Attractive Opportunities

Global Demand Analysis & Sales Opportunities in Aircraft Machine Tools Market

-

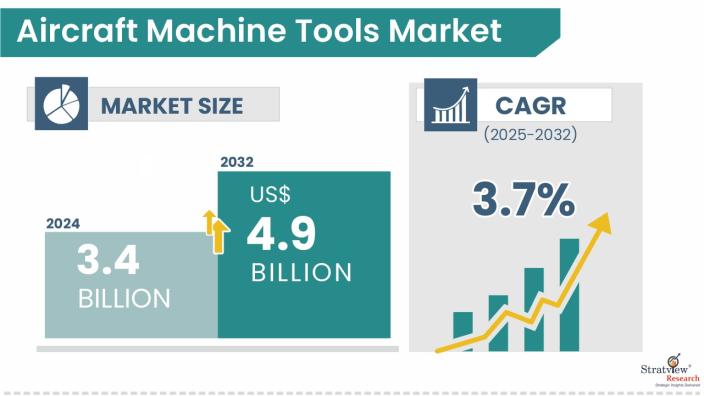

The annual demand for aircraft machine tools was USD 3.5 billion in 2024 and is expected to reach USD 3.8 billion in 2025, up 10.2% than the value in 2024.

-

During the forecast period (2025-2032), the aircraft machine tools market is expected to grow at a CAGR of 3.7%. The annual demand will reach USD 4.9 billion in 2032.

-

During 2025-2032, the aircraft machine tools industry is expected to generate a cumulative sales opportunity of USD 34.8 billion, which is almost 2 times the opportunities during 2019-2024.

Wish to get a free sample? Click Here

High-Growth Market Segments:

-

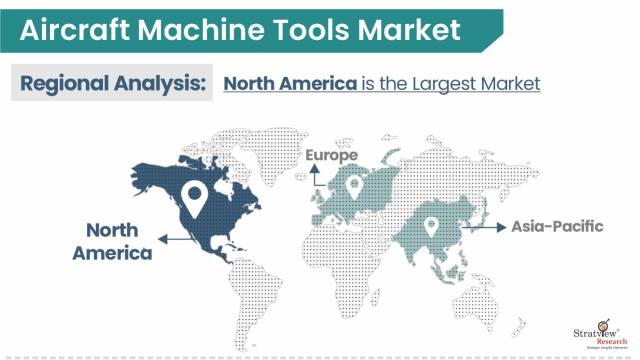

North America generated the highest demand with the largest market share of >50% in 2024, whereas Asia-Pacific is likely to grow at the fastest rate.

-

By machine type, Milling machine is expected to maintain its market dominance as well as witness the fastest growth in the coming years.

-

By axis type, 5-Axis machines are anticipated to be dominant as well as witness the fastest growth in the coming years.

-

By end-user type, Tier-I companies are expected to be the dominant as well as the fastest-growing end-user type during the forecast period.

-

By aircraft type, Civil aircraft is expected to maintain its market dominance as well as witness faster growth in the coming years.

Market Statistics

Have a look at the sales opportunities presented by the aircraft machine tools market in terms of growth and market forecast.

|

Aircraft Machine Tools Market Data & Statistics

|

|

|

Market Statistics

|

Value (in USD Billion)

|

Market Growth (%)

|

|

Annual Market Size in 2023

|

USD 3.2 billion

|

-

|

|

Annual Market Size in 2024

|

USD 3.5 billion

|

YoY Growth in 2024: 10.2%

|

|

Annual Market Size in 2025

|

USD 3.8 billion

|

YoY Growth in 2025: 8.2%

|

|

Annual Market Size in 2032

|

USD 4.9 billion

|

CAGR 2025-2032: 3.7%

|

|

Cumulative Sales Opportunity during 2025-2032

|

USD 34.8 billion

|

-

|

|

Top 10 Countries’ Market Share in 2024

|

USD 2.8 billion +

|

> 80%

|

|

Top 10 Company’s Market Share in 2024

|

USD 1.7 billion to USD 2.4 billion

|

50% - 70%

|

Market Dynamics

Introduction:

Advanced machinery called aerospace machine tools is vital for manufacturing parts of airplanes. Using these tools, workers cut, drill, shape, and finish all materials to satisfy the excellent quality and strict safety standards needed in aerospace. Some of the common tools employed are CNC machining centers, CNC lathes, EDM machines, and grinding machines, which are meant for making items with difficult geometries and tight tolerances reliably. With tough metals such as titanium, Inconel, and composite alloys being used in aerospace, having these specific machines is very important. Since these challenges exist, modern aerospace machine tools have advanced ways of supervising, controlling, and using automation. With smart manufacturing, IoT, data analytics, and digital twin tools, Industry 4.0 techniques are boosting how efficient and accurate the aerospace machining procedures are.

