Attractive Opportunities

Global Demand Analysis & Sales Opportunities in Aerospace & Defense Process Materials Market

-

The annual demand for aerospace & defense process materials was USD 410 million in 2024 and is expected to reach USD 469 million in 2025, up 14.4% than the value in 2024.

-

During the forecast period (2025-2030), the aerospace & defense process materials market is expected to grow at a CAGR of 4.7%. The annual demand will reach USD 589 million in 2030.

-

During 2025-2030, the aerospace & defense process materials industry is expected to generate a cumulative sales opportunity of USD 3189 million, which is more than 1.5 times the opportunities during 2019-2024.

Want to get a free sample? Register Here

High-Growth Market Segments:

-

North America generated the highest demand with the largest market share of more than 40% in 2024.

-

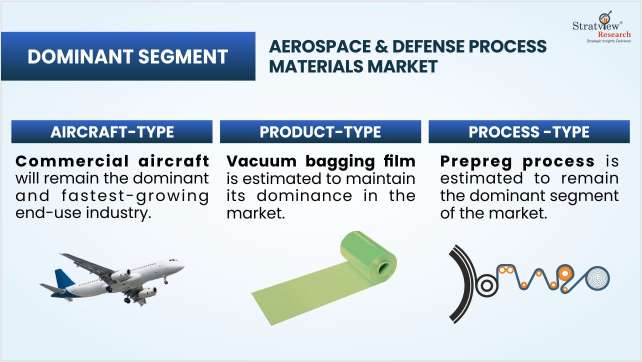

By aircraft type, Commercial aircraft will remain the dominant and fastest-growing end-use industry.

-

By product type, Vacuum bagging film is estimated to maintain its dominance in the market.

-

By process type, Prepreg process is estimated to remain the dominant segment of the market.

Market Statistics

Have a look at the sales opportunities presented by the aerospace & defense process materials market in terms of growth and market forecast.

|

Aerospace & Defense Process Materials Market Data & Statistics

|

|

|

Market Statistics

|

Value (in USD Billion)

|

Market Growth (%)

|

|

Annual Market Size in 2023

|

USD 361 million

|

-

|

|

Annual Market Size in 2024

|

USD 410 million

|

YoY Growth in 2024: 13.6%

|

|

Annual Market Size in 2025

|

USD 469 million

|

YoY Growth in 2025: 14.4%

|

|

Annual Market Size in 2030

|

USD 589 million

|

CAGR 2025-2030: 4.7%

|

|

Cumulative Sales Opportunity during 2025-2030

|

USD 3189 million

|

-

|

|

Top 10 Countries’ Market Share in 2024

|

USD 328 million +

|

> 80%

|

|

Top 10 Company’s Market Share in 2024

|

USD 205 million to USD 287 million

|

50% - 70%

|

Market Dynamics

Introduction:

Aerospace & defense accounted for more than 30% of the total process materials market in 2023. Process materials perform a major function of reducing the air surplus and resin from the laminate, which results in improved performance and reduced VOC emissions. They also optimize the fiber-resin ratio in aircraft composite part manufacturing. The aerospace & defense process materials market is set to reach its pre-COVID figures by 2024.

Market Drivers:

-

High composites content per aircraft, especially in next-generation aircraft such as the B737Max, B787, B777x, A350XWB, A220, and A320neo; expected rise in the production rates of key programs; market entry of new aircraft variants (B777x, etc.); large aircraft fleet size; and advancements in aircraft composite manufacturing are the key drivers of the market.

