Attractive Opportunities

Global Demand Analysis & Sales Opportunities in Stationary Fuel Cell Stack Systems Market

-

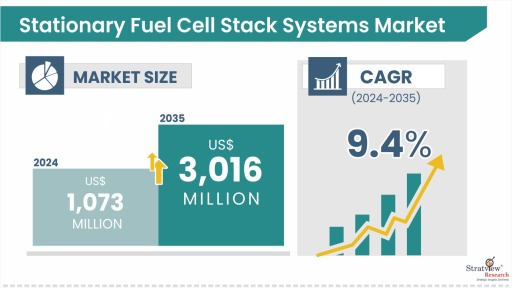

The annual demand for stationary fuel cell stack systems was USD 1.1 billion in 2024 and is expected to reach USD 1.2 billion in 2025, up 14.8% than the value in 2024.

-

During the forecast period (2025-2035), the stationary fuel cell stack systems market is expected to grow at a CAGR of 9.4%. The annual demand will reach USD 3.0 billion in 2035, which is almost 2.5 times the demand in 2025.

-

During 2025-2035, the stationary fuel cell stack systems industry is expected to generate a cumulative sales opportunity of USD 24.3 billion, which is almost 4 times the opportunities during 2019-2024.

Want to get a free sample? Register Here

High-Growth Market Segments:

-

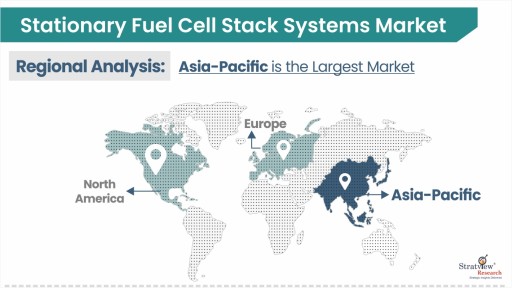

Asia-Pacific region is expected to maintain its reign over the forecast period and is likely to grow at the fastest rate in the forecast period.

-

By fuel cell type, SOFC stack systems have primarily dominated the stationary power generation market due to their high performance and efficiency. SOFC stack systems are expected to be the market leader in the forecasted period.

-

By application type, Small-medium stationary power plants have dominated the market in the past and will continue to reign the market in the forecasted period.

-

By operating mode type, Continuous type has been the market leader and will continue to dominate in the forecasted period.

-

By end-use type, Utilities end-use has dominated the market in recent years but is expected to face increasing competition from the commercial end-use type in the global market in the forecast period. The commercial type is forecasted to grow at the fastest rate.

Market Statistics

Have a look at the sales opportunities presented by the stationary fuel cell stack systems market in terms of growth and market forecast.

|

Stationary Fuel Cell Stack Systems Market Data & Statistics

|

|

|

Market Statistics

|

Value (in USD Billion)

|

Market Growth (%)

|

|

Annual Market Size in 2023

|

USD 0.9 billion

|

-

|

|

Annual Market Size in 2024

|

USD 1.1 billion

|

YoY Growth in 2024: 19.2%

|

|

Annual Market Size in 2025

|

USD 1.2 billion

|

YoY Growth in 2025: 14.8%

|

|

Annual Market Size in 2035

|

USD 3.0 billion

|

CAGR 2025-2035: 9.4%

|

|

Cumulative Sales Opportunity during 2025-2035

|

USD 24.3 billion

|

-

|

|

Top 10 Countries’ Market Share in 2024

|

USD 0.9 billion +

|

> 80%

|

|

Top 10 Company’s Market Share in 2024

|

USD 0.5 billion to USD 0.8 billion

|

50% - 70%

|

Market Dynamics

Introduction:

Fuel cell stack systems are increasingly being employed in stationary power applications, providing a reliable and efficient source of power for various industries. They employ electrochemical reactions to transform constantly fed chemical energy directly into electricity with water as emission. This is more efficient and cleaner than traditional combustion-based power generation, and it avoids pollution in the form of particulate matter and nitrogen oxides. Thus, this operational efficiency positions fuel cells as an attractive option for both primary power generation and backup power systems. Hence, the fuel cell stack systems market for stationary applications has proliferated in recent years. Efficient operation, environmental regulations, integration into combined heat and power systems (CHP), and fuel availability and flexibility will drive the market in the coming years.

Market Drivers:

-

The stationary fuel cell stack systems market is poised for significant growth, driven by increasing environmental regulations and the global push for clean energy solutions. Governments worldwide are implementing stricter emission norms, incentivizing low-carbon technologies like fuel cells.

