Market Insights

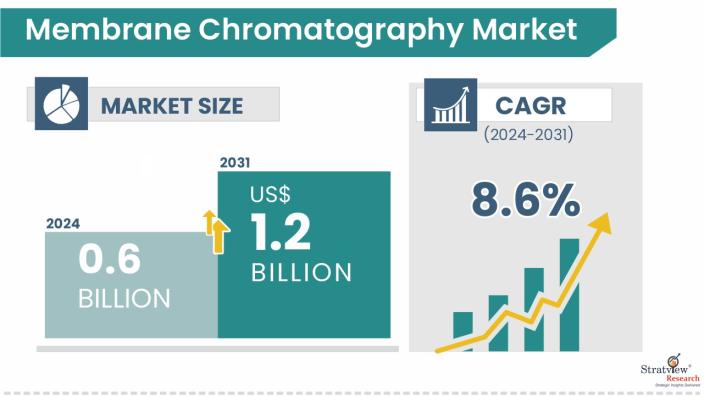

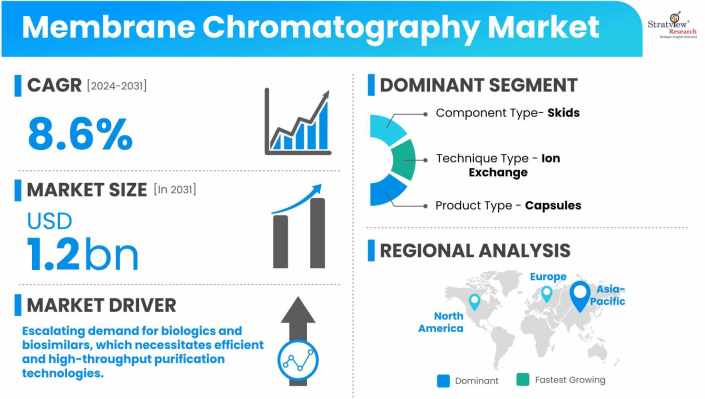

“The membrane chromatography market value was at US$ 0.6 billion in 2024 and is likely to grow at a robust CAGR of 8.6% in the long run to reach US$ 1.2 billion in 2031.”

Want to know more about the market scope? Register Here

Market Dynamics

Introduction

Membrane chromatography is an advanced bio separation technique that combines the high selectivity of chromatography with the speed and throughput of membrane filtration. Unlike traditional packed-bed columns, membrane chromatography utilizes porous membranes as the stationary phase, allowing biomolecules to interact with functional ligands attached to the membrane surface. This results in significantly reduced processing times, lower buffer consumption, and higher productivity, especially in downstream bioprocessing applications. The technique is particularly effective for capturing or polishing steps in biopharmaceutical manufacturing, where fast and efficient separation of proteins, viruses, plasmids, or other biological molecules is essential.

Market Drivers

The membrane chromatography market has been experiencing significant growth, driven by the expanding biopharmaceutical industry and the increasing demand for high-throughput purification processes. As the development of monoclonal antibodies, vaccines, and gene therapies accelerates, biomanufacturers are seeking scalable and cost-effective purification technologies, where membrane chromatography offers a compelling solution. Moreover, stringent regulatory requirements for product purity and safety in pharmaceutical and biotechnological production are further propelling the adoption of membrane-based separation techniques.

Another key growth driver is the rising interest in single-use technologies, which align with membrane chromatography's modular and disposable nature. This is especially relevant for contract research organizations (CROs), small-scale biotech startups, and facilities focusing on personalized medicine. In addition, the increasing adoption of membrane chromatography in environmental testing, food & beverage quality control, and academic research institutions further broadens its application landscape.

Recent Market JVs and Acquisitions:

A considerable number of strategic alliances, including M&As, JVs, etc., have been performed over the past few years:

- In 2024, Thermo Fisher opened a new sterile drug manufacturing facility in Singapore, boosting the use of membrane chromatography in the Asia-Pacific region through enhanced production capabilities and adoption of advanced purification technologies.

