Attractive Opportunities

Global Demand Analysis & Sales Opportunities in High-Voltage Automotive Wires and Cables Market

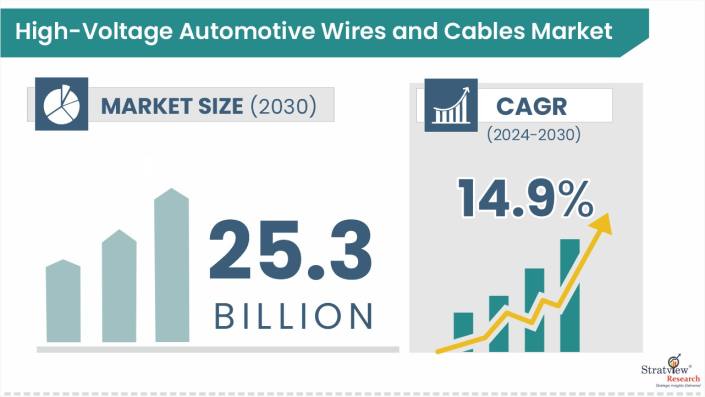

- The annual demand for high-voltage automotive wires and cables was USD 11.0 billion in 2024 and is expected to reach USD 13.8 billion in 2025, up 25.2% than the value in 2024.

- During the forecast period (2025-2030), the high-voltage automotive wires and cables market is expected to grow at a CAGR of 13.0%. The annual demand will reach USD 25.3 billion in 2030, which is more than 2 times the demand in 2025.

- During 2025-2030, the high-voltage automotive wires and cables industry is expected to generate a cumulative sales opportunity of USD 120.6 billion, which is more than 3 times the opportunities during 2019-2024.

Wish to get a free sample? Click Here

High-Growth Market Segments:

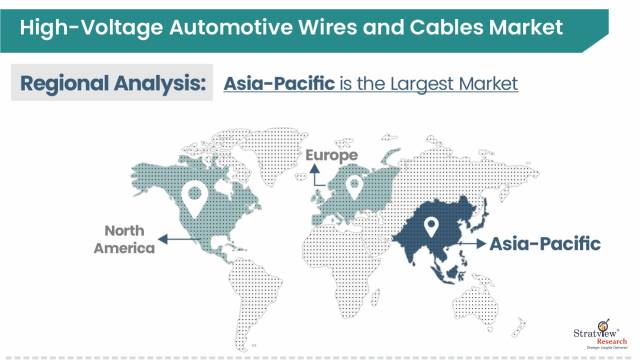

- Asia-Pacific generated the highest demand with the largest market share of more than 60% in 2024.

- By vehicle type, Light Vehicle acts as catalysts for the high-voltage wires & cables market, being both dominant as well as the fastest-growing segment.

- By product type, Copper core is expected to remain the dominant product type with its large current load-carrying capacity.

- By application type, AC/DC is expected to remain the driving force for the high-voltage wires & cables market in the foreseen future.

- By powertrain type, BEV is anticipated to be the larger segment with a high penetration of HV wires & cables.

Market Statistics

Have a look at the sales opportunities presented by the high-voltage automotive wires and cables market in terms of growth and market forecast.

|

High-Voltage Automotive Wires and Cables Market Data & Statistics

|

|

|

Market Statistics

|

Value (in USD Billion)

|

Market Growth (%)

|

|

Annual Market Size in 2023

|

USD 8.9 billion

|

-

|

|

Annual Market Size in 2024

|

USD 11.0 billion

|

YoY Growth in 2024: 23.5%

|

|

Annual Market Size in 2025

|

USD 13.8 billion

|

YoY Growth in 2025: 25.2%

|

|

Annual Market Size in 2030

|

USD 25.3 billion

|

CAGR 2025-2030: 13.0%

|

|

Cumulative Sales Opportunity during 2025-2030

|

USD 120.6 billion

|

|

|

Top 10 Countries’ Market Share in 2024

|

USD 8.8 billion +

|

> 80%

|

|

Top 10 Company’s Market Share in 2024

|

USD 5.5 billion to USD 7.7 billion

|

50% - 70%

|

Market Dynamics

Introduction:

High-voltage wiring harnesses play a critical role in vehicles, serving as essential conduits for transmitting electrical power across electrical systems. These harnesses are meticulously designed to handle elevated voltage levels, often exceeding traditional automotive standards, while ensuring robust insulation and shielding to prevent electrical interference and ensure safety for both vehicle occupants and technicians. Their design and construction adhere to stringent regulations and industry standards to guarantee reliable performance under demanding conditions, supporting the shift towards cleaner and more efficient transportation solutions. Manufacturers.

