Attractive Opportunities

Global Demand Analysis & Sales Opportunities in Automotive Nonwoven Composites Market

-

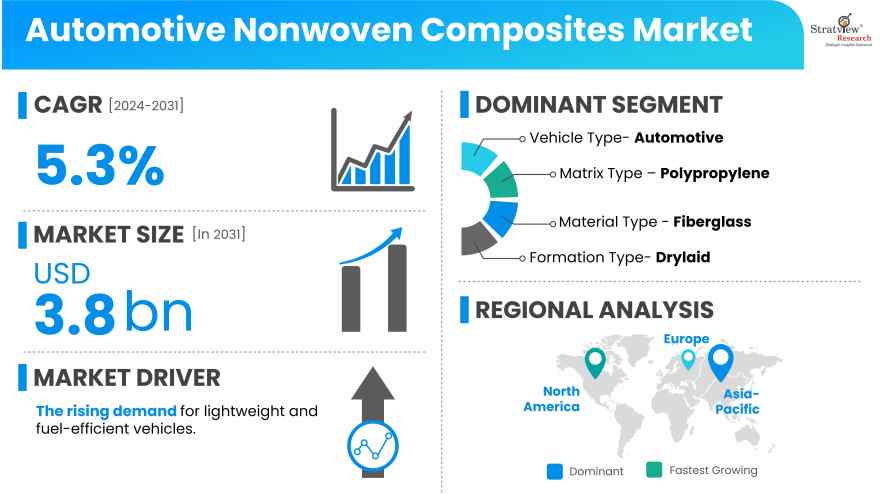

The annual demand for automotive nonwoven composites was USD 2.7 billion in 2024 and is expected to reach USD 2.8 billion in 2025, up 4.1% than the value in 2024.

-

During the forecast period (2025-2031), the automotive nonwoven composites market is expected to grow at a CAGR of 5.6%. The annual demand will reach USD 3.8 billion in 2031.

-

During 2025-2031, the automotive nonwoven composites industry is expected to generate a cumulative sales opportunity of USD 23.3 billion, which is more than 1.5 times the opportunities during 2019-2024.

Want to get a free sample? Register Here

High-Growth Market Segments:

-

Asia-Pacific is expected to remain the largest market in the years to come.

-

By vehicle type, Automotive is anticipated to remain the biggest demand generator for nonwoven composites in the years to come.

-

By matrix type, Polypropylene is expected to dominate the market in the coming years.

-

By material type, Fiberglass is the most preferred reinforcement type in the market. The fiber type is the most dominant category in woven composites too.

-

By application type, Trunk, wheel arch liner, and headliner are expected to remain the largest categories in the years to come.

-

By formation type, Drylaid is likely to dominate the market over the forecasted period.

Market Statistics

Have a look at the sales opportunities presented by the automotive nonwoven composites market in terms of growth and market forecast.

|

Automotive Nonwoven Composites Market Data & Statistics

|

|

|

Market Statistics

|

Value (in USD Billion)

|

Market Growth (%)

|

|

Annual Market Size in 2023

|

USD 2.6 billion

|

-

|

|

Annual Market Size in 2024

|

USD 2.7 billion

|

YoY Growth in 2024: 2.4%

|

|

Annual Market Size in 2025

|

USD 2.8 billion

|

YoY Growth in 2025: 4.1%

|

|

Annual Market Size in 2031

|

USD 3.8 billion

|

CAGR 2025-2031: 5.6%

|

|

Cumulative Sales Opportunity during 2025-2031

|

USD 23.3 billion

|

-

|

|

Top 10 Countries’ Market Share in 2024

|

USD 2.2 billion +

|

> 80%

|

|

Top 10 Company’s Market Share in 2024

|

USD 1.3 billion to USD 1.9 billion

|

50% - 70%

|

Market Dynamics

Introduction:

Nonwoven composites are used in various automotive applications such as parcel trays, floorboards, hood liners, trunk trim, headliners, door panels, and underbody shields. Reinforcements can be synthetic fibers (fiberglass, polyester fibers, carbon fibers, and aramid fibers), natural fibers (jute, flax, or hemp), or a combination of these. Automotive nonwoven composites offer advantages such as weight reduction, improved strength-to-weight ratio, design flexibility, noise reduction, and resistance to corrosion and chemicals. These composites help enhance the overall performance, durability, safety, and aesthetics of vehicles while meeting the industry's stringent requirements.

