Attractive Opportunities

Global Demand Analysis & Sales Opportunities in Graphite Electrode Market

-

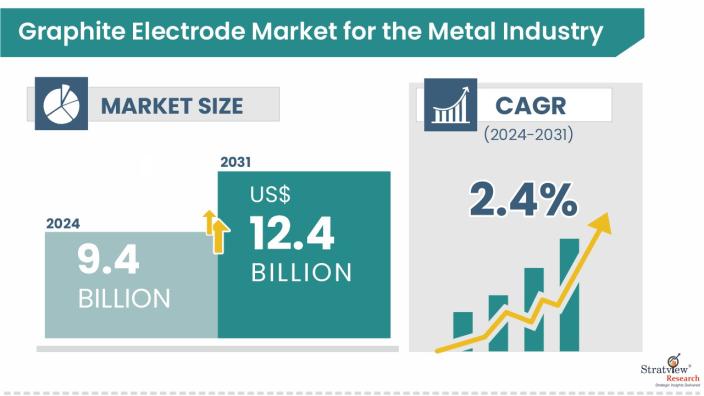

The annual demand for graphite electrode was USD 9.4 billion in 2024 and is expected to reach USD 10.8 billion in 2025, up 14.9% than the value in 2024.

-

During the forecast period (2025-2031), the graphite electrode market is expected to grow at a CAGR of 2.4%. The annual demand will reach USD 12.4 billion in 2031.

-

During 2025-2031, the graphite electrode industry is expected to generate a cumulative sales opportunity of USD 81.3 billion, which is more than 1.5 times the opportunities during 2019-2024.

Wish to get a free sample? Click Here

High-Growth Market Segments:

-

Asia-Pacific is expected to be the dominant and fastest-growing market over the next five years.

-

By product type, UHP is anticipated to be the largest and fastest-growing product type in the coming years.

-

By metal type, Steel is to remain the leading metal during the forecast period.

-

By steel area type, Side Oxidation accounts for more than half of the GE consumption in EAF steelmaking.

-

By steel grade type, Carbon steel is expected to be the dominant and fastest-growing market over the next five years.

Market Statistics

Have a look at the sales opportunities presented by the graphite electrode market in terms of growth and market forecast.

|

Graphite Electrode Market Data & Statistics

|

|

|

Market Statistics

|

Value (in USD Billion)

|

Market Growth (%)

|

|

Annual Market Size in 2023

|

USD 8.6 billion

|

-

|

|

Annual Market Size in 2024

|

USD 9.4 billion

|

YoY Growth in 2024: 9.0%

|

|

Annual Market Size in 2025

|

USD 10.8 billion

|

YoY Growth in 2025: 14.9%

|

|

Annual Market Size in 2031

|

USD 12.4 billion

|

CAGR 2025-2031: 2.4%

|

|

Cumulative Sales Opportunity during 2025-2031

|

USD 81.3 billion

|

-

|

|

Top 10 Countries’ Market Share in 2024

|

USD 7.5 billion +

|

> 80%

|

|

Top 10 Company’s Market Share in 2024

|

USD 4.7 billion to USD 6.6 billion

|

50% - 70%

|

Market Dynamics

Introduction:

Graphite electrode (GE) is an essential component of steel production through the electric arc furnace (EAF) method. The penetration of EAF-based steel production is expected to be stable in the foreseeable future because of the high awareness of the developed economies towards environmentally friendly technologies. The role of China and India in the production of EAF steel is going to be consequential in the coming years, as the current penetration of EAF steel production in both countries is lower than the developed countries but will rise rapidly in the coming years. This will imprint a significant upward trend in the demand for graphite electrodes in the coming five years.

The market’s supply chain is extremely dynamic, with a tight supply of raw materials (petroleum needle coke) as well as graphite electrodes, coupled with the consistent increase in EAF steel production. The preference for lithium-ion batteries in the increasing production of electric vehicles further takes the supply crunch to the next level. Petroleum needle coke is an essential raw material for the production of lithium-ion batteries. In addition, no substitute for graphite electrodes in the production of EAF steel makes the material a strategic resource rather than a mere commodity.