-

The growing adoption of Combined Heat and Power (CHP) systems enhances efficiency by utilizing waste heat for heating and cooling applications. The rising need for reliable, uninterrupted power in industries like healthcare, data centers, and telecommunications further fuels market expansion.

-

Another key driver is the increasing availability and flexibility of fuel sources. While hydrogen remains a primary fuel, advancements in fuel processing technologies enable the use of biogas, natural gas, and ammonia, broadening the market’s reach. Additionally, ongoing research and development efforts are improving fuel cell durability and reducing costs, making them more competitive with traditional power sources. As energy security concerns rise, decentralized power generation through fuel cell systems will become an attractive and sustainable solution.

Segments' Analysis

|

Segmentations

|

List of Sub-Segments

|

Segments with High-Growth Opportunity

|

|

Fuel Cell-Type Analysis

|

PEMFC, SOFC, and Others (PAFC, MCFC, AFC, and DMFC)

|

SOFC stack systems have primarily dominated the stationary power generation market due to their high performance and efficiency. SOFC stack systems are expected to be the market leader in the forecasted period.

|

|

Application-Type Analysis

|

Large Stationary Powerplants and Small-Medium Stationary Powerplants

|

Small-medium stationary powerplants have dominated the market in the past and will continue to reign the market in the forecasted period.

|

|

Operating Mode Type

|

Backup Power and Continuous

|

Continuous type has been the market leader and will continue to dominate in the forecasted period.

|

|

End-Use Type

|

Commercial, Utilities, Data and Telecom, Residential, and Industrial

|

The Utilities end-use has dominated the market in recent years but is expected to face increasing competition from the commercial end-use type in the global market in the forecast period. The commercial type is forecasted to grow at the fastest rate.

|

|

Region Analysis

|

North America, Europe, Asia-Pacific, and The Rest of the World

|

The Asia-Pacific region is expected to maintain its reign over the forecast period and is likely to grow at the fastest rate in the forecast period.

|

Fuel Cell Insights

“SOFC (Solid-Oxide Fuel Cell) stack systems are expected to remain dominant in the market during the forecast period.”

-

The stationary fuel cell stack systems market is segmented into PEMFC, SOFC, and other fuel cell types (PAFC, MCFC, AFC, and DMFC) by fuel cell type.

-

SOFC stack systems have dominated the market and will continue to lead in the forecast period. Although SOFCs have slower start-up times due to high operating temperatures (500°C to 1000°C), they are best suited for stationary power applications requiring higher power output. The high operating temperature accelerates ionization processes and enables the use of non-precious metal catalysts, contributing to cost reduction.

-

Due to their very high efficiency, almost exceeding 80% in cogeneration, SOFCs are well suited for CHP (Combined heat and power) applications. Operating at high temperatures allows SOFCs to generate significant amounts of waste heat, which can be effectively captured and utilized in combined heat and power (CHP) systems. These factors will contribute to the growth of SOFC in the forecast period.

Application Insights

“Small-medium stationary power plants have dominated the market in the past and will continue to reign the market in the forecasted period.”

-

The stationary fuel cell stack systems market is segmented into Large Stationary Powerplants and Small-Medium Stationary Powerplants.

-

Small-medium stationary power plants have dominated the fuel cell stack systems market because they provide efficient, reliable, and low-emission power for commercial, industrial, and residential applications. Their scalability makes them ideal for distributed energy generation, reducing dependence on centralized grids.

-

Additionally, their integration with Combined Heat and Power (CHP) systems enhances overall efficiency. As energy demand grows and environmental regulations tighten, these power plants will continue to lead the market, driven by advancements in fuel cell technology and flexibility.

Operating Mode Insights

“Continuous type has been the market leader and will continue to dominate in the forecasted period.”

-

The stationary fuel cell stack systems market is segmented into backup and continuous by operating mode.

-

Stationary fuel cell systems of the continuous type have dominated the market. They will likely continue leading because they can offer efficient, reliable, and scalable energy solutions for long-term use. They are built for steady power delivery over long durations and are thus suitable for most stationary applications, such as industrial, commercial, and residential. These fuel cells' ability to operate around the clock means that there is a constant power source with minimal chances of interruption, promoting energy grid stability, particularly for off-grid and remote locations.

-

With improvements in fuel cell technology, continuous systems have become efficient, affordable, and able to support fluctuating power requirements. In addition, as the need for clean energy solutions increases across the world, governments and industries are focusing on more reliable and sustainable sources of energy, and this further encourages the use of continuous-type fuel cells. Together, these create continuous-type systems as the reigning force in the stationary fuel cell market for the forecast period.

