Aircraft Pneumatic Valves Market Highlights

“The global aircraft pneumatic valves market size was US$ 1.0 billion in 2024 and is likely to grow at a decent CAGR of 4.4% in the long run to reach US$ 1.7 billion in 2034.”

Introduction

Aircraft pneumatic valves are critical components used in managing and regulating the flow of pressurized air or gases within various systems of an aircraft. These valves play a crucial role in controlling pneumatic operations such as air conditioning, engine starting, anti-icing, cabin pressurization, and actuation systems. They are designed to withstand extreme temperature, pressure, and vibration conditions commonly experienced in aerospace environments, ensuring safe and efficient aircraft performance.

Aircraft Pneumatic Valves Market Drivers

The aircraft pneumatic valves market is experiencing notable growth, driven by several key factors. One of the primary market drivers is the rising production and deliveries of commercial and military aircraft to meet growing air travel demand and defense modernization programs. Additionally, the increasing adoption of advanced pneumatic systems in aircraft for weight reduction and system reliability is pushing manufacturers to innovate and expand their valve offerings. The integration of pneumatic systems in emerging platforms such as unmanned aerial vehicles (UAVs) and next-generation helicopters is further enhancing market potential.

Technological advancements in materials, such as the use of lightweight composites and corrosion-resistant alloys like titanium and stainless steel, are improving valve performance and durability, thereby attracting OEMs and maintenance providers. Moreover, the aftermarket segment is witnessing steady growth due to the rising need for maintenance, repair, and overhaul (MRO) activities, especially as the global aircraft fleet continues to expand and age.

As the aerospace industry continues its post-pandemic recovery and transitions toward sustainable and efficient platforms, the demand for high-performance pneumatic valves is expected to rise significantly, offering ample opportunities for manufacturers, suppliers, and service providers across the value chain.

|

Aircraft Pneumatic Valves Market Report Overview

|

|

Market Size in 2034

|

USD 1.7 Bn

|

|

Market Size in 2024

|

USD 1.0 Bn

|

|

Market Growth (2024-2034)

|

CAGR of 4.4%

|

|

Base Year of Study

|

2023

|

|

Trend Period

|

2018-2022

|

|

Forecast Period

|

2024-2034

|

Segment Analysis

|

Segmentations

|

List of Sub-Segments

|

Segments with High-Growth Opportunity

|

|

Aircraft-Type Analysis

|

Commercial Aircraft, General Aviation, Regional Aircraft, Military Aircraft, Helicopter, and Unmanned Air Vehicle

|

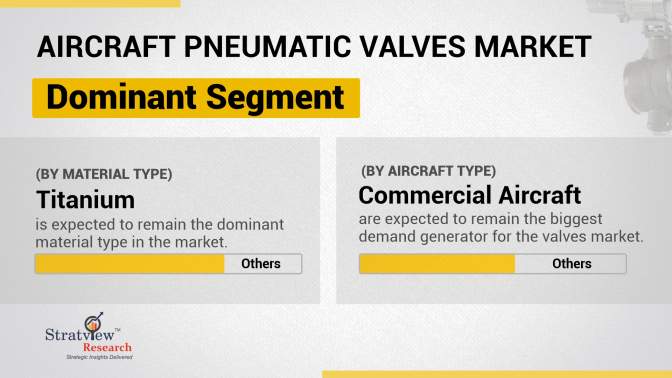

Commercial aircraft are expected to hold the major share of the market and are also likely to be the fastest-growing segment during the forecast period.

|

|

Application-Type Analysis

|

Engine, Landing-Gear, Wheels and Brakes, ECS, Flight Control, and Air Conditioning

|

Engine is anticipated to be the dominant as well as the fastest-growing application of the market throughout the forecast period.

|

|

Material-Type Analysis

|

Stainless Steel, Titanium, and Aluminium

|

Titanium is projected to hold the largest share and exhibit the fastest growth within the segment.

|

|

End-User-Type Analysis

|

OEM and Aftermarket

|

OEM is expected to remain the dominant end-user type throughout the study period.

|

|

Regional Analysis

|

North America, Europe, Asia-Pacific, and The Rest of the World

|

North America is expected to maintain its reign over the forecast period, whereas Asia-Pacific is likely to grow at the fastest rate.

|

Aircraft Insights

“Commercial aircraft are anticipated to be the biggest demand generator of the aircraft pneumatic valves market during the forecast period.”

Based on aircraft type, the market is segmented into commercial aircraft, general aviation, regional aircraft, military aircraft, helicopters, and unmanned air vehicles (UAVs).

Commercial aircraft are anticipated to be the primary demand drivers in the aircraft pneumatic valves market during the forecast period. This dominance is largely attributed to the sustained growth in global air travel and the strong demand for new aircraft deliveries across major airlines. Leading aircraft manufacturers such as Boeing and Airbus project the delivery of approximately 43,975 and 42,430 new commercial aircraft, respectively, over the next two decades, as outlined in their latest market outlooks. This large-scale production pipeline highlights the aerospace industry’s confidence in long-term passenger traffic growth, fleet expansion, and the replacement of older, less efficient aircraft.

