Attractive Opportunities

Global Demand Analysis & Sales Opportunities in Semiconductor Vacuum Valve Market

-

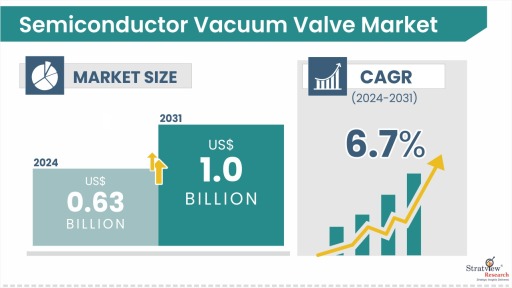

The annual demand for semiconductor vacuum valve was USD 632.8 million in 2024 and is expected to reach USD 682.1 million in 2025, up 7.8% than the value in 2024.

-

During the forecast period (2025-2031), the semiconductor vacuum valve market is expected to grow at a CAGR of 6.7%. The annual demand will reach USD 1006.3 million in 2031, which is almost 1.5 times the demand in 2025.

-

During 2025-2031, the semiconductor vacuum valve industry is expected to generate a cumulative sales opportunity of USD 6058.9 million, which is more than 1.5 times the opportunities during 2019-2024.

Want to get a free sample? Register Here

High-Growth Market Segments:

-

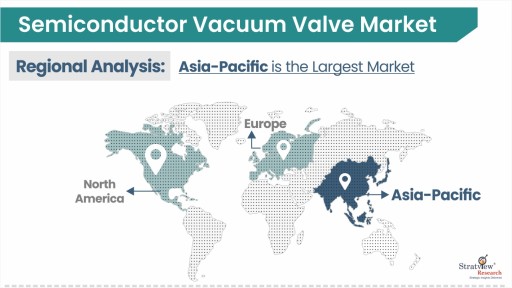

Asia-Pacific is expected to maintain its reign over the forecast period.

-

By technology type, Pneumatic valve is expected to remain dominant and likely to experience the fastest growth during the forecast period.

-

By material type, Stainless Steel will likely remain the market's most dominant material type in the coming years.

-

By process type, Substrate Transfer is the most dominant process type and is expected to maintain its lead during the forecast period.

-

By function type, Isolation valve is likely to be the dominant segment in the market during the forecast period.

-

By valve type, Transfer Valve is expected to remain the dominant type, whereas the Butterfly Valve is likely to be the fastest-growing valve type during the forecast period.

Market Statistics

Have a look at the sales opportunities presented by the semiconductor vacuum valve market in terms of growth and market forecast.

|

Semiconductor Vacuum Valve Market Data & Statistics

|

|

|

Market Statistics

|

Value (in USD Million)

|

Market Growth (%)

|

|

Annual Market Size in 2023

|

USD 601.2 million

|

-

|

|

Annual Market Size in 2024

|

USD 632.8 million

|

YoY Growth in 2024: 5.3%

|

|

Annual Market Size in 2025

|

USD 682.1 million

|

YoY Growth in 2025: 7.8%

|

|

Annual Market Size in 2031

|

USD 1006.3 million

|

CAGR 2025-2031: 6.7%

|

|

Cumulative Sales Opportunity during 2025-2031

|

USD 6058.9 million

|

-

|

|

Top 10 Countries’ Market Share in 2024

|

USD 506.2 million +

|

> 80%

|

|

Top 10 Company’s Market Share in 2024

|

USD 316.4 million to USD 443.0 million

|

50% - 70%

|

Market Dynamics

Introduction:

Semiconductor vacuum valve regulates and controls the flow of gas or liquid with extreme accuracy and efficiency. It helps in producing defect-free semiconductor wafers swept across the two articles with high purity and accuracy. These valves are employed heavily in processes such as chemical vapor deposition, physical vapor deposition, etching, and cleaning. All these processes call for proper control so that any adverse effect on the wafer can be effectively removed. These valves can be employed at high temperatures and pressures, in corrosive locations, and even in vacuum conditions. Chemically resistant and high-performance materials, such as stainless steel and aluminum, are extensively used to make these valves.

Market Drivers:

-

Some of the important factors driving the growth of the semiconductor vacuum valve market include the organic growth of the semiconductor industry, the increased requirement for high-purity components, the enhanced demand for electronics and consumer products, increased investment in fabrication plants for semiconductors, enhanced cleanliness standards, and the need for accurate and reliable flow control.