Segments Analysis

|

Segmentations

|

List of Sub-Segments

|

Dominant and Fastest-Growing Segments

|

|

Machine-Type Analysis

|

Milling Machines, Turning Machines, and Other Machines

|

The milling machine is expected to maintain its market dominance as well as witness the fastest growth in the coming years.

|

|

Axis-Type Analysis

|

5-Axis Machines, 3/4 Axis Machines, and Other Axis Types

|

5-Axis machines are anticipated to be dominant as well as witness the fastest growth in the coming years.

|

|

End-User-Type Analysis

|

OEMs, Tier-I Companies, and Other End-Users

|

Tier-I companies are expected to be the dominant as well as the fastest-growing end-user type during the forecast period.

|

|

Aircraft-Type Analysis

|

Civil Aircraft and Military Aircraft

|

Civil aircraft is expected to maintain its market dominance as well as witness faster growth in the coming years.

|

|

Regional Analysis

|

North America, Europe, Asia-Pacific, and Rest of the World

|

North America is expected to remain the largest market over the next few years, whereas Asia-Pacific is likely to grow at the fastest rate.

|

By Machine Type

“The milling machine segment is projected to remain the leading category in the market and also experience the highest growth in the coming years.”

-

The market is segmented into milling machines, turning machines, and other machines. Milling machines are projected to hold the largest share of the market throughout the forecast period. Their versatility, ability to handle different cutting tools, and capacity for producing high-precision parts in large volumes make them indispensable for aerospace applications.

-

These machines are especially valued for their role in producing uniform, complex components with tight tolerances required in the industry.

By Axis Type

“5-axis machines are expected to retain market dominance and register the fastest growth in the years ahead.”

-

The market is segmented into 5-axis machines, 3/4 axis machines, and other axis types. When categorized by axis configuration, 5-axis machines are anticipated to lead the market and also register the highest growth rate over the next five years.

-

5-axis machine’s ability to handle complex geometries and curved surfaces makes them ideal for manufacturing aerospace parts like wing ribs, fuselage frames, and bulkheads. Additionally, they reduce the need for multiple setups, improving production efficiency and precision, and often allow a part to be completed in just one or two runs.

By End-User Type

“Tier-I companies are expected to be the dominant as well as the fastest-growing end-user type, during the forecast period.”

-

The market is segmented into OEMs, tier-I companies, and other end-users. Among the key buyers of machine tools, Tier-I suppliers are expected to dominate the market and witness the fastest growth over the next seven years.

-

Tier-I companies manufacture critical engine, structure, and landing gear components and rely heavily on advanced machine tools to meet the high standards of quality, performance, and safety demanded by aerospace customers. Their consistent investment in precision tooling drives ongoing demand in this segment.

By Aircraft Type

“Civil aircraft is expected to maintain its market dominance as well as to witness faster growth during the forecast period.”

-

The market is segmented into civil aircraft and military aircraft. By aircraft type, civil aircraft are projected to remain the largest market for machine tools.

-

Although this segment experienced a significant setback in 2020, it has shown a steady recovery. The reintroduction of the Boeing 737 MAX, the launch of new programs like the C919, B777X, and MC-21, along with increased production of A320 and B737 models, are expected to significantly boost demand for machine tools in this segment.

Regional Insights

“North America is projected to retain its leading position in the market over the next few years.”

-

North America is set to continue as the leading regional market, thanks to the strong presence of major aircraft OEMs, Tier-I suppliers, and machine tool manufacturers. The United States, in particular, is likely to remain the global hub for aerospace machine tools.

-

Meanwhile, the Asia-Pacific region is expected to grow at the fastest pace during 2025-2032, led by countries like China, Japan, and India, all of which are ramping up both commercial and defense aircraft manufacturing capabilities.

Know the high-growth countries in this report. Register Here

Competitive Landscape

The aircraft machine tools market is populated by several regional and global players. Most of the major players compete in some of the governing factors, including price, service offerings, regional presence, etc. The following are the key players in the aircraft machine tools market.

Here is the list of the Top Players

-

YAMAZAKI MAZAK CORPORATION

-

DMG MORI CO., LTD.

-

Makino Milling Machine Co., Ltd.

-

DN Solutions

-

Fives Group

-

GF Machining Solutions

-

Okuma Corporation

-

Starrag Group

-

JTEKT Corporation

-

Gebr. Heller Maschinenfabrik GmbH

Note: The above list does not necessarily include all the top players in the market.

