Market Insights

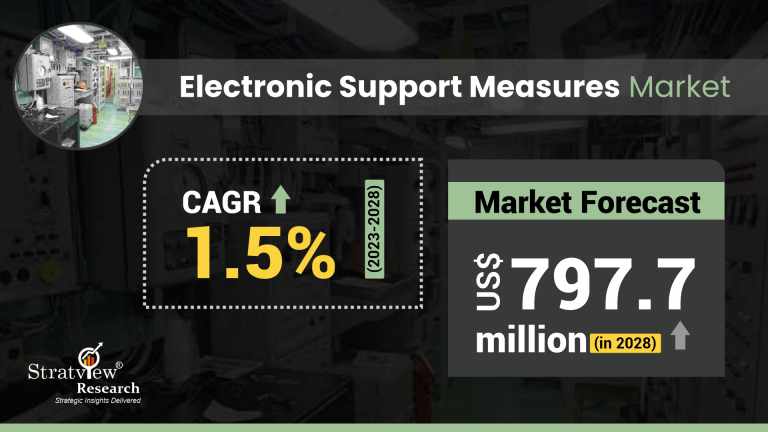

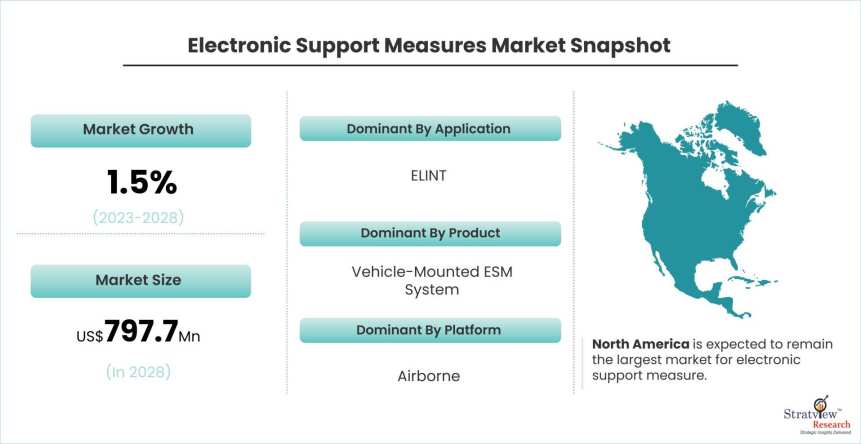

The electronic support measures market is estimated to grow at a CAGR of 1.5% during 2023-2028 to reach USD 797.7 million in 2028.

Want to know more about the market scope? Register Here

Market Dynamics

Introduction

Electronic support measure Systems are the subset of electronic warfare (EW), which encompasses a range of activities and capabilities aimed at detecting, identifying, locating, and analyzing electromagnetic emissions and signals from other electronic devices, such as radar systems, communications equipment, and other electronic systems. The primary objectives of ESM systems are to gain situational awareness, gather intelligence, and support electronic countermeasure systems. These systems provide a tactical advantage by giving commanders insights into enemy capabilities, movements, and intentions based on their electronic emissions. They play a vital role in modern warfare, helping military forces gather intelligence, protect their own electronic systems, and disrupt or deceive the electronic capabilities of adversaries, making them an essential component of contemporary military operations.

ESM systems are in high demand across defense forces worldwide as they enhance intelligence-gathering capabilities, increase asset protection, and help maintain a competitive edge in modern-day warfare. These systems are increasingly integrated into larger electronic warfare suites and platforms. This integration allows for their seamless coordination with electronic countermeasures (ECM) and other electronic warfare equipment.

As a result of the growing developments in the digital warfare marketspace, the defense authorities are focused on boosting their EW capabilities and equipping the electronic support measures systems with their airborne, naval-based, and ground-based military assets in order to improve overall situational awareness and threat assessment and to ensure battlefield supremacy.

