Market Insights

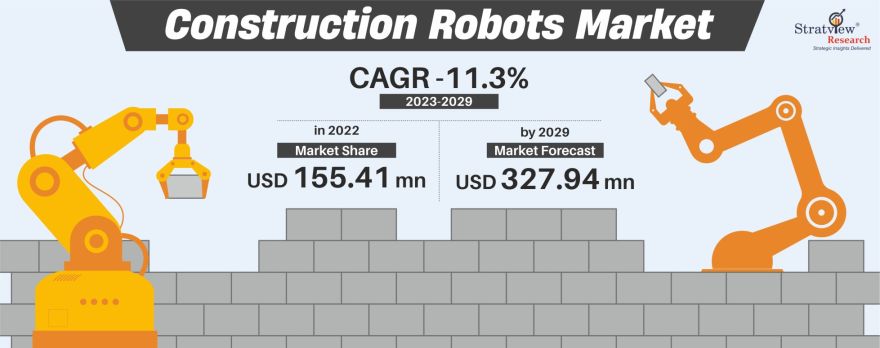

The construction robots market was estimated at USD 155.41 million in 2022 and is likely to grow at a CAGR of 11.3% during 2023-2029 to reach USD 327.94 million in 2029.

Wish to get a free sample? Register Here

Market Dynamics

Introduction

Construction robots are robotic systems designed to perform tasks in the construction industry, from building and assembly to demolition and excavation. These robots are typically equipped with sensors, cameras, and other technologies that enable them to navigate and operate in complex and dynamic environments.

Construction robots can be used for a wide range of applications, from bricklaying and concrete pouring to welding and demolition. They can be programmed to perform tasks with a high level of precision and consistency, reducing the risk of human error and improving overall efficiency. One of the key benefits of construction robots is their ability to improve safety in the construction industry.

They can be used to perform tasks that are dangerous or difficult for humans to perform, reducing the risk of accidents and injuries on construction sites. As technology continues to advance, the potential applications for construction robots are expected to grow, making them an increasingly important part of the construction industry.

Market Drivers: Increasing urbanization worldwide

The demand for construction equipment is largely driven by the increasing population, which has been further accelerated by the global trend of rural-to-urban migration. According to the United Nations Population Division, the world's population is predicted to reach 9.5 billion by 2050, with at least 64% of it residing in urban areas.

In recent years, the construction industry in the Asia Pacific region, which includes emerging markets like India and China, has made significant progress. By 2050, Asian cities are projected to house 52% of the world's urban population, creating the largest workforce.

Market Restraints: High equipment cost

The construction robot industry encounters a major obstacle in the form of high capital requirements. Providers of heavy construction equipment are required to make significant investments in both the purchase and maintenance of the machinery. These providers must maintain a balance between equipment requirements and their ability to generate profits or obtain financing, as this is essential for survival and growth in the construction industry.

The high cost of investment also creates a barrier to entry into the market, which limits the demand for equipment and leads to reduced opportunities for price reductions due to the low economies of scale.

Opportunity: Increasing adoption of automation at construction sites

The construction industry is on the brink of a revolution with the increasing adoption of automation at construction sites, which presents significant opportunities for construction robots. Automation is becoming more prevalent in all areas of construction and has led to the development of automated and robotized construction systems that offer a flexible way of building and operating facilities.

The growing popularity of robotic automation in various sectors such as masonry prefabrication, construction, precast concrete, timber construction, and steel component production has attracted many new players to the construction robot industry. Some companies, including Fastbrick Robotics (Australia) and Construction Robotics (US), have already entered the market with their autonomous bricklaying solutions for masonry prefabrication, which can be used directly on construction sites.

Prefabricated brickwork is gaining significant traction as it eliminates the need for manual labor and greatly increases productivity. In addition, mining, tunneling, earthworks, road construction, and other construction sites are highly automated, with a high level of accuracy in tasks such as excavation, setting molds, placing reinforcement bars, and distributing concrete. Automation also allows for on-site production of construction materials such as cement, steel, aluminum, glass, and wood, making the construction process more flexible and adaptable with the use of robots.

Recent Developments

- In October 2022, Brokk introduced the Brokk Surface Grinder 530 attachment for removing material, such as surface preparation and polishing on walls, paint and asbestos, floors, and ceilings in renovation and restoration applications.

