Attractive Opportunities

Global Demand Analysis & Sales Opportunities in Aerospace Filters Market

-

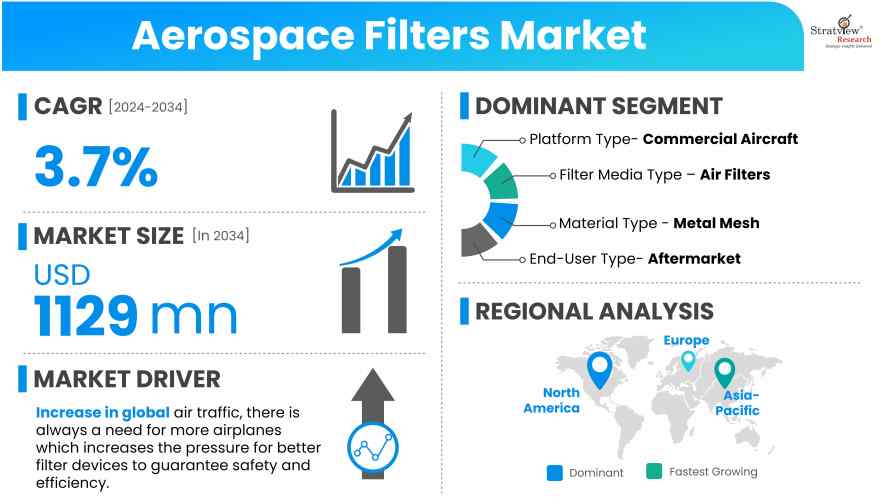

The annual demand for aerospace filters was USD 787.2 million in 2024 and is expected to reach USD 840.4 million in 2025, up 6.8% than the value in 2024.

-

During the forecast period (2025 to 2034), the aerospace filters market is expected to grow at a CAGR of 3.2%. The annual demand will reach of USD 1119.9 million in 2034.

-

During 2025-2034, the aerospace filters industry is expected to generate a cumulative sales opportunity of USD 10038.00 million.

Want to get a free sample? Register Here

High-Growth Market Segments:

-

North America is expected to remain the largest market during the forecast period.

-

By Platform type, Commercial Aircraft are expected to be the biggest demand generator for filters, whereas UAVs are likely to grow fastest in the coming years.

-

By Filter Media type, Air Filters are estimated to remain dominant during the forecast period.

-

By Material type, Metal Mesh is anticipated to contribute the largest share of the market.

-

By End User type, Aftermarket is expected to be the fastest-growing material in the market over the forecast period.

-

By Sales Channel type, Direct Sales type holds the predominant market share.

Market Statistics

Have a look at the sales opportunities presented by the aerospace filters market in terms of growth and market forecast.

|

Aerospace Filters Market Data & Statistics

|

|

|

Market Statistics

|

Value (in USD Million)

|

Market Growth (%)

|

|

Annual Market Size in 2023

|

USD 730.0 million

|

-

|

|

Annual Market Size in 2024

|

USD 787.2 million

|

YoY Growth in 2024: 7.8%

|

|

Annual Market Size in 2025

|

USD 840.4 million

|

YoY Growth in 2025: 6.8%

|

|

Annual Market Size in 2034

|

USD 1119.9 million

|

CAGR 2025-2034: 3.2%

|

|

Cumulative Sales Opportunity during 2025-2034

|

USD 10038.00 million

|

-

|

|

Top 10 Countries’ Market Share in 2024

|

USD 630 million+

|

> 80%

|

|

Top 10 Company’s Market Share in 2024

|

USD 393 million to 551 million

|

50% - 70%

|

Market Dynamics

Introduction:

Aerospace filters serve as essential components in various aircraft and spacecraft systems. Their primary function is to eliminate contaminants from fuel, hydraulic fluid, lubricants, and air, thereby safeguarding the complex systems and components crucial to aerospace applications. This ensures the dependable and effective operation of these systems. These filters help prevent dust, foreign bodies, and any other material that may cause failure or harm to these critical systems from penetrating through them and getting into the systems.

Aerospace filters are used in various operations such as fuel flow, hydraulic, engine, air conditioning, and cabin air. Filters help prevent contamination-related failures in critical systems, enhancing safety. Clean systems operate more efficiently, leading to better fuel economy, engine performance, and reliability.

Market Drivers:

-

Several factors contribute to the growth of the aerospace filters market such as growing orders for new aircraft from major manufacturers like Boeing and Airbus due to which there will be a corresponding increase in demand for the components that support these new builds, including filtration systems, aging fleets that require regular maintenance and replacement of parts, growing awareness of cabin air quality, and safety and environmental standards.

