Attractive Opportunities

Global Demand Analysis & Sales Opportunities in Dental Cement Market

-

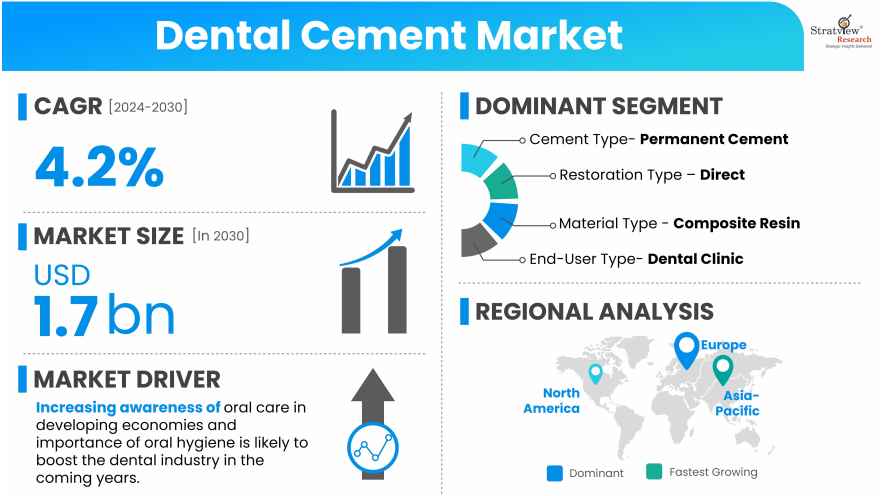

The annual demand for dental cement was USD 1.36 billion in 2024 and is expected to reach USD 1.42 billion in 2025, up 4.5% than the value in 2024.

-

During the forecast period (2025 to 2030), the dental cement market is expected to grow at a CAGR of 4.1%. The annual demand will reach of USD 1.74 billion in 2030.

-

During 2025-2030, the dental cement industry is expected to generate a cumulative sales opportunity of USD 9.52 billion.

Want to get a free sample? Register Here

High-Growth Market Segments:

-

Asia-Pacific is anticipated to retain its position as the dominant region during the forecast period.

-

By Cement type, Permanent Cement is estimated to contribute the largest share of the material type.

-

By Restoration type, Direct Restoration is expected to remain the leading restoration segment for dental cement throughout the forecast period.

-

By Material type, Composite Resin is expected to remain the most preferred material in the market.

-

By Defect Class type, Class I is expected to be the fastest-growing defect class.

-

By End Use type, Dental Clinic is going to remain the dominant end-user of the market.

Market Statistics

Have a look at the sales opportunities presented by the dental cement market in terms of growth and market forecast.

|

Dental Cement Market Data & Statistics

|

|

|

Market Statistics

|

Value (in USD Billion)

|

Market Growth (%)

|

|

Annual Market Size in 2023

|

USD 1.30 billion

|

-

|

|

Annual Market Size in 2024

|

USD 1.36 billion

|

YoY Growth in 2024: 4.7%

|

|

Annual Market Size in 2025

|

USD 1.42 billion

|

YoY Growth in 2025: 4.5%

|

|

Annual Market Size in 2030

|

USD 1.74 billion

|

CAGR 2025-2030: 4.1%

|

|

Cumulative Sales Opportunity during 2025-2030

|

USD 9.52 billion

|

-

|

|

Top 10 Countries’ Market Share in 2024

|

USD 1 billion +

|

> 80%

|

|

Top 10 Company’s Market Share in 2024

|

USD 0.6 billion to 0.9 billion

|

50% - 70%

|

Market Dynamics

Introduction:

What is dental cement?

Dental cement is a dental material used to bond, seal, or protect teeth and restorations in various dental procedures. It acts as an adhesive that helps fix crowns, bridges, inlays, onlays, orthodontic brackets, and other dental appliances securely to the tooth structure. Dental cements can also serve as cavity liners, bases, or temporary fillings, depending on their formulation and intended use.

They come in different types, such as glass ionomer cements, resin-based cements, zinc phosphate, and polycarboxylate cements, each offering specific properties like fluoride release, high strength, or ease of handling. By providing a strong seal between the restoration and the natural tooth, dental cement prevents microleakage, enhances durability, and supports long-term oral health.

Market Drivers:

-

The market has been advancing rapidly with the development of new and innovative dental procedures. Advancements in dental procedures have led to an increased demand for dental restorative materials that are durable, biocompatible, and aesthetically pleasing.