Market Drivers:

-

The automotive nonwoven composites market is experiencing significant growth due to the rising demand for lightweight and fuel-efficient vehicles. Automakers are increasingly using these composites to reduce vehicle weight, enhance fuel economy, and ensure compliance with stringent emission regulations. Nonwoven composites also provide superior acoustic and thermal insulation, improving cabin comfort and noise reduction.

-

Another major driver is the increasing emphasis on vehicle safety, durability, and cost-effectiveness. Nonwoven composites offer excellent impact resistance, corrosion protection, and a superior strength-to-weight ratio, making them ideal for structural and interior applications like floorboards, headliners, and underbody shields.

-

Advances in material technology have led to the development of bio-based and recycled fiber composites, catering to the growing demand for sustainable automotive solutions. Increasing automobile production and consumer preference for high-performance, aesthetically appealing vehicle interiors are expanding market opportunities, encouraging innovation and investment in nonwoven composite materials.

-

The growing adoption of electric vehicles (EVs) is accelerating demand, as lightweight materials play a crucial role in optimizing battery efficiency and extending driving range. Their recyclability and eco-friendly properties further align with the industry’s push toward sustainability and circular economy initiatives.

Segment Analysis

|

Segmentations

|

List of Sub-Segments

|

Segments with High-Growth Opportunity

|

|

Vehicle-Category Type Analysis

|

Automotive, Recreational Vehicles, and Other Vehicles

|

Automotive is anticipated to remain the biggest demand generator for nonwoven composites in the years to come.

|

|

Matrix-Type Analysis

|

Bicomponent PET/coPET Fiber, Polypropylene, and Other Matrix/Binders

|

Polypropylene is expected to dominate the market in the coming years.

|

|

Material-Type Analysis

|

Fiberglass Composites, Natural/Wood Fiber Composites, Polyester Fiber Composites, Carbon Fiber Composites, Other Materials.

|

Fiberglass is the most preferred reinforcement type in the market. The fiber type is the most dominant category in woven composites too.

|

|

Application-Type Analysis

|

Door Panel, Trunk, Packaged Tray, Headliner, Underbody Shield, Wheel Arch Liner, Center Console, and Other Applications

|

Trunk, wheel arch liner, and headliner are expected to remain the largest categories in the years to come.

|

|

Formation-Type Analysis

|

Spunlaid, Drylaid, and Other Formations

|

Drylaid is likely to dominate the market over the years.

|

|

Region Analysis

|

North America, Europe, Asia-Pacific, and The Rest of the World

|

The Asia-Pacific is expected to remain the largest market in the years to come.

|

By Vehicle-Category Type

“Automotive is expected to remain the dominant segment for the automotive nonwoven composites market during the forecast period.”

-

Based on the vehicle type, the automotive nonwoven composites market is segmented into automotive (ICE, BEV, and hybrid), recreational vehicles, and other vehicles.

-

Automotive is expected to remain the largest demand generator for nonwoven composites during the forecast period. The key whys and wherefores behind the usage of nonwoven composites are extremely lightweight, strong, durable, flexible, easy to process, and can be made from recycled materials. These advantages are making nonwoven composites increasingly popular in a wide range of automotive applications.

-

In addition to that, factors like increasing demand for electric vehicles (EVs) in upcoming years (EV production is expected to reach 76 million units by 2031, rising from 35 million units in 2024) to reduce vehicle weight to improve range and overall performance, are expected to drive the market growth during the forecast period.

By Matrix Type

“Polypropylene is expected to be the dominant category of the market during the forecast period.”

