Attractive Opportunities

Global Demand Analysis & Sales Opportunities in Cement Additives Market

-

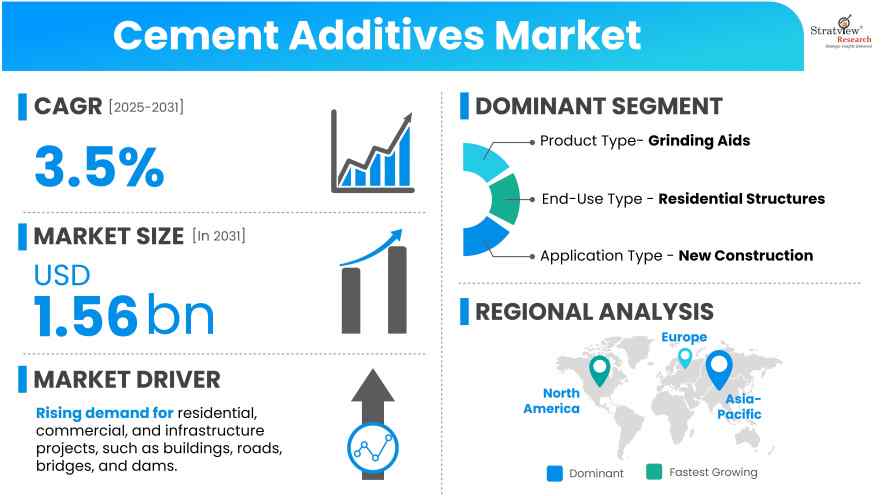

The annual demand for cement additives was USD 1206.5 million in 2024 and is expected to reach USD 1272.5 million in 2025, up 5.5% than the value in 2024.

-

During the forecast period (2025 to 2031), the cement additives market is expected to grow at a CAGR of 3.5%. The annual demand will reach of USD 1563.9 million in 2031.

-

During 2025-2031, the cement additives industry is expected to generate a cumulative sales opportunity of USD 10055.60 million.

Want to get a free sample? Register Here

High-Growth Market Segments:

-

Asia-Pacific is expected to be the dominant and fastest-growing region for the cement additive over the forecasted years.

-

By Product type, Grinding Aids is anticipated to be the biggest demand generator as well as to witness the fastest growth in the years to come.

-

By End-Use type, Residential Structure is expected to be the dominant and fastest-growing end-use industry during the forecast period.

-

By Application type, New Construction is likely to generate the largest market demand as well as witness faster growth in the foreseen years.

Market Statistics

Have a look at the sales opportunities presented by the cement additives market in terms of growth and market forecast.

|

Cement Additives Market Data & Statistics

|

|

|

Market Statistics

|

Value (in USD Million)

|

Market Growth (%)

|

|

Annual Market Size in 2024

|

USD 1206.5 million

|

|

|

Annual Market Size in 2025

|

USD 1272.5 million

|

YoY Growth in 2025: 5.5%

|

|

Annual Market Size in 2031

|

USD 1563.9 million

|

CAGR 2025-2031: 3.5%

|

|

Cumulative Sales Opportunity during 2025-2031

|

USD 10055.60 million

|

-

|

|

Top 10 Countries’ Market Share in 2024

|

USD 900 million+

|

> 80%

|

|

Top 10 Company’s Market Share in 2024

|

USD 600 million to 800 million

|

50% - 70%

|

Market Dynamics

Introduction:

What are the cement additives?

Cement additives are chemicals added to cement while manufacturing or when mixing with concrete to increase its performance and quality. Cement additives are made to improve such parameters as strength, durability, workability, and resistance to weathering conditions. These additives perform a critical function in improving cement performance for diverse construction uses, ranging from housing development to high-end infrastructure projects. Moreover, they are part of sustainable construction through the minimization of cement usage, less carbon dioxide emissions, and increased durability of structures.

Cement additives have grown more necessary in the face of rising demands from the construction industry for high-performance materials and sustainable construction practices. Not only do they enhance cement's physical and chemical characteristics, but they also provide value for money through energy saving and material minimization. They make concrete work better, and this makes it less difficult to mix, transport, and apply in the construction area. With the continuous development of additive technology, producers are formulating specialist products to serve a particular project purpose, adding more usage of cement additives in residential, commercial, and infrastructure projects around the globe.