- In 2022, Sartorius expanded its downstream bioprocessing portfolio by acquiring Novasep’s chromatography division, which includes membrane chromatography technologies. This acquisition strengthens Sartorius’ capabilities in continuous bioprocessing and advanced purification solutions for biopharmaceutical manufacturing.

Want to have a closer look at this report? Click Here

Key Players

The membrane chromatography market is characterized by a consolidated structure, with a select group of key players exerting significant influence over market dynamics. These leading companies compete on various critical factors, including pricing strategies, service portfolios, regional presence, and technological advancements. To maintain and enhance their market positions, these firms actively engage in strategic initiatives such as mergers and acquisitions, product innovations, and global expansions.

Here is the list of the Top Players (Based on Dominance)

- Sartorius AG

- Danaher (Cytiva)

- Merck KGaA

- Thermo Fisher Scientific

- The 3M Company

- Repligen Corp.

- Donaldson

- Shimadzu Corporation

- Agilent Technologies Inc.

- Restec Corporation

- Cole Parmer Instrument Company LLC

- GVS Groups

Note: The above list does not necessarily include all the top players in the market.

Are you the leading player in this market? We would love to include your name. Please write to us at [email protected]

Segments Analysis

|

Segmentations

|

List of Sub-Segments

|

Segments with High-Growth Opportunity

|

|

Component-Type Analysis

|

Instrument/Skid, Consumables, Software, and Other Components

|

Instruments/skids are expected to hold the major share of the market, while consumables are poised to grow at the fastest pace due to their recurring usage.

|

|

End-Use-Industry-Type Analysis

|

Pharmaceutical, Biotechnology, Academic, Chemicals, Environmental Testing, CROs, Government Research, Hospitals & Clinical Trials, Agricultural, Food & Beverages, and Other End-Use Industries

|

The pharmaceutical industry is expected to be the dominant end-use industry of the membrane chromatography market throughout the forecast period.

|

|

Technique-Type Analysis

|

Ion-Exchange, Affinity, and HIC (Hydrophobic Interaction Chromatography)

|

Ion-Exchange is expected to hold the largest market share and likely to be the fastest-growing technique during the forecast period.

|

|

Product-Type Analysis

|

Capsules, Cartridges, Cassettes, and Other Products

|

Capsules are expected to be the dominant as well as the fastest-growing product type of the market over the forecast period.

|

|

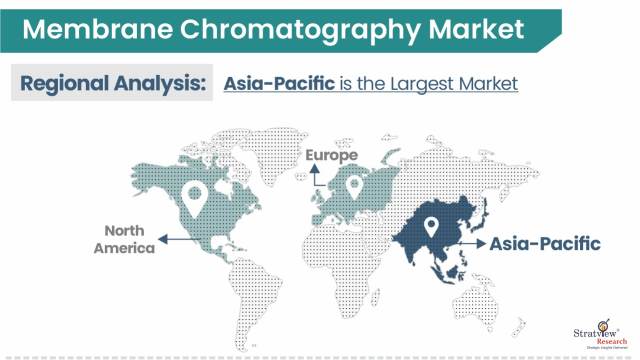

Regional Analysis

|

North America, Europe, Asia-Pacific, and The Rest of the World

|

Asia-Pacific region is expected to hold the largest market share and emerge as the fastest-growing region during the forecast period.

|

By Component Type

“Instruments/skids are expected to hold the dominant market share, and consumables are set to experience the fastest growth during the forecast period.”

By component type, membrane chromatography market is segmented as instrument/skid, consumables, software, and other components. Instruments/skids are anticipated to be the dominant component of the membrane chromatography market due to their essential role in bioprocessing workflows. These skids serve as the central hardware units that house and control the chromatography process, ensuring precise fluid flow, pressure regulation, and integration with upstream and downstream operations. Their ability to maintain consistent purification parameters is critical for meeting the rigorous quality and safety standards demanded in pharmaceutical and biopharmaceutical production. Moreover, advancements in automation and control systems integrated within modern skids further enhance their operational reliability and efficiency. As biopharmaceutical companies increasingly prioritize scalable, modular, and compliant systems, the demand for high-performance chromatography skids continues to grow. Their alignment with trends such as continuous bioprocessing and single-use systems also reinforces their market dominance.