-

Based on the matrix type, the market is segmented into bicomponent PET/coPET fiber, polypropylene, and other Matrix/Binders.

-

Polypropylene is expected to remain the dominant whereas bicomponent PET/coPET fiber is expected to grow at the fastest rate in the market during the forecast period. Polypropylene can be easily molded and formed into complex shapes, allowing for design flexibility in automotive components.

-

Nonwoven composites made from polypropylene can be customized to fit specific component requirements and geometry, enabling efficient manufacturing processes and reducing production costs. In Europe, the nonwoven composite structure is typically made from polypropylene and PET fibers for underbody shields in most luxury vehicles.

By Material Type

“Fiberglass Composites are expected to hold the largest share of the market during the forecast period.”

-

Based on the material type, the market is segmented into fiberglass composites, natural/wood fiber composites, polyester fiber composites, carbon fiber composites, and other materials.

-

Fiberglass is expected to showcase an incredible lead in the market during the forecast period due to its high tensile strength and excellent resistance to impact, making it ideal for reinforcing nonwoven composites used in automotive applications.

-

Fiberglass works as an excellent reinforcement material with polypropylene to form composite parts suited for door panels, underbody shields, floorboards, trunk trims, etc.

By Application Type

“Trunk, wheel arch liner, and headliner are expected to hold the largest share of the automotive nonwoven composites market during the forecast period.”

-

Based on the application type, the market is segmented into door panel, trunk, packaged tray, headliner, underbody shield, wheel arch liner, center console, and other applications.

-

Trunk, wheel arch liner, and headliner are likely to be the major application categories in the years to come. These application types are likely to grow at a healthy pace in the years to come.

-

Nonwoven composites provide thermal insulation, sound insulation, strength, and stiffness in the interior of a vehicle, along with impact absorption to protect occupants in the event of a collision or other impact situations.

By Formation Type

“Drylaid is expected to hold the largest share of the market during the forecast period.”

-

Based on the formation type, the market is segmented into spunlaid, drylaid, and other formations.

-

Drylaid is expected to remain the most dominant formation type in the market during the forecast period. Drylaid nonwovens are commonly used as the primary backing material for automotive applications. The entangled fiber structure provides dimensional stability, strength, and durability to withstand the demands of automotive use.

-

Drylaid composites offer excellent resistance to wear, abrasion, and fading, while providing thermal and acoustic insulation properties.

Regional Analysis

“Asia-Pacific is expected to hold the largest share of the automotive nonwoven composites market during the forecast period.”

-

In terms of regions, Asia-Pacific is expected to remain the largest market for automotive nonwoven composites during the forecast period. This region is home to some of the world's largest automotive markets, including China, Japan, India, and South Korea. The region has witnessed significant growth in automobile production (with 49 million units produced in 2022, which is 58% of total global production) as compared to other regions, driving the demand for automotive nonwoven composites.

-

North America and Europe are also likely to create sizeable opportunities in the coming years, due to high automobile production, stringent regulations, technological advancements, and consumer preferences for comfort and aesthetics.

Want to get a free sample? Register Here

Competitive Landscape

The market is highly fragmented, with over 200 players. Most of the major players compete in some of the governing factors, including price, service offerings, regional presence, etc. The following are the key players in the automotive nonwoven composites market. Some of the major players provide a complete range of services,

Here is the list of the Top Players (Based on Dominance)

Note: The above list does not necessarily include all the top players in the market.

Are you the leading player in this market? We would love to include your name. Please write to us at [email protected]

Report Features

This report provides market intelligence most comprehensively. The report structure has been kept so that it offers maximum business value. It provides critical insights into market dynamics and will enable strategic decision-making for existing market players as well as those willing to enter the market.

The following are the key features of the report:

-

Market structure: Overview, industry life cycle analysis, supply chain analysis.

-

Market environment analysis: Growth drivers and constraints, Porter’s five forces analysis, SWOT analysis.

-

Market trend and forecast analysis.

-

Market segment trend and forecast.

-

Competitive landscape and dynamics: Market share, Service portfolio, New Product Launches, etc.