-

With the increase in global air traffic, there is always a need for more airplanes, which increases the pressure for better filter devices to guarantee safety and efficiency. The efforts to minimize maintenance costs and improve the efficiency of aircraft accelerate the growth of the aerospace filters market. In addition to that, the rise in government and private sector investments in space exploration drives the demand for advanced filtration systems to support life support and propulsion systems in spacecraft.

Segment Analysis

|

Segmentations

|

List of Sub-Segments

|

Dominant and Fastest-Growing Segments

|

|

Platform Type

|

Commercial Aircraft, Regional Aircraft, Helicopter, Military Aircraft, General Aviation, UAV, and Space

|

Commercial aircraft are expected to be the biggest demand generator for filters in the coming years.

|

|

Filter Media Type

|

Air Filters (Cabin Air Filters, Avionics Air Filters, and Engine Filters) and Liquid Filters (Hydraulic Filters, Oil & Lube Filters, Fuel Filters, Coolant Filters, and Water Filters)

|

Air filters are estimated to remain dominant during the forecast period. Cabin air filters are anticipated to have the largest share of the air filters.

|

|

Material Type

|

Metal Mesh, Fiberglass, Pleated Paper, and Others

|

Metal mesh is anticipated to contribute the largest share of the market.

|

|

End User

|

OE and Aftermarket

|

The aftermarket will maintain a significant market share.

|

|

Sales Channel

|

Direct Sales and Indirect Sales

|

The predominant share of the market is held by the direct sales channel.

|

|

Region Analysis

|

North America, Europe, Asia-Pacific, and The Rest of the World

|

North America is expected to maintain its reign over the forecast period.

|

By Platform Type

“Commercial aircraft are expected to remain the dominant aircraft of the market during the forecast period.”

-

The aerospace filters market is segmented into commercial aircraft, regional aircraft, helicopters, military aircraft, general aviation, UAVs, and space.

-

The escalating worldwide volume of passenger air travel, particularly in burgeoning markets such as Asia-Pacific and the Middle East, is generating increased demand for commercial aircraft, consequently amplifying the requirement for filters.

-

Commercial aircraft operate frequently, necessitating regular maintenance and the replacement of filters to ensure safety and efficiency.

-

The pursuit of enhanced fuel efficiency and environmental sustainability in aviation has necessitated the evolution of sophisticated engines and systems. This evolution, in turn, demands efficient filtration to maximize performance and minimize emissions.

-

Airlines prioritize passenger comfort and safety. This includes maintaining high air quality in the cabin. This results in increased investment in sophisticated air filtration systems to provide a clean and comfortable environment for travelers.

-

Filter technology has been highly developed and has become essential for advanced commercial aircraft due to the improvements in efficiency and performance.

By Filter Media Type

“Air filters are anticipated to remain dominant during the forecast period. Cabin air filters are expected to remain the dominant in air filter, and hydraulic filters are expected to dominate liquid filters.”

-

The market is segmented into air filters (cabin air filters, avionics air filters, engine filters), and liquid filters (hydraulic filters, oil & lube filters, fuel filters, coolant filters, and water filters).

-

Air filters are anticipated to be dominant during the forecast period since they are used in a wide range of applications within aerospace systems, including engine air filters, cabin air filters, and avionics air filters.

-

A higher focus on providing adequately clean and safe cabin air to passengers to enhance their health condition and comfort fuels the need for higher-quality cabin air filters. Air filters play a crucial role in maintaining high-quality air within the aircraft cabin, ensuring passenger comfort and safety by removing dust, allergens, and microorganisms.

-

Air filters are essential for protecting the engine's air intake system from dust and debris, preventing wear, and maintaining efficiency.

-

Aircraft employ hydraulic systems for the operation of essential equipment such as landing gear, brakes, and flaps. Hydraulic filters facilitate the passage of hydraulic fluid through a filtration element, effectively capturing detrimental particulates including dirt, sand, sludge, oxidation, chemical byproducts, etc.

-

It is important to make certain that hydraulic systems are reliable and safe, which is why high-performance filters are vital.

-

Changing hydraulic filters with great frequency increases the lifespan of hydraulics, which lowers maintenance and time loss.

-

The high safety and performance standards expected out of the aircraft hydraulic systems compel the uptake of high-quality hydraulic filters.

By Material Type

“Metal mesh is expected to stay the top material of the market during the forecast period.”