Major ESM System Models:

|

ESM System Models

|

Manufacturer

|

Platform

|

|

AN/ASQ-239

|

BAE Systems

|

Airborne Platform

|

|

Mantlet

|

BAE Systems

|

Airborne, Naval-Based, and Ground-Based Platform

|

|

AN/ALQ-217

|

Lockheed Martin Corporation

|

Airborne Platform

|

|

AN/BLQ-10(V)

|

Lockheed Martin Corporation

|

Naval-Based Platform

|

|

AN/ALQ-210

|

Lockheed Martin Corporation

|

Airborne Platform

|

|

AN/SLQ-32(V)6

|

Northrop Grumman Corporation

|

Naval-Based Platform

|

|

ARDS (Advanced Radar Detection System)

|

Raytheon Technologies Corporation

|

Airborne Platform

|

Recent Contracts

There have been several investments in the defense industry directed at ESM systems in recent years, which would boost the overall market. Some of them have been mentioned below:

- In April 2023, BAE Systems was awarded a contract worth US$ 491 million by Lockheed Martin Corporation to manufacture the cutting-edge Block 4 electronic warfare (EW) systems for the F-35 Lightning II fighter jets. The powerful Block 4 EW system would offer greater situational awareness, enhanced survivability, and increased capabilities to counter modern-day threats, and is also upgradable to address evolving threats.

- In April 2021, a deal was signed by Leonardo on behalf of the EuroDASS consortium to provide the Praetorian EW system for 38 of the modern Eurofighter Typhoon aircraft being provided to the German Air Force.

- In March 2021, L3Harris Technologies, Inc. was awarded a contract by Lockheed Martin Corporation for the development of Viper Shield, an advanced EW system, to protect the F-16 multirole fighter aircraft against emerging radar and electronic threats for the US Air Force and global coalition partners.

Recent Market JVs and Acquisitions: Over the past few years, there have been a fair number of strategic alliances, including M&As, JVs, etc., across the globe, which has increased the overall consolidation level of the market. Some of them have been mentioned below:

- In January 2022, Leonardo completed the acquisition of 25.1% of the shares in Hensoldt AG, resulting in strengthening both companies in the defense electronics industry.

- In April 2020, Raytheon Corporation merged with United Technologies Corporation to form Raytheon Technologies Corporation. This merger of equals is the largest-ever merger in the defense industry, in terms of value.

- In June 2019, L3 Technologies and Harris Corporation merged their businesses to form L3Harris Technologies, Inc. The company is among the key manufacturers of ESM systems across the globe.

Want to have a closer look at this market report? Click Here

Key Players

In recent years, there has been stiff competition in the global electronic support measures system market. Moreover, there is a high level of consolidation in the market, with the top companies capturing a majority of the overall market share. These companies are also actively contributing to the market demand as a result of their large industry experience, financial position, technological expertise, government support, innovative product developments, and geographic reach. The following are the key players in the electronic support measures market:

- BAE Systems

- Raytheon Technologies

- Lockheed Martin Corporation

- Leonardo DRS

- Northrop Grumman Corporation

- L3Harris Technologies, Inc.

- Elbit Systems Ltd.

- Thales Group

- Rohde & Schwarz India Pvt., Ltd.

- HENSOLDT

Note: The above list does not necessarily include all the top players in the market.

Are you the leading player in this market? We would love to include your name. Write to us at [email protected]