-

COVID-19 impact and its recovery curve.

-

Attractive market segments and associated growth opportunities.

-

Emerging trends.

-

Strategic growth opportunities for the existing and new players.

-

Key success factors.

|

Market Study Period

|

2019-2031

|

|

Base Year

|

2024

|

|

Forecast Period

|

2025-2031

|

|

Trend Period

|

2019-2023

|

|

Number of Tables & Figures

|

>100

|

|

Number of Segments Analysed

|

6 (Vehicle Type, Matrix Type, Material Type, Application Type, Formation Type, and Region)

|

|

Number of Regions Analysed

|

4 (North America, Europe, Asia-Pacific, Rest of the World)

|

|

Countries Analysed

|

15 (The USA, Canada, Mexico, Germany, France, Italy, The UK, China, Japan, India, Brazil, Saudi Arabia, Rest of Europe, Rest of APAC, and Rest of the World)

|

|

Free Customization Offered

|

10%

|

|

After Sales Support

|

Unlimited

|

|

Report Presentation

|

Complimentary

|

|

Market Dataset

|

Complimentary

|

|

Further Deep Dive & Consulting Services

|

10% Discount

|

Market Segmentation

The report provides detailed insights into the market dynamics to enable informed business decision-making and growth strategy formulation based on the opportunities present in the market.

The global automotive nonwoven composites market is segmented into the following categories.

Automotive Nonwoven Composites Market, by Vehicle Type

-

Automotive (Automotive Type Analysis: ICE, BEV, and Hybrid) (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of World)

-

Recreational Vehicles (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of World)

-

Other Vehicles (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

Automotive Nonwoven Composites Market by Matrix/Binder Formation

-

Biocomponent PET/coPET (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

-

Polypropylene (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

-

Other Matrix/Binders (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

Automotive Nonwoven Composites Market by Material Type

-

Fiberglass Composites (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

-

Natural/Wood Fiber Composites (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

-

Polyester Fiber Composites (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

-

Carbon Fiber Composites (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

-

Other Composites (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

Automotive Nonwoven Composites Market by Application Type

-

Door Panel (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

-

Trunk (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

-

Packaged Tray (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

-

Headliner (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

-

Underbody shield (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

-

Wheel Arch Liners (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

-

Center Console (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

-

Other Applications (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

Automotive Nonwoven Composites Market by Formation Type

-

Spunlaid (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

-

Drylaid (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

-

Other Formations (Regional Analysis: North America, Europe, Asia-Pacific, and Rest of the World)

Automotive Nonwoven Composites Market by Region

-

North America (Country Analysis: The USA, Canada, and Mexico)

-

Europe (Country Analysis: Germany, France, The UK, Russia, and the Rest of Europe)

-

Asia-Pacific (Country Analysis: Japan, China, India, and Rest of Asia-Pacific)

-

Rest of the World (Country Analysis: Brazil, Argentina, and Others)

Research Methodology

-

This strategic assessment report from Stratview Research provides a comprehensive analysis that reflects today’s automotive nonwoven composites market realities and future market possibilities for the forecast period.

-

The report segments and analyzes the market in the most detailed manner to provide a panoramic view of the market.

-

The vital data/information provided in the report can play a crucial role for market participants and investors in identifying the low-hanging fruit available in the market and formulating growth strategies to expedite their growth process.

-

This report offers high-quality insights and is the outcome of a detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research’s internal database and statistical tools.

-

More than 1,000 authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white papers, patents, and articles, have been leveraged to gather the data.

-

We conducted more than 15 detailed primary interviews with market players across the value chain in all four regions and industry experts to obtain both qualitative and quantitative insights.

Customization Options

With this detailed report, Stratview Research offers one of the following free customization options to our respected clients:

Company Profiling

Competitive Benchmarking

-

Benchmarking of key players on the following parameters: Service portfolio, geographical reach, regional presence, and strategic alliances

Custom Research: Stratview Research offers custom research services across sectors. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to [email protected]