Segment Analysis

|

Segmentations

|

List of Sub-Segments

|

Segments with High Growth Opportunity

|

|

Product-Type Analysis

|

Ultra-High Power (UHP), High Power (HP), and Regular Power (RP)

|

UHP is anticipated to be the largest and fastest-growing product type in the coming years.

|

|

Metal-Type Analysis

|

Steel, Silicon Metal, Aluminium, and Other Metals

|

Steel is to remain the leading metal during the forecast period.

|

|

Steel-Area-Type Analysis

|

Arc-Zone, Slag, Side, and Other Areas

|

Side Oxidation accounts for more than half of the GE consumption in EAF steelmaking.

|

|

Steel-Grade-Type Analysis

|

Carbon Steel, Stainless Steel, and Other Steel Grades

|

Carbon steel is expected to be the dominant and fastest-growing market over the next five years.

|

|

Regional Analysis

|

North America, Europe, Asia-Pacific, and The Rest of the World

|

Asia-Pacific is expected to be the dominant and fastest-growing market over the next five years.

|

By Product Type

“UHP is expected to remain the most preferred as well as the fastest-growing product on the market during the forecast period.”

-

The graphite electrode market for the metal industry is segmented into ultra-high power (UHP), high power (HP), and regular power (RP). UHP is expected to remain the most preferred as well as the fastest-growing product during the forecast period.

-

Higher durability, higher thermal resistance, and superior quality are some of the properties that are propelling the demand for UHP graphite electrodes, especially in the steel industry. All the major global players are primarily in the manufacturing of UHP graphite electrodes.

By Metal type

“Steel is expected to remain dominant, whereas aluminum and other metals are expected to be the fastest-growing metals of the market during the forecast period.”

-

The market is segmented into steel, silicon metal, aluminum, and other metals. The market is experiencing dual growth due to increasing steel production and a shift from traditional steel production methods to the Electric Arc Furnace (EAF) method, which employs graphite electrodes.

-

For instance, in China, the share of steel production through EAF was 12.5% in 2024 (still below the global average of 45%, excluding China). The government of China has set a target of achieving 20% steel production through EAF by 2030.

By Area Type

“Side wall is expected to remain dominant, and the arc zone area will be the fastest-growing during the forecast period.”

-

The Graphite Electrode market for the metal industry for steel is segmented into arc-zone, slag, side, and others.

-

Oxidation consumption, occurring at the side of the electrode, accounts for more than 50% of total Graphite Electrode consumption in EAF steelmaking. This form of consumption arises from the reaction between electrodes and oxygen/moisture during the steelmaking process. It correlates with furnace atmosphere, gas temperature, flow rate, and other variables, with gas flow rate exerting the most significant impact.

By Steel Grade Type

“Carbon steel is expected to be the dominant and fastest-growing market over the years.”

-

The Graphite Electrode for the metal industry market for steel grade type is segmented into carbon steel, stainless steel, and others.

-

Carbon steel is the dominant segment because production volume is the largest due to its high uses and low production cost, as compared to other segments that account for more than 85% of total Graphite Electrode consumption in EAF steelmaking.

-

The demand for stainless steel is also expected to grow because increasing demand for corrosion-resistant materials in sectors such as medical devices, food processing, and chemical industries is driving the growth of stainless-steel production.

Regional Analysis

“Asia-Pacific is expected to remain the largest and fastest-growing market for graphite electrodes during the forecast period.”

-

Asia-Pacific is expected to remain the largest market for graphite electrodes during the forecast period. China is the largest steel-producing country through the EAF method globally.

-

Furthermore, five of the leading players, namely Resonac Corporation (Japan), Fangda Carbon New Material Co. Ltd. (China), Tokai Carbon Co. Ltd. (Japan), Graphite India Limited (India), and HEG Ltd. (India), are based in the Asia-Pacific.

Know the high-growth countries in this report. Register Here

Competitive Landscape

The market is dominated by key players, which hold about 80% of the market share (excluding China). The following are the key players in the graphite electrode for the metal industry market.

Here is the list of the Top Players (Based on Dominance)

-

GrafTech International Ltd.

-

Resonac Corporation (Formerly Showa Denko Materials Co., Ltd.)

-

Fangda Carbon New Material Co., Ltd.

-

Tokai Carbon Co., Ltd

-

Graphite India Limited

-

HEG Limited

-

Energoprom

-

Nippon Carbon Co. Ltd

-

Sangraf International

-

SEC Carbon, Ltd

Note: The above list does not necessarily include all the top players in the market.

Are you the leading player in this market? We would love to include your name. Please write to us at [email protected]

Recent Market JVs and Acquisitions

A considerable number of strategic alliances, including M&As, JVs, etc., have been performed over the past few years:

-

In January 2025, General Motors (GM) entered into a multi-year, multi-billion-dollar agreement with Norwegian company Vianode to supply synthetic graphite anode materials for electric vehicle (EV) batteries. This material will be utilized in batteries produced by Ultium Cells, a joint venture between GM and LG Energy Solution. The contract spans from 2027, when Vianode's North American plant is expected to commence operations, until 2033.