Segments Analysis

|

Segmentations

|

List of Sub-Segments

|

Dominant and Fastest-Growing Segments

|

|

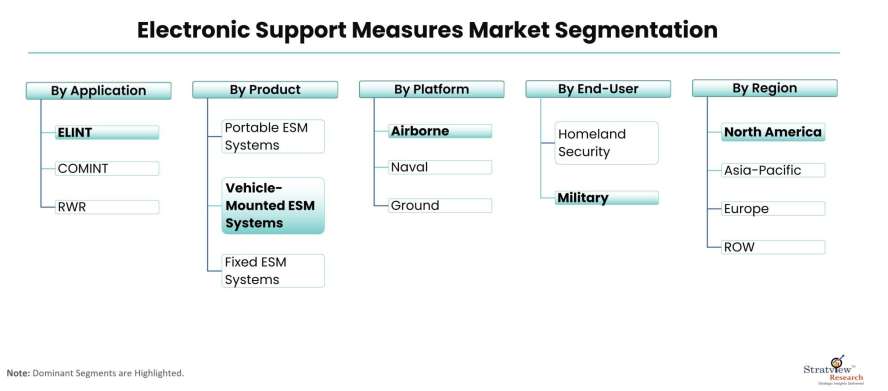

Product Type Analysis

|

Vehicle-Mounted ESM System, Fixed ESM System, and Portable ESM System

|

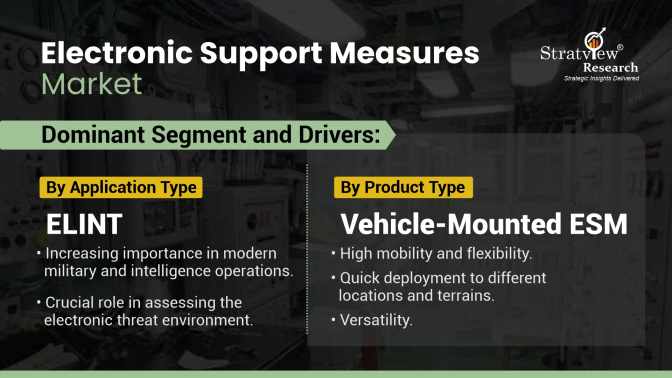

Vehicle-mounted ESM systems are anticipated to be the dominant as well as the fastest-growing products in the years to come.

|

|

Platform Type Analysis

|

Airborne Platform, Naval-Based Platform, and Ground-Based Platform

|

The airborne platform is expected to maintain its market dominance as well as witness the fastest growth in the next five years.

|

|

Application Type Analysis

|

ELINT, COMINT, and RWR

|

ELINT is anticipated to remain the biggest demand generator as well as witness the fastest growth during the forecast period.

|

|

End-User Type Analysis

|

Military and Homeland Security

|

The military is likely to remain the biggest demand generator for ESM in the next five years.

|

|

Regional Analysis

|

North America, Europe, Asia-Pacific, and The Rest of the World

|

North America is expected to remain the largest market over the next five years, whereas Asia-Pacific is likely to grow at the fastest rate.

|

By Application Type

Based on the application type, the market is segmented into ELINT, COMINT, and RWR. Among these application types, ELINT is expected to maintain its market dominance as well as witness the fastest growth during the forecast period. ELINT is of great importance in modern military and intelligence operations, as it helps in situational awareness, threat assessment, and decision-making processes. In particular, ELINT plays a crucial role in assessing the electronic threat environment, which helps the military and homeland security intelligence agencies understand the adversary's electronic capabilities, tactics, and vulnerabilities and accordingly develop strategies to counter or exploit those capabilities. ELINT is closely linked to electronic warfare (EW) operations, providing information on enemy electronic systems and allowing for jamming, deception, or suppression of hostile electronic emissions.

By Product Type

Based on the product type, the market is segmented into vehicle-mounted ESM systems, fixed ESM systems, and portable ESM systems. Among these product types, the vehicle-mounted ESM system is expected to remain the dominant as well as the fastest-growing category in the next five years. These systems offer high mobility and flexibility and can be quickly deployed to different locations and terrains, making them ideal for rapidly changing battlefield scenarios. They help the defense forces with the provision of intelligence and threat assessment on the move. Furthermore, these systems are versatile and can be deployed on a variety of military vehicles, including aircraft, armored vehicles, submarines, and even naval vessels.

By Platform Type

Based on the platform type, the market is segmented into airborne platforms, naval-based platforms, and ground-based platforms. Among these platform types, the airborne platform is likely to remain the dominant category during the forecast period. Airborne platforms, such as fighter aircraft, surveillance planes, and drones, offer unparalleled mobility and access to different operational areas. These aircraft can quickly cover large areas, gather electronic intelligence from multiple sources, and respond rapidly to hostile threats. The airborne ESM systems are often integrated with the military aircraft’s avionics and mission systems. In addition, with the year-on-year increasing orders for the F-35 aircraft, which holds unprecedented potential for gathering electronic intelligence, the market category is likely to witness the fastest growth in the coming years.