-

The aerospace filters market is segmented into metal mesh, fiberglass, pleated paper, and others.

-

Metal mesh filters are very robust and last longer than most of the materials used in manufacturing filters, hence effective in the long run. Metal mesh filters are constructed from stainless steel or other durable metals, providing excellent resistance to wear and tear, corrosion, and extreme temperatures.

-

Metal mesh can withstand the extreme temperature fluctuations experienced in both aircraft and spacecraft environments.

-

Metal mesh filters can be used in various systems, including air intake, fuel, oil, and hydraulic systems, making them highly versatile.

-

Metal mesh filters can often be cleaned and reused, providing a cost-effective solution over time compared to disposable filter materials. Their durability and reusability contribute to lower maintenance costs, which is attractive to airlines and operators focused on cost management.

-

Due to their durability and long lifespan, metal mesh filters can lower maintenance costs and reduce the need for frequent replacements, which is especially important in space applications where maintenance opportunities are limited.

By End-User Type

“Aftermarket is anticipated to continue being the foremost end user of the market during the forecast period.”

-

The aerospace filters market is segmented into OE and aftermarket.

-

The increasing global fleet of commercial, military, and private aircraft will drive demand for replacement parts and maintenance services, including filters.

-

The need for regular maintenance and repair of existing aircraft creates a consistent demand for after-sales filters. As aircraft age, the frequency and volume of MRO activities tend to increase.

-

Increasing air travel, especially in emerging markets, results in more aircraft in operation, thereby expanding the aftermarket for filters and other components.

-

The growth of low-cost airlines increases the number of flights and aircraft in operation, further boosting the demand for aftermarket filters to maintain their fleets.

By Sales Channel

“Direct sales channel is projected to hold a prominent position of the market during the forecast period.”

-

The aerospace filters market is segmented into direct and indirect.

-

Direct sales, bypassing intermediaries, are particularly advantageous for manufacturers from a financial standpoint; this is why it is more profitable.

-

Direct sales offer manufacturers the advantage of providing unique, customized products and ensuring product quality through dedicated technical support.

-

Direct sales significantly reduce the number of intermediary channels between the manufacturer and the aircraft, resulting in a streamlined process and reduced delivery times, particularly during critical stages such as aircraft maintenance and production.

Regional Analysis

“North America is expected to remain the largest market for aerospace filters during the forecast period.”

-

North America, being an established aerospace market through the presence of large manufacturers such as Boeing and Lockheed Martin, etc. there has a robust demand for aerospace filters.

-

North America has one of the highest levels of air traffic globally, with a large fleet of commercial, military, and general aviation aircraft. This creates a substantial and continuous demand for both original equipment (OE) and aftermarket filters.

-

North American countries are currently the most technologically and innovatively developed, sometimes using sophisticated filtration technologies to optimize the performance and safety of their planes.

-

Significant investment in space exploration and satellite deployment by organizations like NASA and private companies such as SpaceX drives demand for filters in space applications.

-

In North America, there exists a robust infrastructure of MRO facilities that caters to a substantial fleet of aircraft. Consequently, there is a notable surge in the demand for aerospace filters as an integral component of routine maintenance and repair operations.

-

Asia-Pacific is expected to be the fastest-growing market for aerospace filters due to a significant rise in air travel demand, fleet expansion, and rapid economic development in countries like China, India, and Southeast Asian nations.

-

The growth in the number of aircraft operating in the region also fuels the aftermarket segment, as airlines seek maintenance, repair, and overhaul (MRO) services to ensure fleet reliability and performance.

Want to get a free sample? Register Here

Competitive Landscape

Most of the major players compete in some of the factors, including price, service offerings, regional presence, etc. The following are the key players in the aerospace filters market -

The following are the key players in the aerospace filters market (based on dominance).

-

Parker Hannifin Corporation

-

Donaldson Filtration Solutions

-

Pall Corporation

-

PTI Technologies

-

Porvair Filtration Group

-

Fluid Conditioning Products, Incorporation

-

Mott Corporation

-

Hollingsworth & Vose Company

-

Aerospace Systems & Components

-

Champion Aerospace LLC

Note: The above list does not necessarily include all the top players in the market.

Are you the leading player in this market? We would love to include your name. Write to us at [email protected]

Recent Developments/Mergers & Acquisitions:

-

In 2023, Porvair PLC acquired European Filter Corporation NV, a filter manufacturer and distributor based in Belgium, providing complementary products to the Aerospace & Industrial division.