Segment Analysis

|

Segmentations

|

List of Sub-Segments

|

Segments with High-Growth Opportunity

|

|

Product-Type Analysis

|

Grinding Aids, Strength Enhancers, Performance Enhancers, and Other Products.

|

Grinding aids are anticipated to be the biggest demand generator as well as to witness the fastest growth in the years to come.

|

|

End-Use-Type Analysis

|

Residential Structures, Non-Residential Structures, and Infrastructures

|

Residential structure is expected to be the dominant and fastest-growing end-use industry during the forecast period.

|

|

Application-Type Analysis

|

New Construction and Renovation

|

New construction is likely to generate a larger market demand as well as witness faster growth in the foreseeable years.

|

|

Regional Analysis

|

North America, Europe, Asia-Pacific, and The Rest of the World

|

Asia-Pacific is expected to be the dominant and fastest-growing region for the cement additive over the forecasted years.

|

By Product Type

“Grinding aids dominate the market and is also expected to experience the fastest growth in the market during the forecast period.”

-

The market for cement additives is segmented into grinding aids, strength promoters, performance promoters, and other products. Grinding aids are expected to dominate the market and grow at the fastest rate in the forecast period. These additives have a substantial impact on the process of grinding clinker, which is required in the production of cement, by lowering energy consumption and enhancing the efficiency of cement mills.

-

Apart from maximizing grinding efficiency, they lead to better quality cement, enhanced strength development, and reliable performance. Their potential to maximize production processes and minimize operating costs renders them a first choice in the cement industry.

By End-Use Type

“Residential structures are expected to be the largest category and are expected to grow in the forecast period.”

-

The market for cement additives is segmented into residential structures, non-residential structures, and infrastructures. Among these, residential structures are anticipated to remain the largest and fastest-growing end-use category throughout the forecast period. This growth is fuelled by factors such as population expansion, rapid urbanization, evolving lifestyles, and increasing disposable incomes.

-

Additionally, the rising demand for homeownership and growing investments in residential real estate are expected to drive the adoption of cement additives. These additives enhance the durability, strength, and overall quality of construction, making them an essential component in modern residential projects. Government initiatives promoting affordable housing and urban development further contribute to the increasing use of cement additives in the housing market.

By Application Type

“New construction is likely to generate the largest market demand during the study period.”

-

The market for cement additives is divided between new construction and renovation. Cement additives play a crucial role in new construction works as they hugely contribute to enhancing concrete performance by making it more workable, durable, and strong. They also provide flexibility for customizing concrete properties in accordance with project demands, guaranteeing the structural integrity and durability of buildings.

-

Moreover, with the increase in urbanization, infrastructural development, and government investment in mega construction projects, the need for cement additives in new construction is likely to increase further. Their application in streamlining construction processes and reducing material wastage makes them a necessity in contemporary construction practices.

Regional Analysis

“Asia-Pacific is expected to be the dominant market and the fastest-growing market over the years.”

-

Major Asian nations propelling the expansion of the cement additive market are China, India, Japan, South Korea, and Southeast Asian nations such as Vietnam, Indonesia, and Thailand. These nations are investing heavily in infrastructure projects such as roads, bridges, railways, airports, and residential and commercial buildings, resulting in a high demand for cement additives.

-

Further, the high growth in the economy of key countries like India and China is increasing disposable incomes and fast-paced construction activity, hence fuelling the regional cement additive market.

Want to get a free sample? Register Here

Competitive Landscape

Most of the major players compete in some of the factors, including price, service offerings, regional presence, etc. The following are the key players in the cement additives market -

Here is the list of the Top Players (Based on Dominance)

Note: The above list does not necessarily include all the top players in the market.

Are you the leading player in this market? We would love to include your name. Please write to us at [email protected]

Recent Developments/Mergers & Acquisitions:

-

In May 2023, Sika AG acquired MBCC Group, formerly known as BASF Construction Chemicals, strengthening its position in the global construction chemicals market and expanding its product portfolio.

-

In September 2022, Saint-Gobain acquired GCP Applied Technologies, a key player in construction chemicals, strengthening its position in the cement additive market by expanding its product portfolio and global presence.