Want to have a closer look at this market report? Click Here

By End-User Type

Based on the end-user type, the market is segmented into military and homeland security. Between end-user types, the military is expected to remain the biggest procurement of ESMs as well as the fastest-growing category during the forecast period. With the developments in the digital warfare marketspace globally, the military forces actively invest in the development and deployment of cutting-edge ESM systems to maintain their military superiority. The military faces a more complex and diverse threat environment as compared to homeland security. In addition, military operations often involve confronting adversaries with sophisticated electronic warfare capabilities. As a result, there is a higher demand for ESM systems in the defense industry.

Regional Insights

In terms of regions, North America is expected to remain the largest market for electronic support measure during the forecast period. The US DoD, in particular, has been extensively investing in ESM systems with companies, such as BAE Systems, Raytheon Technologies Corporation, Lockheed Martin Corporation, and Northrop Grumman Corporation, which provide the country with an unmatched edge over other regions. As the US DoD continues to add new tactical aircraft, naval vessels, and land vehicles while modernizing older platforms, they will continue to call on these companies to provide the latest technology to help protect these assets and the personnel who operate them. Concurrently, Asia Pacific is expected to witness the fastest growth in the market in the coming years with major contributions from countries, such as China, India, and Japan, leading to growing demand for ESM systems to enhance situational awareness, intelligence collection, and protection of assets.

Know the high-growth countries in this report. Register Here

Research Methodology

This strategic assessment report, from Stratview Research, provides a comprehensive analysis that reflects today’s electronic support measures market realities and future market possibilities for the forecast period of 2023 to 2028. After a continuous interest in our electronic support measures market report from the industry stakeholders, we have tried to further accentuate our research scope to the electronic support measures market to provide the most crystal-clear picture of the market. The report segments and analyses the market in the most detailed manner to provide a panoramic view of the market. The vital data/information provided in the report can play a crucial role for the market participants as well as investors in the identification of the low-hanging fruits available in the market as well as to formulate the growth strategies to expedite their growth process.

This report offers high-quality insights and is the outcome of a detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research’s internal database and statistical tools. More than 1000 authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white papers, patents, and articles, have been leveraged to gather the data. We conducted more than 15 detailed primary interviews with the market players across the value chain in all four regions and industry experts to obtain both qualitative and quantitative insights.

Report Features

This report provides market intelligence in the most comprehensive way. The report structure has been kept such that it offers maximum business value. It provides critical insights into market dynamics and will enable strategic decision-making for existing market players as well as those willing to enter the market. The following are the key features of the report:

- Market structure: Overview, industry life cycle analysis, supply chain analysis.

- Market environment analysis: Growth drivers and constraints, Porter’s five forces analysis, SWOT analysis.

- Market trend and forecast analysis.

- Market segment trend and forecast.

- Competitive landscape and dynamics: Market share, Service portfolio, New Product Launches, etc.

- COVID-19 impact and its recovery curve

- Attractive market segments and associated growth opportunities.

- Emerging trends.

- Strategic growth opportunities for the existing and new players.

- Key success factors

Market Segmentation

This report studies the market, covering a period of 12 years of trends and forecasts. The report provides detailed insights into the market dynamics to enable informed business decision-making and growth strategy formulation based on the opportunities present in the market.

The electronic support measures market is segmented into the following categories.

By Product Type

- Vehicle-Mounted ESM Systems

- Fixed ESM Systems

- Portable ESM Systems

By Platform Type

- Airborne Platform

- Naval-Based Platform

- Ground-Based Platform

By Application Type

By End-Use Type

- Military

- Homeland Security

By Region

- North America (Country Analysis: The USA and The Rest of North America)

- Europe (Country Analysis: Germany, France, The UK, and Rest of Europe)

- Asia-Pacific (Country Analysis: Japan, China, India, and Rest of Asia-Pacific)

- Rest of the World (Country Analysis: Brazil, Saudi Arabia, and Others)

Click Here, to learn the market segmentation details

Report Customization Options

With this detailed report, Stratview Research offers one of the following free customization options to our respectable clients:

Company Profiling

- Detailed profiling of additional market players (up to three players)

- SWOT analysis of key players (up to three players)

Competitive Benchmarking

- Benchmarking of key players on the following parameters: Product portfolio, geographical reach, regional presence, and strategic alliances.

Custom Research: Stratview Research offers custom research services across sectors. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to [email protected].