Attractive Opportunities

Global Demand Analysis & Sales Opportunities in Data Center Busway Market

-

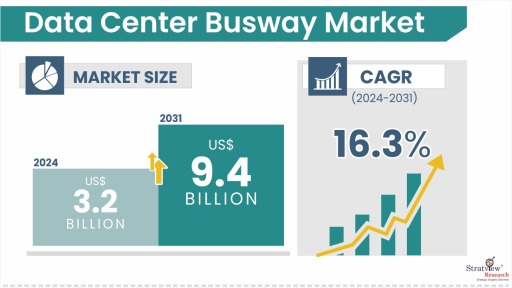

The annual demand for data center busway was USD 3.2 billion in 2024 and is expected to reach USD 3.8 billion in 2025, up 16.2% than the value in 2024.

-

During the forecast period (2025-2031), the data center busway market is expected to grow at a CAGR of 16.3%. The annual demand will reach USD 9.4 billion in 2031, which is more than 2.5 times the demand in 2025.

-

During 2025-2031, the data center busway industry is expected to generate a cumulative sales opportunity of USD 43.6 billion, which is almost 3 times the opportunities during 2019-2024.

Want to get a free sample? Register Here

High-Growth Market Segments:

-

North America is estimated to hold the biggest share of the data center busway market. Asia-Pacific is the fastest-growing region. The USA has the biggest share of the data center busway market.

-

By product type, Track busway is likely to offer the highest growth to players primarily due to its scalability and versatility.

-

By voltage type, Low-voltage busway is the most dominant, whereas medium-voltage busway is the fastest-growing voltage type.

-

By data center type, although colocation data centers dominate the market heavily at the moment, hyperscale data centers are likely to grow at the fastest rate.

Market Statistics

Have a look at the sales opportunities presented by the data center busway market in terms of growth and market forecast.

|

Data Center Busway Market Data & Statistics

|

|

|

Market Statistics

|

Value (in USD Billion)

|

Market Growth (%)

|

|

Annual Market Size in 2023

|

USD 2.9 billion

|

-

|

|

Annual Market Size in 2024

|

USD 3.2 billion

|

YoY Growth in 2024: 13.1%

|

|

Annual Market Size in 2025

|

USD 3.8 billion

|

YoY Growth in 2025: 16.2%

|

|

Annual Market Size in 2031

|

USD 9.4 billion

|

CAGR 2025-2031: 16.3%

|

|

Cumulative Sales Opportunity during 2025-2031

|

USD 43.6 billion

|

-

|

|

Top 10 Countries’ Market Share in 2024

|

USD 2.6 billion +

|

> 80%

|

|

Top 10 Company’s Market Share in 2024

|

USD 1.6 billion to USD 2.3 billion

|

50% - 70%

|

Market Dynamics

Introduction:

A busway is a modular, enclosed power distribution system that delivers electrical power efficiently within a data center. It consists of an insulated metal enclosure containing conductors, which can be customized with plug-in units to provide power to IT equipment. Busways offer flexibility, scalability, and ease of maintenance compared to traditional power distribution methods like cable and conduit systems.

In modern data centers, efficient power distribution ensures uninterrupted operations and optimal energy management. A busway system is a reliable and scalable power distribution solution designed to support high-density IT environments. Unlike traditional wiring methods, busways provide a streamlined and adaptable approach, allowing for quick modifications and expansions without extensive downtime. They enhance power efficiency, reduce installation complexity, and improve safety by minimizing cable clutter and heat generation.

_34805.webp)

Market Drivers:

-

The growing demand for scalable and energy-efficient power distribution in data centers is a key driver for the busway market. As businesses increasingly rely on cloud computing, big data, and AI-driven applications, data centers must expand rapidly while ensuring optimal energy management. Busway systems offer a modular and flexible solution, reducing downtime and installation costs compared to traditional cable-based power distribution. Their ability to enhance power density, minimize heat loss, and improve operational efficiency makes them an attractive choice for modern IT infrastructures.

-

Another significant factor fueling market growth is the rise in hyperscale and colocation data centers. With global digital transformation accelerating, companies are investing heavily in high-capacity data centers to support growing computational needs. Busways help meet increasing power demands by providing high-reliability power distribution, reducing cable clutter, and enabling rapid system reconfigurations. Additionally, sustainability concerns and regulatory compliance drive the adoption of energy-efficient busway systems, aligning with green data center initiatives and carbon reduction goals.