Segments' Analysis

|

Segmentations

|

List of Sub-Segments

|

Segments with High-Growth Opportunity

|

|

Technology-Type Analysis

|

Pneumatic, Manual, and Other Technology Types

|

Pneumatic valve is expected to remain dominant and likely to experience the fastest growth during the forecast period.

|

|

Material-Type Analysis

|

Stainless Steel, Aluminum, and Other Material Types

|

During the forecast period, stainless Steel will likely remain the market's most dominant material type.

|

|

Process-Type Analysis

|

Substrate Transfer, Process Control & Isolation, and Sub-Fab Systems

|

Substrate Transfer is the most dominant process type and is expected to maintain its lead during the forecast period.

|

|

Function-Type Analysis

|

Isolation, Control, and Combined

|

Isolation valve is likely to be the dominant segment in the market during the forecast period.

|

|

Valve-Type Analysis

|

Transfer Valve, Gate Valve, Butterfly Valve, Cylinder Valve, and Other Valves Types

|

The Transfer Valve is expected to remain the dominant type, whereas the Butterfly Valve is likely to be the fastest-growing valve type during the forecast period.

|

|

Region Analysis

|

North America, Europe, Asia-Pacific, and The Rest of the World

|

Asia-Pacific is expected to maintain its reign over the forecast period.

|

Technology Insights

“Pneumatic valve is expected to remain dominant and is also likely to experience the fastest growth during the forecast period.”

-

The market is segmented into pneumatic, manual, and other technology types. Amongst these, pneumatic valves stand out, as they offer high resistance to temperature variations, dust, and most chemical solutions.

-

They can also withstand high pressure and vacuum, which are key semiconductor production features. These valves have fewer components and less complex structures than others; hence, they require minimal overhaul and thus reduce offline time.

-

Actuation can be pneumatic, electric, or other advanced technologies; however, pneumatic valves retain their position in the market as they are relatively cheaper than the others.

Material Insights

“Stainless Steel is currently the most dominant material type and is also likely to grow at the fastest pace during the forecast period.”

-

The market is segmented into stainless steel, aluminum, and other materials.

-

Amongst stainless steel valves, stainless steel is a very sturdy material with excellent corrosion resistance, so it adapts well to the severe conditions of the semiconductor manufacturing processes that involve high temperatures and aggressive chemicals.

-

Stainless steel has very low particle emissions, which is a very important factor in semiconductor production, where even a spatter of a particle can break a production. They prefer using autoclaves to ensure they are extremely sterile and free from contamination procedures. It has been learned that operations involving semiconductor manufacturing entail much time. Thus, stainless-steel valves do not rust and need not be replaced often; this eliminates time.

Process Insights

“Substrate transfer is the most dominant process type and is expected to maintain its lead during the forecast period.”

-

The market is segmented into substrate transfer, process control & isolation, and sub-fab systems.

-

Amongst, the substrate transfer valve stands out as the lines of a substrate transfer are the initial stage during the manufacture of semiconductors, where wafers are transferred from one piece of equipment to another, which includes deposition, etching, cleaning, and inspection tools.

-

During this transfer, valves are essential to creating and maintaining a controlled environment. Given that drafter node sizes are shrinking (5 nm and below), the need to achieve finer and cleaner manufacturing and strict control of the substrate handling increases the demand for the required valves.

-

Substrate transfer commonly takes place in a vacuum or conditions of controlled pressure. Vacuum valves maintain these conditions and are indispensable for the defect-less production of wafers.

Function Insights

“Isolation valve is likely to be the dominant function type of the market, whereas control valve to be the second dominant function type in the forecast period.”

-

The market is segmented into isolation, control, and combined. Isolation valves are important control elements that keep different steps of semiconductor manufacturing processes separate. This is very important since the quality of the products being produced is another factor that defines value for a business organization.

-

Semiconductor manufacturing needs clean environments, and isolation valves play a crucial role in achieving this by providing no flow or leak. Isolation valves also help increase operational safety by reducing the effective leakage of hazardous gases or fluids common to semiconductor fabs.

Valve Insights

“Transfer Valve is expected to remain dominant and fastest-growing during the forecast period.”

-

The market is segmented into transfer valve, gate valve, butterfly valve, cylinder valve, and other valve types. Amongst these, transfer valves stand out as they are manufactured to work under various demanding environments like high vacuum or reacting equally, and they are thus critical in producing semiconductors.

-

Transfer valves are required to transfer wafers and substrates from one process chamber to another while maintaining the environmental condition of chambers in either a vacuum or ultra-clean environment. They incorporate means of substrate transfer that are efficient and smooth, which is critical in semiconductor manufacturing.

Regional Insights

“Asia-Pacific is expected to maintain its reign of dominance in the market over the forecast period.”

-

Asia-Pacific is the global base for the production of various commodities, such as consumer electronics, automobiles, and telecommunications equipment. The continued demand for these products contributes indirectly to the growth of semiconductors, which in turn promotes the use of valves.

-

Major capital expenditures in new fabs around the Asia Pacific region also help to maintain the region’s global leadership. Taiwan, South Korea, China, and Japan are among the largest semiconductor-producing nations globally.

Want to get a free sample? Register Here

Competitive Landscape

The market is highly consolidated, with the top player, VAT Group AG, capturing strong market share. The following are the key players in the semiconductor vacuum valve market.

