Attractive Opportunities

Global Demand Analysis & Sales Opportunities in Medical Implant Fasteners Market

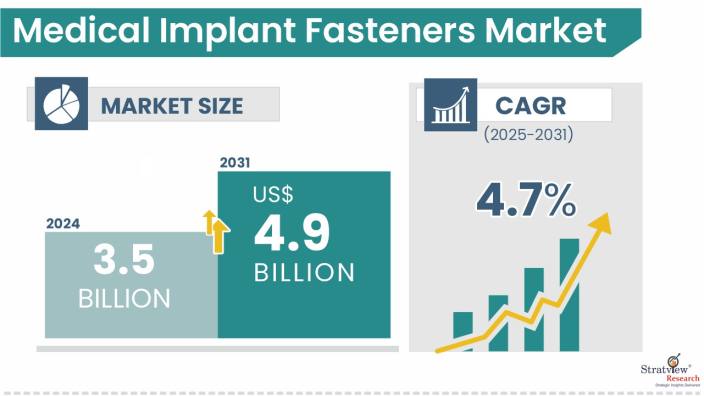

- The annual demand for medical implant fasteners was USD 3.5 billion in 2024 and is expected to reach USD 3.7 billion in 2025, up 6.2% than the value in 2024.

- During the forecast period (2025-2031), the medical implant fasteners market is expected to grow at a CAGR of 4.7%. The annual demand will reach USD 4.9 billion in 2031.

- During 2025-2031, the medical implant fasteners industry is expected to generate a cumulative sales opportunity of USD 30.5 billion, which is almost 2 times the opportunities during 2019-2024.

Want to know more about the market scope? Register Here

High-Growth Market Segments:

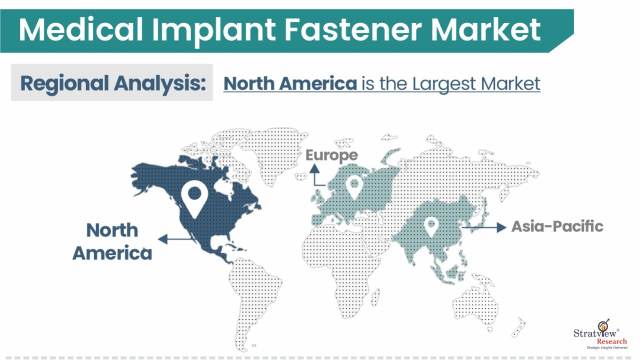

- North America generated the highest demand with the largest market share of more than 50% in 2024, whereas Asia-Pacific is expected to experience the fastest growth in the coming years.

- By range type, Trauma & Extremities is expected to remain the demand generator of the market during the forecast period.

- By type, Titanium is likely to hold the dominant position of the market during the forecast period.

- By range type, Screw is expected to remain the most dominant fastener type in the market over the next six years.

- By type, Threaded is likely to be the most preferred threading type of the market during the forecast period.

Market Statistics

Have a look at the sales opportunities presented by the medical implant fasteners market in terms of growth and market forecast.

|

Medical Implant Fasteners Market Data & Statistics

|

|

|

Market Statistics

|

Value (in USD Billion)

|

Market Growth (%)

|

|

Annual Market Size in 2023

|

USD 3.3 billion

|

-

|

|

Annual Market Size in 2024

|

USD 3.5 billion

|

YoY Growth in 2024: 6.6%

|

|

Annual Market Size in 2025

|

USD 3.7 billion

|

YoY Growth in 2025: 6.2%

|

|

Annual Market Size in 2031

|

USD 4.9 billion

|

CAGR 2025-2031: 4.7%

|

|

Cumulative Sales Opportunity during 2025-2031

|

USD 30.5 billion

|

|

|

Top 10 Countries’ Market Share in 2024

|

USD 2.8 billion +

|

> 80%

|

|

Top 10 Company’s Market Share in 2024

|

USD 1.7 billion to USD 2.4 billion

|

50% - 70%

|

Market Dynamics

Introduction

Medical implant fasteners are essential components to securely join and support orthopedic implants, dental implants, spines, hips & knees, and CMF (craniomaxillofacial) implants. For orthopedic implant application, they are essential in trauma fixation, joint replacements (hip, knee, spine), and extremity implants for bone stabilization and healing. In dental implant application, abutment screws help anchor artificial teeth securely to the jawbone. Key materials used to manufacture implant fasteners are titanium, stainless steel, bioabsorbable materials, and brass.

The selection of appropriate fasteners is crucial for the success of implant procedures, as they must offer durability, strength, and resistance to adhesions or failures. Advancements in engineering have enhanced their performance, improving corrosion resistance and compatibility with imaging techniques, ultimately leading to better patient outcomes.