- In December 2022, Husqvarna enhanced its offer to demolition professionals with the launch of a new range of demolition robots, such as the DXR 145, DXR 275, DXR 305, and DXR 315 which are more powerful and allow users to get more demolition work done faster and more efficiently.

- In December 2022, Fastbrick Robotics introduced the newest version of the Hadrian X, which can complete both the internal and external walls of a standard double-brick house in just one day. This robot has also been fitted out with a ‘shuttle block delivery system.

Segments Analysis

|

Segmentations

|

List of Sub-Segments

|

Dominant and Fastest-Growing Segments

|

|

Function-Type Analysis

|

Demolition, Bricklaying, 3D Printing, Concrete Structural Erection, Finishing Work, Doors and Windows Installation

|

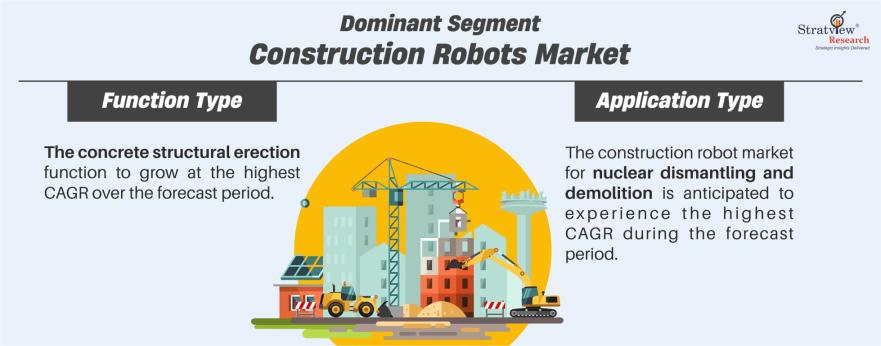

The concrete structural erection function to grow at the highest CAGR over the forecast period.

|

|

Application-Type Analysis

|

Public Infrastructure, Commercial and Residential Buildings, Nuclear Dismantling and Demolition

|

The nuclear dismantling and demolition is anticipated to experience the highest CAGR during the forecast period.

|

|

Regional Analysis

|

North America, Europe, Asia-Pacific, and Rest of the World

|

Asia-Pacific is expected to experience the highest CAGR during the forecast period.

|

By Function Type

“The concrete structural erection function is to grow at the highest CAGR over the forecast period.”

The market is segmented into demolition, bricklaying, 3D printing, concrete structural erection, finishing work, and doors and windows installation. The growth rate for concrete structural erection is anticipated to be the highest among all functions during the forecast period. Robots that are specifically designed for erecting concrete structures construct prefabricated concrete components or units that can be assembled on-site to form an entire building structure. The use of robots for the automated erection of concrete structures has simplified construction operations, which is why many construction firms are adopting this technology.

Want to get more details about the segmentations? Register Here

By Application Type

“The nuclear dismantling and demolition segment is expected to see the highest CAGR over the forecast period.”

The market is segmented into public infrastructure, commercial and residential buildings, nuclear dismantling, and demolition. The construction robot market for nuclear dismantling and demolition is anticipated to experience the highest compound annual growth rate (CAGR) between 2023 and 2029. This growth is primarily driven by the need to eliminate the presence of human operators in hazardous areas and protect them from radiation during nuclear decommissioning.

Construction robot companies have incorporated various features in demolition robots, which facilitate easy access, promote safety, and increase efficiency in confined spaces. These advantages make them more beneficial than handheld breakers or other substitutes used for demolition purposes.

Regional Insights

“The Asia-Pacific market is anticipated to achieve the highest CAGR during 2023-2029.”

The market is broken down geographically into areas, namely North America, Europe, Asia-Pacific, and the Rest of the World (RoW). During the forecast period, the market in Asia-Pacific is expected to experience the highest CAGR. This is due to the region's abundance of natural reserves distributed among various countries, with mining and construction being among the top industries in Australia, China, India, Malaysia, and Vietnam.

With increasing urbanization and the wide availability of natural resources throughout the region, mining, and construction companies have begun to use automated equipment, operating software, and communication systems to connect and operate on-site.

Additionally, the presence of a large number of robotic manufacturing companies in China and Japan and the high growth rate of the market for 3D printers for advanced construction are driving the growth of the construction robot market in the Asia-Pacific.