On the other hand, consumables are likely to be the fastest-growing component type during the forecast period. This surge is primarily driven by the increasing adoption of single-use technologies across the biopharmaceutical and biotechnology industries. Consumables are designed for one-time use, which reduces the risk of cross-contamination, minimizes downtime, and enhances operational flexibility. As drug developers and contract research organizations (CROs) focus on accelerating time-to-market and improving cost-efficiency, the use of disposable membrane chromatography consumables has become more prevalent. Their recurring nature and adaptability to varying scales of operation make consumables a rapidly expanding segment in the overall market.

By End-Use Industry Type

“The pharmaceutical industry is set to dominate the market, while hospitals & clinical trials are projected to witness the fastest growth during the forecast period.”

The membrane chromatography market serves a wide array of end-use industries, including pharmaceuticals, biotechnology, academic research, chemicals, environmental testing, contract research organizations (CROs), government research, hospitals & clinical trials, agriculture, food & beverages, and other end-use industries.

The pharmaceutical industry is likely to hold the major share in the membrane chromatography market due to its pivotal role in the production of biopharmaceuticals, including monoclonal antibodies, vaccines, and gene therapies. These complex biologics require efficient and scalable purification processes to ensure product quality and regulatory compliance. Membrane chromatography offers advantages such as higher throughput, faster processing times, and better scalability compared to traditional chromatography techniques, making it an essential tool in pharmaceutical manufacturing. The increasing demand for biologics and the need for cost-effective purification solutions are driving pharmaceutical companies to adopt membrane chromatography technologies extensively.

Hospitals & clinical trials are anticipated to be the fastest-growing end-use industry in the membrane chromatography market during the forecast period. This growth is attributed to the rising adoption of personalized medicine and the increasing number of clinical trials focusing on biologic therapies. Membrane chromatography's ability to provide rapid and efficient purification makes it suitable for small-scale, high-throughput applications commonly found in clinical settings. Additionally, the need for high-purity biologics in clinical trials and hospital-based research is propelling the demand for advanced purification technologies like membrane chromatography.

By Technique Type

“Ion-exchange chromatography is projected to dominate the market in terms of share and is also anticipated to be the fastest-growing technique during the forecast period.”

The membrane chromatography market is segmented by technique into ion-exchange, affinity, and hydrophobic interaction chromatography (HIC). Ion-exchange chromatography is anticipated to maintain its leading position in the membrane chromatography market due to its versatility, cost-effectiveness, and scalability. This technique separates biomolecules based on their charge properties, making it highly effective for purifying proteins, nucleic acids, and other charged biomolecules. Its widespread applicability across various stages of biopharmaceutical manufacturing, from initial capture to final polishing, underscores its dominance. The method's ability to handle large volumes and deliver high-resolution separation aligns well with the industry's demand for efficient and scalable purification processes.

A significant advantage of ion-exchange chromatography is its cost-effectiveness compared to other techniques like affinity chromatography. Ion-exchange resins are generally less expensive and can be regenerated and reused multiple times, reducing operational costs. This economic efficiency makes ion-exchange chromatography particularly attractive for large-scale biopharmaceutical production, where cost control is crucial. Furthermore, leading industry players are investing in the development of advanced ion-exchange membrane chromatography products. For instance, companies like Sartorius have focused on creating high-performance cation and anion exchange membrane filters, reflecting the market's confidence in this technique's efficacy and future growth potential.

Regional Insights

“The Asia-Pacific region is projected to lead the market with the largest share and register the fastest growth throughout the forecast period.”

The Asia-Pacific region is estimated to hold the major share in the membrane chromatography market and likely to be the fastest-growing market by region throughout the forecast period. This growth is driven by several key factors, including the rapid expansion of the biopharmaceutical sector, substantial investments in healthcare infrastructure, and supportive government initiatives. Countries like China and India are at the forefront of this growth. China has emerged as a dominant force in the region, bolstered by significant investments in biopharmaceutical research and development, as well as the expansion of manufacturing facilities. The Chinese government's strategic initiatives, such as the "Made in China 2025" program, have emphasized the development of high-end medical equipment and biotechnology industries, further propelling the demand for advanced purification technologies like membrane chromatography.