-

In February 2017, Parker Hannifin Corporation signed the deal to acquire the filtration manufacturer, CLARCOR Inc. The company said that the goal of this strategic deal was to form an integrated business with an extensive range of filtration products and technologies so that customers would have one supplier of all their filtration solutions.

Report Features

This report provides market intelligence most comprehensively. The report structure has been kept so that it offers maximum business value. It provides critical insights into market dynamics and will enable strategic decision-making for existing market players as well as those willing to enter the market.

The following are the key features of the report:

-

Market structure: Overview, industry life cycle analysis, supply chain analysis.

-

Market environment analysis: Growth drivers and constraints, Porter’s five forces analysis, SWOT analysis.

-

Market trend and forecast analysis.

-

Market segment trend and forecast.

-

Competitive landscape and dynamics: Market share, Service portfolio, New Product Launches, etc.

-

COVID-19 impact and its recovery curve.

-

Attractive market segments and associated growth opportunities.

-

Emerging trends.

-

Strategic growth opportunities for the existing and new players.

-

Key success factors.

|

Market Study Period

|

2019-2034

|

|

Base Year

|

2024

|

|

Forecast Period

|

2025-2034

|

|

Trend Period

|

2019-2023

|

|

Number of Tables & Figures

|

>100

|

|

Number of Segments Analysed

|

6 (Platform Type, Filter Media Type, Material Type, End User Type, Sales Channel Type, and Region)

|

|

Number of Regions Analysed

|

4 (North America, Europe, Asia-Pacific, Rest of the World)

|

|

Countries Analysed

|

15 (The USA, Canada, Mexico, Germany, France, Italy, The UK, China, Japan, India, Brazil, Saudi Arabia, Rest of Europe, Rest of APAC, and Rest of the World)

|

|

Free Customization Offered

|

10%

|

|

After Sales Support

|

Unlimited

|

|

Report Presentation

|

Complimentary

|

|

Market Dataset

|

Complimentary

|

|

Further Deep Dive & Consulting Services

|

10% Discount

|

Market Segmentation

The report provides detailed insights into the market dynamics to enable informed business decision-making and growth strategy formulation based on the opportunities present in the market.

The aerospace filters market is segmented into the following categories:

Aerospace Filters Market, by Platform Type

-

Commercial Aircraft

-

Regional Aircraft

-

Helicopter

-

Military Aircraft

-

General Aviation

-

UAV

-

Space

Aerospace Filters Market, by Filter Media Type

-

Air Filters (Cabin Air Filters, Avionics Air Filters, and Engine Filters)

-

Liquid Filters (Hydraulic Filters, Oil & Lube Filters, Fuel Filters, Coolant Filters, and Water Filters)

Aerospace Filters Market, by Material Type

-

Metal Mesh

-

Fiberglass

-

Pleated Paper

-

Others

Aerospace Filters Market, by End User Type

Aerospace Filters Market, by Sales Channel Type

-

Direct Sales

-

Indirect Sales

Aerospace Filters Market, by Region

-

North America (Country Analysis: The USA, Canada, and Mexico)

-

Europe (Country Analysis: Germany, France, The UK, and Rest of Europe)

-

Asia-Pacific (Country Analysis: Japan, China, India, and Rest of Asia-Pacific)

-

Rest of the World (Country Analysis: Brazil, Saudi Arabia, and Others)

Research Methodology

-

This strategic assessment report from Stratview Research provides a comprehensive analysis that reflects today’s aerospace filters market realities and future market possibilities for the forecast period. The report segments and analyzes the market in the most detailed manner in order to provide a panoramic view of the market. The vital data and information provided in the report can play a crucial role for market participants as well as investors in the identification of the low-hanging fruits available in the market as well as to formulate growth strategies to expedite their growth process.

-

This report offers high-quality insights and is the outcome of a detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research’s internal database and statistical tools.

-

More than 1,000 authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white papers, patents, and articles, have been leveraged to gather the data.

-

We conducted more than 15 detailed primary interviews with market players across the value chain in all four regions and industry experts to obtain both qualitative and quantitative insights.

Customization Options

With this detailed report, Stratview Research offers one of the following free customization options to our respectable clients:

Company Profiling

- Detailed profiling of additional market players (up to three players)

- SWOT analysis of key players (up to three players)

Competitive Benchmarking

- Benchmarking of key players on the following parameters: Service portfolio, geographical reach, regional presence, and strategic alliances

Custom Research: Stratview Research offers custom research services across sectors. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to [email protected]