-

In June 2023, NOVONIX, a battery materials company, entered into a Joint Development Agreement (JDA) with LG Energy Solution. The collaboration focuses on developing artificial graphite anode material, essential for lithium-ion batteries.

Recent Product Development:

-

In October 2024, Northern Graphite, a Canadian company, announced an agreement with Rain Carbon to jointly develop natural graphite anode materials for the EV battery market. This collaboration aims to produce anode materials with a lower carbon footprint, aligning with the industry's shift towards sustainable practices.

Report Features

This report provides market intelligence most comprehensively. The report structure has been kept so that it offers maximum business value. It provides critical insights into market dynamics and will enable strategic decision-making for existing market players as well as those willing to enter the market.

The following are the key features of the report:

-

Market structure: Overview, industry life cycle analysis, supply chain analysis.

-

Market environment analysis: Growth drivers and constraints, Porter’s five forces analysis, SWOT analysis.

-

Market trend and forecast analysis.

-

Market segment trend and forecast.

-

Competitive landscape and dynamics: Market share, Service portfolio, New Product Launches, etc.

-

COVID-19 impact and its recovery curve.

-

Attractive market segments and associated growth opportunities.

-

Emerging trends.

-

Strategic growth opportunities for the existing and new players.

-

Key success factors.

|

Market Study Period

|

2019-2031

|

|

Base Year

|

2024

|

|

Forecast Period

|

2025-2031

|

|

Trend Period

|

2019-2023

|

|

Number of Tables & Figures

|

>100

|

|

Number of Segments Analysed

|

5 (Metal Type, Steel-Area Type, Steel-Grade Type, Product Type, and Region)

|

|

Number of Regions Analysed

|

4 (North America, Europe, Asia-Pacific, Rest of the World)

|

|

Countries Analysed

|

15 (The USA, Canada, Mexico, Germany, France, Italy, The UK, China, Japan, India, Brazil, Saudi Arabia, Rest of Europe, Rest of APAC, and Rest of the World)

|

|

Free Customization Offered

|

10%

|

|

After Sales Support

|

Unlimited

|

|

Report Presentation

|

Complimentary

|

|

Market Dataset

|

Complimentary

|

|

Further Deep Dive & Consulting Services

|

10% Discount

|

Market Segmentation

The report provides detailed insights into the market dynamics to enable informed business decision-making and growth strategy formulation based on the opportunities present in the market.

The graphite electrode market for the metal industry is segmented into the following categories:

Graphite Electrode Market, by Product Type

Graphite Electrode Market, by Metal Type

-

Steel

-

Silicon Metal

-

Aluminium

-

Other Metals

Graphite Electrode Market, by Steel-Area Type

-

Arc-Zone

-

Slag

-

Side

-

Other Areas

Graphite Electrode Market, by Steel-Grade Type

-

Carbon Steel

-

Stainless Steel

-

Other Grades

Graphite Electrode Market, by Region

-

North America (Trend and Forecast, Insights, Regional Breakdown, and Attractiveness: The USA, Canada, and Mexico)

-

Europe (Trend and Forecast, Insights, Regional Breakdown, and Attractiveness: Germany, France, The UK, Russia, and The Rest of Europe)

-

Asia-Pacific (Trend and Forecast, Insights, Regional Breakdown, and Attractiveness: Japan, China, India, and The Rest of Asia-Pacific)

-

Rest of the World (Trend and Forecast, Insights, Regional Breakdown, and Attractiveness: Brazil, Saudi Arabia, and Others)

Research Methodology

-

This strategic assessment report from Stratview Research offers a comprehensive analysis that reflects the current realities of the graphite electrode market and its future market possibilities for the forecast period.

-

The report segments and analyses the market in the most detailed manner to provide a panoramic view of the market.

-

The vital data/information provided in the report can play a crucial role for market participants and investors in identifying the low-hanging fruit available in the market and formulating growth strategies to expedite their growth process.

-

This report provides high-quality insights and is the outcome of a detailed research methodology that comprises extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research’s internal database and statistical tools.

-

More than 1,000 authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white papers, patents, and articles, have been leveraged to gather the data.

-

We conducted more than 15 detailed primary interviews with market players across the value chain in all four regions and industry experts to obtain both qualitative and quantitative insights.

Customization Options

With this detailed report, Stratview Research offers one of the following free customization options to our respected clients:

Company Profiling

- Detailed profiling of additional market players (up to three players)

- SWOT analysis of key players (up to three players)

Competitive Benchmarking

- Benchmarking of key players on the following parameters: Product portfolio, geographical reach, regional presence, and strategic alliances

Custom Research: Stratview Research offers custom research services across sectors. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to [email protected].