-

The availability of dental procedures at lower costs in emerging economies has led to an increase in dental treatments. This trend has not only led to the growth of the dental industry but has also positively impacted the dental cement market.

- The rising prevalence of dental cavities, periodontal diseases, and tooth loss has created a high demand for restorative dental procedures, which has increased the demand for dental restorative materials.

- Due to increasing awareness of oral care in developing economies, the importance of oral hygiene is likely to boost the dental industry in the coming years.

-

Telehealth and Teledentistry will offer a pragmatic approach to providing optimal dental care to patients.

Segment Analysis

|

Segmentations

|

List of Sub-Segments

|

Dominant and Fastest-Growing Segments

|

|

Cement Type Analysis

|

Permanent Cement and Temporary Cement.

|

Permanent cement will likely be the fastest-growing cement in the coming years.

|

|

Restoration Type Analysis

|

Direct Restoration and Indirect restoration.

|

Direct restoration is expected to hold a larger market share during the forecast year.

|

|

Material Type Analysis

|

Amalgam, Glass Ionomer, Composite Resin, Zinc oxide-eugenol, and Others.

|

Composite resin is expected to remain the most preferred material in the market.

|

|

Defect Class Type Analysis

|

Class I, Class II, Class III, Class IV, Class V, and Class VI.

|

Class I is expected to be the fastest-growing defect class.

|

|

End-Use Type Analysis

|

Hospital, Dental Clinic, and Laboratory.

|

The dental clinic is going to remain the dominant end-user of the market.

|

|

Region Analysis

|

North America, Europe, Asia-Pacific, and The Rest of the World.

|

The Asia-Pacific is expected to be the highest-growing market over the forecast period.

|

Cement Trends

“The permanent cement is expected to be the fastest-growing cement of the dental cement market during the forecast period.”

-

The market is segmented into permanent cement types and temporary Cement types. Permanent cement is expected to remain the most dominant as well as the fastest-growing cement in the market over the coming years.

-

Permanent cement holds a dominant position in the dental cement market due to its wide-ranging applications and long-term benefits like durability, marginal sealing, leakage prevention, etc. Dental professionals prefer permanent cement for its durability, reliability, and ability to provide a secure and lasting bond between dental restorations and natural teeth.

Restoration Trends

“The direct restoration type is expected to hold a larger market share of the dental cement market in the forecast period.”

-

The market is also segmented based on restoration type. The direct segment occupied a lion's share of the market in 2023 and is expected to maintain its lead in the market over the coming years, owing to its efficiency coupled with high preference among dentists across the globe.

-

Indirect dental restorations are only necessary for patients when there is extensive tooth damage. Indirect dental restorations involve applying artificial dental substitutes, usually made from porcelain in a laboratory.

Material Trends

“The composite resin is expected to be the most preferred material type during the forecast period.”

-

The market is segmented into amalgam, glass ionomer, composites, Zinc oxide-eugenol, and others. Composite Resin accounted for the largest share of the market in 2023 and is expected to remain the most dominant as well as the fastest-growing material over the forecast period.

-

The huge dominance is attributed to the superior esthetics offered by composite restorative materials coupled with the property to chemically bond with teeth. Glass ionomers also hold a significant share of the market and are slowly gaining traction, owing to the property of releasing fluoride ions to prevent tooth decay in the future.

End-User Trends

“The dental clinic is expected to remain the dominant end-user of the dental cement market during the forecast period.”

-

The market is also segmented based on the end-user type into dental hospitals, dental clinics, and laboratories. The dental clinic dominated the market with a share of more than half in the current year, propelled by a growing number of dentists, coupled with specialized attention provided to patients at dental clinics. Hospitals also have a significant share of the market.

Regional Insights

“Europe is expected to be the largest market for dental cement during the forecast period.”

-

Europe is projected to remain the largest market for dental cement during the forecast period. The high share is attributed to high dental expenditure, awareness regarding oral care, the presence of skilled dentists, and the high adoption of advanced medical technologies. The presence of many hospitals and dental clinics further contributes to the region’s larger share.

-

Despite enduring a severe blow during 2020 and 2021, the Asia-Pacific is likely to remain the fastest-growing market during the forecast period. Significant economic development in the region, growing awareness about oral care, and increasing disposable income of consumers are the major factors propelling the growth of the region’s market.