Here is the list of the Top Players (Based on Dominance)

Note: The above list does not necessarily include all the top players in the market.

Are you the leading player in this market? We would love to include your name. Please write to us at [email protected]

Recent Developments

Recent Market Strategic Alliances, JVs, Acquisitions, and Expansions:

A considerable number of strategic alliances, including M&As, JVs, etc., have been performed over the past few years:

-

On December 10, 2024, KITZ Corporation (KITZ) officially started operations at its new subsidiary, KITZ Corporation of Vietnam Co., Ltd. (KCV) plant in Vinh Phuc Province, Vietnam, to produce stainless steel valves that are widely used across various industries. In addition, the company is currently constructing a new building on the same site to deliver high-purity gas valves used in semiconductor manufacturing processes.

Report Features

This report provides market intelligence most comprehensively. The report structure has been kept so that it offers maximum business value. It provides critical insights into market dynamics and will enable strategic decision-making for existing market players as well as those willing to enter the market.

The following are the key features of the report:

-

Market structure: Overview, industry life cycle analysis, supply chain analysis.

-

Market environment analysis: Growth drivers and constraints, Porter’s five forces analysis, SWOT analysis.

-

Market trend and forecast analysis.

-

Market segment trend and forecast.

-

Competitive landscape and dynamics: Market share, Service portfolio, New Product Launches, etc.

-

COVID-19 impact and its recovery curve.

-

Attractive market segments and associated growth opportunities.

-

Emerging trends.

-

Strategic growth opportunities for the existing and new players.

-

Key success factors.

|

Market Study Period

|

2019-2031

|

|

Base Year

|

2024

|

|

Forecast Period

|

2025-2031

|

|

Trend Period

|

2019-2023

|

|

Number of Tables & Figures

|

>100

|

|

Number of Segments Analysed

|

5 (Technology Type, Material Type, Function Type, Valve Type, and Region)

|

|

Number of Regions Analysed

|

4 (North America, Europe, Asia-Pacific, Rest of the World)

|

|

Countries Analysed

|

15 (The USA, Canada, Mexico, Germany, France, Italy, The UK, China, Japan, India, Brazil, Saudi Arabia, Rest of Europe, Rest of APAC, and Rest of the World)

|

|

Free Customization Offered

|

10%

|

|

After Sales Support

|

Unlimited

|

|

Report Presentation

|

Complimentary

|

|

Market Dataset

|

Complimentary

|

|

Further Deep Dive & Consulting Services

|

10% Discount

|

Market Segmentation

The report provides detailed insights into the market dynamics to enable informed business decision-making and growth strategy formulation based on the opportunities present in the market.

The global semiconductor vacuum valve market is segmented into the following categories:

Semiconductor Vacuum Valve Market, by Technology Type

-

Pneumatic

-

Manual

-

Other Technology Types

Semiconductor Vacuum Valve Market, by Material Type

-

Stainless Steel

-

Aluminum

-

Other Material Types

Semiconductor Vacuum Valve Market, by Process Type

Semiconductor Vacuum Valve Market, by Function Type

-

Isolation Valves

-

Control Valves

-

Combined Valves

Semiconductor Vacuum Valve Market, by Valve Type

-

Transfer Valve

-

Gate Valve

-

Butterfly Valve

-

Cylinder Valve

-

Other Valve Types

Semiconductor Vacuum Valve Market, by Region

-

North America (Country Analysis: The USA and Rest of North America)

-

Europe (Country Analysis: Germany, Netherlands, The UK, and Rest of Europe)

-

Asia-Pacific (Country Analysis: Japan, China, South Korea, Taiwan, and Rest of Asia-Pacific)

-

Rest of the World (Country Analysis: Brazil, Saudi Arabia, and Others)

Research Methodology

-

This strategic assessment report from Stratview Research provides a comprehensive analysis that reflects today’s semiconductor vacuum valve market realities and future market possibilities for the forecast period.

-

The report segments and analyzes the market in the most detailed manner to provide a panoramic view of the market.

-

The vital data/information provided in the report can play a crucial role for market participants and investors in identifying the low-hanging fruits available in the market and formulating growth strategies to expedite their growth process.

-

This report offers high-quality insights and is the outcome of a detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research’s internal database and statistical tools.

-

More than 1,000 authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white papers, patents, and articles, have been leveraged to gather the data.

-

We conducted more than 15 detailed primary interviews with market players across the value chain in all four regions and industry experts to obtain both qualitative and quantitative insights.

Customization Options

With this detailed report, Stratview Research offers one of the following free customization options to our respectable clients:

Company Profiling

Competitive Benchmarking

-

Benchmarking of key players on the following parameters: Service portfolio, geographical reach, regional presence, and strategic alliances

Custom Research: Stratview Research offers custom research services across sectors. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to [email protected]