India, on the other hand, demonstrates the highest growth trajectory in the Asia-Pacific region. This is attributed to increasing research and development activities in biopharmaceutical companies, the expansion of biopharmaceutical facilities, and government support for biotechnology research and development. The country's focus on developing indigenous manufacturing capabilities and increasing adoption of advanced purification technologies are shaping the market dynamics favorably. Additionally, the Asia-Pacific region's attractiveness as a cost-competitive location for manufacturing chromatography products has led to increased investments from global companies. The region's growing role as a hub for contract manufacturing and research organizations is further contributing to the market's expansion.

Know the high-growth countries in this report. Register Here

Research Methodology

This strategic assessment report, from Stratview Research, provides a comprehensive analysis that reflects today’s membrane chromatography market realities and future market possibilities for the forecast period of 2024 to 2031. After a continuous interest in our membrane chromatography market report from the industry stakeholders, we have tried to further accentuate our research scope to the membrane chromatography market to provide the most crystal-clear picture of the market. The report segments and analyses the market in the most detailed manner to provide a panoramic view of the market. The vital data/information provided in the report can play a crucial role for the market participants as well as investors in the identification of the low-hanging fruits available in the market as well as to formulate the growth strategies to expedite their growth process.

This report offers high-quality insights and is the outcome of a detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research’s internal database and statistical tools. More than 1000 authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white papers, patents, and articles, have been leveraged to gather the data. We conducted more than 15 detailed primary interviews with the market players across the value chain in all four regions and industry experts to obtain both qualitative and quantitative insights.

Report Features

This report provides market intelligence most comprehensively. The report structure has been kept so that it offers maximum business value. It provides critical insights into market dynamics and will enable strategic decision-making for existing market players as well as those willing to enter the market. The following are the key features of the report:

- Market structure: Overview, industry life cycle analysis, supply chain analysis.

- Market environment analysis: Growth drivers and constraints, Porter’s five forces analysis, SWOT analysis.

- Market trend and forecast analysis.

- Market segment trend and forecast.

- Competitive landscape and dynamics: Market share, product portfolio, New Product Launches, etc.

- COVID-19 impact and its recovery curve.

- Attractive market segments and associated growth opportunities.

- Emerging trends.

- Strategic growth opportunities for the existing and new players.

- Key success factors.

The membrane chromatography market is segmented into the following categories.

Membrane Chromatography Market, by Component Type

- Instrument/Skid (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Consumables (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Software (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Other Components (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

Membrane Chromatography Market by End-Use Industry Type

- Pharmaceutical (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Biotechnology (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Academic (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Chemicals (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Environmental Testing (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- CROs (Contract Research Organizations) (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Government Research (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Hospitals & Clinical Trials (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Agricultural (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Food & Beverages (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Other End-Use Industries (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

Membrane Chromatography Market by Technique Type

- Ion-Exchange (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Affinity (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Hydrophobic Interaction Chromatography (HIC) (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

Membrane Chromatography Market by Product Type

- Capsules (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Cartridges (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Cassettes (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

- Other Products (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

Membrane Chromatography Market by Region

- North America (Country Analysis: The USA, Canada, and Mexico)

- Europe (Country Analysis: Germany, France, The UK, and Rest of Europe)

- Asia-Pacific (Country Analysis: Japan, China, India, and Rest of Asia-Pacific)

- Rest of the World (Country Analysis: Latin America, the Middle East, and Others)

Report Customization Options

With this detailed report, Stratview Research offers one of the following free customization options to our respected clients:

Company Profiling

- Detailed profiling of additional market players (up to three players)

- SWOT analysis of key players (up to three players)

Competitive Benchmarking

- Benchmarking of key players on the following parameters: Product portfolio, geographical reach, regional presence, and strategic alliances

Custom Research: Stratview Research offers custom research services across sectors. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to [email protected]