Market Challenges:

Market Segments' Analysis

|

Segmentations

|

List of Sub-Segments

|

Segments with High Growth Opportunity

|

|

Aircraft-Type Analysis

|

Commercial Aircraft, Regional Aircraft, General Aviation, Helicopter, Military Aircraft, and Others

|

Commercial aircraft will remain the dominant and fastest-growing end-use industry.

|

|

Product-Type Analysis

|

Vacuum Bagging Film, Release Film, Peel Ply, Breathers & Bleeders, and Others

|

Vacuum bagging film is estimated to maintain its dominance in the market.

|

|

Process-Type Analysis

|

Prepreg Layup, Resin Infusion, and Others

|

Prepreg process is estimated to remain the dominant segment of the market.

|

|

Region Analysis

|

North America, Europe, Asia-Pacific, and The Rest of the World

|

North America is anticipated to retain its position as the dominant region during the forecast period.

|

By Aircraft Type

"Commercial aircraft is expected to remain the largest and fastest-growing aircraft type in the market during the forecast period."

-

It is expected that commercial aircraft will maintain an unwavering share of <70% during the forecast period.

-

Leading commercial aircraft manufacturers, Boeing and Airbus are driving the market demand. Expected rise in the production rate of key programs (10 B787s per month by 2025/26, 75 A320s per month by 2027, 10 A350s per month by 2026 and 12 by 2028, 14 A220s per month by 2026, and 4 777s per month by 2025/26).

-

Pioneer for composite manufacturing in the aircraft industry, the military segment secured a healthy share in 2023. Rising global tensions are encouraging major defense markets to raise the budget, ultimately creating greater business opportunities for market stakeholders.

Want to get a free sample? Register Here

By Product Type

"Vacuum bagging film is expected to remain the dominant material type in the market during the forecast period."

-

Vacuum bagging film plays a vital role in composite manufacturing, where it ensures smooth resin flow and reduces air trapping, making them desirable due to their durability and appearance and effective for creating a closed environment. The aerospace & defense industry requires bagging films and other process materials that offer high-temperature and pressure-resistant properties.

-

Release film is expected to grow at the fastest rate during the forecast period. It is used in applications that require easy separation of materials. The versatility and functionality of release films are accelerating their increasing adoption in the composite process materials market.

By Process Type

"The prepreg process is estimated to remain the largest process type in the market."

-

Key drivers are increasing penetration of composites in modern aircraft programs (having high usage of prepreg); the level of consistency and ease of use have made the process indispensable in producing high-performance aircraft components.

-

Resin Infusion to gradually gained momentum, primarily in the engine category.

Regional Insights

"North America is projected to remain the largest market during the forecast period."

-

North America is likely to maintain its position in the years to come. The region has been the pioneer in the advanced composites industry with the presence of several small to large OEMs, part manufacturers, process material suppliers, and raw material suppliers.

-

Asia-Pacific is emerging as a new powerhouse in the market. Significant aerospace & defense industry expansion is taking place in the region, leading to increased demand for the process materials.

-

In countries like China, there is a strong focus on localization of the process to substitute the import. Local players are expected to enhance their presence in the market during the forecast period.

Want to get a free sample? Register Here

Competitive Landscape

The market is consolidated; however, there has been the emergence of some local players, especially in Asia. Most of the major players compete in some of the governing factors, including price, service offerings, regional presence, etc. The following are the key players:

Here is the list of the Top Players (Based on Dominance)

-

Airtech Advanced Materials Group

-

Aerovac Composites One

-

Flextech S.R.L.

-

Diatex SAS

-

Precision Fabrics Group

-

METYX Composites

-

Kejian Polymer Materials Co., Ltd.

-

Shanghai Leadgo-Tech Co., Ltd.

-

Zhejiang Hengyida Composite Materials Co., Ltd.

-

Zhejiang Youwei New Materials Co., Ltd.

Note: The above list does not necessarily include all the top players in the market.

Are you the leading player in this market? We would love to include your name. Please write to us at [email protected]

Recent Mergers & Acquisitions:

-

In March 2021, Composites One acquired the process materials business from Solvay S.A. in March 2021. The acquisition led the company to be the second-largest provider of process materials in the composites industry. The acquired business was rebranded as Aerovac.

-

In June 2017, Flextech S.R.L., a composite-film solution provider based in Italy, was acquired by Ginegar Plastic Products, an Israeli company. This acquisition enhanced Ginegar's product portfolio and strengthened its presence in international markets.