The automotive industry is witnessing a shift towards advanced electronics and electrification, driving demand for sophisticated wiring and cable solutions. This includes high-voltage components tailored for vehicles, optimizing power transmission, and supporting complex systems like ADAS and infotainment. Innovations focus on reducing weight, optimizing space, and enhancing durability to meet stringent safety standards and improve vehicle performance across diverse environmental conditions. These developments underscore a broader trend towards more efficient, reliable, and technologically integrated vehicles.

Segments Analysis

|

Segmentations

|

List of Sub-Segments

|

Dominant and Fastest-Growing Segments

|

|

Vehicle-Type Analysis

|

Light Vehicles and Commercial Vehicles

|

Light Vehicle acts as catalysts for the high-voltage wires & cables market, being both dominant as well as the fastest-growing segment.

|

|

Product-Type Analysis

|

Copper Core, Aluminum Core, and Others

|

Copper core to remain the dominant product type with its large current load-carrying capacity.

|

|

Application-Type Analysis

|

AC/DC Wiring, Auxiliaries, Traction, and Others

|

AC/DC to remain the driving force for the high-voltage wires & cables market in the foreseen future.

|

|

Powertrain-Type Analysis

|

BEV and Hybrid

|

BEV is anticipated to be the larger segment with a high penetration of HV wires & cables.

|

|

Regional Analysis

|

North America, Europe, Asia-Pacific, and RoW

|

Asia-Pacific is expected to maintain its reign over the forecast period.

|

By Vehicle Type

“Light vehicles are expected to remain dominant as well as the faster-growing vehicle type in the market during the forecast period.”

- The high-voltage automotive wires and cables market is broadly segmented into light vehicles and commercial vehicles. Light vehicles are expected to remain dominant owing to increasing electrical content in vehicles, necessitating robust harnesses for increased power demands.

- There's also a focus on integrating advanced vehicle features like safety systems and infotainment, driving the need for sophisticated wiring solutions that optimize weight and space while meeting stringent regulatory standards for safety and performance.

By Application Type

“AC/DC wiring is expected to remain the largest as well as fastest-growing application type during the forecast period.”

- The market is segmented based on application type into AC/DC wiring, auxiliaries, traction, and others. AC/DC wiring is expected to remain the dominant application type in the market during the forecast period.

- These systems are essential for managing diverse power needs, including battery connections, power electronics, and supporting advanced vehicle features such as electric drivetrains and sophisticated electronic systems like ADAS and infotainment. They ensure reliable performance, safety, and compatibility with evolving automotive technologies and regulatory standards.

Regional Analysis

“Asia-Pacific is likely to remain the largest as well as the fastest-growing market during the forecast period.”

- The Asia-Pacific region is witnessing significant growth in the market, driven by the rapid adoption of electric and hybrid vehicles. Governments in the region are implementing supportive policies and incentives to promote cleaner transportation solutions, boosting demand for advanced HV wiring systems.

- Increasing urbanization, rising disposable incomes, and growing consumer awareness of environmental sustainability are further fueling market expansion. Key players are investing in innovative technologies to enhance the efficiency, safety, and reliability of HV wiring systems to meet the evolving needs of the automotive industry in this dynamic region.

Know the high-growth countries in this report. Register Here

Competitive Landscape

The market is highly consolidated with the presence of over 100 players across the region. Most of the major players compete in some of the governing factors including price, service offerings, regional presence, etc. The following are the key players in the high-voltage automotive wires and cables market. Some of the major players are providing a complete range of services, including wires, cables, and related electronic components.

- Sumitomo Electric Industries, Inc.

- Yazaki Corporation

- Leoni AG

- Aptiv plc

- Fukura Electric

- Lear Corporation

- Dräxlmaier

- TE Connectivity

- Coficab

- Coroplast Fritz Müller GmbH & Co. KG

- Kyungshin Corporation

Note: The above list does not necessarily include all the top players in the market.

Are you the leading player in this market? We would love to include your name. Write to us at [email protected]

Recent Market JVs and Acquisitions:

Some of the strategic alliances, including M&As, JVs, etc. have been performed over the past few years:

- In June 2023, Delta Electronics, Inc. acquired 100% shareholding of HY&T Investments Holdings B.V. and its subsidiaries, including TB&C Group which is a leading provider of automotive high voltage hybrid components, to strengthen its EV business.

- In June 2023, Aurrigo acquired UK-based GB Wiring Systems Limited to enhance capabilities in the core automotive area of wiring harness and electrical components.

