operating temperatures, which makes them ideal for harsh processing environments. Unlike some elastomeric materials that may degrade over time when exposed to corrosive substances or extreme conditions, thermoplastics such as PTFE, PEEK, and UHMWPE can maintain structural integrity and performance, ensuring longer service life and reduced maintenance needs.

-

Additionally, thermoplastic materials are highly customizable and compatible with precision manufacturing techniques such as injection molding and CNC machining. This allows manufacturers to design seals with complex geometries and tighter tolerances, catering to application-specific requirements. With the rising trend toward automation and equipment optimization, there is a growing demand for seals that can perform reliably under dynamic and high-speed conditions, further boosting the adoption of thermoplastic seals.

By Seal Type

“Lip seals are expected to be the dominant as well as the fastest-growing product of the processing industry seals market throughout the forecast period.”

-

Based on product type, the processing industry seals market is divided into O-rings, gaskets, profile seals, lip seals, energized seals, mechanical seals, and other products.

-

Owing to their rising popularity is largely attributed to their versatile sealing capabilities, cost-effectiveness, and ability to perform reliably in both static and dynamic applications. Lip seals, also known as radial shaft seals, are designed to retain lubricants and exclude contaminants in rotating, reciprocating, and oscillating motion environments, making them essential for a wide range of processing equipment.

-

In end-use industries such as food & beverage, chemical processing, and pharmaceuticals, lip seals are increasingly preferred for applications involving mixers, agitators, pumps, and rotating shafts, where maintaining system integrity and cleanliness is critical. These seals offer a tight, consistent sealing interface while accommodating slight misalignments and shaft deflections, which is particularly advantageous in high-speed or high-load operations.

-

From a material type perspective, lip seals made from elastomeric and thermoplastic materials are gaining strong traction due to their enhanced resistance to temperature, pressure, and reactive substances commonly found in processing environments. The integration of advanced lip seal designs with thermoplastic sealing elements, such as PTFE or PEEK, has enabled high-performance, low-friction sealing solutions that meet stringent regulatory standards for hygiene and durability.

Regional Insights

“Europe is anticipated to remain the leading regional market for processing industry seals throughout the forecast period, and the Asia-Pacific region is expected to emerge as the fastest-growing market.”

-

Europe is expected to maintain its dominance in the processing industry seals market due to its mature and highly regulated industrial landscape. The region is home to some of the world's largest and most advanced food & beverage, pharmaceutical, and chemical processing companies, which consistently demand high-quality, precision-engineered sealing solutions to ensure compliance with strict hygiene, safety, and environmental standards. Regulatory frameworks such as those enforced by the European Food Safety Authority (EFSA) and the European Medicines Agency (EMA) require the use of seals that can withstand aggressive cleaning agents, extreme temperatures, and reactive substances without compromising product purity or equipment efficiency. Furthermore, European industries are at the forefront of adopting sustainable practices and advanced automation technologies, both of which rely heavily on durable and efficient sealing systems. The presence of key seal manufacturers and advanced R&D centers in countries such as Germany, France, and Italy further contributes to the region's stronghold in the market.

-

Asia-Pacific is poised to be the fastest-growing region in the processing industry seals market, fueled by rapid industrialization, urbanization, and a growing population. As developing economies such as China, India, Indonesia, and Vietnam experience rising consumer demand for packaged foods, pharmaceuticals, and personal care products, there has been a surge in the establishment of new processing plants and expansion of existing facilities. This rapid growth in production capacity directly translates into increased demand for sealing solutions that ensure reliability, safety, and regulatory compliance. As global manufacturers shift production bases to Asia-Pacific for cost advantages and proximity to high-demand markets, the region continues to emerge as a vital growth hub for sealing solutions in processing industries.

Know the high-growth countries in this report. Register Here

Competitive Landscape

The following are the key players in the processing industry seals market.

Here is the list of the Top Players (Based on Dominance)

Note: The above list does not necessarily include all the top players in the market.