Know the high-growth countries in this report. Register Here

Key Players

The following are the key players in the construction robots market (arranged alphabetically):

- Advanced Construction Robotics (US)

- Alpine Sales and Rental (US)

- Apis Cor (Russia)

- Autonomous Solutions (US)

- Beijing Borui Intelligent Control Technology (China)

- Brokk (Sweden)

- CYBERDYNE (Japan)

- Conjet (Sweden)

- Construction Robotics (US)

- CyBe Construction (Netherlands)

- Ekso Bionics (US)

- Fastbrick Robotics (Australia)

- Fujita (Japan)

- Giant Hydraulic Tech (China)

- Husqvarna (Sweden)

- Komatsu (Japan)

- MXD (Netherlands)

- nLink (Norway)

- TopTec Spezialmaschinen (Germany)

- Yingchuang Building Technique Co. (WinSun) (China)

Note: The above list does not necessarily include all the top players in the market.

Are you the leading player in this market? We would love to include your name. Write to us at [email protected]

Research Methodology

This strategic assessment report, from Stratview Research, provides a comprehensive analysis that reflects today’s construction robots market realities and future market possibilities for the forecast period of 2023 to 2029. After a continuous interest in our construction robots market report from the industry stakeholders, we have tried to further accentuate our research scope to the construction robots market to provide the most crystal-clear picture of the market. The report segments and analyses the market in the most detailed manner to provide a panoramic view of the market. The vital data/information provided in the report can play a crucial role for the market participants as well as investors in the identification of the low-hanging fruits available in the market as well as to formulate the growth strategies to expedite their growth process.

This report offers high-quality insights and is the outcome of a detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research’s internal database and statistical tools. More than 1000 authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white papers, patents, and articles, have been leveraged to gather the data. We conducted more than 15 detailed primary interviews with the market players across the value chain in all four regions and industry experts to obtain both qualitative and quantitative insights.

Report Features

This report provides market intelligence in the most comprehensive way. The report structure has been kept such that it offers maximum business value. It provides critical insights into market dynamics and will enable strategic decision-making for existing market players as well as those willing to enter the market. The following are the key features of the report:

- Market structure: Overview, industry life cycle analysis, supply chain analysis.

- Market environment analysis: Growth drivers and constraints, Porter’s five forces analysis, SWOT analysis.

- Market trend and forecast analysis.

- Market segment trend and forecast.

- Competitive landscape and dynamics: Market share, Service portfolio, New Product Launches, etc.

- COVID-19 impact and its recovery curve

- Attractive market segments and associated growth opportunities.

- Emerging trends.

- Strategic growth opportunities for the existing and new players.

- Key success factors

Market Segmentation

This report studies the market, covering a period of 12 years of trends and forecasts. The report provides detailed insights into the market dynamics to enable informed business decision-making and growth strategy formulation based on the opportunities present in the market.

The construction robots market is segmented into the following categories:

By Type

- Traditional, Robotic Arm

- Exoskeleton

By Automation Type

- Fully Autonomous

- Semi-autonomous

By Function Type

- Demolition

- Bricklaying

- 3D Printing

- Concrete Structural Erection

- Finishing Work

- Doors and Windows Installation

By Application Type

- Public Infrastructure

- Commercial and Residential Buildings

- Nuclear Dismantling

- Demolition

By Region

- North America (Country Analysis: the USA, Canada, and Mexico)

- Europe (Country Analysis: Germany, France, the UK, Russia, Spain, and Rest of Europe)

- Asia-Pacific (Country Analysis: China, Japan, India, South Korea, and Rest of Asia-Pacific)

- Rest of the World (Sub-Region Analysis: Latin America, the Middle East, and Others)

Customization Options

With this detailed report, Stratview Research offers one of the following free customization options to our respectable clients:

Company Profiling

- Detailed profiling of additional market players (up to three players)

- SWOT analysis of key players (up to three players)

Competitive Benchmarking

- Benchmarking of key players on the following parameters: Product portfolio, geographical reach, regional presence, and strategic alliances.

Custom Research:

Stratview Research offers custom research services across sectors. In case of any custom research requirement related to market assessment, competitive benchmarking, sourcing and procurement, target screening, and others, please send your inquiry to [email protected].