Are you the leading player in this market? We would love to include your name. Please write to us at [email protected]

Recent Developments/Mergers & Acquisitions:

Over the past few years, there have been a fair number of strategic alliances, including M&As, JVs, etc., across the globe. Some of them have been mentioned below:

-

In February 2023, NIDEC Corporation completed the acquisition of the Italian machine tool manufacturer PAMA along with its nine affiliates, which is renowned for its diverse product lineup and advanced large machine tools, especially in boring and milling. The company also completed the acquisition of Mitsubishi Heavy Industries Machine Tool Co., Ltd., a company that designs, manufactures, and sells machine tools, cutting tools, and related products, in August 2021.

-

In April 2022, Massey Capital, a private investment firm, closed a deal to acquire SMS Machine Tools Limited, an industry-leading distributor and servicer of CNC machines and tools in Ontario and Quebec, serving the aerospace, automotive, medical, energy, and related industries.

-

In August 2021, Hardinge Inc. acquired the shares of Ohio Tool Works, LLC. This acquisition enhanced Hardinge’s machine tool and workholding portfolio with an attractive platform of high-precision honing machines, tooling, and abrasives across the industrial, aerospace, defense, and metalworking industries.

Report Features

This report provides market intelligence most comprehensively. The report structure has been kept so that it offers maximum business value. It provides critical insights into market dynamics and will enable strategic decision-making for existing market players as well as those willing to enter the market.

The following are the key features of the report:

-

Market structure: Overview, industry life cycle analysis, supply chain analysis.

-

Market environment analysis: Growth drivers and constraints, Porter’s five forces analysis, SWOT analysis.

-

Market trend and forecast analysis.

-

Market segment trend and forecast.

-

Competitive landscape and dynamics: Market share, Service portfolio, New Product Launches, etc.

-

COVID-19 impact and its recovery curve.

-

Attractive market segments and associated growth opportunities.

-

Emerging trends.

-

Strategic growth opportunities for the existing and new players.

-

Key success factors.

|

Market Study Period

|

2019-2032

|

|

Base Year

|

2024

|

|

Forecast Period

|

2025-2032

|

|

Trend Period

|

2019-2023

|

|

Number of Tables & Figures

|

>100

|

|

Number of Segments Analysed

|

5 (Machine Type, Axis Type, End-User Type, Aircraft Type, and Region)

|

|

Number of Regions Analysed

|

4 (North America, Europe, Asia-Pacific, Rest of the World)

|

|

Countries Analysed

|

15 (The USA, Canada, Mexico, Germany, France, Italy, The UK, China, Japan, India, Brazil, Saudi Arabia, Rest of Europe, Rest of APAC, and Rest of the World)

|

|

Free Customization Offered

|

10%

|

|

After Sales Support

|

Unlimited

|

|

Report Presentation

|

Complimentary

|

|

Market Dataset

|

Complimentary

|

|

Further Deep Dive & Consulting Services

|

10% Discount

|

Market Segmentation

The report provides detailed insights into the market dynamics to enable informed business decision-making and growth strategy formulation based on the opportunities present in the market.

The aircraft machine tools market is segmented into the following categories:

Aircraft Machine Tools Market, by Machine Type

-

Milling Machines

-

Turning Machines

-

Other Machines

Aircraft Machine Tools Market, by Axis Type

-

5-Axis Machines

-

3/4-Axis Machines

-

Other Axis Types

Aircraft Machine Tools Market, by End-User Type

-

OEMs

-

Tier-I Companies

-

Others

Aircraft Machine Tools Market, by Aircraft Type

-

Civil Aircraft

-

Military Aircraft

Aircraft Machine Tools Market, by Region

-

North America (Country Analysis: The USA, Canada, and Mexico)

-

Europe (Country Analysis: Germany, France, The UK, Russia, and The Rest of Europe)

-

Asia-Pacific (Country Analysis: Japan, China, India, and The Rest of Asia-Pacific)

-

Rest of the World (Country Analysis: Brazil, Saudi Arabia, and Others)

Research Methodology

-

This strategic assessment report from Stratview Research provides a comprehensive analysis that reflects today’s aircraft machine tools market realities and future market possibilities for the forecast period.

-

The report segments and analyzes the market in the most detailed manner to provide a panoramic view of the market.

-

The vital data/information provided in the report can play a crucial role for market participants and investors in identifying the low-hanging fruit available in the market and formulating growth strategies to expedite their growth process.

-

This report offers high-quality insights and is the outcome of a detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research’s internal database and statistical tools.

-

More than 1,000 authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white papers, patents, and articles, have been leveraged to gather the data.

-

We conducted more than 15 detailed primary interviews with market players across the value chain in all four regions and industry experts to obtain both qualitative and quantitative insights.

Customization Options

With this detailed report, Stratview Research offers one of the following free customization options to our respected clients:

Company Profiling

Competitive Benchmarking

-

Benchmarking of key players on the following parameters: Service portfolio, geographical reach, regional presence, and strategic alliances.

Custom Research: Stratview Research offers custom research services across industries. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to [email protected].