Are you the leading player in this market? We would love to include your name. Please write to us at [email protected]

Report Features

This report provides market intelligence most comprehensively. The report structure has been kept so that it offers maximum business value. It provides critical insights into market dynamics and will enable strategic decision-making for existing market players as well as those willing to enter the market.

The following are the key features of the report:

-

Market structure: Overview, industry life cycle analysis, supply chain analysis.

-

Market environment analysis: Growth drivers and constraints, Porter’s five forces analysis, SWOT analysis.

-

Market trend and forecast analysis.

-

Market segment trend and forecast.

-

Competitive landscape and dynamics: Market share, Service portfolio, New Product Launches, etc.

-

COVID-19 impact and its recovery curve.

-

Attractive market segments and associated growth opportunities.

-

Emerging trends.

-

Strategic growth opportunities for the existing and new players.

-

Key success factors.

|

Market Study Period

|

2019-2031

|

|

Base Year

|

2024

|

|

Forecast Period

|

2025-2031

|

|

Trend Period

|

2019-2023

|

|

Number of Tables & Figures

|

>100

|

|

Number of Segments Analysed

|

5 (Material Type, End-Use Industry Type, Seal Type, Motion Type, and Region)

|

|

Number of Regions Analysed

|

4 (North America, Europe, Asia-Pacific, Rest of the World)

|

|

Countries Analysed

|

15 (The USA, Canada, Mexico, Germany, France, Italy, The UK, China, Japan, India, Brazil, Saudi Arabia, Rest of Europe, Rest of APAC, and Rest of the World)

|

|

Free Customization Offered

|

10%

|

|

After Sales Support

|

Unlimited

|

|

Report Presentation

|

Complimentary

|

|

Market Dataset

|

Complimentary

|

|

Further Deep Dive & Consulting Services

|

10% Discount

|

Market Segmentation

The report provides detailed insights into the market dynamics to enable informed business decision-making and growth strategy formulation based on the opportunities present in the market.

The processing industry seals market is segmented into the following categories:

Processing Industry Seals Market, by End-Use Industry Type

-

Food & Beverage (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

-

Chemical Processing (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

-

Pharmaceutical (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

Processing Industry Seals Market, by Material Type

-

Elastomeric Seals (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

-

Thermoplastic Seals (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

-

Metallic Seals (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

Processing Industry Seals Market, by Seal Type

-

O-rings (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

-

Gaskets (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

-

Profile Seals (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

-

Lip Seals (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

-

Energized Seals (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

-

Mechanical Seals (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

-

Other Products (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

Processing Industry Seals Market, by Motion Type

-

Static Seals (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

-

Linear Seals (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

-

Rotary Seals (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

Processing Industry Seals Market by Region

-

North America (Country Analysis: The USA, Canada, and Mexico)

-

Europe (Country Analysis: Germany, France, The UK, Russia, and the Rest of Europe)

-

Asia-Pacific (Country Analysis: Japan, China, India, Australia, and Rest of Asia-Pacific)

-

Rest of the World (Country Analysis: Brazil, Saudi Arabia, and Others)

Research Methodology

-

This strategic assessment report from Stratview Research provides a comprehensive analysis that reflects today’s processing industry seals market realities and future market possibilities for the forecast period

-

The report segments and analyzes the market in the most detailed manner in order to provide a panoramic view of the market.

-

The vital data/information provided in the report can play a crucial role for market participants and investors in identifying the low-hanging fruit available in the market and formulating growth strategies to expedite their growth process.

-

This report offers high-quality insights and is the outcome of a detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research’s internal database and statistical tools.

-

More than 1,000 authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white papers, patents, and articles, have been leveraged to gather the data

-

We conducted more than 15 detailed primary interviews with market players across the value chain in all four regions and industry experts to obtain both qualitative and quantitative insights.

Customization Options

With this detailed report, Stratview Research offers one of the following free customization options to our respected clients:

Company Profiling

Competitive Benchmarking

-

Benchmarking of key players on the following parameters: product portfolio, geographical reach, regional presence, and strategic alliances

Custom Research: Stratview Research offers custom research services across industries. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to [email protected]