End-Use Insights

“The utilities end-use has dominated the market in recent years. However, Commercial type is forecasted to grow at the fastest rate in the forecast period.”

-

The stationary fuel cell stack systems market is segmented into commercial, utilities, data and telecom, residential, and industrial by end-use type.

-

Utilities have been the leading end-use customers of stationary fuel cell systems over the last few years due to the growing demand for clean sources of energy for power generation. Its dominance will be challenged by the commercial end-use type in the global market in the forecast period.

-

Utilities have embraced mainly fuel cell technology to strengthen grid stability, facilitate renewable integration, and deliver backup power. Their capacity for providing steady, large-scale output of energy has made them an attractive option to lower fossil fuel dependence while pursuing emission reduction strategies.

-

The commercial category is anticipated to expand at a higher rate in the forecast period. This is fueled by companies looking for decentralized and sustainable energy solutions for energy security and cost savings. Fuel cells are becoming increasingly popular in commercial buildings, retail outlets, and data centers because of their scalability, high efficiency, and capacity to supply power without interruptions.

Regional Insights

“The Asia-Pacific is expected to remain the largest market for stationary fuel cell stack systems during the forecast period.”

-

The stationary fuel cell stack systems market is segmented into North America, Europe, Asia-Pacific, and the Rest of the World by region type.

-

The Asia-Pacific region, under global climate regulations, comprising a giant consumer base and massive energy needs, will invest heavily in sustainable alternatives, which include fuel cells. Thus, the market will grow rapidly in the region and will account for the majority of the market share in the forecasted period. The global technological giants are marking a shift towards the region to cater to the needs of the huge market demand. The government subsidies and policies favoring fuel cell-driven mobility will result in higher demand creation and market growth.

-

The North American and European markets will also experience decent growth in the forecast period owing to their current technological dominance, highly allocated funds for R&D, and policies revolving around a hydrogen-based economy.

Want to get a free sample? Register Here

Competitive Landscape

The market is fragmented, with multiple players supplying either a particular component or complete stack systems solutions. Most of the major players compete in some of the governing factors, including price, service offerings, regional presence, etc. The following are the key players in the stationary fuel cell stack systems market.

Here is the list of the Top Players (Based on Dominance)

-

Doosan Fuel Cell Co. Ltd.

-

Bloom Energy

-

Plug Power Inc.

-

Ballard Power Systems

-

Cummins

-

Flex Energy Solutions

-

Nuvera Fuel Cells LLC

-

Enchanted Rock

-

Nedstack Fuel Cell Technology

-

Powercell Group

-

Schaeffler AG

-

AVL Fuel Cell Canada Inc.

Note: The above list does not necessarily include all the top players in the market.

Are you the leading player in this market? We would love to include your name. Please write to us at [email protected]

Recent Developments

Recent Market JVs and Acquisitions:

A considerable number of strategic alliances, including M&As, JVs, etc., have been performed over the past few years:

-

In October 2024, SFC Energy bought a minor Scandinavian stationary hydrogen fuel cell company from Ballard. The takeover will assist SFC's Danish subsidiary, SFC Denmark, in expanding its footprint in Europe.

-

In May 2023, BASF and Advent Technologies joined hands to create a stable supply chain of hydrogen fuel cells in Europe. Under their terms, BASF will accelerate the production of Celtec MEA technology to help Advent's proposed fuel cell production plant in Greece.

-

Nuvera Fuel Cells and DEVINN entered into a partnership in which Nuvera Fuel Cells supplied fuel cell engines to DEVINN, a European systems integrator, for stationary power projects. Their collaboration includes integrating Nuvera's fuel cell technology with on-site electrolyzers to produce clean electricity for grid distribution.

Recent Product Development:

Most recent developments concerning stationary fuel cell stack systems have focused on cost reduction to ensure commercial viability and accelerate the adoption of fuel cells. The stack systems rely on costly components such as platinum-based catalysts and high-performance materials. R&D has focused on optimizing total cost structure, efficiency, and machinery improvement under high-temperature environments.

-

In November 2024, Bloom Energy announced a landmark project to deliver fuel cells to the largest single-site installation to date. The 80 MW project, developed in partnership with SK Eternix, will power two eco-parks in North Chungcheong Province, South Korea, providing reliable, sustainable energy for critical infrastructure and regional development.

-

In March 2024, Nissan announced that it had started the trial of a stationary power generation system fueled by bioethanol using SOFC. The system will be capable of high-efficiency power generation.

-

In 2023, Nuvera Fuel Cells announced the commercial availability of 360 kW and 470 kW Nuvera® G-Series Fuel Cell Power Generators, a modular zero-emission power solution for commercial and industrial applications including data centers, electric vehicles, backup power, and microgrids.