Market Drivers

Key factors driving the medical implant fasteners market are:

- Increase in demand for orthopedic, dental, and CMF implant procedures owing to increasing cases of fractures, joint replacements, and dental restorations.

- Rising aging population leads to a higher prevalence of osteoporosis, arthritis, and degenerative bone diseases.

- Rising sports and trauma injuries due to increasing accidents and sports-related fractures.

- Growing investment in healthcare infrastructure, including R&D investments.

- Stringent regulatory compliance and quality standards drive the demand for high-performance fasteners.

Key Trends Shaping the Market

- Rising Incidence of Musculoskeletal Disorders.

- Customization and Patient-Specific Solutions.

- Smart Fasteners Integration.

Segments Analysis

|

Segmentations

|

List of Sub-Segments

|

Segments with High-Growth Opportunity

|

|

Application-Type Analysis

|

Trauma & Extremities, Hip & Knees, Spine, CMF, Dental, and Other Application Types

|

Trauma & Extremities is expected to remain the demand generator of the market during the forecast period.

|

|

Material-Type Analysis

|

Titanium, Stainless Steel, and Other Material Types

|

Titanium is likely to hold the dominant position of the market during the forecast period.

|

|

Fastener-Type Analysis

|

Screw, Bolt, Nut, and Other Fastener Types

|

The screw is expected to remain the most dominant fastener type in the market over the next six years.

|

|

Threading-Type Analysis

|

Threaded and Non-Threaded

|

Threaded is likely to be the most preferred threading type of the market during the forecast period.

|

|

Regional Analysis

|

North America, Europe, Asia-Pacific, and The Rest of the World

|

North America is expected to be the dominant region, whereas Asia-Pacific is expected to experience the fastest growth in the coming years.

|

By Application Type

“Trauma & extremities is expected to remain dominant, whereas dental is anticipated to be the fastest-growing application type of the market during the forecast period.”

- The trauma & extremities application holds the largest share of the medical implant fasteners market due to the rising incidence of fractures and bone injuries caused by accidental falls, osteoporosis, and bone deformities. The need for internal fixation devices, such as plates and screws, to support bone healing, along with advancements in technology and increased healthcare spending, further drive growth in this segment.

- Dental application is likely to experience the fastest growth owing to a growing demand for dental implants, technological advancements in implants, such as mini dental implants, 3D printing, and use of biocompatible materials; growing cosmetic dentistry trends; and higher demand for minimally invasive procedures.

By Material Type

“Titanium is likely to hold the dominant position in the market during the forecast period.”

- Titanium occupies the largest share in the medical implant fasteners market, owing to its properties, such as biocompatibility, corrosion resistance, high strength-to-weight ratio, exceptional mechanical properties, durability, non-magnetic and MRI compatibility, and durability, making them ideal medical implants and devices. Titanium meets stringent regulatory medical standards, and it is widely accepted across the global healthcare industry.

By Fastener Type

“Screws are expected to remain the most dominant fastener type of the market over the next six years.”

- Screws dominate the medical implant fasteners market due to their strong holding ability and ease of use in orthopedic surgeries and implants. Their high level of secure fixation, availability in various sizes, and biocompatibility make them a preferred choice. Additionally, their adaptability for minimally invasive procedures further drives their demand.

By Threading Type

“The threaded category is likely to be the most preferred threading type of the market during the forecast period.”

- Threaded fasteners offer superior mechanical strength, high secure fastening capacity, and ease of assembly and removal. Its widespread use in orthopedic and dental surgeries, biocompatibility, adaptability for minimally invasive procedures, and availability in various sizes make them essential for critical medical applications. Additionally, their compliance with regulations and standards makes them even more reliable and widely used.

Regional Insights

“North America is expected to be the dominant region, whereas Asia-Pacific will be the fastest-growing region of the market over the next six years.”

- North America is expected to remain the largest market for medical implant fasteners due to its advanced healthcare infrastructure, significant R&D investments in medical technology, and continuous innovations. The rising prevalence of orthopedic conditions such as osteoporosis and arthritis, along with high rates of joint replacements, trauma surgeries, and dental implants, further drive market growth.

- Asia-Pacific is projected to be the fastest-growing region in the medical implant fasteners market, driven by expanding healthcare infrastructure, a growing aging population, increasing medical tourism, and rising demand for orthopedic and dental treatments. Technological advancements further support market growth. China serves as the region's growth engine, being the largest medical device manufacturing hub and experiencing rapid healthcare infrastructure expansion.