Segments' Analysis

|

Segmentations

|

List of Sub-Segments

|

Segments with High-Growth Opportunity

|

|

Product-Type Analysis

|

Sandwich-style Busway, Track Busway, and Air-Insulated Busway

|

Track busway is likely to offer the highest growth to players primarily due to its scalability and versatility.

|

|

Voltage-Type Analysis

|

Low-voltage Busway and Medium-voltage Busway.

|

Low-voltage busway is the most dominant, whereas medium-voltage busway is the fastest-growing voltage type.

|

|

Data Center-Type Analysis

|

Hyperscale, Colocation, and Enterprise Data Centers.

|

Although colocation data centers dominate the market heavily at the moment, hyperscale data centers are likely to grow at the fastest rate.

|

|

Regional Analysis

|

North America, Europe, Asia-Pacific, and The Rest of the World.

|

North America is estimated to hold the biggest share of the data center busway market. Asia-Pacific is the fastest-growing region. The USA has the biggest share of the data center busway market.

|

Product Insights

“Sandwich-style busways have the most dominant share of the market, whereas track busways are the fastest-growing category of the market.”

-

The data center busway market is classified into sandwich-style busway, track busway, and air-insulated busway based on product type. Sandwich-style busways are estimated to remain dominant in the forecasted period. The dominance of sandwich-style busways is attributed to their compact size, improved power density, and better thermal performance, allowing them to be the first choice for large-capacity and high-power data centers.

-

Track busways are estimated to grow at the highest rate, owing to benefits like future expansion compatibility and easier installation. On the other hand, the most rapid growth is powered by its scalability, modular nature, and ease of expansion. With the increasing adoption of AI and cloud computing, data centers increasingly need more flexible and easily reconfigurable power distribution solutions, thereby driving the demand for track busways.

Voltage Insights

“Low-voltage Busway is expected to remain most dominant, whereas demand for medium-voltage Busway is likely to grow faster during the mentioned period.”

-

The market is segmented into low-voltage and medium-voltage busways. The low-voltage busway is expected to generate the most demand, as it is widely employed within distribution networks and data halls to meet the power needs of IT equipment and racks.

-

The medium voltage busway is the most rapidly developing category, and it is fueled by the increasing power requirements of hyperscale and AI-based data centers, which need high-capacity power distribution systems for effective management of growing loads.

-

As data centers grow in density and scale, the adoption of medium-voltage busway is gaining traction, due to advantages like minimized transmission loss, better power efficiency, and greater next-generation scalability.

Data Center Insights

“Colocation data center is expected to retain its share, whereas hyperscale data center is expected to be the fastest-growing demand generator for data center busways.”

-

The data center busway market is segmented into hyperscale, colocation, and enterprise based on the type of data center. Colocation data centers are expected to dominate the market in the forecasted period.

-

Colocation data centers possess the largest market share, fueled by the growth in demand from companies wanting cost-effective, scalable, and high-redundancy infrastructure without the capital expense of constructing their facilities.

-

Increased acceleration in the cloud service provider market, digital transformation, and edge computing have fastened the adoption of colocation, driving demand for efficient and flexible power distribution solutions like busways.

Regional Insights

“The North America region is expected to continue being the largest demand generator for data center busway, whereas Asia-Pacific is exhibiting the fastest growth in the forecasted period.”

-

North America's dominance is driven by the high density of hyperscale data centers, sophisticated digital infrastructure, and the pronounced presence of major cloud services in the form of AWS, Microsoft, and Google. Moreover, strict regulations regarding energy efficiency and sustainability fuel the use of cutting-edge power distribution solutions like busways in data centers throughout the region.

-

At the same time, the Asia-Pacific is experiencing the fastest growth, propelled by accelerated digitalization, enhanced cloud adoption, and heavy data center infrastructure investment in China, India, and Southeast Asia. The growth in AI workloads, hyperscale facility expansion, and government-sponsored data localization drive the demand for high-efficiency power distribution technologies such as busways even higher, making the Asia-Pacific a major growth driver in the international market.

Want to get a free sample? Register Here

Competitive Landscape

The market is highly consolidated, with 5-6 players dominating more than 75% of the market. Most of the major players compete in some of the governing factors, including price, service offerings, regional presence, etc. The following are the key players in the data center Busway market. Some of the major players provide a complete range of services.

Here is the list of the Top Players (Based on Dominance)

Note: The above list does not necessarily include all the top players in the market.

Are you the leading player in this market? We would love to include your name. Please write to us at [email protected]

Recent Developments

Recent Market JVs and Acquisitions:

A considerable number of strategic alliances, including M&As, JVs, etc., have been performed over the past few years:

-

In 2023, Siemens and Compass Data Centers entered a multi-year agreement to supply 1500 pre-fabricated medium-voltage power skids incorporating transformers and busways.