-

Hydrogenics (a Cummins company) has introduced new combined heat and power (CHP) systems for stationary applications. These systems utilize hydrogen fuel cells to provide both electricity and thermal energy, improving overall energy utilization.

-

Blue World Technologies ApS unveiled its CellPack Stationary methanol fuel cell technology in February 2023. This move demonstrates the company's emphasis on creating strategic partnerships to increase the use of fuel cells in telecommunication and other industries.

Report Features

This report provides market intelligence most comprehensively. The report structure has been kept so that it offers maximum business value. It provides critical insights into market dynamics and will enable strategic decision-making for existing market players as well as those willing to enter the market.

The following are the key features of the report:

-

Market structure: Overview, industry life cycle analysis, supply chain analysis.

-

Market environment analysis: Growth drivers and constraints, Porter’s five forces analysis, SWOT analysis.

-

Market trend and forecast analysis.

-

Market segment trend and forecast.

-

Competitive landscape and dynamics: Market share, Service portfolio, New Product Launches, etc.

-

COVID-19 impact and its recovery curve.

-

Attractive market segments and associated growth opportunities.

-

Emerging trends.

-

Strategic growth opportunities for the existing and new players.

-

Key success factors.

|

Market Study Period

|

2019-2035

|

|

Base Year

|

2024

|

|

Forecast Period

|

2025-2035

|

|

Trend Period

|

2019-2023

|

|

Number of Tables & Figures

|

>100

|

|

Number of Segments Analysed

|

5 (Fuel Cell Type, Application Type, Operating Mode Type, End-Use Type, and Region)

|

|

Number of Regions Analysed

|

4 (North America, Europe, Asia-Pacific, Rest of the World)

|

|

Countries Analysed

|

15 (The USA, Canada, Mexico, Germany, France, Italy, The UK, China, Japan, India, Brazil, Saudi Arabia, Rest of Europe, Rest of APAC, and Rest of the World)

|

|

Free Customization Offered

|

10%

|

|

After Sales Support

|

Unlimited

|

|

Report Presentation

|

Complimentary

|

|

Market Dataset

|

Complimentary

|

|

Further Deep Dive & Consulting Services

|

10% Discount

|

Market Segmentation

The report provides detailed insights into the market dynamics to enable informed business decision-making and growth strategy formulation based on the opportunities present in the market.

The global stationary fuel cell stack systems market is segmented into the following categories:

Stationary Fuel Cell Stack Systems Market, by Fuel Cell Type

-

PEMFC

-

SOFC

-

Other Fuel Cell Types

-

(Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

-

(Fuel Cell Type Analysis: PAFC, MCFC, AFC, and DMFC)

Stationary Fuel Cell Stack Systems Market, by Application Type

Stationary Fuel Cell Stack Systems Market, by Operating Mode Type

Stationary Fuel Cell Stack Systems Market, by End-Use Type

-

Commercial

-

Utilities

-

Data and Telecom

-

Residential

-

Industrial

Stationary Fuel Cell Stack Systems Market, by Region

-

North America (Country Analysis: The USA, Canada, and Mexico)

-

Europe (Country Analysis: Germany, France, The UK, Italy, Russia, Spain, and Rest of Europe)

-

Asia-Pacific (Country Analysis: Japan, China, India, and Rest of Asia-Pacific)

-

Rest of the World (Country Analysis: Brazil, Saudi Arabia, and Others)

Research Methodology

-

This strategic assessment report from Stratview Research provides a comprehensive analysis that reflects today’s stationary fuel cell stack systems market realities and future market possibilities for the forecast period.

-

The report segments and analyzes the market in the most detailed manner to provide a panoramic view of the market.

-

The vital data/information provided in the report can play a crucial role for market participants and investors in identifying the low-hanging fruits available in the market and formulating growth strategies to expedite their growth process.

-

This report offers high-quality insights and is the outcome of a detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research’s internal database and statistical tools.

-

More than 1,000 authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white papers, patents, and articles, have been leveraged to gather the data.

-

We conducted more than 15 detailed primary interviews with market players across the value chain in all four regions and industry experts to obtain both qualitative and quantitative insights.

Customization Options

With this detailed report, Stratview Research offers one of the following free customization options to our respectable clients:

Company Profiling

Competitive Benchmarking

-

Benchmarking of key players on the following parameters: Service portfolio, geographical reach, regional presence, and strategic alliances

Custom Research: Stratview Research offers custom research services across industries. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to [email protected]