Know the high-growth countries in this report. Register Here

Competitive Landscape

The market is highly fragmented, with the presence of a large number of players across the region. Most of the major players often specialize in orthopedic, spinal, dental, and hip & knee implants, providing both individual fasteners and fully assembled implant systems. The following are the key players in the medical implant fasteners market.

Here is the list of the Top Players (Based on Dominance)

- DePuy Synthes (Part of Johnson & Johnson)

- Stryker Corporation

- Zimmer Biomet Holdings, Inc.

- Smith Nephew plc

- Arthrex, Inc.

Note: The above list does not necessarily include all the top players in the market.

Are you the leading player in this market? We would love to include your name. Please write to us at [email protected]

Report Features

This report provides market intelligence most comprehensively. The report structure has been kept so that it offers maximum business value. It provides critical insights into market dynamics and will enable strategic decision-making for existing market players as well as those willing to enter the market.

The following are the key features of the report:

- Market structure: Overview, industry life cycle analysis, supply chain analysis.

- Market environment analysis: Growth drivers and constraints, Porter’s five forces analysis, SWOT analysis.

- Market trend and forecast analysis.

- Market segment trend and forecast.

- Competitive landscape and dynamics: Market share, Service portfolio, New Product Launches, etc.

- COVID-19 impact and its recovery curve.

- Attractive market segments and associated growth opportunities.

- Emerging trends.

- Strategic growth opportunities for the existing and new players.

- Key success factors.

|

Market Study Period

|

2019-2031

|

|

Base Year

|

2024

|

|

Forecast Period

|

2025-2031

|

|

Trend Period

|

2019-2023

|

|

Number of Tables & Figures

|

>100

|

|

Number of Segments Analysed

|

5 (Application Type, Material Type, Fastener Type, Threading Type, and Region)

|

|

Number of Regions Analysed

|

4 (North America, Europe, Asia-Pacific, Rest of the World)

|

|

Countries Analysed

|

15 (The USA, Canada, Mexico, Germany, France, Italy, The UK, China, Japan, India, Brazil, Saudi Arabia, Rest of Europe, Rest of APAC, and Rest of the World)

|

|

Free Customization Offered

|

10%

|

|

After Sales Support

|

Unlimited

|

|

Report Presentation

|

Complimentary

|

|

Market Dataset

|

Complimentary

|

|

Further Deep Dive & Consulting Services

|

10% Discount

|

Market Segmentation

This report studies the market, covering a period of 15 years of trend and forecast. The report provides detailed insights into the market dynamics to enable informed business decision-making and growth strategy formulation based on the opportunities present in the market.

The medical implant fasteners market is segmented into the following categories.

Medical Implant Fasteners Market, by Application Type

- Trauma & Extremities

- Hips & Knees

- Spine

- CMF

- Dental

- Other Application Types

Medical Implant Fasteners Market, by Material Type

- Titanium

- Stainless Steel

- Other Material Types

Medical Implant Fasteners Market, by Fastener Type

- Screw

- Bolt

- Nut

- Other Fastener Types

Medical Implant Fasteners Market, by Threading Type

Medical Implant Fasteners Market, by Region

- North America (Country Analysis: The USA, Canada, and Mexico)

- Europe (Country Analysis: Germany, France, The UK, Russia, and Rest of Europe)

- Asia-Pacific (Country Analysis: Japan, China, India, and Rest of Asia-Pacific)

- Rest of the World (Country Analysis: Brazil, Saudi Arabia, and Others)

Research Methodology

- This strategic assessment report from Stratview Research provides a comprehensive analysis that reflects today’s medical implant fasteners market realities and future market possibilities for the forecast period.

- The report segments and analyzes the market in the most detailed manner to provide a panoramic view of the market.

- The vital data/information provided in the report can play a crucial role for market participants and investors in identifying the low-hanging fruits available in the market and formulating growth strategies to expedite their growth process.

- This report offers high-quality insights and is the outcome of a detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research’s internal database and statistical tools.

- More than 1,000 authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white papers, patents, and articles, have been leveraged to gather the data.

- We conducted more than 15 detailed primary interviews with market players across the value chain in all four regions and industry experts to obtain both qualitative and quantitative insights.

Customization Options

With this detailed report, Stratview Research offers one of the following free customization options to our respectable clients:

Company Profiling

- Detailed profiling of additional market players (up to three players)

- SWOT analysis of key players (up to three players)

Competitive Benchmarking

- Benchmarking of key players on the following parameters: Service portfolio, geographical reach, regional presence, and strategic alliances

Custom Research: Stratview Research offers custom research services across industries. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to [email protected]