Report Features

This report provides market intelligence most comprehensively. The report structure has been kept so that it offers maximum business value. It provides critical insights into market dynamics and will enable strategic decision-making for existing market players as well as those willing to enter the market.

The following are the key features of the report:

-

Market structure: Overview, industry life cycle analysis, supply chain analysis.

-

Market environment analysis: Growth drivers and constraints, Porter’s five forces analysis, SWOT analysis.

-

Market trend and forecast analysis.

-

Market segment trend and forecast.

-

Competitive landscape and dynamics: Market share, Service portfolio, New Product Launches, etc.

-

COVID-19 impact and its recovery curve.

-

Attractive market segments and associated growth opportunities.

-

Emerging trends.

-

Strategic growth opportunities for the existing and new players.

-

Key success factors.

|

Market Study Period

|

2019-2030

|

|

Base Year

|

2024

|

|

Forecast Period

|

2025-2030

|

|

Trend Period

|

2019-2023

|

|

Number of Tables & Figures

|

>100

|

|

Number of Segments Analysed

|

4 (Aircraft Type, Process Type, Product Type, and Region)

|

|

Number of Regions Analysed

|

4 (North America, Europe, Asia-Pacific, Rest of the World)

|

|

Countries Analysed

|

15 (The USA, Canada, Mexico, Germany, France, Italy, The UK, China, Japan, India, Brazil, Saudi Arabia, Rest of Europe, Rest of APAC, and Rest of the World)

|

|

Free Customization Offered

|

10%

|

|

After Sales Support

|

Unlimited

|

|

Report Presentation

|

Complimentary

|

|

Market Dataset

|

Complimentary

|

|

Further Deep Dive & Consulting Services

|

10% Discount

|

Market Segmentation

The report provides detailed insights into the market dynamics to enable informed business decision-making and growth strategy formulation based on the opportunities present in the market.

The aerospace & defense process materials market is segmented into the following categories:

Aerospace & Defense Process Materials Market, by Aircraft Type

-

Commercial Aircraft

-

Regional Aircraft

-

General Aviation

-

Helicopter

-

Military Aircraft

-

Others

Aerospace & Defense Process Materials Market, by Product Type

-

Vacuum Bagging Film

-

Release Film

-

Peel Ply

-

Breathers & Bleeders

-

Others

Aerospace & Defense Process Materials Market, by Process Type

-

Prepreg Layup

-

Resin Infusion

-

Others

Aerospace & Defense Process Materials Market, by Region

-

North America (Country Analysis: The USA, Canada, and Mexico)

-

Europe (Country Analysis: Germany, France, The UK, Russia, and Rest of Europe)

-

Asia-Pacific (Country Analysis: Japan, China, India, and Rest of Asia-Pacific)

-

Rest of the World (Country Analysis: Brazil, Argentina, and Others)

Research Methodology

-

This strategic assessment report from Stratview Research provides a comprehensive analysis that reflects today’s aerospace & defense process materials market realities and future market possibilities for the forecast period.

-

The report segments and analyzes the market in the most detailed manner to provide a panoramic view of the market.

-

The vital data/information provided in the report can play a crucial role for market participants and investors in identifying the low-hanging fruits available in the market and formulating growth strategies to expedite their growth process.

-

This report offers high-quality insights and is the outcome of a detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research’s internal database and statistical tools.

-

More than 1,000 authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white papers, patents, and articles, have been leveraged to gather the data.

-

We conducted more than 15 detailed primary interviews with market players across the value chain in all four regions and industry experts to obtain both qualitative and quantitative insights.

Customization Options

With this detailed report, Stratview Research offers one of the following free customization options to our respectable clients:

Company Profiling

Competitive Benchmarking

-

Benchmarking of key players on the following parameters: Service portfolio, geographical reach, regional presence, and strategic alliances.

Custom Research: Stratview Research offers custom research services across sectors. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to [email protected].