-

In 2022, Legrand acquired French power firm Voltadis, aiming to strengthen its portfolio in data center electrical systems.

-

In November 2021, Vertiv acquired E&I Engineering for US$ 1.8 Billion. At the time of acquisition, E&I ranked 5th in the data center Busway market. This acquisition expanded Vertiv’s capabilities in busways, switchgear, and transfer switches.

Recent Product Development:

-

In April 2024, Schneider Electric unveiled I-line Track, a next-gen power distribution system providing an all-in-one solution to help build more flexible data centers. Its innovative design enables flexible deployment and rapid expansion in colocation data centers.

-

In September 2022, Vertiv expanded its power distribution portfolio and introduced Powerbar iMPB, busbar solutions, a modular busbar system designed to enable seamless, on-demand power upgrades in dynamic data center environments.

Report Features

This report provides market intelligence most comprehensively. The report structure has been kept so that it offers maximum business value. It provides critical insights into market dynamics and will enable strategic decision-making for existing market players as well as those willing to enter the market.

The following are the key features of the report:

-

Market structure: Overview, industry life cycle analysis, supply chain analysis.

-

Market environment analysis: Growth drivers and constraints, Porter’s five forces analysis, SWOT analysis.

-

Market trend and forecast analysis.

-

Market segment trend and forecast.

-

Competitive landscape and dynamics: Market share, Service portfolio, New Product Launches, etc.

-

COVID-19 impact and its recovery curve.

-

Attractive market segments and associated growth opportunities.

-

Emerging trends.

-

Strategic growth opportunities for the existing and new players.

-

Key success factors.

|

Market Study Period

|

2019-2031

|

|

Base Year

|

2024

|

|

Forecast Period

|

2025-2031

|

|

Trend Period

|

2019-2023

|

|

Number of Tables & Figures

|

>100

|

|

Number of Segments Analysed

|

4 (Product Type, Voltage Type, Data Center Type, and Region)

|

|

Number of Regions Analysed

|

4 (North America, Europe, Asia-Pacific, Rest of the World)

|

|

Countries Analysed

|

15 (The USA, Canada, Mexico, Germany, France, Italy, The UK, China, Japan, India, Brazil, Saudi Arabia, Rest of Europe, Rest of APAC, and Rest of the World)

|

|

Free Customization Offered

|

10%

|

|

After Sales Support

|

Unlimited

|

|

Report Presentation

|

Complimentary

|

|

Market Dataset

|

Complimentary

|

|

Further Deep Dive & Consulting Services

|

10% Discount

|

Market Segmentation

The report provides detailed insights into the market dynamics to enable informed business decision-making and growth strategy formulation based on the opportunities present in the market.

The global data center busway market is segmented into the following categories:

Data Center Busway Market, by Product Type

-

Sandwich-style Busway

-

Track Busway

-

Air-insulated Busway

Data Center Busway Market, by Voltage Type

-

Low-voltage Busway

-

Medium-voltage Busway

Data Center Busway Market, by Data Center Type

-

Hyperscale

-

Colocation

-

Enterprise

Data Center Busway Market, by Region

-

North America (Country Analysis: The USA, Canada, and Mexico)

-

Europe (Country Analysis: Germany, France, The UK, and the Rest of Europe)

-

Asia-Pacific (Country Analysis: China, Australia, Japan, India, and Rest of Asia-Pacific)

-

Rest of the World (Country Analysis: Brazil, Africa, and Others)

Research Methodology

-

This strategic assessment report from Stratview Research provides a comprehensive analysis that reflects today’s data center busway market realities and future market possibilities for the forecast period.

-

The report segments and analyzes the market in the most detailed manner to provide a panoramic view of the market.

-

The vital data/information provided in the report can play a crucial role for market participants and investors in identifying the low-hanging fruits available in the market and formulating growth strategies to expedite their growth process.

-

This report offers high-quality insights and is the outcome of a detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research’s internal database and statistical tools.

-

More than 1,000 authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white papers, patents, and articles, have been leveraged to gather the data.

-

We conducted more than 15 detailed primary interviews with market players across the value chain in all four regions and industry experts to obtain both qualitative and quantitative insights.

Customization Options

With this detailed report, Stratview Research offers one of the following free customization options to our respected clients:

Company Profiling

Competitive Benchmarking

-

Benchmarking of key players on the following parameters: Service portfolio, geographical reach, regional presence, and strategic alliances

Custom Research: Stratview Research offers custom research services across sectors. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to [email protected]