Recent Product Development:

- Advancements in automotive technology include the development of next-generation cables for high-current applications with smaller diameters. Leoni has introduced new AC charging cables using LEONI EcoSense Nxt and LEONI EcoSense technologies. The LEONI EcoSense Nxt+ product line is power-optimized to carry the highest available current level for each application, reducing the conductor cross-section and achieving a 6% weight reduction for Nxt and 20% for Nxt+. The Nxt cables have a 4% smaller diameter, while Nxt+ cables are 9% smaller than the previous generation. These next-generation cables meet IEC, EN, and GBT standards, enabling EV charging in 167 countries, with specific cables for Japan (PSE) and North America (UL). Both product lines offer cables ranging from 3×1.5 mm²+X to 5×10 mm²+X.

Report Features

This report provides market intelligence most comprehensively. The report structure has been kept so that it offers maximum business value. It provides critical insights into market dynamics and will enable strategic decision-making for existing market players as well as those willing to enter the market.

The following are the key features of the report:

- Market structure: Overview, industry life cycle analysis, supply chain analysis.

- Market environment analysis: Growth drivers and constraints, Porter’s five forces analysis, SWOT analysis.

- Market trend and forecast analysis.

- Market segment trend and forecast.

- Competitive landscape and dynamics: Market share, Service portfolio, New Product Launches, etc.

- COVID-19 impact and its recovery curve.

- Attractive market segments and associated growth opportunities.

- Emerging trends.

- Strategic growth opportunities for the existing and new players.

- Key success factors.

|

Market Study Period

|

2019-2030

|

|

Base Year

|

2024

|

|

Forecast Period

|

2025-2030

|

|

Trend Period

|

2019-2023

|

|

Number of Tables & Figures

|

>100

|

|

Number of Segments Analysed

|

5 (Vehicle Type, Powertrain Type, Application Type, Product Type, and Region)

|

|

Number of Regions Analysed

|

4 (North America, Europe, Asia-Pacific, Rest of the World)

|

|

Countries Analysed

|

15 (The USA, Canada, Mexico, Germany, France, Italy, The UK, China, Japan, India, Brazil, Saudi Arabia, Rest of Europe, Rest of APAC, and Rest of the World)

|

|

Free Customization Offered

|

10%

|

|

After Sales Support

|

Unlimited

|

|

Report Presentation

|

Complimentary

|

|

Market Dataset

|

Complimentary

|

|

Further Deep Dive & Consulting Services

|

10% Discount

|

Market Segmentation

This report studies the market, covering a period of 15 years of trend and forecast. The report provides detailed insights into the market dynamics to enable informed business decision-making and growth strategy formulation based on the opportunities present in the market.

The high-voltage automotive wires and cables market is segmented into the following categories:

High-Voltage Automotive Wires and Cables Market, by Vehicle Type

- Light Vehicles

- Commercial Vehicles

High-Voltage Automotive Wires and Cables Market, by Powertrain Type

High-Voltage Automotive Wires and Cables Market, by Application Type

- AC/DC Wiring

- Auxiliaries

- Traction

- Others

High-Voltage Automotive Wires and Cables Market, by Product Type

- Copper Core

- Aluminum Core

- Others

High-Voltage Automotive Wires and Cables Market, by Region

- North America (Country Analysis: The USA, Canada, and Mexico)

- Europe (Country Analysis: Germany, France, The UK, and Rest of Europe)

- Asia-Pacific (Country Analysis: Japan, China, India, and Rest of Asia-Pacific)

- Rest of the World (Country Analysis: Brazil, Argentina, and Others)

Research Methodology

- This strategic assessment report from Stratview Research provides a comprehensive analysis that reflects today’s high-voltage automotive wires and cables market realities and future market possibilities for the forecast period.

- The report segments and analyzes the market in the most detailed manner to provide a panoramic view of the market.

- The vital data/information provided in the report can play a crucial role for market participants and investors in identifying the low-hanging fruits available in the market and formulating growth strategies to expedite their growth process.

- This report offers high-quality insights and is the outcome of a detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research’s internal database and statistical tools.

- More than 1,000 authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white papers, patents, and articles, have been leveraged to gather the data.

- We conducted more than 15 detailed primary interviews with market players across the value chain in all four regions and industry experts to obtain both qualitative and quantitative insights.

Customization Options

With this detailed report, Stratview Research offers one of the following free customization options to our respectable clients:

Company Profiling

- Detailed profiling of additional market players (up to three players)

- SWOT analysis of key players (up to three players)

Competitive Benchmarking

- Benchmarking of key players on the following parameters: Service portfolio, geographical reach, regional presence, and strategic alliances.

Custom Research: Stratview Research offers custom research services across sectors. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to [email protected].