This surge in commercial aircraft production directly translates into an increased requirement for high-performance pneumatic systems and associated components, including valves. Pneumatic valves are essential for the operation of various onboard systems such as air conditioning, environmental control systems (ECS), anti-icing, engine start, and flight control systems that are particularly critical in modern commercial jets operating under diverse climatic and operational conditions.

Moreover, the extensive and growing order backlog from major OEMs, estimated at nearly 14,849 aircraft as of early 2025, further reinforces the projected stability and upward trajectory of the commercial aviation segment. These orders not only ensure a steady flow of production but also sustain the aftermarket demand for valve maintenance, replacement, and upgrades. As airlines seek to improve fuel efficiency, reliability, and compliance with evolving environmental regulations, the integration of advanced and lightweight pneumatic valves will remain a top priority, thereby cementing the commercial aircraft segment as the leading contributor to market growth.

Application Insights

“The engine is expected to account for the largest share and register the highest growth within the market throughout the forecast period.”

Based on application type, the market is segmented into engine, landing gears, wheels and brakes, environmental control systems (ECS), flight control, and air conditioning.

Among the various application segments, the engine is expected to dominate the aircraft pneumatic valves market in terms of both market share and growth rate throughout the forecast period. This is primarily due to the critical role pneumatic valves play in several engine-related systems such as engine start, bleed air regulation, anti-icing, and fuel system control. These functions are essential for efficient engine operation, safety, and performance, especially in modern high-bypass turbofan engines used in commercial and military aviation.

As aircraft manufacturers move toward more fuel-efficient and cleaner propulsion technologies, there is an increasing emphasis on optimizing engine systems through the use of advanced pneumatic control components. Pneumatic valves are vital in managing high-temperature and high-pressure air extracted from engines, ensuring proper airflow distribution to other systems such as the ECS and anti-icing systems. As a result, any advancement or increase in engine production, whether for new aircraft platforms or for retrofitting existing fleets, drives demand for next-generation pneumatic valves capable of withstanding extreme conditions.

Moreover, the strong growth outlook for commercial aircraft deliveries, as projected by major OEMs like Boeing and Airbus, indirectly boosts the engine segment’s growth. Each new aircraft requires highly specialized and often custom-engineered valve systems integrated into its propulsion setup. Additionally, the engine segment benefits significantly from the aftermarket, as engines undergo regular inspection, maintenance, and component replacement over their lifecycle. This ensures a sustained demand for replacement pneumatic valves and supports strong growth prospects in the MRO ecosystem.

Want to get a free sample? Register Here

Material Insights

“Titanium is expected to be the most preferred material type in the market during the forecast period.”

Based on material type, the market is segmented into stainless steel, titanium, and aluminium.

Titanium is projected to be the dominant as well as the fastest-growing material type in the aircraft pneumatic valves market during the forecast period. This growing preference is largely due to titanium’s exceptional strength-to-weight ratio, high corrosion resistance, and ability to withstand extreme temperatures and pressures, properties that are critically important for components operating in the harsh conditions of aerospace environments.

As modern aircraft increasingly prioritize fuel efficiency and lightweight design, the aerospace industry is shifting toward advanced materials that reduce overall weight without compromising performance. Titanium’s lightweight nature compared to traditional stainless steel allows aircraft designers to achieve meaningful weight savings, contributing directly to improved fuel efficiency and lower emissions, an increasingly critical factor in the context of stricter environmental regulations and airline cost pressures.

Regional Insights

“North America is expected to retain its leading position throughout the forecast period, while Asia-Pacific is projected to witness the fastest growth.”

North America is expected to maintain its dominant position in the aircraft pneumatic valves market throughout the forecast period. This leadership is primarily driven by the presence of major aircraft OEMs, engine manufacturers, and aerospace component suppliers headquartered in the region, including Boeing, Raytheon Technologies, General Electric, and Honeywell Aerospace. These companies account for a significant share of global aircraft production and are at the forefront of developing advanced pneumatic systems. The region also benefits from a robust defense aviation industry, with substantial government investments in military aircraft modernization programs, further supporting demand for high-performance pneumatic valves in both OEM and aftermarket channels.

Additionally, North America's well-established MRO (Maintenance, Repair, and Overhaul) infrastructure contributes to sustained aftermarket demand for pneumatic valve replacements and upgrades. The continued expansion of the commercial aviation industry, coupled with high passenger traffic across the U.S. and Canada, further strengthens the region’s market base. Regulatory emphasis on aircraft safety, performance, and emission standards also drives the adoption of advanced pneumatic technologies in new and existing fleets.

The Asia-Pacific region is projected to witness the fastest growth in the aircraft pneumatic valves market during the forecast period. This rapid expansion is largely fueled by rising air passenger traffic, a growing middle class, and significant investments in indigenous aircraft manufacturing programs across countries like China, India, and Japan. China’s COMAC and India’s HAL are expanding their domestic aerospace capabilities, which is leading to increased demand for local component manufacturing, including pneumatic valves.

Furthermore, several Asia-Pacific airlines have placed large orders for new commercial aircraft to accommodate future travel demand and fleet modernization. The increasing presence of aircraft assembly and component manufacturing facilities in the region, along with supportive government policies and international joint ventures, is accelerating the localization of supply chains. As a result, the Asia-Pacific market is evolving from being a consumption base to a production and innovation hub for aerospace components.

Want to get a free sample? Register Here