Want to get a free sample? Register Here

Competitive Landscape

Most of the major players compete in some of the factors, including price, service offerings, regional presence, etc. The following are the key players in the dental cement market -

The following are the key players in the dental cement market (Based on Dominance)

Note: The above list does not necessarily include all the top players in the market.

Are you the leading player in this market? We would love to include your name. Write to us at [email protected]

Report Features

This report provides market intelligence most comprehensively. The report structure has been kept so that it offers maximum business value. It provides critical insights into market dynamics and will enable strategic decision-making for existing market players as well as those willing to enter the market.

The following are the key features of the report:

-

Market structure: Overview, industry life cycle analysis, supply chain analysis.

-

Market environment analysis: Growth drivers and constraints, Porter’s five forces analysis, SWOT analysis.

-

Market trend and forecast analysis.

-

Market segment trend and forecast.

-

Competitive landscape and dynamics: Market share, Service portfolio, New Product Launches, etc.

-

COVID-19 impact and its recovery curve.

-

Attractive market segments and associated growth opportunities.

-

Emerging trends.

-

Strategic growth opportunities for the existing and new players.

-

Key success factors.

|

Market Study Period

|

2019-2030

|

|

Base Year

|

2024

|

|

Forecast Period

|

2025-2030

|

|

Trend Period

|

2019-2023

|

|

Number of Tables & Figures

|

>100

|

|

Number of Segments Analysed

|

6 (Cement Type, Restoration Type, Material Type, Defect Class Type, End-Use Type, and Region)

|

|

Number of Regions Analysed

|

4 (North America, Europe, Asia-Pacific, Rest of the World)

|

|

Countries Analysed

|

15 (The USA, Canada, Mexico, Germany, France, Italy, The UK, China, Japan, India, Brazil, Saudi Arabia, Rest of Europe, Rest of APAC, and Rest of the World)

|

|

Free Customization Offered

|

10%

|

|

After Sales Support

|

Unlimited

|

|

Report Presentation

|

Complimentary

|

|

Market Dataset

|

Complimentary

|

|

Further Deep Dive & Consulting Services

|

10% Discount

|

Market Segmentation

The report provides detailed insights into the market dynamics to enable informed business decision-making and growth strategy formulation based on the opportunities present in the market.

The dental cement market is segmented into the following categories:

Dental Cement Market, by Cement Type

-

Permanent Cement

-

Temporary Cement.

Dental Cement Market, by Restoration Type

-

Direct Restoration

-

Indirect restoration.

Dental Cement Market, by End-Use Type

-

Hospital

-

Dental Clinic

-

Laboratory.

Dental Cement Market, by Material Type

-

Amalgam

-

Glass

-

Ionomer

-

Composite Resin

-

Zinc oxide-eugenol

-

Others.

Dental Cement Market, by Defect Class Type

-

Class I

-

Class II

-

Class II

-

Class IV

-

Class V

-

Class VI

Dental Cement Market by Region

-

North America (Country Analysis: The USA, Canada, and Mexico)

-

Europe (Country Analysis: Germany, France, The UK, Russia, and the Rest of Europe)

-

Asia-Pacific (Country Analysis: China, Japan, India, and Rest of Asia-Pacific)

-

Rest of the World (Country Analysis: Brazil, Saudi Arabia, and Others)

Research Methodology

This strategic assessment report from Stratview Research provides a comprehensive analysis that reflects today’s Dental Cement Market realities and future market possibilities for the forecast period. The report segments and analyzes the market in the most detailed manner in order to provide a panoramic view of the market.

The vital data/information provided in the report can play a crucial role for market participants as well as investors in the identification of the low-hanging fruits available in the market as well as to formulate growth strategies to expedite their growth process.

This report offers high-quality insights and is the outcome of a detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research’s internal database and statistical tools.

More than 1,000 authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white papers, patents, and articles, have been leveraged to gather the data.

We conducted more than 15 detailed primary interviews with market players across the value chain in all four regions and industry experts to obtain both qualitative and quantitative insights.

Customization Options

With this detailed report, Stratview Research offers one of the following free customization options to our respectable clients:

Company Profiling

- Detailed profiling of additional market players (up to three players)

- SWOT analysis of key players (up to three players)

Competitive Benchmarking

- Benchmarking of key players on the following parameters: Service portfolio, geographical reach, regional presence, and strategic alliances

Custom Research: Stratview Research offers custom research services across sectors. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to [email protected].