-

In April 2022, Euclid Chemical Company acquired Chryso's North American cement grinding aids and cement additive business, enhancing its product offerings and market reach in the region.

-

In November 2021, Euclid Chemical acquired Brett Admixtures, a manufacturer and distributor of concrete admixtures, bolstering its capabilities in providing specialized solutions for the cement and concrete industry.

Report Features

This report provides market intelligence most comprehensively. The report structure has been kept so that it offers maximum business value. It provides critical insights into market dynamics and will enable strategic decision-making for existing market players as well as those willing to enter the market.

The following are the key features of the report:

-

Market structure: Overview, industry life cycle analysis, supply chain analysis.

-

Market environment analysis: Growth drivers and constraints, Porter’s five forces analysis, SWOT analysis.

-

Market trend and forecast analysis.

-

Market segment trend and forecast.

-

Competitive landscape and dynamics: Market share, Service portfolio, New Product Launches, etc.

-

COVID-19 impact and its recovery curve.

-

Attractive market segments and associated growth opportunities.

-

Emerging trends.

-

Strategic growth opportunities for the existing and new players.

-

Key success factors.

|

Market Study Period

|

2019-2031

|

|

Base Year

|

2024

|

|

Forecast Period

|

2025-2031

|

|

Trend Period

|

2019-2023

|

|

Number of Tables & Figures

|

>100

|

|

Number of Segments Analysed

|

4 (Product Type, End-Use Type, Application Type, and Region)

|

|

Number of Regions Analysed

|

4 (North America, Europe, Asia-Pacific, Rest of the World)

|

|

Countries Analysed

|

15 (The USA, Canada, Mexico, Germany, France, Italy, The UK, China, Japan, India, Brazil, Saudi Arabia, Rest of Europe, Rest of APAC, and Rest of the World)

|

|

Free Customization Offered

|

10%

|

|

After Sales Support

|

Unlimited

|

|

Report Presentation

|

Complimentary

|

|

Market Dataset

|

Complimentary

|

|

Further Deep Dive & Consulting Services

|

10% Discount

|

Market Segmentation

The report provides detailed insights into the market dynamics to enable informed business decision-making and growth strategy formulation based on the opportunities present in the market.

The cement additives market is segmented into the following categories:

Cement Additive Market, by Product Type

-

Grinding Aids (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

-

Strength Enhancers (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

-

Performance Enhancers (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

-

Other Products (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

Cement Additive Market, by End Use Type

-

Residential Structures (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

-

Non-Residential Structures (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

-

Infrastructures (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

Cement Additive Market, by Application Type

-

New Construction (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

-

Renovation (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

Cement Additive Market, by Region

-

North America (Country Analysis: The USA, Canada, and Mexico)

-

Europe (Country Analysis: Germany, Turkey, Italy, Russia, and Rest of Europe)

-

Asia-Pacific (Country Analysis: Japan, China, India, South Korea, Indonesia, and Rest of Asia-Pacific)

-

Rest of the World (Country Analysis: Brazil, Egypt, Saudi Arabia, Iran and Others)

Research Methodology

-

This strategic assessment report from Stratview Research provides a comprehensive analysis that reflects today’s cement additive market realities and future market possibilities for the forecast period.

-

The report segments and analyzes the market in the most detailed manner in order to provide a panoramic view of the market.

-

The vital data/information provided in the report can play a crucial role for market participants and investors in identifying the low-hanging fruits available in the market and formulating growth strategies to expedite their growth process.

-

This report offers high-quality insights and is the outcome of a detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research’s internal database and statistical tools.

-

More than 1,000 authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white papers, patents, and articles, have been leveraged to gather the data.

-

We conducted more than 15 detailed primary interviews with market players across the value chain in all four regions and industry experts to obtain both qualitative and quantitative insights.

Customization Option

With this detailed report, Stratview Research offers one of the following free customization options to our respectable clients:

Company Profiling

- Detailed profiling of additional market players (up to three players)

- SWOT analysis of key players (up to three players)

Competitive Benchmarking

- Benchmarking of key players on the following parameters: Service portfolio, geographical reach, regional presence, and strategic alliances

Custom Research: Stratview Research offers custom research services across sectors. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to [email protected].